Apartments.com Releases Multifamily Rent Growth Report for Third Quarter of 2024

Apartments.com, a CoStar Group marketplace, released its Q3 2024 multifamily rent trends report. Key findings include:

- 176,000 units absorbed, highest since Q3 2021

- 178,000 new units delivered, smallest supply-demand gap in 3 years

- Vacancy rate dropped 10 basis points to 7.8%

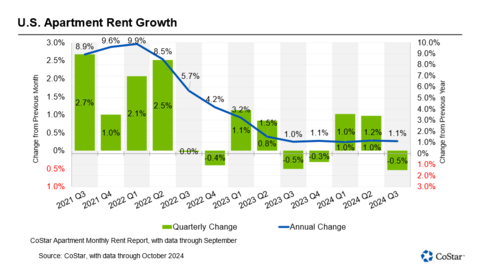

- National average annual asking rent growth eased to 1.1%

- Washington, DC led top 50 markets with 3.5% annual rent growth

- Austin saw the largest decline at -4.7% annual rent growth

- 4&5-Star units led absorption but had weakest rent growth (0.3%)

- 3-Star properties showed stronger performance with 1.5% rent growth

- 636,000 new units projected for 2024, a 40-year record

The report suggests varied market performance for the rest of 2024 and early 2025, with Sun Belt and luxury properties facing potential weakness due to oversupply.

Apartments.com, un marketplace del CoStar Group, ha pubblicato il suo rapporto sui trend degli affitti multifamiliari per il Q3 2024. I principali risultati includono:

- 176.000 unità assorbite, il valore più alto dal Q3 2021

- 178.000 nuove unità consegnate, il divario tra domanda e offerta più ridotto degli ultimi 3 anni

- Il tasso di vacanza è sceso di 10 punti base al 7,8%

- La crescita annuale media degli affitti nazionali è scesa all'1,1%

- Washington, DC ha guidato i primi 50 mercati con una crescita annuale degli affitti del 3,5%

- Austin ha registrato il maggior calo con una crescita annuale degli affitti del -4,7%

- Le unità 4&5 Stelle hanno guidato l'assorbimento, ma hanno avuto la crescita degli affitti più debole (0,3%)

- Le proprietà 3 Stelle hanno mostrato prestazioni migliori con una crescita degli affitti dell'1,5%

- 636.000 nuove unità previste per il 2024, un record in 40 anni

Il rapporto suggerisce un andamento di mercato vario per il resto del 2024 e i primi mesi del 2025, con il Sun Belt e le proprietà di lusso che potrebbero affrontare una potenziale debolezza a causa di un eccesso di offerta.

Apartments.com, un mercado del CoStar Group, publicó su informe sobre tendencias de alquiler multifamiliar para el Q3 2024. Los hallazgos clave incluyen:

- 176,000 unidades absorbidas, el mayor número desde el Q3 2021

- 178,000 nuevas unidades entregadas, la menor brecha de oferta-demanda en 3 años

- La tasa de vacantes cayó 10 puntos básicos al 7.8%

- El crecimiento anual promedio de rentas a nivel nacional se redujo al 1.1%

- Washington, DC lideró los 50 principales mercados con un crecimiento anual de rentas del 3.5%

- Austin vio la mayor caída con un crecimiento anual de rentas del -4.7%

- Las unidades de 4 y 5 estrellas lideraron la absorción, pero tuvieron el crecimiento de rentas más débil (0.3%)

- Las propiedades de 3 estrellas mostraron un rendimiento más fuerte con un crecimiento de rentas del 1.5%

- Se proyectan 636,000 nuevas unidades para 2024, un récord de 40 años

El informe sugiere un desempeño de mercado variado para el resto de 2024 y principios de 2025, con el Sun Belt y las propiedades de lujo enfrentando potencial debilidad debido a un exceso de oferta.

Apartments.com, CoStar Group의 마켓플레이스, Q3 2024 다세대 주택 임대 트렌드 보고서를 발표했습니다. 주요 발견 사항은 다음과 같습니다:

- 176,000 유닛 흡수, Q3 2021 이후 가장 높은 수치

- 178,000 신규 유닛 공급, 3년 만에 가장 작은 공급-수요 격차

- 공실률이 10bp 하락하여 7.8%에 도달함

- 전국 평균 연간 임대료 성장률이 1.1%로 완화됨

- 워싱턴 D.C.가 연간 임대료 성장률 3.5%로 상위 50개 시장 중 선두를 차지함

- 오스틴은 연간 임대료 성장률 -4.7%로 가장 큰 하락을 경험함

- 4 및 5성급 유닛이 흡수를 이끌었지만 임대료 성장률은 가장 약함 (0.3%)

- 3성급 부동산은 1.5% 임대료 성장률로 더 강한 성과를 보임

- 2024년에는 636,000개의 신규 유닛이 예상되며, 이는 40년 만의 기록임

보고서는 2024년 나머지 기간과 2025년 초에 대한 시장 성과가 다양할 것이라고 제안하며, 선벨트와 고급 부동산은 공급 과잉으로 인해 잠재적 약세를 겪을 수 있습니다.

Apartments.com, un marché du groupe CoStar, a publié son rapport sur les tendances des loyers multifamiliaux pour le T3 2024. Les principales conclusions comprennent :

- 176 000 unités absorbées, le chiffre le plus élevé depuis le T3 2021

- 178 000 nouvelles unités livrées, l'écart offre-demande le plus faible depuis 3 ans

- Le taux de vacance a chuté de 10 points de base à 7,8 %

- La croissance annuelle moyenne des loyers au niveau national a ralenti à 1,1 %

- Washington, DC a mené les 50 meilleurs marchés avec une croissance annuelle des loyers de 3,5 %

- Austin a connu la plus forte baisse avec -4,7 % de croissance annuelle des loyers

- Les unités 4 et 5 étoiles ont conduit l'absorption mais ont eu la plus faible croissance des loyers (0,3 %)

- Les propriétés 3 étoiles ont montré de meilleures performances avec une croissance des loyers de 1,5 %

- 636 000 nouvelles unités projetées pour 2024, un record en 40 ans

Le rapport suggère une performance de marché variée pour le reste de 2024 et début 2025, avec le Sun Belt et les propriétés de luxe faisant face à une faiblesse potentielle en raison d'une surabondance.

Apartments.com, ein Markt von CoStar Group, hat seinen Bericht über die Trends bei den Mietpreisen für Mehrfamilienhäuser im Q3 2024 veröffentlicht. Die wichtigsten Ergebnisse umfassen:

- 176.000 Einheiten absorbiert, die höchste Zahl seit Q3 2021

- 178.000 neue Einheiten geliefert, die kleinste Angebots-Nachfrage-Lücke seit 3 Jahren

- Die Leerstandsquote fiel um 10 Basispunkte auf 7,8%

- Das bundesweite durchschnittliche jährliche Mietwachstum hat sich auf 1,1% verlangsamt

- Washington, DC führte die Top-50-Märkte mit einem jährlichen Mietwachstum von 3,5% an

- Austin verzeichnete den größten Rückgang mit -4,7% jährlichem Mietwachstum

- 4- und 5-Sterne-Einheiten führten die Absorption an, hatten jedoch das schwächste Mietwachstum (0,3%)

- 3-Sterne-Eigentümer zeigten eine stärkere Leistung mit 1,5% Mietwachstum

- Für 2024 werden 636.000 neue Einheiten prognostiziert, ein 40-Jahresrekord

Der Bericht deutet auf eine unterschiedliche Marktperformance für den Rest von 2024 und Anfang 2025 hin, wobei im Sun Belt und bei Luxusimmobilien aufgrund von Überangeboten potenzielle Schwächen zu erwarten sind.

- Highest quarterly absorption (176,000 units) since Q3 2021

- First quarterly drop in vacancy rate since end of 2021

- Strong performance in 3-Star properties with 1.5% rent growth and 7.1% vacancy rate

- Nine of the top 10 markets saw annual asking rent growth of at least 3.0%

- Improving consumer confidence and sustained economic expansion boosting demand

- Quarter-over-quarter rent growth decreased by 0.5%

- Annual asking rent fell by 4.7% in Austin

- Nine of the bottom ten performing markets are in the Sun Belt

- Luxury market (4&5-Star units) showing weakest rent growth at 0.3% with 11.1% vacancy rate

- Projected record 636,000 new units in 2024 could lead to oversupply in some markets

Insights

The multifamily rental market is showing signs of stabilization, with the smallest supply-demand gap in three years. This is a positive indicator for the sector, suggesting a more balanced market environment. Key points to note:

- Absorption of

176,000 units in Q3 2024, the highest since Q3 2021 - Vacancy rate dropped

10 basis points to7.8% , first quarterly decline since 2021 - National average annual asking rent growth slightly decreased to

1.1%

The market shows regional disparities, with Washington, DC leading in rent growth at

Looking ahead, the projected addition of

Quarterly data shows smallest gap between multifamily supply and demand since 2021

The

The national average annual asking rent growth eased to

At

At the opposite end of the spectrum, annual asking rent fell by

Absorption was led by 4&5-Star units, with just over 147,000 units in the quarter. But with most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment, finishing September 2024 at

The multifamily market is projected to add 636,000 new units in 2024, a 40-year record. Property operations for the remainder of 2024 and the first half of 2025 could vary widely depending on the market and the price point. Markets in the Sun Belt and luxury properties remain most at risk for weakness due to oversupply conditions, while Midwest and Northeast locations and mid-priced 3-star properties could continue to outperform.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241009007629/en/

NEWS MEDIA:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202)-346-6775

mblocher@costar.com

Source: CoStar Group