Cerrado Gold Completes Feasibility Infill Drill Program and Is Finalizing Plans for an Aggressive Exploration Program at Its Monte Do Carmo Project in Brazil

Cerrado Gold announced the completion of a 48,842m drilling program at its Monte do Carmo Project in Brazil, expected to enhance resources for an upcoming Feasibility Study slated for completion by May 2023. The infill drilling program successfully upgraded the majority of resources into Measured and Indicated categories, while new extensional zones and condemned areas were identified. The company is also preparing a 23,000m exploration program targeting potential new deposits. Notable drill results include 11m at 5.39 g/t Au and 25m at 19.01 g/t Au, showcasing the area's rich mineralization. Full assay results are anticipated in February.

- Successful completion of a 48,842m drilling program, enhancing resource categories.

- Significant gold intercepts reported: 11m at 5.39 g/t Au and 25m at 19.01 g/t Au.

- Plans to initiate a 23,000m exploration program to test new targets.

- None.

Insights

Analyzing...

- 48,842m infill/extensional/condemnation drilling program completed

- Feasibility Study completion expected May 2023

- 23,000m step-out exploration program to begin shortly

- Monte do Carmo property still considered in "Discovery" phase

TORONTO, ON / ACCESSWIRE / January 31, 2023 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to announce additional results from its 2022/23 infill/extensional drill program for the completion of its Feasibility Study expected by the end of May at its Monte Do Carmo Project located in Tocantins State, Brazil ("MDC").

The 2022/23 drill program has successfully upgraded the bulk of the known resources into Measured and Indicated categories, targeted new extensional zones and condemned areas for project infrastructure in support of the ongoing Feasibility Study. The final hole as part of this program was completed last week. Full assay results from the program are expected to be completed in February.

The Company is now finalizing plans for the 2023 exploration program which will be designed to test numerous targets along a 30km stretch of known mineralization within the Monte Do Carmo property. While moving towards production, the Monte do Carmo property is still considered to be under explored and in the "Discovery" phase with potential for significant new deposits.

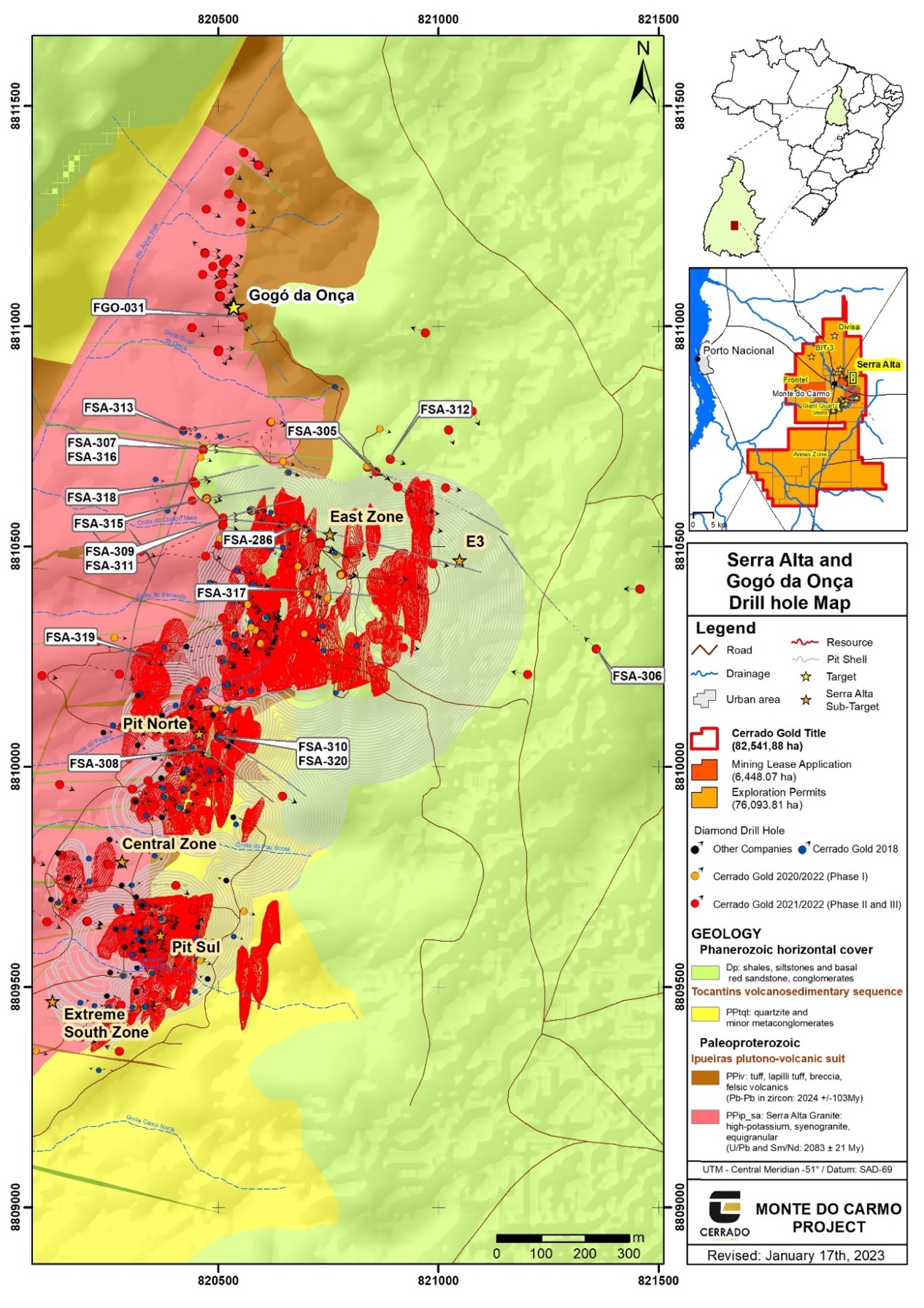

The Company is currently reporting assay results from 17 drill holes, totaling 4,913m (see Tables 1 & 2) completed from October to December 2022. As of January 16, 2022, a total of 193 drill holes, totaling 48,842m have been completed as part of the program started in early 2022, including 157 holes at Serra Alta: and 36 holes in the satellite exploration areas.

Drill Hole Highlights (All composites are reported as true thickness):

Serra Alta (Infill)

FSA-308

- 11m at 5.39 g/t Au from 3m

- Including 4m at 11.91 g/t Au from 7m

- 39m at 1.46 g/t Au from 101m

- Including 2m at 10.19 g/t Au from 43m

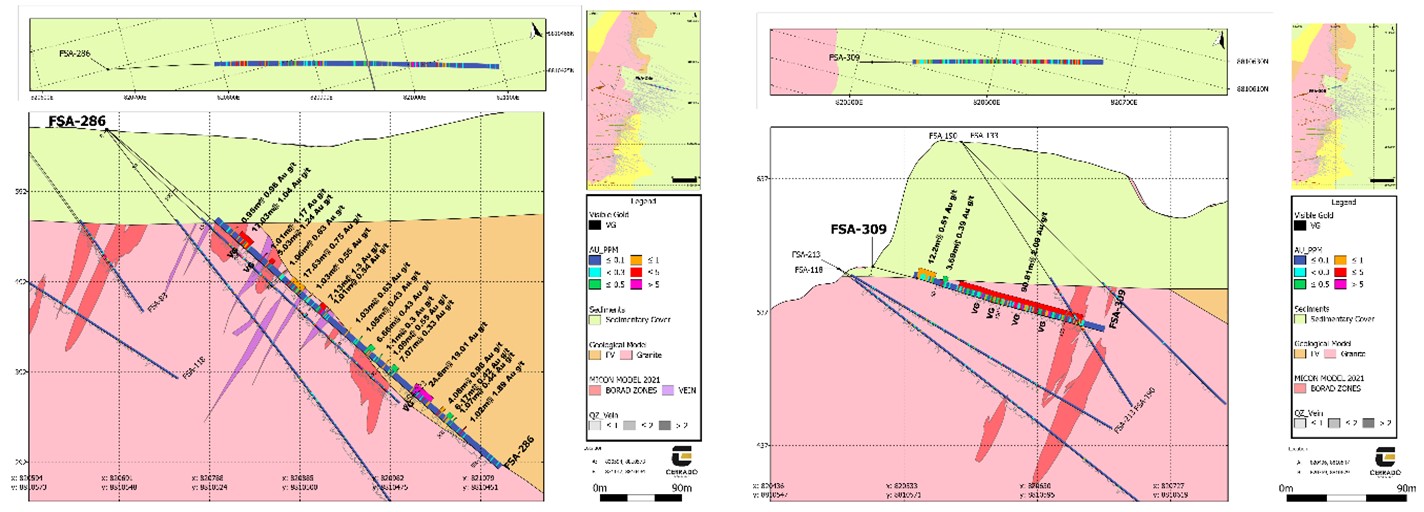

FSA-286

- 25m at 19.01g/t Au from 443.18m

- Including 3m at 178.46 g/t Au from 446m

FSA-309

- 91m at 2.09g/t Au from 66m

- Including 7m at 19.09 g/t Au from 110m

Mark Brennan, CEO and Co-Chairman commented, "The infill program at Serra Alta has been extremely successful in converting the majority of known resources for the pending feasibility study, as well as having identified several extensional zones, namely Gogo do Onca, E2 and the new and very promising Northeast zone."

He continued, "While work continues to focus on delivering the Feasibility Study, we are very excited to be in the final stages of planning an aggressive new exploration program for 2023 at Monte do Carmo. There are a substantial number of gold showings and targets on the property that have not yet been drill tested where we see the potential for future discoveries similar to Serra Alta. We remain convinced of the district scale potential at Monte Do Carmo."

East Zone

Drill holes FSA-286, FSA-307, FSA-309, FSA-311, FSA-313, FSA-315, FSA-316, FSA-317, FSA-318, FSA-319 were collared in the East Zone. The best reported intercepts in the East Zone correspond to hole FSA-286 that intercepted a notable discrete sheer quartz vein that reported 3m at 178.46 g/t Au from 446m (including 1 m at 412 g/t). The shear vein has a Northwest orientation.

This intercept defines an interesting zone of coalescence of at least 3 fertile structures, including the mentioned shear zone, the East Zone/E2 general trend of extensional veins (North-South) and the main E3 Porphyritic Dyke orientation (West/Northwest). Cerrado considers that conceptually these intersection zones may represent second order control of higher-grade trends.

Hole FSA-309 is also outstanding. Shallow dipping drilling targeted the granite in proximity to the volcanic intrusive contact intercepting 91m at 2.09g/t Au from 66m, including 7m at 19.09 g/t Au from 110m. Results confirm the significance of the contact zone in terms of extending the continuity and lateral extent of the mineralization and consolidate a well-endowed area on the northern edge of the east zone.

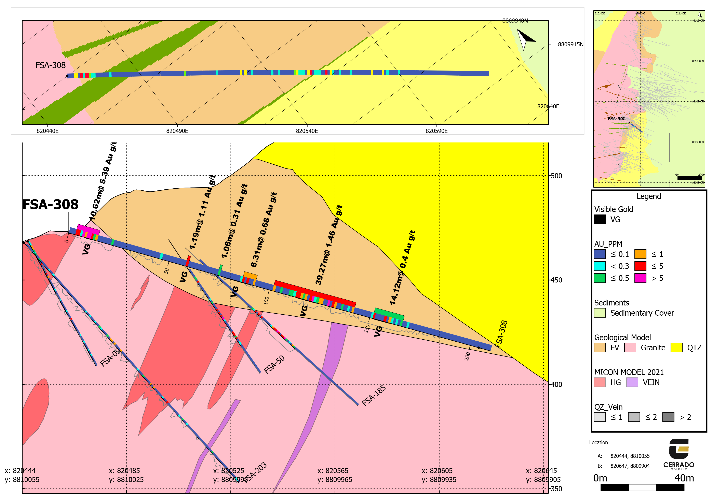

Pit Norte

Drill Holes FSA-308, FSA-310 and FSA 320 were collared in Pit Norte. The best intercept comes from hole FSA-308, collared in the central part of the zone. FDS-308 intercepted 11m at 5.39 g/t Au from 3m, including 4m at 11.91 g/t Au from 7m; and 39m at 1.46 g/t Au from 101m, including 2m at 10.19 g/t Au from 43m. This shallow intercept confirms the low strip in this segment of the Pit which is expected to be exploited during the early phases of mining.

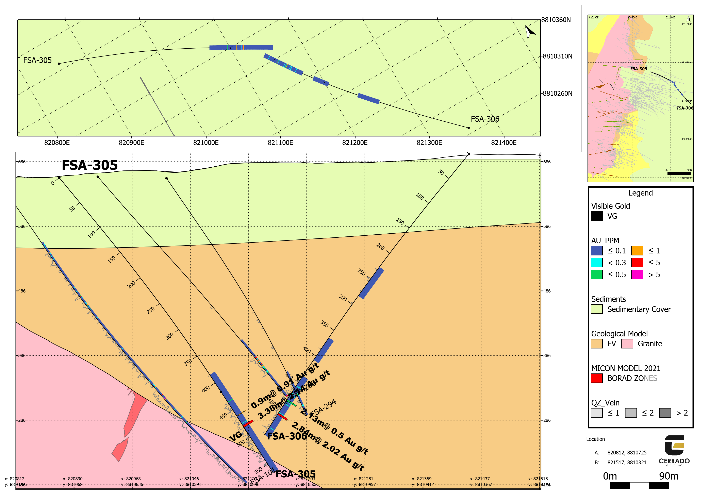

East 3 (E3)

Drill Hole FSA-306 targeted the recently discovered E3 zone. Mineralization in E3 relates to the occurrence of a granitic porphyry dyke with a general West/Northwest direction, that provides a permissive host rock and fluid conduits to upper stratigraphic levels. Holes have been drilled in different directions to better constrain the geometry and extent of the dyke. The best intercept in E3 reported today is from hole FSA-305 that crosses 3m (apparent width) at 2.14 g/t. E3 remains open both along strike and down dip.

Figure 1. Reported and Ongoing Drill Hole Locations

Figure 2. Select Highlighted Cross Sections of Reported Holes

East Zone

E3

Pit Norte

* Scales vary by section

Table 1. Drill Hole Collar Table

| Sector | Hole number | UTM N m | UTM E m | Elevation m | Depth m | Azimuth | Dip |

| Pit Norte | FSA-308 | 8810040 | 820461 | 473 | 210.0 | 125.00 | -15.74 |

| Pit Norte | FSA-310 | 8810069 | 820502 | 505 | 285.6 | 121.69 | -33.78 |

| Pit Norte | FSA-320 | 8810066 | 820504 | 505 | 210.3 | 140.00 | -20.28 |

| East Zone | FSA-286 | 8810545 | 820676 | 661 | 573.9 | 100.75 | -41.16 |

| East Zone | FSA-307 | 8810721 | 820466 | 567 | 170.7 | 95.00 | -15.13 |

| East Zone | FSA-309 | 8810565 | 820510 | 571 | 180.3 | 75.00 | -15.40 |

| East Zone | FSA-311 | 8810564 | 820510 | 571 | 150.6 | 95.00 | -15.74 |

| East Zone | FSA-313 | 8810763 | 820420 | 556 | 164.9 | 80.00 | -19.60 |

| East Zone | FSA-315 | 8810604 | 820440 | 552 | 201.6 | 80.00 | -19.98 |

| East Zone | FSA-316 | 8810722 | 820465 | 567 | 114.8 | 70.00 | -15.22 |

| East Zone | FSA-317 | 8810401 | 820670 | 668 | 340.3 | 92.64 | -54.72 |

| East Zone | FSA-318 | 8810647 | 820444 | 569 | 170.5 | 75.00 | -25.06 |

| East Zone | FSA-319 | 8810249 | 820343 | 512 | 132.2 | 120.00 | -25.39 |

| East 3 | FSA-305 | 8810670 | 820858 | 661 | 565.4 | 118.92 | -50.33 |

| East 3 | FSA-306 | 8810269 | 821359 | 698 | 550.0 | 314.80 | -49.76 |

| East 3 | FSA-312 | 8810699 | 820891 | 666 | 687.9 | 110.56 | -50.39 |

| Gogó da Onça | FGO-031 | 8811023 | 820556 | 538 | 204.5 | 145.00 | -29.46 |

*Collar coordinates by GNSS TP-20 UTM Coordinates, Datum: SAD69 / zone 22S.

*Azimuth Set by compass

*Dip and drill hole trajectory by SPT (Stockholm Precision Tools) GyroMaster™

Table 2. Drill Hole Composites

DDH |

| From | To | LENGTH (m) | Width (m) | Au (g/t) | |

Serra Alta Pit Norte | FSA-308 |

| 3.24 | 14.12 | 10.88 | 10.62 | 5.39 |

FSA-308 | includes | 6.55 | 10.89 | 4.34 | 4.24 | 11.91 | |

FSA-308 | and | 58.13 | 59.35 | 1.22 | 1.19 | 1.11 | |

FSA-308 | and | 74.13 | 75.22 | 1.09 | 1.06 | 0.31 | |

FSA-308 | and | 86.19 | 92.65 | 6.46 | 6.31 | 0.68 | |

FSA-308 | and | 101.54 | 141.77 | 40.23 | 39.27 | 1.46 | |

FSA-308 | includes | 119.62 | 121.84 | 2.22 | 2.17 | 10.58 | |

FSA-308 | includes | 128.62 | 131.95 | 3.33 | 3.25 | 5.99 | |

FSA-308 | and | 151.34 | 165.80 | 14.46 | 14.12 | 0.40 | |

FSA-310 |

| 76.06 | 80.05 | 3.99 | 3.56 | 0.56 | |

FSA-310 | and | 84.16 | 88.18 | 4.02 | 3.59 | 1.83 | |

FSA-310 | Includes | 87.16 | 88.18 | 1.02 | 0.91 | 6.27 | |

FSA-310 | and | 101.31 | 121.98 | 20.67 | 18.44 | 1.05 | |

FSA-310 | Includes | 103.32 | 105.31 | 1.99 | 1.78 | 5.86 | |

FSA-310 | and | 126.05 | 127.10 | 1.05 | 0.94 | 0.49 | |

FSA-310 | and | 131.10 | 140.35 | 9.25 | 8.25 | 1.42 | |

FSA-310 | Includes | 134.10 | 136.26 | 2.16 | 1.93 | 3.99 | |

FSA-310 | and | 144.13 | 150.26 | 6.13 | 5.47 | 1.04 | |

FSA-310 | and | 155.38 | 183.35 | 27.97 | 24.95 | 1.32 | |

FSA-310 | Includes | 160.93 | 161.93 | 1.00 | 0.89 | 18.40 | |

FSA-310 | Includes | 164.89 | 165.83 | 0.94 | 0.84 | 7.36 | |

FSA-310 | and | 190.85 | 191.88 | 1.03 | 0.92 | 0.73 | |

FSA-310 | and | 258.57 | 261.65 | 3.08 | 2.75 | 1.62 | |

FSA-310 | and | 265.80 | 267.93 | 2.13 | 1.90 | 1.89 | |

FSA-320 |

| No significant values | |||||

Serra Alta - East Zone | FSA-286 |

| 179.30 | 180.27 | 0.97 | 0.95 | 0.96 |

FSA-286 | and | 186.55 | 203.88 | 17.33 | 17.03 | 1.04 | |

FSA-286 | and | 222.79 | 223.82 | 1.03 | 1.01 | 1.17 | |

FSA-286 | and | 230.70 | 235.82 | 5.12 | 5.03 | 1.24 | |

FSA-286 | and | 250.63 | 251.71 | 1.08 | 1.06 | 0.63 | |

FSA-286 | and | 262.57 | 280.51 | 17.94 | 17.63 | 0.75 | |

FSA-286 | and | 290.20 | 291.25 | 1.05 | 1.03 | 0.55 | |

FSA-286 | and | 305.14 | 312.40 | 7.26 | 7.13 | 1.30 | |

FSA-286 | and | 315.65 | 316.68 | 1.03 | 1.01 | 0.54 | |

FSA-286 | and | 347.49 | 348.54 | 1.05 | 1.03 | 0.63 | |

FSA-286 | and | 363.12 | 364.19 | 1.07 | 1.05 | 0.43 | |

FSA-286 | and | 376.14 | 382.92 | 6.78 | 6.66 | 0.43 | |

FSA-286 | and | 392.80 | 393.92 | 1.12 | 1.10 | 0.30 | |

FSA-286 | and | 402.61 | 403.72 | 1.11 | 1.09 | 0.55 | |

FSA-286 | and | 410.21 | 417.40 | 7.19 | 7.07 | 0.33 | |

FSA-286 | and | 443.18 | 468.21 | 25.03 | 24.60 | 19.01 | |

FSA-286 | includes | 446.42 | 449.15 | 2.73 | 2.68 | 148.46 | |

FSA-286 | includes | 452.90 | 455.69 | 2.79 | 2.74 | 22.99 | |

FSA-286 | and | 481.60 | 485.75 | 4.15 | 4.08 | 0.98 | |

FSA-286 | and | 491.15 | 497.43 | 6.28 | 6.17 | 0.42 | |

FSA-286 | and | 500.62 | 501.71 | 1.09 | 1.07 | 0.44 | |

FSA-286 | and | 515.36 | 516.40 | 1.04 | 1.02 | 1.89 | |

FSA-307 |

| 82.21 | 83.22 | 1.01 | 1.01 | 0.35 | |

FSA-307 | and | 91.54 | 92.60 | 1.06 | 1.06 | 0.34 | |

FSA-307 | and | 95.84 | 96.88 | 1.04 | 1.04 | 0.30 | |

FSA-307 | and | 101.07 | 107.22 | 6.15 | 6.15 | 0.66 | |

FSA-309 |

| 34.00 | 46.93 | 12.93 | 12.20 | 0.51 | |

FSA-309 | and | 52.97 | 56.88 | 3.91 | 3.69 | 0.39 | |

FSA-309 | and | 65.91 | 162.15 | 96.24 | 90.81 | 2.09 | |

FSA-309 | Includes | 83.06 | 85.12 | 2.06 | 1.94 | 8.50 | |

FSA-309 | Includes | 109.68 | 116.87 | 7.19 | 6.78 | 19.09 | |

FSA-309 | Includes | 134.26 | 137.40 | 3.14 | 2.96 | 2.26 | |

FSA-309 | Includes | 161.13 | 162.15 | 1.02 | 0.96 | 3.86 | |

FSA-311 |

| 35.18 | 49.82 | 14.64 | 14.48 | 0.85 | |

FSA-311 | includes | 38.50 | 39.58 | 1.08 | 1.07 | 3.63 | |

FSA-311 | includes | 44.37 | 45.54 | 1.17 | 1.16 | 3.69 | |

FSA-311 | and | 52.94 | 53.97 | 1.03 | 1.02 | 1.81 | |

FSA-311 | and | 57.17 | 58.24 | 1.07 | 1.06 | 0.80 | |

FSA-311 | and | 68.00 | 69.04 | 1.04 | 1.03 | 0.41 | |

FSA-311 | and | 73.15 | 74.15 | 1.00 | 0.99 | 2.49 | |

FSA-311 | and | 81.20 | 82.22 | 1.02 | 1.01 | 1.58 | |

FSA-311 | and | 85.26 | 90.39 | 5.13 | 5.07 | 1.44 | |

FSA-311 | and | 94.52 | 104.71 | 10.19 | 10.08 | 1.63 | |

FSA-311 | includes | 96.51 | 98.62 | 2.11 | 2.09 | 4.99 | |

FSA-311 | and | 113.93 | 118.04 | 4.11 | 4.06 | 1.49 | |

FSA-311 | includes | 113.93 | 114.95 | 1.02 | 1.01 | 5.22 | |

FSA-311 | and | 122.18 | 133.40 | 11.22 | 11.09 | 1.58 | |

FSA-311 | includes | 130.35 | 133.40 | 3.05 | 3.02 | 3.64 | |

FSA-311 | and | 140.44 | 148.52 | 8.08 | 7.99 | 1.36 | |

FSA-313 |

| No significant values | |||||

FSA-315 |

| 95.10 | 96.06 | 0.96 | 0.92 | 0.53 | |

FSA-315 | and | 110.07 | 111.06 | 0.99 | 0.95 | 0.67 | |

FSA-315 | and | 132.60 | 133.62 | 1.02 | 0.98 | 0.38 | |

FSA-316 |

| No significant values | |||||

FSA-317 |

| 207.17 | 219.47 | 12.30 | 11.93 | 0.85 | |

FSA-317 | Includes | 207.17 | 208.09 | 0.92 | 0.89 | 3.99 | |

FSA-317 | Includes | 213.41 | 214.41 | 1.00 | 0.97 | 2.46 | |

FSA-317 | Includes | 218.46 | 219.47 | 1.01 | 0.98 | 2.37 | |

FSA-317 | and | 223.39 | 226.14 | 2.75 | 2.67 | 0.24 | |

FSA-317 | and | 272.38 | 273.42 | 1.04 | 1.01 | 0.41 | |

FSA-317 | and | 314.11 | 318.26 | 4.15 | 4.02 | 0.59 | |

FSA-317 | and | 323.47 | 329.70 | 6.23 | 6.04 | 0.64 | |

FSA-317 | Includes | 324.49 | 325.56 | 1.07 | 1.04 | 2.77 | |

FSA-318 |

| 13.43 | 18.00 | 4.57 | 4.51 | 0.33 | |

FSA-318 | and | 35.00 | 36.04 | 1.04 | 1.03 | 0.70 | |

FSA-318 | and | 45.43 | 47.54 | 2.11 | 2.08 | 0.32 | |

FSA-318 | and | 60.88 | 61.89 | 1.01 | 1.00 | 0.83 | |

FSA-318 | and | 86.69 | 87.72 | 1.03 | 1.02 | 0.50 | |

FSA-318 | and | 96.90 | 97.90 | 1.00 | 0.99 | 0.34 | |

FSA-318 | and | 134.87 | 135.90 | 1.03 | 1.02 | 0.56 | |

FSA-318 | and | 142.15 | 145.14 | 2.99 | 2.95 | 0.59 | |

FSA-319 |

| 39.15 | 40.34 | 1.19 | 1.19 | 0.40 | |

FSA-319 | and | 44.60 | 45.61 | 1.01 | 1.01 | 0.31 | |

FSA-319 | and | 51.91 | 62.03 | 10.12 | 10.12 | 0.33 | |

FSA-319 | and | 72.35 | 73.40 | 1.05 | 1.05 | 0.32 | |

FSA-319 | and | 80.75 | 82.79 | 2.04 | 2.04 | 0.44 | |

FSA-319 | and | 101.38 | 102.60 | 1.22 | 1.22 | 0.31 | |

Serra Alta - E3 | FSA-305 |

| 461.02 | 461.92 | 0.90 | - | 0.91 |

FSA-305 | and | 478.95 | 482.33 | 3.38 | - | 2.14 | |

FSA-305 | Includes | 478.95 | 479.77 | 0.82 | - | 6.75 | |

FSA-306 |

| 482.98 | 485.11 | 2.13 | - | 0.50 | |

FSA-306 | and | 508.87 | 511.71 | 2.84 | - | 2.02 | |

FSA-306 | Includes | 509.69 | 510.64 | 0.95 | - | 5.10 | |

FSA-312 |

| No significant values | |||||

Gogó da Onça | FGO-031 |

| 71.21 | 73.22 | 2.01 | 1.42 | 0.59 |

FGO-031 | and | 80.08 | 81.11 | 1.03 | 0.73 | 0.54 | |

FGO-031 | and | 126.40 | 129.78 | 3.38 | 2.38 | 0.45 | |

FGO-031 | and | 136.06 | 141.45 | 5.39 | 3.80 | 0.37 | |

FGO-031 | and | 145.15 | 146.28 | 1.13 | 0.80 | 0.40 | |

FGO-031 | and | 154.33 | 157.77 | 3.44 | 2.42 | 0.37 | |

| >10m x g/t | >30m x g/t |

|

|

|

| ||

Quality Assurance and Quality Control

Analytical work was carried out by ALS international lab (ALS). MDC send half core samples for sample preparation to the lab. The facilities of the prep lab are located in Goiânia, Brazil 835 km from the MDC project and alternatively in Belo Horizonte, Brazil 1,110 Km from the MDC project. MDC sends out samples to ALS international labs (ALS) with the prep lab located in Goiânia or alternatively in Belo Horizonte. ALS lab sends the prepared aliquots for analytical assay to their lab in Lima, Peru where the prepared samples are systematically analyzed for gold (ppm) by fire assay (Au-AA24) or gold (ppm) by metallic screen (Au-SCR24). Randomly the ICP (Inductively coupled plasma mass spectrometry) is done for trace elements in 4 acids (hydrofluoric, perchloric, nitric and hydrochloric) digestion (ME-MS-61). ALS has routine quality control procedures which ensure that every batch of samples includes three sample repeats and at least two commercial standards and two blanks. Cerrado uses standard QA/QC procedures, inserting reference standards and blanks, for the drilling program. The Reference material used are from CDN Resource Laboratories Ltd., ITAK (Instituto de Tecnologia August Kekulé Ltda. And OREAS).

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

| Mark Brennan | David Ball |

| CEO and Co Chairman | Vice President, Corporate Development |

| Tel: +1-647-796-0023 | Tel: +1-647-796-0068 |

| mbrennan@cerradogold.com | dball@cerradogold.com |

About Cerrado

Cerrado is a Toronto based gold production, development and exploration company focused on gold projects in the Americas. The Company is the

At Minera Don Nicolas, Cerrado is maximising asset value through further operation optimization and continued production growth. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package.

At Monte Do Carmo, Cerrado is rapidly advancing the Serra Alta deposit through Feasibility and production. The Serra Alta deposit Indicated Resources of 541 kozs of contained gold and Inferred Resources of 780 kozs of contained gold. The Preliminary Economic Assessment demonstrates robust economics as well as the potential to be one of the industry's lowest cost producers. Cerrado also holds an extensive and highly prospective 82,542 ha land package at Monte Do Carmo.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the expected timing to complete the Feasibility Study at MDC, the exploration potential and scale of MDC and conversion of resources from inferred to indicated. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/737353/Cerrado-Gold-Completes-Feasibility-Infill-Drill-Program-and-Is-Finalizing-Plans-for-an-Aggressive-Exploration-Program-at-Its-Monte-Do-Carmo-Project-in-Brazil