Cerrado Gold Reports Third Quarter Operating and Financial Results at Its Minera Don Nicolas Mine in Argentina

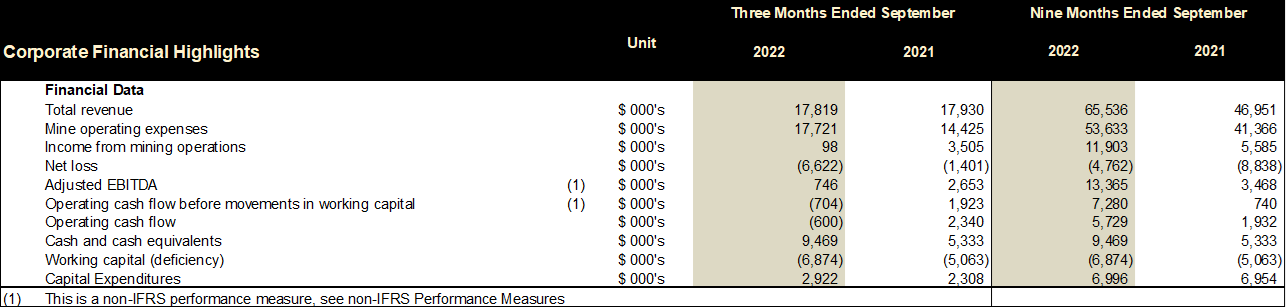

Cerrado Gold Inc. (OTCQX: CRDOF) reported its Q3 2022 results, producing 11,284 Gold Equivalent Ounces. The AISC rose to $1,494 per ounce, influenced by increased stripping and labor costs, but is expected to decrease in Q4. Adjusted EBITDA stood at $0.7 million, reflecting higher operational costs. Revenue for Q3 was $17.8 million, down from Q2's $20.3 million, attributed to lower gold prices. The company received a permit for heap leach construction at the Calandrias Project as it continues exploration efforts in Brazil.

- Production of 11,284 Gold Equivalent Ounces aligns with annual guidance.

- Heap leach pad construction has commenced at the Calandrias Heap Leach Project.

- Increased gold head grade to 4.40 g/t, a 28% rise over Q2 2022.

- Net loss of $6.6 million, up from a loss of $1.5 million in Q2 2022.

- Revenue dropped to $17.8 million from $20.3 million in Q2 due to lower gold prices.

- Adjusted EBITDA decreased by $2.3 million compared to the previous quarter.

Insights

Analyzing...

- Q3 Production of 11,284 Gold Equivalent Ounces

- AISC of

$1,494 per ounce of gold (Expected Peak Costs at MDN) - Q3 adjusted EBITDA of

$0.7 million - Minera Don Nicolas receives permit to allow pad construction at Calandrias Heap Leach Project

TORONTO, ON / ACCESSWIRE / November 23, 2022 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") reports its operational and financial results for the third quarter of 2022 ("Q3 2022"). The Company's financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com).

Q3 2022 Financial and Operational Highlights (All numbers reported in US$)

- Production of 11,015 ounces of gold in Q3 2022 (11,284 Gold Equivalent Ounces ("GEO"), in-line with annual guidance of 45,000 - 55,000 ounces of production

- AISC of

$1,494 per ounce of gold sold due to higher stripping costs, lower throughput and higher labor costs during the quarter; costs expected to be significantly reduced in the fourth quarter - Q3 adjusted EBITDA of

$0.7 million primarily due to higher operating costs

Mark Brennan, CEO and Co-Chairman stated: "Q3 provided challenges as we integrated new pits, increased strip ratios and incurred increased labor costs. We expect unit operating costs to have peaked with the fourth quarter looking particularity strong and note that production levels are within our range of guidance for 2022. Our heap leach pad construction has commenced and we believe this is the first step towards bringing stronger long term operating metrics to MDN. In Brazil, work continues to upgrade the resources at Monte Do Carmo while feasibility works are progressing as planned."

Third Quarter 2022 Operational and Financial Performance

Minera Don Nicolas

The Company produced 11,015 ounces of gold and 22,419 ounces of silver during the three month period ended September 30, 2022, as compared to 11,296 ounces of gold and 28,721 ounces of silver in the second quarter of 2022. Ounces produced in the quarter were consistent with the second quarter, however, the slight decrease was primarily related to a decrease in throughput at the mill. Although mine production rates showed a slight decrease at the start of the quarter, planning and management intervention has ensured that mining numbers ended in line with expectations at the end of the quarter. As the new pits are further developed, we expect grades and throughput rates to improve in the fourth quarter of the year. Gold production was

The average gold head grade of 4.40 grams per tonne ("g/t") represents a

Monte Do Carmo Project

In Brazil, the Company continues to focus on numerous fronts to support the completion of the Feasibility Study ("FS") at Monte do Carmo. Infill drilling continued in the quarter and to November 10th Cerrado completed 26,405 metres as well as 14,174 metres of exploratory drilling and 3,480 metres of sterilization drilling with the use of 5 drill rigs. To date, assay results from 97 complete infill drill holes have been received, and results to date continue to support the conversion of Inferred Resources to the Measured and Indicated resource categories. In addition, four exploratory drill holes to the east of the East Zone at Serra Alta returned anomalous assay grades defining a new mineralized zone called E3. The discovery drill hole FSZ-008 presented a remarkable composite of 13.23m@ 5.53 Au g/t, demonstrating potential expansion of the resource base to the east at Serra Alta. An additional 6,300 meters of drilling were added to the overall 2022 drilling program to target potential areas to expand the Indicated and inferred resources at Serra Alta.

Exploration drilling continues at MDC targeting extensional and satellite zones like Gogo de Onca ("Gogo") and the newly discovered E3 target. The Company announced on November 21 the discovery hole at E3; a 150m step out corridor to the east of the East Zone, that according to preliminary continuity models indicate it could have approximately 250 m of strike length. To date, the Company has received 24 complete drill hole results from the Gogo target. Initial drilling results at the Gogo target are encouraging as the main mineralization controls seen at the Serra Alta deposit are replicated at Gogo. 6,745 meters have been drilled to November 10th. The remarkable results at Gogo include; FGO-004 25.09m@ 3.38 Au g/t, FGO-008 - 12.49m@ 3.39 Au g/t and FGO-12 11.69m@ 5.37 Au g/t. The company will continue to work at Gogo with geological modeling, and has completed a shipment of 115 Kg of mineralized material from core to perform metallurgical test work.

The Company has also completed its Environmental Impact Studies ("EIS") for the Serra Alta deposit at MDC and filed a full report in July 2022 with the local environmental authorities, NATURATINS. After receiving approval from NATURATINS, public hearings will be held with the local community followed by an application for the Preliminary License ("PL") followed rapidly thereafter by the Installation License ("IL").

Financial Results

The Company generated revenue of

Cash operating costs per ounce sold was

Adjusted EBITDA was

The Company incurred general and administrative expenses of

Other expenses included a

Net loss for the three months ended September 30, 2022, was

Capital expenditure for the quarter was

Basic and diluted loss per share for the three months ended September 30, 2022, was

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

| Mark Brennan | David Ball |

| CEO and Co Chairman | Vice President, Corporate Development |

| Tel: +1-647-796-0023 | Tel: +1-647-796-0068 |

| mbrennan@cerradogold.com | dball@cerradogold.com |

About Cerrado

Cerrado is a Toronto based gold production, development and exploration company focused on gold projects in the Americas. The Company is the

At Minera Don Nicolas, Cerrado is maximising asset value through further operation optimization and continued production growth. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package.

At Monte Do Carmo, Cerrado is rapidly advancing the Serra Alta deposit through Feasibility and production. The Serra Alta deposit Indicated Resources of 541 kozs of contained gold and Inferred Resources of 780 kozs of contained gold. The Preliminary Economic Assessment demonstrates robust economics as well as the potential to be one of the industry's lowest cost producers. Cerrado also holds an extensive and highly prospective 82,542 ha land package at Monte Do Carmo.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado Gold. In making the forward- looking statements contained in this press release, Cerrado Gold has made certain assumptions, including, but not limited to the peak of unit operating costs, the anticipated strength of financial results and production rates for the fourth quarter of 2022, the ability to meet production guidance, the expansion potential of the resource to the east of Serra Alta and the dates for the completion of the Monte Do Carmo Feasibility Study. Although Cerrado Gold believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado Gold disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/727938/Cerrado-Gold-Reports-Third-Quarter-Operating-and-Financial-Results-at-Its-Minera-Don-Nicolas-Mine-in-Argentina