Homes.com Report: Home Prices Rise in February, but at a Slower Rate than the Previous Two Months

The median home price increased

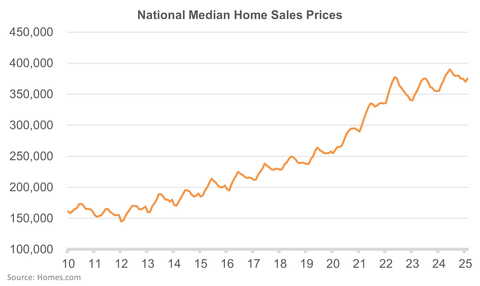

Chart 1 Home Prices (Graphic: Business Wire)

Preliminary prices increased

In addition to the rate of price appreciation declining, February also saw an increase in the number of homes for sale. This moderation in pricing and increase in the supply of for-sale homes means more leverage for homebuyers, and could tilt market conditions towards a buyer’s market and away from a seller’s market.

Highest price appreciation concentrated in the Northeast and Midwest, lowest in the South. Of the 10 markets with the largest price increases, 4 were in the Northeast, and 4 were in the Midwest.

The data shared in this report could experience a slight shift once all home sales are accounted for. Melina Duggal, Senior Director of Market Analytics at CoStar Group and Homes.com, is available for interviews to provide expert insights on this data and the residential real estate market in general. For more information and insight on the latest home buying and selling market trends visit: Homes.com

About Homes.com

Homes.com is the fastest-growing residential real estate marketplace and the second largest portal in

Homes.com is the first major

The Homes.com Network reached an audience of 110 million average monthly unique visitors in the fourth quarter ending December 31, 2024.** Consumer brand awareness skyrocketed from

*Based on internal analyses comparing Members to non-Members on Homes.com.

** Homes.com Network (which includes Homes.com, the Apartments Network, and the Land Network) average monthly unique visitors for the quarter ended December 31, 2024, according to Google Analytics.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is the global leader in commercial real estate information, analytics, and online marketplaces. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; and Homes.com, the fastest-growing residential real estate marketplace. CoStar Group’s industry-leading brands include STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the

CoStar Group’s websites attracted over 163 million average monthly unique visitors in the third quarter of 2024, serving clients worldwide. Headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250307092266/en/

News Media Contact

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com

Source: CoStar Group