RETRANSMISSION: CreditRiskMonitor 2020 Operating Results

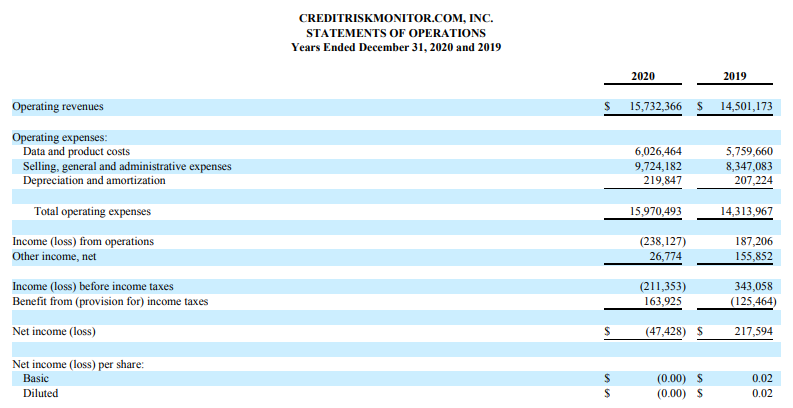

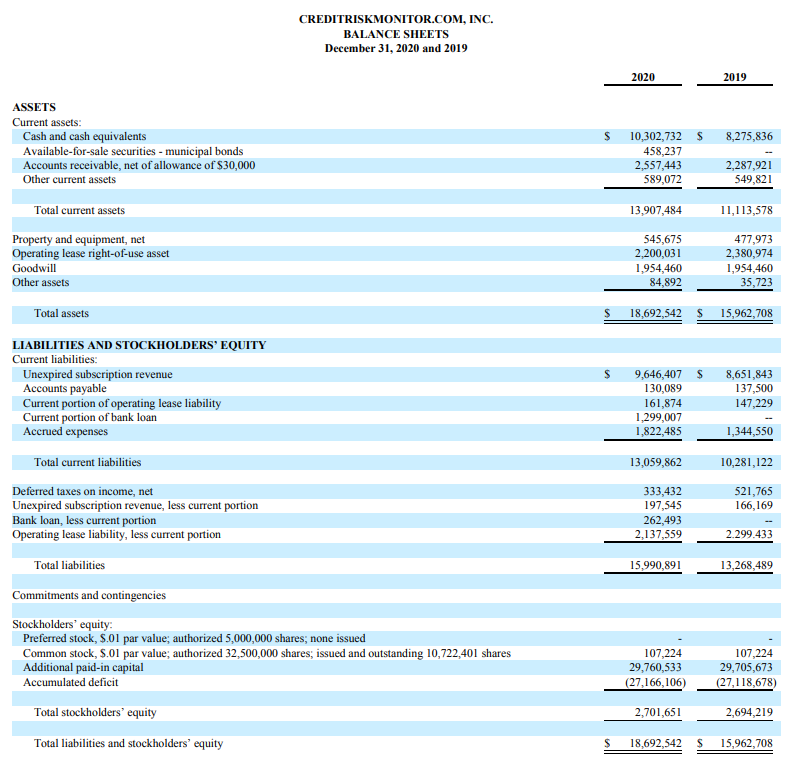

CreditRiskMonitor (CRMZ) reported 2020 revenues of $15.7 million, an 8% increase from $14.5 million in 2019. However, the company faced a pre-tax loss of $211,000 compared to a pre-tax income of $343,000 in the previous year. The net loss was approximately $47,000, down from $218,000 net income in 2019. CEO Jerry Flum emphasized their commitment to investing in service quality and expanding operations despite the financial challenges. Future initiatives include a new platform and expanded private company coverage, which may impact short-term profitability.

- Revenue increased by 8% to $15.7 million.

- Investment in service value and staffing positions the company for future growth.

- Plans for a new platform and enhancements to private company coverage.

- Pre-tax loss of $211,000 compared to prior year's income.

- Net loss of $47,000 versus previous year's net income of $218,000.

VALLEY COTTAGE, NY / ACCESSWIRE / April 5, 2021 / CreditRiskMonitor (OTCQX:CRMZ) reported that revenues for the year ended December 31, 2020 increased to

Jerry Flum, CEO, said, "While our revenue is growing at

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (http://www.crmz.com) is a web-based publisher of financial information that helps corporate credit and procurement professionals stay ahead of business financial risk quickly, accurately, and cost-effectively. The service offers comprehensive commercial credit reports and financial risk analysis covering public companies worldwide.

The Company also collects a significant amount of trade receivable data on both public and a select group of private companies every month to help subscribers determine payment performance.

Over

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates," "estimates," "believes," "expects," or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, expectations, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties, and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Jerry Flum, CEO

(845) 230-3030

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/639490/RETRANSMISSION-CreditRiskMonitor-2020-Operating-Results

FAQ

What were CreditRiskMonitor's revenues for 2020?

Did CreditRiskMonitor experience a profit or loss in 2020?

What are the future plans announced by CreditRiskMonitor?