Minera Don Nicolas Enters Option Agreement with AngloGold Ashanti Argentinian Subsidiary, Cerro Vanguardia SA, for the Sale of its Michelle Exploration Properties for Total Consideration of US$14 Million

Cerrado Gold (CRDOF) has entered into an option agreement with AngloGold Ashanti's subsidiary, Cerro Vanguardia SA (CVSA), for the sale of its Michelle Properties in Argentina for US$14 million. The agreement includes an initial US$4 million payment and US$10 million upon exercise within 3 years.

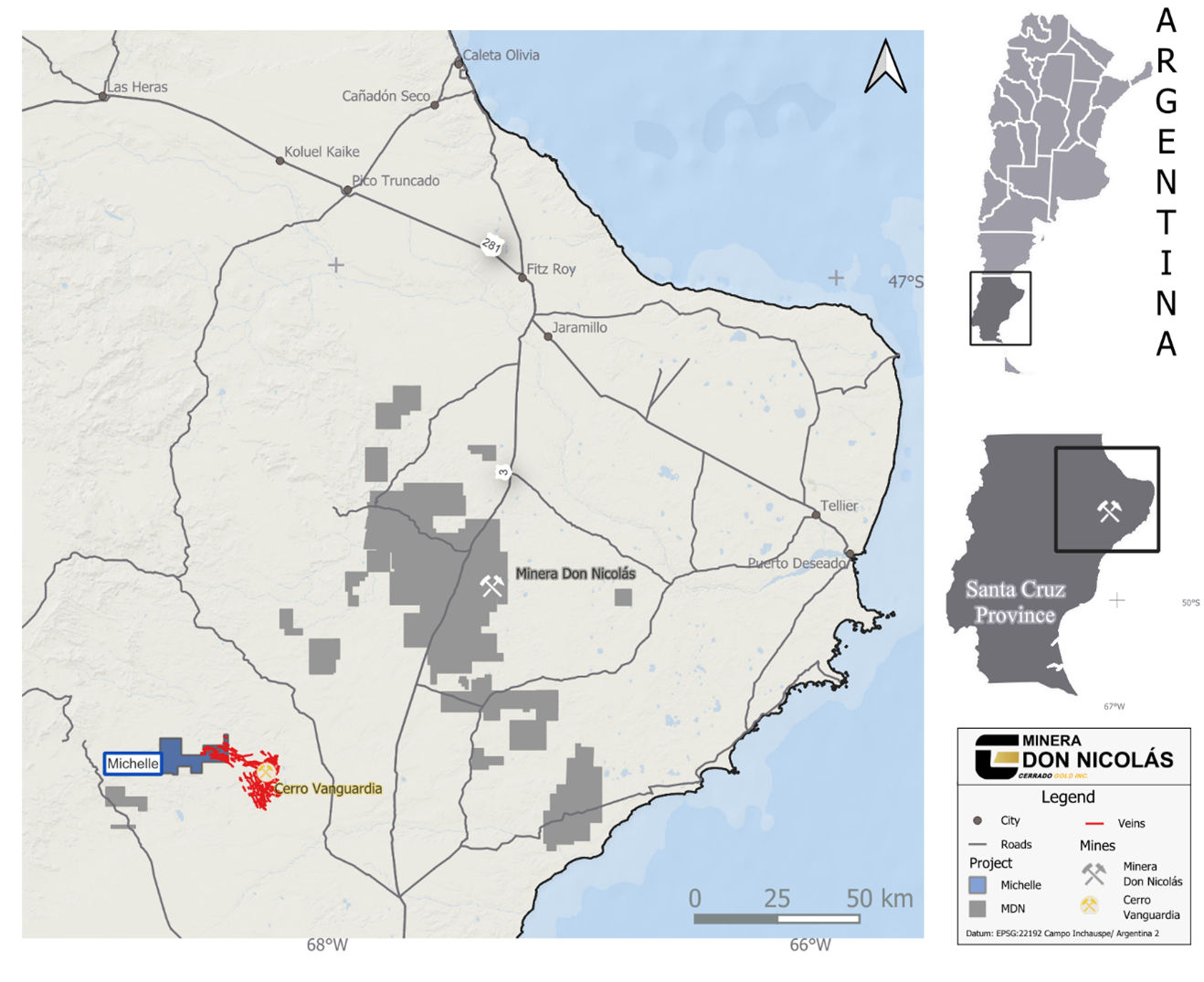

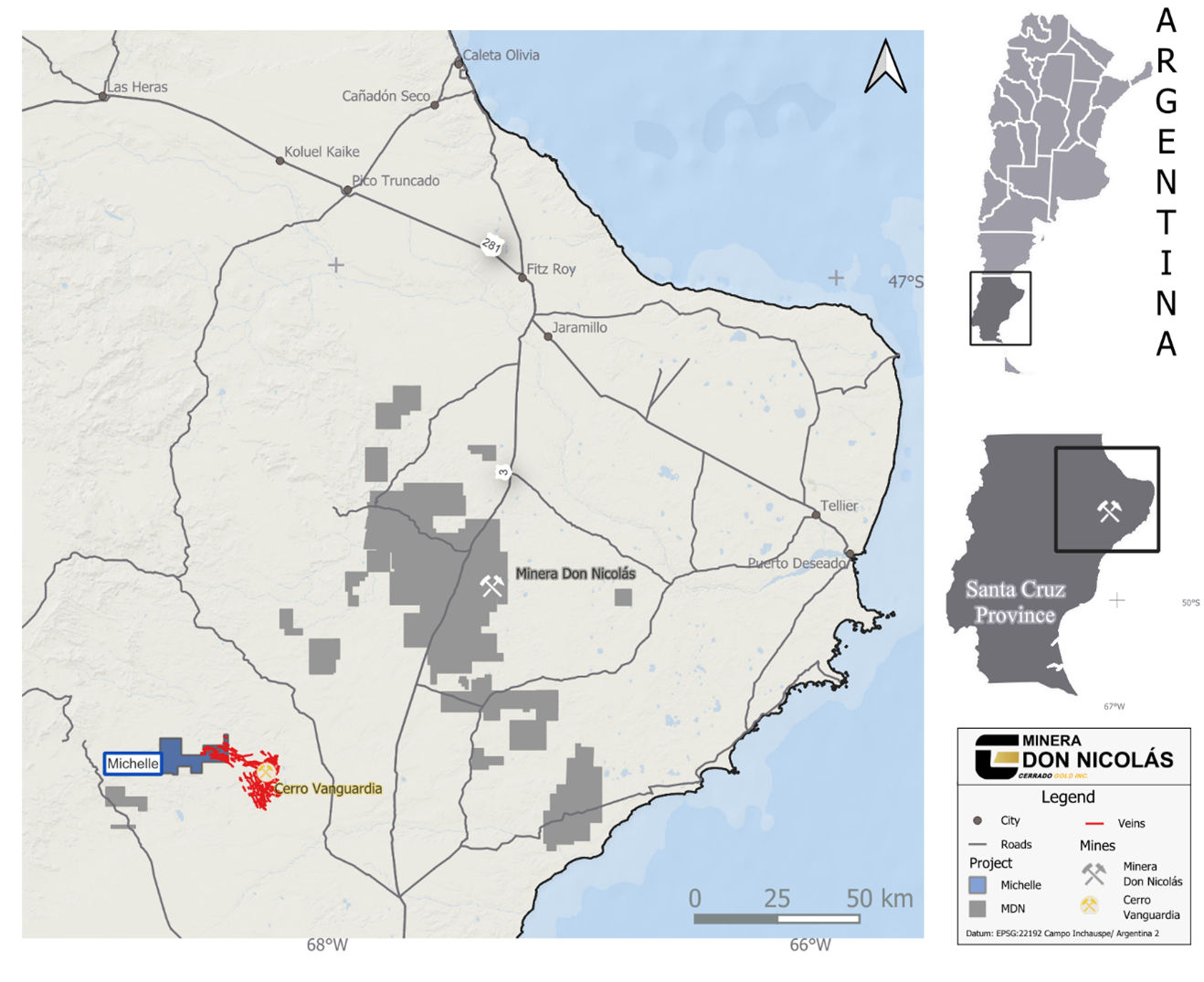

The Michelle Properties comprise 14 exploration concessions totaling 14,000 hectares, located 100 km southeast of the MDN plant. CVSA will take operational control during the option period. The transaction strengthens Cerrado's balance sheet and allows focus on core properties, including the operating Minera Don Nicolas gold mine and Mont Sorcier iron ore project.

The company has secured consents from royalty holders Royal Gold, Sandstorm, and Sprott, with outstanding royalty payments being settled and interest penalties waived.

Cerrado Gold (CRDOF) ha stipulato un accordo di opzione con la sussidiaria di AngloGold Ashanti, Cerro Vanguardia SA (CVSA), per la vendita delle sue Michelle Properties in Argentina per 14 milioni di dollari USA. L'accordo prevede un pagamento iniziale di 4 milioni di dollari USA e 10 milioni di dollari USA al momento dell'esercizio entro 3 anni.

Le Michelle Properties comprendono 14 concessioni di esplorazione per un totale di 14.000 ettari, situati a 100 km a sud-est dell'impianto MDN. CVSA assumerà il controllo operativo durante il periodo di opzione. La transazione rafforza il bilancio di Cerrado e consente di concentrarsi sulle proprietà principali, incluso l'operante mina d'oro Minera Don Nicolas e il progetto di ferro Mont Sorcier.

L'azienda ha ottenuto i consensi dai titolari di royalty Royal Gold, Sandstorm e Sprott, con i pagamenti di royalty in sospeso che vengono saldati e le penalità sugli interessi annullate.

Cerrado Gold (CRDOF) ha firmado un acuerdo de opción con la subsidiaria de AngloGold Ashanti, Cerro Vanguardia SA (CVSA), para la venta de sus Michelle Properties en Argentina por 14 millones de dólares EE. UU.. El acuerdo incluye un pago inicial de 4 millones de dólares EE. UU. y 10 millones de dólares EE. UU. al momento de ejercer la opción dentro de 3 años.

Las Michelle Properties comprenden 14 concesiones de exploración que totalizan 14,000 hectáreas, ubicadas a 100 km al sureste de la planta MDN. CVSA tomará el control operativo durante el período de opción. La transacción fortalece el balance de Cerrado y permite enfocarse en las propiedades principales, incluido la mina de oro en operación Minera Don Nicolás y el proyecto de mineral de hierro Mont Sorcier.

La empresa ha obtenido consentimientos de los titulares de regalías Royal Gold, Sandstorm y Sprott, con los pagos de regalías pendientes siendo liquidadas y las penalizaciones de interés canceladas.

세라도 골드 (CRDOF)는 앵글로골드 아샨티의 자회사인 Cerro Vanguardia SA (CVSA)와 아르헨티나에 위치한 미셸 자산을 1400만 달러에 판매하는 옵션 계약을 체결했습니다. 이 계약은 초기 400만 달러의 지급과 3년 이내에 행사 시 1000만 달러를 포함합니다.

미셸 자산은 MDN 공장에서 남동쪽으로 100km에 위치한 총 1만 4천 헥타르의 14개 탐사 양허권으로 구성되어 있습니다. CVSA는 옵션 기간 동안 운영 통제를 맡게 됩니다. 이번 거래는 세라도의 재무 분포를 강화하고 운영 중인 미네라 돈 니콜라스 금광 및 몽 소르시에 철광 프로젝트를 포함한 핵심 자산에 집중할 수 있게 해줍니다.

회사는 로열 골드, 샌드스톰, 그리고 스프롯과의 로열티 보유자로부터 동의를 확보했으며, 미결제 로열티 지급이 완료되고 이자에 대한 벌금이 면제되었습니다.

Cerrado Gold (CRDOF) a conclu un accord d'option avec la filiale de AngloGold Ashanti, Cerro Vanguardia SA (CVSA), pour la vente de ses Michelle Properties en Argentine pour 14 millions de dollars. L'accord comprend un premier paiement de 4 millions de dollars et 10 millions de dollars lors de l'exercice dans les 3 ans.

Les Michelle Properties comprennent 14 concessions d'exploration totalisant 14 000 hectares, situées à 100 km au sud-est de l'usine MDN. CVSA exercera le contrôle opérationnel pendant la période d'option. La transaction renforce le bilan de Cerrado et permet de se concentrer sur les actifs principaux, y compris la mine d'or en exploitation Minera Don Nicolas et le projet de minerai de fer Mont Sorcier.

L'entreprise a obtenu des consentements des titulaires de redevances Royal Gold, Sandstorm et Sprott, avec des paiements de redevances en souffrance réglés et des pénalités d'intérêt annulées.

Cerrado Gold (CRDOF) hat eine Optionsvereinbarung mit der Tochtergesellschaft von AngloGold Ashanti, Cerro Vanguardia SA (CVSA), über den Verkauf seiner Michelle Properties in Argentinien für 14 Millionen USD abgeschlossen. Die Vereinbarung umfasst eine anfängliche Zahlung von 4 Millionen USD und 10 Millionen USD bei Ausübung innerhalb von 3 Jahren.

Die Michelle Properties bestehen aus 14 Explorationskonzessionen mit insgesamt 14.000 Hektar, die 100 km südöstlich des MDN-Werks liegen. CVSA wird während der Optionsperiode die operative Kontrolle übernehmen. Die Transaktion stärkt die Bilanz von Cerrado und ermöglicht es, sich auf die Kernanlagen zu konzentrieren, einschließlich der operierenden Minera Don Nicolas Goldmine und des Eisenprojekts Mont Sorcier.

Das Unternehmen hat die Zustimmungen von den Lizenzinhabern Royal Gold, Sandstorm und Sprott erhalten, wobei ausstehende Lizenzzahlungen beglichen und Zinsstrafen erlassen wurden.

- Immediate US$4 million cash injection strengthening balance sheet

- Potential additional US$10 million within 3 years

- Reduction in accounts payable through settlement of outstanding royalties

- Waiver of accrued interest and penalties from royalty holders

- Divestment of 14,000 hectares of exploration properties

- Conditional obligation to pay Sandstorm up to US$500,000 for royalty cap

Initial US

$4 Million Option Payment; Further strengthening balance sheetRemaining consideration of US

$10 Million payable on exercise within 3 yearsCompany well-positioned to drive future growth via its operating Minera Don Nicolas gold mine in Argentina and its Mont Sorcier High Grade Iron Ore development project in Quebec

TORONTO, ON / ACCESSWIRE / December 23, 2024 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces that it and its wholly owned subsidiary, Minera Don Nicolas S.A. ("MDN"), have entered into an option agreement ("Option Agreement") with Cerro Vanguardia S.A. ("CVSA") a wholly-owned subsidiary of AngloGold Ashanti Holdings Plc, whereby MDN has granted to CVSA the option ("Option") to purchase a

The Purchase Price is payable in the following stages:

US

$4 million equivalent in Argentina pesos at the CCL Buyers rate upon grant of the Option); andUS

$10 million equivalent in Argentina pesos at the CCL Buyers rate upon exercise of the Option within 3 years.

During the Option Period CVSA will take operational control of the Michelle Properties.

Mark Brennan, CEO and Chairman commented: "The option of these non-core properties to CVSA, the logical owner of these properties, is highly accretive to Cerrado and its shareholders. The Transaction will immediately improve the balance sheet and short-term capital position at MDN, allowing us to focus on our core properties. With current strong operating cashflows at MDN and capital proceeds from asset sales, we are very well positioned to pursue strong growth programs at MDN and at our Mont Sorcier high grade iron project, as well as look at additional opportunities to grow the Company in the near term."

Transaction Summary and Details

The Michelle Properties are a collection of 14exploration concessions, totaling approximately 14,000 hectares located approximately 100 km to the South-East of the MDN plant and 10 km to the North-West of CVSA's Cerro Vanguardia Mine. The Michelle Properties are highlighted in the following map:

MDN will receive from CVSA the Argentina CCL peso equivalent of US

CVSA may exercise the Option at its sole discretion at any time within three (3) years unless earlier terminated (the "Option Period") by providing an exercise notice to MDN and paying the exercise price of the Argentina pesos equivalent of US

Royalty and Stream Holders

Concurrent with the Transaction, MDN obtained prior written consents to the Transaction and exercise of the Option from all holders of royalties and metals streams applicable to the Michelle Properties (the "Consents"), including RG Royalties, LLC ("Royal Gold"), a subsidiary of Royal Gold Inc., Sandstorm Gold Limited ("Sandstorm"), a subsidiary of Sandstorm Gold Royalties, and Sprott Private Resource Streaming and Royalty (B) Corp. ("Sprott"). Receipt of the Consents reduces risks and expedites closing if CVSA elects to exercise the Option.

Prior to executing the Option Agreement, Royal Gold was paid all accrued royalty amounts outstanding as of September 30, 2024, and Sandstorm was paid a lump sum. Both Royal Gold and Sandstorm agreed to waive all accrued interest and penalties on royalty amounts outstanding as of September 30, 2024, provided that in the case of Sandstorm, all royalty amounts are paid when due in instalments over the next two quarters. The waiver of accrued interest and penalties, taken together with the repayment of outstanding royalties, results in substantial reductions of Company accounts payable. In connection with the Consents and the waiver of interest and penalties, the Company provided corporate guarantees to Royal Gold and Sandstorm relating to their royalty agreements with MDN, and MDN and has conditionally agreed to pay Sandstorm up to US

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

Email: info@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, that CVSA will exercise the Option, receipt by Cerrado of the whole Purchase Price including the

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com