Cerrado Gold Announces Q4 and Annual 2024 Gold Production Results for its Minera Don Nicolas Mine in Argentina

Cerrado Gold reported its Q4 and annual 2024 production results from the Minera Don Nicolas Mine in Argentina. The company achieved annual gold equivalent production of 54,494 GEO, within their guidance of 50,000-60,000 GEO. Q4 production was 10,431 GEO, lower than Q3's 16,604 GEO due to decreased ore grades from residual open pits.

The company's heap leach operations reached record production of 5,956 GEO in Q4. Cerrado received significant asset sale and option payments totaling $34 MM during the quarter, strengthening their balance sheet. For 2025, production guidance is set at 50,000-55,000 GEO.

The company is installing additional crushing capacity at Calandrias Sur, aiming to reach 4,000-4,500 GEO monthly production by March 2025. They're also preparing to commence underground operations at Paloma in H2/25. At their Mont Sorcier project, metallurgical testwork confirmed potential for high-grade iron concentrate production, with a Bankable Feasibility Study targeted for Q1 2026.

Cerrado Gold ha riportato i risultati di produzione per il quarto trimestre e per l'anno 2024 della Minera Don Nicolas in Argentina. L'azienda ha raggiunto una produzione annuale equivalente di oro di 54.494 GEO, all'interno delle loro previsioni di 50.000-60.000 GEO. La produzione del quarto trimestre è stata di 10.431 GEO, inferiore ai 16.604 GEO del terzo trimestre a causa della diminuzione dei gradi di minerale dalle miniere a cielo aperto residue.

Le operazioni di heap leach della società hanno raggiunto una produzione record di 5.956 GEO nel quarto trimestre. Cerrado ha ricevuto significativi pagamenti da vendite di asset e opzioni totali di 34 milioni di dollari durante il trimestre, rafforzando il proprio bilancio. Per il 2025, le previsioni di produzione sono fissate a 50.000-55.000 GEO.

L'azienda sta installando capacità di frantumazione aggiuntiva a Calandrias Sur, puntando a raggiungere una produzione mensile di 4.000-4.500 GEO entro marzo 2025. Stanno anche preparando l'avvio delle operazioni sotterranee a Paloma nel secondo semestre del 2025. Nel loro progetto Mont Sorcier, i test metallurgici hanno confermato il potenziale per la produzione di concentrato di ferro ad alto grado, con uno studio di fattibilità bancabile previsto per il primo trimestre 2026.

Cerrado Gold informó sus resultados de producción del cuarto trimestre y del año 2024 de la Mina Minera Don Nicolas en Argentina. La empresa alcanzó una producción anual equivalente de oro de 54,494 GEO, dentro de su guía de 50,000-60,000 GEO. La producción del cuarto trimestre fue de 10,431 GEO, inferior a los 16,604 GEO del tercer trimestre debido a la disminución de las leyes de mineral de las minas a cielo abierto residuales.

Las operaciones de lixiviación en montón de la compañía alcanzaron una producción récord de 5,956 GEO en el cuarto trimestre. Cerrado recibió pagos significativos por ventas de activos y opciones que totalizaron 34 millones de dólares durante el trimestre, fortaleciendo su balance. Para 2025, la guía de producción se establece en 50,000-55,000 GEO.

La compañía está instalando capacidad de trituración adicional en Calandrias Sur, con el objetivo de alcanzar una producción mensual de 4,000-4,500 GEO para marzo de 2025. También se están preparando para iniciar operaciones subterráneas en Paloma en el segundo semestre de 2025. En su proyecto Mont Sorcier, los trabajos de prueba metalúrgica confirmaron el potencial para la producción de concentrado de hierro de alta ley, con un Estudio de Viabilidad Bancable previsto para el primer trimestre de 2026.

세라도 골드는 아르헨티나의 미네라 돈 니콜라스 광산에서 2024년 4분기 및 연간 생산 결과를 발표했습니다. 이 회사는 연간 금당량 생산량 54,494 GEO을 달성하였으며, 이는 50,000-60,000 GEO의 예상 범위 내입니다. 4분기 생산량은 10,431 GEO로, 잔여 개방 구덩이에서의 광석 등급 감소로 인해 3분기 16,604 GEO보다 낮았습니다.

회사의 힙 리치 운영은 4분기에 5,956 GEO의 기록적인 생산량에 도달했습니다. 세라도는 분기 동안 총 3,400만 달러의 자산 매각 및 옵션 대금을 수령하여 재무 상태를 강화했습니다. 2025년 생산 지침은 50,000-55,000 GEO로 설정되었습니다.

회사는 칼란드리아스 수르에 추가 분쇄 능력을 설치하고 있으며, 2025년 3월까지 월 4,000-4,500 GEO 생산을 목표로 하고 있습니다. 또한 2025년 하반기 팔로마에서 지하 작업을 시작할 준비를 하고 있습니다. 몽 소르시에르 프로젝트에서는 금속 시험 작업을 통해 고품질 철 농축물 생산 가능성을 확인했으며, 2026년 1분기에 자금 조달 가능 연구를 목표로 하고 있습니다.

Cerrado Gold a publié ses résultats de production du quatrième trimestre et de l'année 2024 de la Mine Minera Don Nicolas en Argentine. L'entreprise a atteint une production équivalente en or annuelle de 54 494 GEO, dans la fourchette de prévisions de 50 000 à 60 000 GEO. La production du quatrième trimestre s'est élevée à 10 431 GEO, inférieure aux 16 604 GEO du troisième trimestre en raison de la baisse des teneurs en minerai des mines à ciel ouvert résiduelles.

Les opérations de lixiviation sur tas de l'entreprise ont atteint une production record de 5 956 GEO au quatrième trimestre. Cerrado a reçu pendant le trimestre des paiements importants liés à la vente d'actifs et aux options, totalisant 34 millions de dollars, renforçant ainsi son bilan. Pour 2025, les prévisions de production sont fixées entre 50 000 et 55 000 GEO.

L'entreprise installe une capacité de concassage supplémentaire à Calandrias Sur, visant à atteindre une production mensuelle de 4 000 à 4 500 GEO d'ici mars 2025. Elle se prépare également à commencer des opérations souterraines à Paloma au second semestre 2025. Dans son projet Mont Sorcier, des essais métallurgiques ont confirmé le potentiel de production de concentré de fer de haute qualité, avec une étude de faisabilité bancable prévue pour le premier trimestre 2026.

Cerrado Gold hat die Produktionszahlen für das vierte Quartal und das gesamte Jahr 2024 aus der Minera Don Nicolas Mine in Argentinien veröffentlicht. Das Unternehmen erzielte eine jährliche Goldäquivalentproduktion von 54.494 GEO, was innerhalb ihrer Prognose von 50.000-60.000 GEO liegt. Die Produktion im vierten Quartal betrug 10.431 GEO, was niedriger ist als die 16.604 GEO im dritten Quartal aufgrund verringerten Erzgehalten aus residualen Tagebauen.

Die Heap-Leach-Operationen des Unternehmens erreichten im vierten Quartal eine Rekordproduktion von 5.956 GEO. Cerrado erhielt im Quartal signifikante Zahlungen aus Asset-Verkäufen und Optionen in Höhe von insgesamt 34 Millionen Dollar, wodurch die Bilanz gestärkt wurde. Für 2025 wurde die Produktionsprognose auf 50.000-55.000 GEO festgelegt.

Das Unternehmen installiert zusätzliche Brechkraft an Calandrias Sur und strebt an, bis März 2025 eine monatliche Produktion von 4.000-4.500 GEO zu erreichen. Sie bereiten sich auch darauf vor, im zweiten Halbjahr 2025 mit unterirdischen Operationen in Paloma zu beginnen. In ihrem Projekt Mont Sorcier bestätigten metallurgische Testarbeiten das Potenzial zur Produktion von hochgradigem Eisenerzkonzentrat, wobei eine bankfähige Machbarkeitsstudie für das erste Quartal 2026 angestrebt wird.

- Annual production of 54,494 GEO achieved within guidance range

- Record heap leach production of 5,956 GEO in Q4

- Received $34 MM from asset sales and option payments

- Significant balance sheet improvement

- Additional crushing capacity installation in progress to increase production

- Q4 production declined to 10,431 GEO from 16,604 GEO in Q3

- Lower than planned ore grades from residual open pits

- 2025 guidance shows potential decrease from 2024 levels (50,000-55,000 GEO vs 54,494 GEO)

Annual Gold Equivalent Ounce ("GEO") Production of 54,494 GEO; in line with Guidance of 50,000 - 60,000 GEO.

Q4 Production of 10,431 GEO impacted by lower than planned ore grades from residual open pits.

Record Production of 5,956, GEO from Heap Leach operations during the quarter.

Received Asset Sale and Option payments totaling

$34 M M during the quarter, significantly strengthening the balance sheet.2025 Production Guidance of between 50,000-55,000 GEO.

TORONTO, ON / ACCESSWIRE / January 15, 2025 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the fourth quarter ended December, 2024 ("Q4 2024") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full fourth quarter financial results are expected to be released prior to April 30, 2025.

Q4 Operating Highlights

Q4 Production of 10,431 GEO vs 16,604 GEO in Q3.

Annual Sales of 51,694 GEO for 2024

Production impacted by lower than planned feed grade to the CIL plant during the quarter as mining of high-grade pits nears completion.

Studies to commence underground operations at Paloma in H2/25 initiated during the quarter.

Focus remains on ramping up crushing capacity at Calandrias Sur and bringing heap leach production up to 4,000- 4,500 GEO per month by March 2025.

While operational results for Q4 2024 demonstrated a decrease in production over the previous quarter, this was driven by lower than expected ore grades delivered from the final stages of mining of the older high grade open pits and stockpiles to feed the CIL plant as the Company's operations transition to a primarily heap leach operation in 2025. The heap leach operational performance continued to improve over the quarter, reaching record production levels as more ore was added to the pad. The performance of the heap leach continues to depend on the crushing circuit. An additional secondary crushing circuit is currently being installed to ensure excess capacity is in place to support the transition to a heap leach only facility. Once fully operational, the crushing capacity should allow for approximately 300,000 tonnes of ore to be placed on the pad per month. The installation of the secondary crusher is expected to reduce fleet and operating costs and is expected to operate at full capacity by the end of the 1st quarter, at which time the mobile crushers will be placed on stand by.

In addition, the company is undertaking detailed analysis and preparations for equipment sourcing with the view to commencing underground operations later this year beneath the Palmoa pit. While the initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at lower costs than drilling from surface with the aim to materially expand the resources available for underground development. Further details will be released once finalized and a development decision is made.

The Company provides 2025 annual production guidance of between 50,000 - 55,000 GEO at an ASIC of between

Mont Sorcier Update

At the Mont Sorcier high purity iron project, detailed metallurgical testwork and flow sheet design continued during the quarter. As announced in early December 2024 (see press release dated December 4, 2024) testwork has reaffirmed the potential to produce high grade and high purity iron concentrate grading in excess of

Current testwork and overall process design are to be at the core of the NI 43-101 Bankable Feasibility Study ("BFS") which is targeted to be completed by the end of Q1 2026. The Bankable Feasibility Study will look to provide greater detail into the potential of the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV

Corporate Activities

The Company has also continued to make progress on improving its working capital position during the quarter with the receipt of a total of US

Mark Brennan, CEO and Chairman commented, "While 2024 was a year with significant challenges, we are pleased to have achieved gold production in line with our guidance for the year, supported by strong growth in production from the heap leach as the year progressed. With the new crushing circuit currently being installed, we expect this trend to continue to support production targets for 2025 while we review the potential to add additional production from a potential underground operation at Paloma. Further testwork at our Mont Sorcier project in Quebec continues to highlight the significant upside we see in this project as we work to unlock value with the completion of a feasibility study by Q1/2026. Cerrado is exiting the year with a significantly improved working capital position, placing Cerrado in a stronger financial position heading into 2025. "

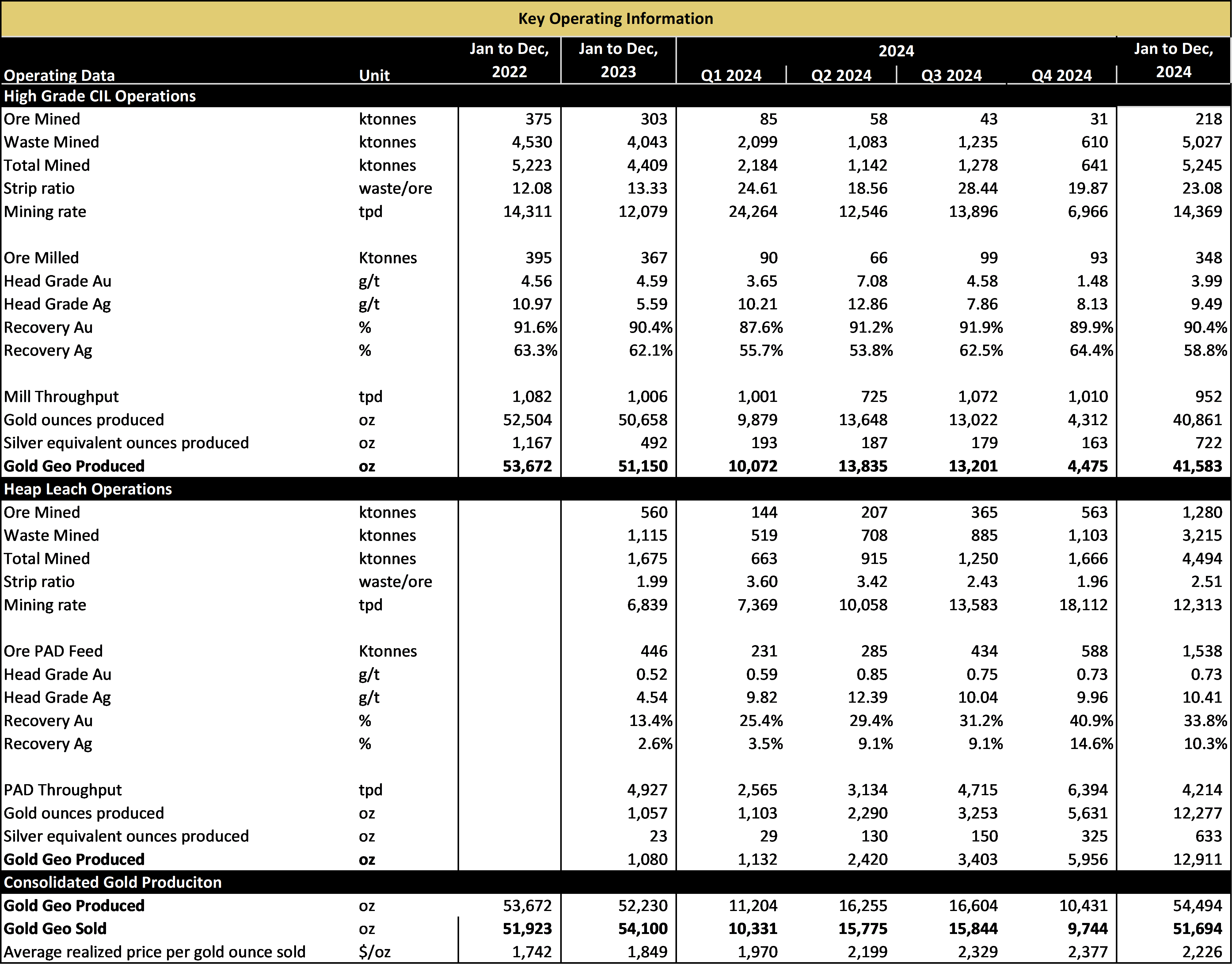

Table 1. Key Operating Information

Note : Q1-Q3 2024 Ore mined for Heap Leach Operations has been adjusted to reflect a recalculation based on updated information. This has no impact on ounces produced.

Review of Technical Information

The scientific and technical information from Minera don Nicolas in this press release has been reviewed and approved by Cid Bonfim, P. Geo., Senior Geologist Cerrado Gold, and Pierre Jean LaFleur, P. Geo., VP Exploration for Voyager Metals, a

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, production forecasts and estimated ASIC for 2025 and beyond, the potential for additional crushing capacity that may be added and the performance of the heap leach pad, the possibility of commencing underground mining, the potential to produce iron concentrate grading in excess of

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com