Apartments.com Releases Multifamily Rent Report for the Fourth Quarter of 2024

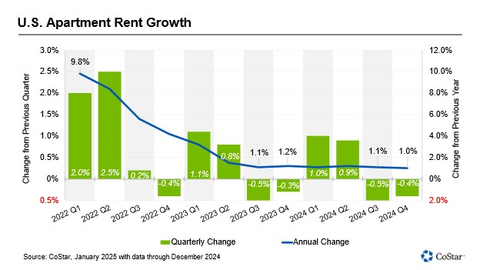

Quarterly data shows rent growth easing through 2024

National year-over-year asking rent growth eased to

The national rent per unit closed the year at

The fourth quarter recorded 113,200 units of absorption, the second consecutive quarter of easing. Supply additions in the quarter numbered 133,300, once again exceeding absorption, a trend seen since the fourth quarter of 2021. However, the gap between supply and demand is now at its smallest over that same period, suggesting more balanced market conditions. For the full year 2024, absorption reached 556,800 units, a

At

At the opposite end of the spectrum, annual asking rent fell by

Absorption during the year was led by 4&5-Star units, with just over 429,000 units absorbed in the fourth quarter. However, with most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment at

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight into property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners with a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the worldwide hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest-growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the

This news release includes "forward-looking statements," including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected or at all and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof. CoStar assumes no obligation to update or revise any forward-looking statements, whether due to new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250106244222/en/

NEWS MEDIA:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202)-346-6775

mblocher@costar.com

Source: CoStar Group