CreditRiskMonitor Announces Third Quarter Results

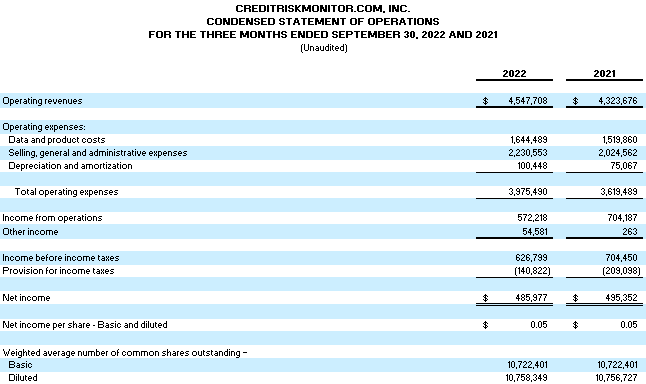

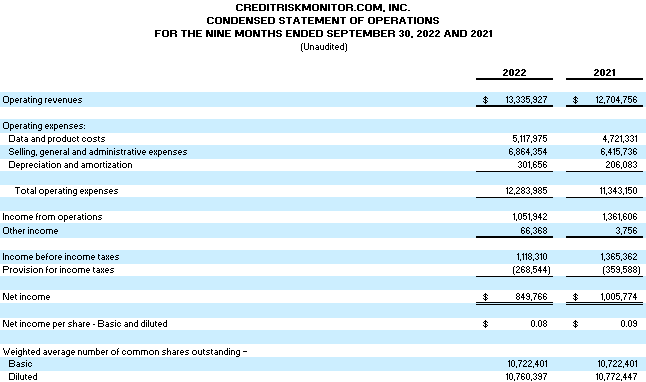

CreditRiskMonitor (OTCQX:CRMZ) reported operating revenues of $4.55 million for Q3 2022, marking a 5% increase from the previous year. The pre-tax income stood at approximately $627 thousand, with a profit margin of 14%, down from 16% in Q3 2021. Increased expenses driven by inflation impacted profitability. Notable developments include the launch of the PAYCE® score, enhancing bankruptcy analytics coverage to over 330,000 businesses, and the early traction of the SupplyChainMonitor™ platform, responding to rising financial risk amid interest rate hikes.

- None.

- None.

Insights

Analyzing...

VALLEY COTTAGE, NY / ACCESSWIRE / November 10, 2022 / CreditRiskMonitor (OTCQX:CRMZ) reported operating revenues of

Mike Flum, President & COO, said, "We have launched the update to our proprietary, private company bankruptcy analytic, the PAYCE® score, which expands coverage by a factor of three to over 330 thousand businesses while also improving its predictive accuracy by approximately

We continue to be pleased with the launch of SupplyChainMonitor™ as our go-to-market strategy is starting to get some traction. The response from subscribers and prospects on this new supply chain-focused platform has been very encouraging, validating our design decisions and agile development approach. Subscriber and prospect feedback is informing our feature roadmap, with some notable enhancements that are in the works including electric power outage map overlays and alerting, business certification data, and cyber security scores. Our affordable pricing and ‘all-you-can-eat' supplier coverage model are resonating with the market. The mounting recessionary pressures of the current inflationary-come-rising-interest-rate environment have put solutions that address counterparty financial risk squarely in the ‘must-have' category for all sophisticated operators.

These aggressive interest rate hikes by central banks globally coupled with the large population of zombie companies that have approaching debt maturity walls set the stage for a potentially major swath of bankruptcies rolling in over the next 24-36 months. Such environments have traditionally advanced our business and I think we are well-positioned to reap additional value for our shareholders, subscribers, employees, and partners during this period and beyond. As always, we remain committed to reinvesting in the Company through new product development, data acquisition, and employee retention in support of delivering subscription services whose value exceeds the cost to our clients."

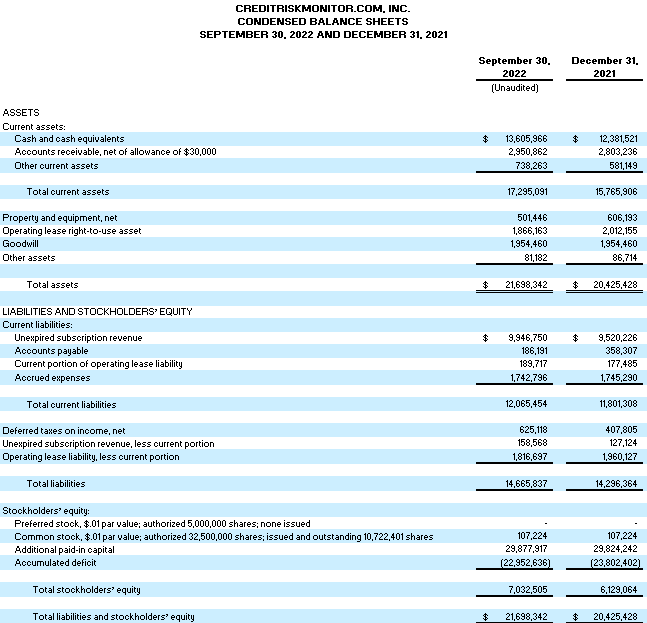

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor® (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and supply chain professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company's newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including more than

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file exceeds

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, those risks, uncertainties, and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, President & COO

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/725043/CreditRiskMonitor-Announces-Third-Quarter-Results