Cerrado Gold Provides an Update on its Mont Sorcier High Purity 67%+ Iron Grade Project in Quebec

Cerrado Gold provides an update on its Mont Sorcier iron ore project in Quebec, highlighting ongoing metallurgical testing that confirms production of DRI grade iron concentrate with 67%+ purity and combined Silica and Alumina below 2.5%. The company has appointed DRA Global to deliver a NI 43-101 Bankable Feasibility Study by Q1 2026.

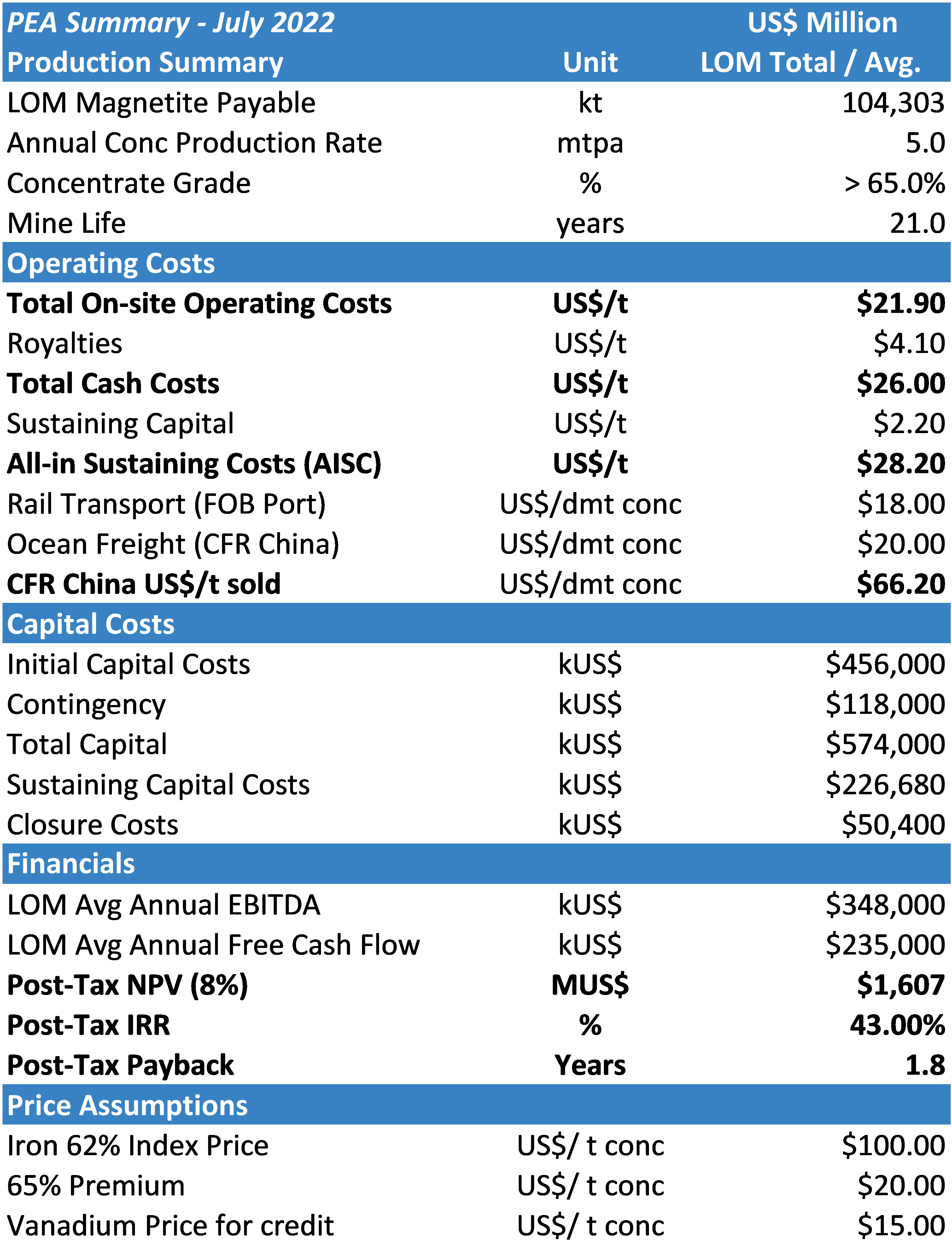

The project's 2022 PEA showed an NPV8% of US$1.6 Billion for a 21-year mine life, projecting 5MT of Iron Concentrate production annually, generating US$348M per annum in cash flow with initial capex of US$574M. UKEF and TD Bank have agreed to sponsor 70% of project capital required.

The metallurgical program, conducted by Soutex Inc. and SGS Canada, shows promising results with potential for further improvements in iron grade and purity.

Cerrado Gold fornisce un aggiornamento sul suo progetto minerario di ferro Mont Sorcier in Quebec, evidenziando i test metallurgici in corso che confermano la produzione di concentrato di ferro di grado DRI con oltre il 67% di purezza e una combinazione di silice e allumina inferiore al 2,5%. L'azienda ha nominato DRA Global per fornire uno Studio di Fattibilità Bankabile NI 43-101 entro il primo trimestre del 2026.

Il PEA del progetto 2022 ha mostrato un VAN8% di 1,6 miliardi di dollari USA per una vita mineraria di 21 anni, prevedendo una produzione annuale di 5MT di concentrato di ferro, generando 348 milioni di dollari USA all'anno in flusso di cassa con un capex iniziale di 574 milioni di dollari USA. UKEF e TD Bank hanno accettato di finanziare il 70% del capitale necessario per il progetto.

Il programma metallurgico, condotto da Soutex Inc. e SGS Canada, mostra risultati promettenti con potenziali ulteriori miglioramenti nella qualità e purezza del ferro.

Cerrado Gold proporciona una actualización sobre su proyecto de mineral de hierro Mont Sorcier en Quebec, destacando las pruebas metalúrgicas en curso que confirman la producción de concentrado de hierro de grado DRI con más del 67% de pureza y una combinación de sílice y alúmina por debajo del 2,5%. La compañía ha designado a DRA Global para entregar un Estudio de Viabilidad Financiera NI 43-101 para el primer trimestre de 2026.

El PEA del proyecto 2022 mostró un VAN8% de 1,6 mil millones de dólares estadounidenses para una vida útil de la mina de 21 años, proyectando una producción anual de 5MT de concentrado de hierro, generando 348 millones de dólares estadounidenses al año en flujo de caja con un capex inicial de 574 millones de dólares estadounidenses. UKEF y TD Bank han acordado patrocinar el 70% del capital necesario para el proyecto.

El programa metalúrgico, realizado por Soutex Inc. y SGS Canadá, muestra resultados prometedores con potencial para mejorar aún más la calidad y pureza del hierro.

Cerrado Gold는 퀘벡의 Mont Sorcier 철광석 프로젝트에 대한 업데이트를 제공하며, 67% 이상의 순도를 가진 DRI 등급의 철 농축물을 생산하는 것을 확인하는 진행 중인 금속 테스트를 강조하고, 규산과 알루미나의 조합이 2.5% 미만임을 알렸습니다. 회사는 2026년 1분기까지 NI 43-101 은행 가능성 분석을 제공하기 위해 DRA Global을 임명했습니다.

2022년 프로젝트 PEA는 21년의 광산 수명 동안 8% 할인된 순현재가치(NPV) 16억 달러를 보여주었으며, 연간 5MT의 철 농축물 생산을 예상하며, 연간 3억 4,800만 달러의 현금 흐름을 생성하고 초기 자본 지출이 5억 7,400만 달러라고 밝혔습니다. UKEF 및 TD 은행은 프로젝트 자본의 70%를 지원하기로 합의했습니다.

Soutex Inc. 및 SGS Canada에서 수행한 금속 프로그램은 철의 품질과 순도를 더욱 개선할 수 있는 잠재력을 가진 유망한 결과를 보여줍니다.

Cerrado Gold fournit une mise à jour sur son projet de minerai de fer Mont Sorcier au Québec, soulignant les tests métallurgiques en cours qui confirment la production de concentré de fer de grade DRI avec plus de 67% de pureté et une combinaison de silice et d'alumine inférieure à 2,5%. L'entreprise a nommé DRA Global pour livrer une étude de faisabilité bancable NI 43-101 d'ici le premier trimestre 2026.

Le PEA du projet 2022 a montré un VAN8% de 1,6 milliard USD pour une durée de vie de mine de 21 ans, projetant une production annuelle de 5MT de concentré de fer, générant 348 millions USD par an de flux de trésorerie avec un capex initial de 574 millions USD. UKEF et TD Bank ont accepté de financer 70% du capital projet requis.

Le programme métallurgique, mené par Soutex Inc. et SGS Canada, montre des résultats prometteurs avec un potentiel d'amélioration supplémentaire de la qualité et de la pureté du fer.

Cerrado Gold gibt ein Update zu seinem Mont Sorcier Eisenerzprojekt in Quebec und hebt laufende metallurgische Tests hervor, die die Produktion von DRI-Grad Eisensand mit über 67% Reinheit sowie eine Kombination aus Siliziumdioxid und Aluminiumoxid unter 2,5% bestätigen. Das Unternehmen hat DRA Global beauftragt, bis zum ersten Quartal 2026 eine bankfähige Machbarkeitsstudie nach NI 43-101 zu erstellen.

Die PEA des Projekts 2022 zeigte einen NPV8% von 1,6 Milliarden USD bei einer Bergbaufahrzeit von 21 Jahren, mit einer prognostizierten Produktion von jährlich 5MT Eisensand, was einen jährlichen Cashflow von 348 Millionen USD bei anfänglichen Investitionskosten von 574 Millionen USD generiert. UKEF und die TD Bank haben zugesagt, 70% des erforderlichen Projektkapitals zu finanzieren.

Das metallurgische Programm, das von Soutex Inc. und SGS Kanada durchgeführt wurde, zeigt vielversprechende Ergebnisse mit Potenzial für weitere Verbesserungen in Bezug auf Eisenqualität und Reinheit.

- Project NPV8% of US$1.6 Billion with 21-year mine life

- Secured 70% project funding from UKEF and TD Bank

- Annual cash flow projection of US$348M

- High-purity iron concentrate production (67%+ grade)

- Production capacity of 5MT iron concentrate annually

- High initial capital expenditure requirement of US$574M

- Feasibility study completion not until Q1 2026

Detailed Metallurgical test work is ongoing and reaffirms production of DRI grade,

67% + or better iron concentrate with combined Silica and Alumina below2.5% Work Programs initiated and DRA Global appointed to deliver NI 43-101 Bankable Feasibility Study by end of Q1 2026

2022 PEA on Mont Sorcier provided an NPV

8% of US$1.6 Billion for a 21-year mine life producing 5MT of Iron Concentrate per year (300,000 oz/Au equiv.) generating US$348M per annum in cash flow based upon initial capex of US$574M UKEF and TD Bank have agreed to sponsor

70% of project capital required subject to customary conditions of Export Credit Agency funding

(All numbers reported in US dollars)

TORONTO, ON / ACCESSWIRE / December 4, 2024 / (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to provide an update on its ongoing work programs to complete a NI 43-101 Bankable Feasibility Study("BFS") by end of Q1 2026 on its High Purity, DRI Grade, +

Metallurgical Program Focused on Delivering Premium Product

Detailed metallurgical testwork programs are currently being undertaken by Soutex Inc, to build on the previous metallurgical test results announced in March 2024. Previous testing has confirmed the ability to produce High Purity, DRI Grade, iron concentrates grading over

The design and analysis of the metallurgical test work program is being completed by Soutex Inc., a consultancy firm specializing in ore processing and metallurgical processes based in Quebec City, Quebec, with testwork completed by SGS Canada, one of the world's leading testing, inspection and certification companies based in Quebec City.

Bankable Feasibility Program

In addition to the current testwork, the Company has selected various consultants to undertake the key work programs in 2025 to deliver a NI 43-101 Compliant Bankable Feasibility study ("BFS") for the Mont Sorcier High Purity iron project. The lead consultant and study integrator will be DRA Global who will also be responsible for the updated Mineral Resource estimate, mine design and planning, geotech and hydrogeology. In addition, the company has retained Soutex (process design), LDV Consultants (site infrastructure, capital and operating Cost estimation) and WSP (environmental and permitting). Additional specialized consultants will be added as needed.

The Bankable Feasibility Study will look to provide greater detail into the potential of the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV

Figure 1 - Summary Of 2022 PEA Results

A Premium Product for the Transition Economy

The Mont Sorcier project is uniquely positioned to be at the centre of the Green Steel transition. As the global demand for Green Steel increases, it is expected that the demand and overall price premium paid for higher grade products and DRI, will continue to increase and replace demand for lower grade materials. The ability to produce High Purity iron concentrates places Mont Sorcier as a project capable of delivering Critical and Strategic High Purity Iron as outlined by the Quebec and Canadian Governments, as it aspires to become a leader to support energy transition through the development of critical and strategic minerals and reduce overall global emissions.

The ability to produce a high purity iron concentrate grading

Mark Brennan, CEO and Chairman, stated: "We are very excited to be ramping up our work programs for the high purity

Review of Technical Information

The technical information contained in this news release with respect to the Mont Sorcier Project has been reviewed and approved on behalf of Voyager by Pierre-Jean Lafleur of Voyager Metals, who is a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to predictions about the future demand for higher grade iron concentrates and the Company's ability to produce this type of produce from the Mont Sorcier Project, Project, the expected timing of completion of the BFS, all of the assumptions and qualifications set out in the PEA, the assumption that demand and overall price premium paid for higher grade products and that DRI will continue to increase and replace demand for lower grade materials, the ability of the Mont Sorcier Project to produce high purity iron concentrates, the assumption that Mont Sorcier may be capable of delivering critical and strategic high purity iron in the form of

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com