CreditRiskMonitor Announces First Quarter Results

CreditRiskMonitor Announces First Quarter Results

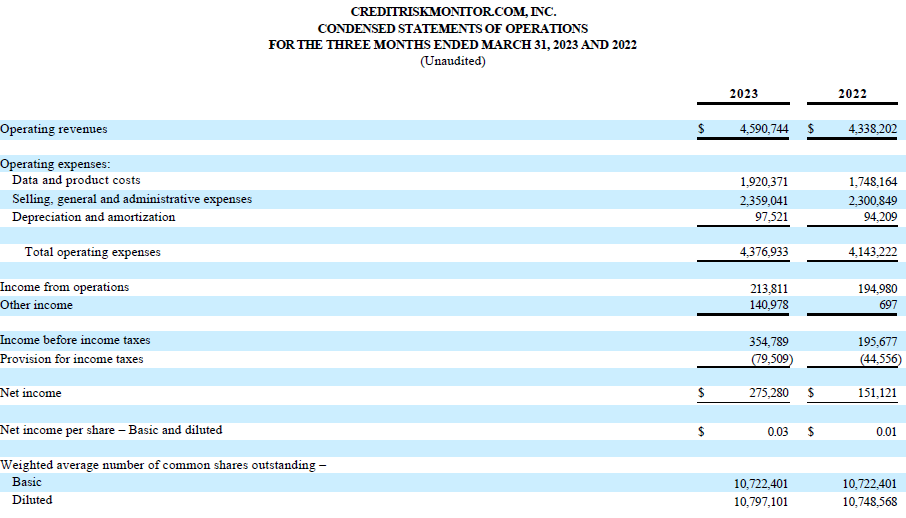

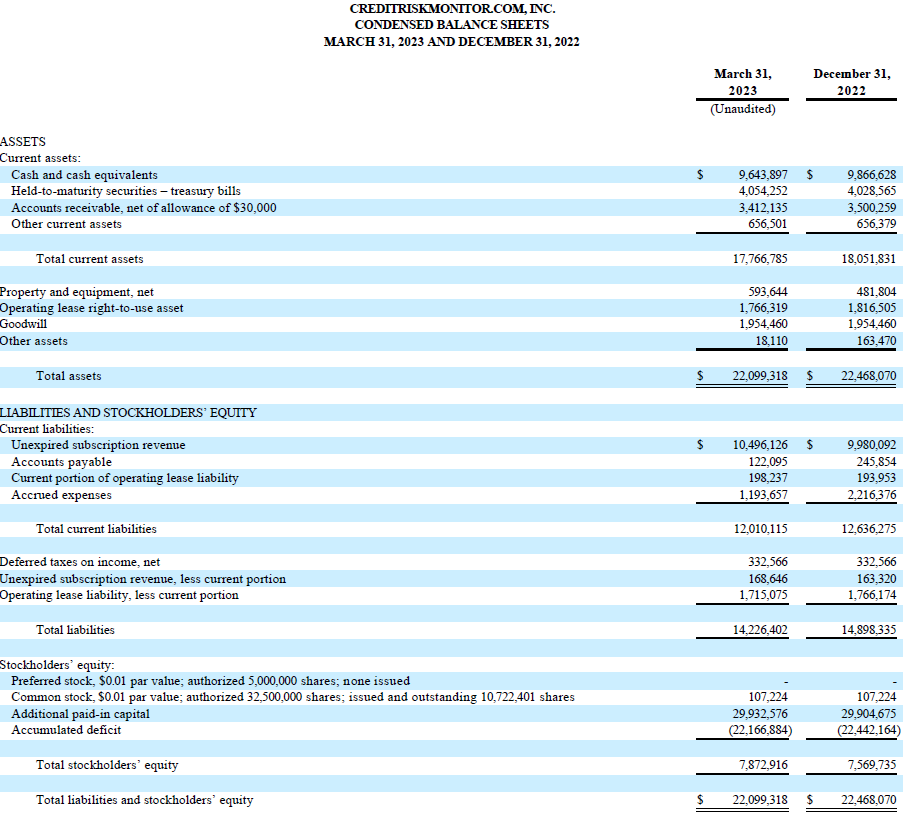

VALLEY COTTAGE, NY / ACCESSWIRE / May 12, 2023 / CreditRiskMonitor (OTCQX:CRMZ) reported operating revenues of

Mike Flum, CEO & President, said, "In Q1 2023, our performance reflects increased recessionary concern in the economy among B2B risk professionals. Corporate bankruptcies have surged as compared to the record lows of the past two years, highlighting that the most effective strategy for focusing corporate risk teams on alternative solutions is experiencing bankruptcy. More prospect and client conversations are centered around the recent failures of some of our competitors' credit risk models to identify a counterparty's financial distress before a bankruptcy filing. Many of these models are driven by sparse and stale payment data mixed with generalized firmographic data. Using such error-prone models creates a false sense of security around counterparty creditworthiness only to be exposed in periods of high volatility.

At CreditRiskMonitor, we consider the pursuit of model coverage above long-term predictive accuracy as a dangerous proposition for our subscribers. We use a Hippocratic philosophy when it comes to our FRISK® and PAYCE® analytics so we will only produce scores on businesses with enough robust and entity-specific data to stand behind our predictions for the full business cycle. The current economic conditions show why the standard operating playbook for financial risk mitigation established during the low-volatility zero interest rate policy period cannot persist without significant pain.

Our roadmap for 2023 includes updating the FRISK® model, incorporating a third-party ESG data add-on, augmenting our business records with certification data, and introducing our new confidential financial statement engine that automatically standardizes, spreads, and scores uploaded financial statements for our clients. We continue leveraging AI developments such as Large Language Models and new technologies to improve our efficiency as we remain committed to reinvesting through product development, data acquisition, and expanded capacity to deliver subscription services whose value exceeds their cost."

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor® (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and supply chain professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company's newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including nearly

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file processes nearly

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, those risks, uncertainties, and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, CEO & President

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/754529/CreditRiskMonitor-Announces-First-Quarter-Results