Cerrado Gold Reports Q3 Operating Results

- Gold production of 10,082 GEO in Q3/23

- Operating performance has returned to normal in October and November

- Significant opportunity to see a reduction in operating costs and increased cashflow

- After-Tax NPV of US$369 million and IRR of 32% for MDC project

- Gold production decrease of 11% yoy

- AISC of $1,703 per ounce due to difficult operating conditions

- Cash costs per ounce sold increased by 16%

- Net loss for the three months ended September 30, 2023 was $0.4 million

- Q3 Production of 10,082Gold Equivalent Ounces("GEO")

- Q3 results impacted by severe weather conditions

- Operations back on track in October and November with shipments of approximately 5,600 and 5,470 GEO, respectively

- Minera Don Nicolas ("MDN") Expansion Capital Expenditure program now largely complete

(All numbers reported in US dollars)

TORONTO, ON / ACCESSWIRE / November 29, 2023 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces the operational and financial results for the third quarter 2023 ("Q3/23") at its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and reports on its ongoing activities at the Monte Do Carmo gold project ("MDC") in Brazil. Production results at MDN were previously released on October 24, 2023. The Company's quarterly financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com).

Q3 2023 MineraDon Nicolas ("MDN")Financial Highlights:

- Gold production of 10,082 GEO in Q3/23, an

11% decrease year-on-year ("yoy"). - AISC of

$1,703 per ounce duringQ3/23 due to difficult operating conditions seen in the quarter resulting in lower production rates. - Operating performance has returned to normal in October and November, with sales of approximately 5,600 and 5,470 GEO, respectively.

- MDN capital program now largely complete,

$34.3m invested in Expansion Capital year to date to develop heap leach facility (US$23.9m ), pre-stripping of Calandrias Norte (US$5.0m ) and exploration (US$5.4m ).- Expansion program largely funded via short term notes in Argentina to be rolled over to longer maturity.

- Production expected to ramp up into 2024, generating significant cash flows to rapidly reduce debt levels.

- Significant opportunity to see a reduction in operating costs and increased cashflow in US dollar terms going forward should depreciation in applicable exchange rate continue post-election.

Mark Brennan, CEO and Chairman, stated: "While these results reflect very severe winter weather conditions resulting in lower production in Argentina, the team at MDN has rapidly enabled us to ramp up production while completing our capital projects and expansion plans from October. With our initial heap leach project operating and Calandrias Norte now in production, we now look to reap the benefits of these capital investment programs moving into 2024 through increased production and significant operating cashflow." He added "Post-election, we remain optimistic for a more accommodative fiscal regime providing for significant accretion to cashflow allowing us to restructure our debt and develop a healthy balance sheet at Cerrado."

MDN Outlook

Going forward into Q4/2023 and 2024, Cerrado's MDN operations are now positioned to benefit from the completion of its recent expansionary capital expenditure program to grow production with its new heap leach operations, while sustaining high-grade CIL production. The Company has invested approximately US

Results in October and November are already demonstrating more normalized operations as a result of these investments, with shipments for the two months totaling approximately 11,070 GEOs. With operations returning to normal, the Company anticipates a significant improvement in cash generation, which should be significantly enhanced with an improved fiscal policy and a more normalized FX regime in Argentina supporting lower operating costs in US dollar terms. While the near-term cash generating profile continues to improve, the company is also actively working to term out the maturity of its current short term debt profile and roll a significant amount of these obligations as is customary in Argentina.

Argentinian Currency Controls

Starting October 11 2023, by means of Joint Resolution No. 1/23 of the certain Ministries of the Argentinian Government, exporters of gold, silver and their concentrates were allowed to settle their exports at a preferential exchange rate resulting from settling

Third Quarter 2023 Operational and Financial Performance

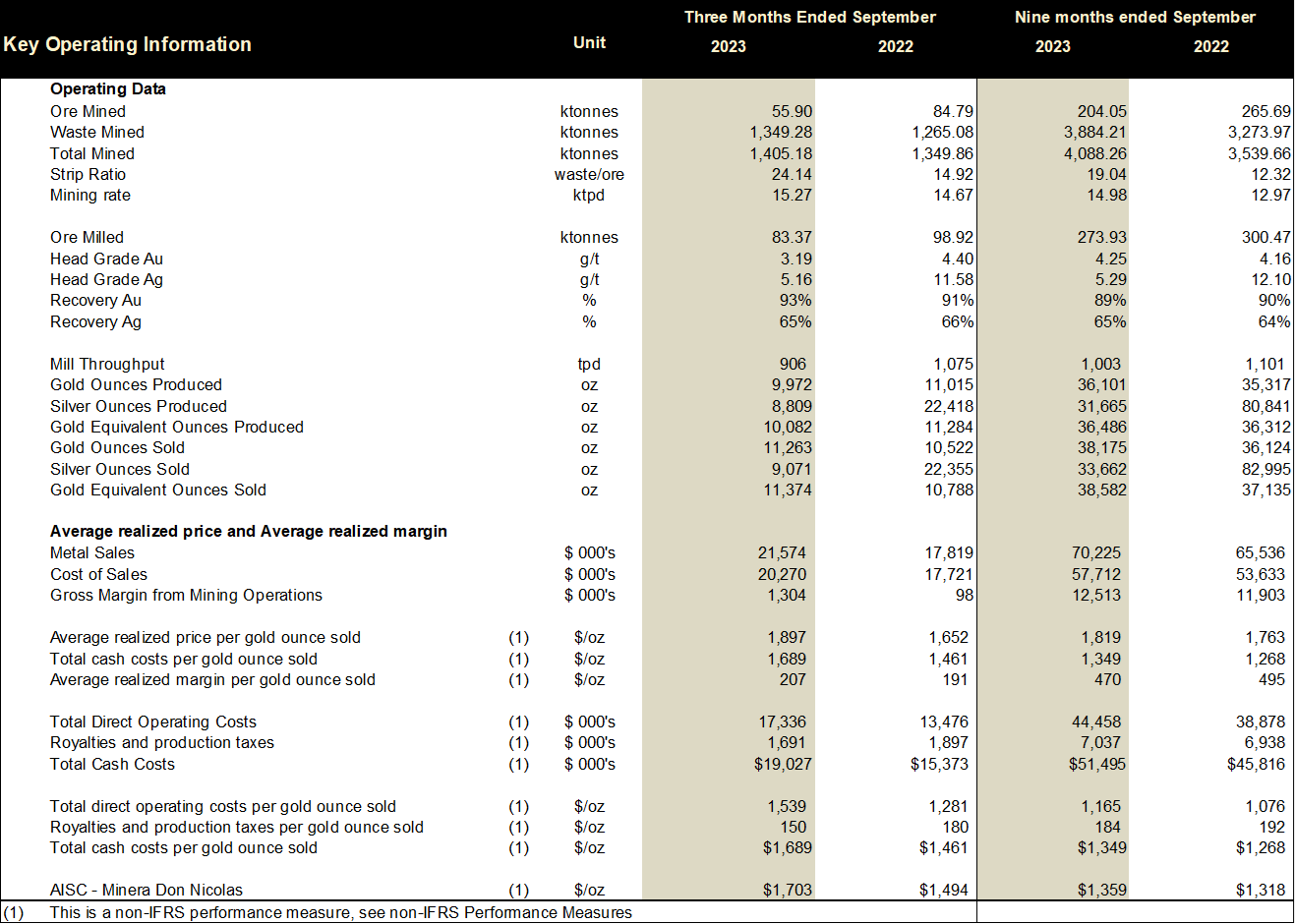

Q3/23 and Full Year Operational Highlights Minera Don Nicolas

The Company produced 10,082 GEO ("Gold Equivalent Ounces") during the three months ended September 30, 2023, as compared to 11,284 GEO in the three months ended September 30, 2022. Production was

The average quarterly gold head grade of 3.19 g/t recorded in the third quarter of 2023 represents a

Stripping at Calandrias Norte commenced during the quarter with over 1.6MM tonnes of material moved. A further 2.7MM tonnes is to be stripped in October and November and fresh ore is set to feed the mill from December onwards. Results in Q4 are expected to show significant improvement and benefit from access and limited future stripping required for the Calandrias Norte material and the further ramp up of the heap leach operations. This new pit is planned to be the primary source of ore in 2024.

During Q3/2023, the team continued exploration efforts to advance several greenfield and brownfield targets with the aim of increasing mine life and expanding the overall resource endowment, while continuing to support the move to underground mining at Paloma.

Las Calandrias Heap Leach Project

At the new Calandrias heap leach project, work continued as the operation remained in the commissioning phase during the quarter. Initial ramp up was impacted by freezing conditions reducing initial irrigation rates which has now been addressed. Finalization of the crushing plant has now been completed, which should also see more consistent feed to the pad and improve overall performance going forward. Approximately 538 ozs were produced in the quarter. Production is set to achieve nameplate production rates from January thereafter.

Given weather production disruption in Q3/23 full production is now targeted for January 2024. The Calandrias Heap Leach is the first step in Cerrado's plans for growing production capacity at MDC. All Argentinian projects continue to be funded by operating cash flow and local debt facilities.

Monte Do Carmo Project, Brazil

During Q3/2023, the Company, together with its numerous advisors, completed the bankable feasibility study ("FS") announced on November 7, 2023 showing MDC to be an extremely high quality, low-cost robust economic project. A summary of the key highlights is presented below:

Highlights

- After-Tax NPV of US

$369 million and IRR of32% - Average annual gold production of 94,797 ounces per annum over 9 year Life of Mine ("LOM")

- Average AISC of US

$711 per ounce over LOM - Initial Capex of US

$186.6 million (including US$15.8 million contingency)- 2:1 ratio of NPV over Initial Capex

- Annual average free cash flow of

$85 million over the LOM, with total cumulative after-tax free cash flow of$562 million over LOM - Initial Proven and Probable Reserves of 895 koz of Gold (16.8 Mt at 1.66 g/t Au)

- Updated Measured and Indicated Resources of 1,012 koz of Gold (18.4 Mt at 1.72 g/t Au) and Inferred Resources of 66 koz of Gold (1.1 Mt at 1.95 g/t Au)

In addition, regional exploration continues on the greater project area aimed at growing the known resources and extending the potential mine life. During the quarter, the exploration focus has been on the Northern extension of the Serra Alta deposit, to the East of the south pit and to the north of Gogo, as well as on testing more greenfield targets such as Divisa and Bit-3 for ongoing development.

The Preliminary License ("LP") was issued from the InstitutoNatureza do Tocantins("NATURATINS") on May 29, 2023 and the License of Installation/Construction ("LI")is expected to follow within 90 - 120 days of the LP issuance.

The Company also continues to pursue project funding from the UK Export Credit Agency("UKEF"), which is progressing well, and subject to successful due diligence and other review, is expected to be completed approximately during Q3 2024.

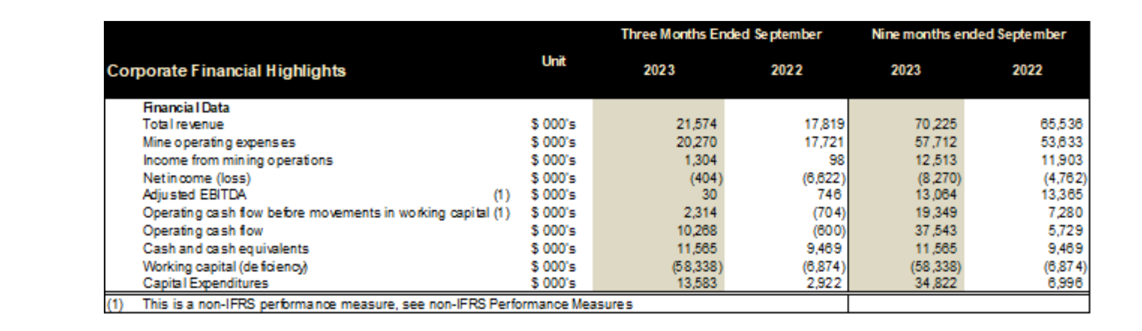

Q3/2023 Financial Highlights

The Company generated revenue of

Cash costs per ounce sold were

Cash provided by operating activities during the third quarter ended September 30, 2023, was

Adjusted EBITDA was

Net loss for the three months ended September 30, 2023 was

Basic and diluted loss per share for the three months ended September 30, 2023,was

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich,P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masif.

In Brazil,Cerrado is rapidly advancing the Serra Alta deposit at its Monte Do Carmo Project, through feasibility and into production. Serra Alta is expected to be a high-margin and high-return project with significant exploration potential on an extensive and highly prospective 82,542 hectare land package.

In Canada,Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan Mike McAllister

CEO and Chairman Vice President, Investor Relations Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward- looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the expectation of production ramp up in 2024, the political situation in Argentina, including the likelihood of changes to the fiscal and currency regimes and the potential benefits to the Company resulting from political changes, the ability of MDN to fund its operations through cash flow and local debt facilities, anticipated timing for licensing at Monte Do Carmo, time required to reach production capacity at Las Calandrias, the future operating costs in Argentina, as well the timing of the feasibility study at Monte Do Carmo. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/810872/cerrado-gold-reports-q3-operating-results

FAQ

What is Cerrado Gold Inc.'s ticker symbol?

What was the gold production in Q3/23?

What were the financial highlights for Q3/23?