Cerrado Gold Announces Q2 Financials, Cashflow and Operating Cost Performance at Its Minera Don Nicolas Mine in Argentina

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) has released its Q2 2024 operational and financial results for the Minera Don Nicolas (MDN) gold project in Argentina. Key highlights include:

- Gold equivalent production of 16,255 GEO

- Adjusted EBITDA of $14.7 million

- AISC of $1,233 per ounce

- Revenue of $34.7 million from the sale of 15,484 ounces of gold and 23,509 ounces of silver

The company also announced a recent 43-101 Mineral Resource Update and Preliminary Economic Assessment (PEA) for MDN, showing an NPV5% of $111 million at $2,100/oz gold price over a 5-year mine life. The PEA highlights average annual production of 56,000 GEO and LOM average annual EBITDA of $49 million.

Cerrado Gold is on track to meet its full-year guidance of 50,000-60,000 GEO and is focusing on cost reduction initiatives and strengthening its balance sheet.

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ha pubblicato i risultati operativi e finanziari per il secondo trimestre del 2024 per il progetto minerario Don Nicolas (MDN) in Argentina. Punti chiave includono:

- Produzione equivalente d'oro di 16.255 GEO

- EBITDA rettificato di 14,7 milioni di dollari

- AISC di 1.233 dollari per oncia

- Fatturato di 34,7 milioni di dollari dalla vendita di 15.484 once d'oro e 23.509 once d'argento

La società ha anche annunciato un recente Aggiornamento delle Risorse Minerarie 43-101 e una Valutazione Economica Preliminare (PEA) per MDN, mostrando un NPV5% di 111 milioni di dollari con un prezzo dell'oro di 2.100 dollari/oncia su una vita mineraria di 5 anni. La PEA evidenzia una produzione annuale media di 56.000 GEO e un EBITDA annuale medio di LOM di 49 milioni di dollari.

Cerrado Gold è in linea per raggiungere le previsioni annuali di 50.000-60.000 GEO e si sta concentrando su iniziative di riduzione dei costi e sul rafforzamento del proprio bilancio.

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ha publicado sus resultados operativos y financieros del segundo trimestre de 2024 para el proyecto minero Don Nicolas (MDN) en Argentina. Los aspectos destacados incluyen:

- Producción equivalente de oro de 16,255 GEO

- EBITDA ajustado de 14.7 millones de dólares

- AISC de 1,233 dólares por onza

- Ingresos de 34.7 millones de dólares por la venta de 15,484 onzas de oro y 23,509 onzas de plata

La compañía también anunció una reciente Actualización de Recursos Minerales 43-101 y una Evaluación Económica Preliminar (PEA) para MDN, mostrando un NPV5% de 111 millones de dólares con un precio del oro de 2,100 dólares/onza durante una vida útil de mina de 5 años. La PEA destaca una producción anual promedio de 56,000 GEO y un EBITDA anual promedio de LOM de 49 millones de dólares.

Cerrado Gold está en camino de cumplir con su guía anual de 50,000-60,000 GEO y se está centrando en iniciativas de reducción de costos y en fortalecer su balance general.

세라다 골드 주식회사 (TSXV:CERT)(OTCQX:CRDOF)가 아르헨티나의 도니콜라스(MDN) 금 프로젝트에 대한 2024년 2분기 운영 및 재무 결과를 발표했습니다. 주요 내용은 다음과 같습니다:

- 금 동등 생산량 16,255 GEO

- 조정 EBITDA 1,470만 달러

- AISC 1,233달러/온스

- 15,484온스의 금과 23,509온스의 은 판매로 인한 수익 3,470만 달러

회사 측은 또한 MDN에 대한 최근 43-101 광물 자원 업데이트와 초기 경제 평가(PEA)를 발표했으며, 5년의 광산 수명 동안 온스당 2,100달러의 금 가격에 대해 NPV5%가 1억 1,100만 달러에 이른다고 밝혔습니다. PEA는 연평균 생산량이 56,000 GEO이며, LOM의 연평균 EBITDA가 4,900만 달러로 나타났습니다.

세라다 골드는 연간 50,000~60,000 GEO 목표 달성을 위해 순항 중이며, 비용 절감과 재무 건전성 강화를 위한 노력을 기울이고 있습니다.

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) a publié ses résultats opérationnels et financiers pour le deuxième trimestre 2024 concernant le projet minier Don Nicolas (MDN) en Argentine. Les points clés incluent :

- Production équivalente en or de 16 255 GEO

- EBITDA ajusté de 14,7 millions de dollars

- AISC de 1 233 dollars par once

- Chiffre d'affaires de 34,7 millions de dollars provenant de la vente de 15 484 onces d'or et de 23 509 onces d'argent

L'entreprise a également annoncé une mise à jour récente des ressources minérales 43-101 et une évaluation économique préliminaire (PEA) pour le MDN, montrant un NPV5% de 111 millions de dollars avec un prix de l'or de 2 100 dollars/once sur une durée de mine de 5 ans. La PEA souligne une production annuelle moyenne de 56 000 GEO et un EBITDA annuel moyen de LOM de 49 millions de dollars.

Cerrado Gold est sur la bonne voie pour atteindre ses prévisions annuelles de 50 000-60 000 GEO et se concentre sur des initiatives de réduction des coûts et le renforcement de son bilan.

Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) hat die operativen und finanziellen Ergebnisse für das zweite Quartal 2024 für das Goldprojekt Don Nicolas (MDN) in Argentinien veröffentlicht. Wichtige Highlights sind:

- Goldäquivalentproduktion von 16.255 GEO

- Bereinigtes EBITDA von 14,7 Millionen US-Dollar

- AISC von 1.233 US-Dollar pro Unze

- Einnahmen von 34,7 Millionen US-Dollar aus dem Verkauf von 15.484 Unzen Gold und 23.509 Unzen Silber

Das Unternehmen gab auch ein kürzliches 43-101 Mineralressourcen-Update und eine vorläufige Wirtschaftlichkeitsanalyse (PEA) für MDN bekannt, die einen NPV5% von 111 Millionen US-Dollar bei einem Goldpreis von 2.100 US-Dollar/Unze über eine Lebensdauer der Mine von 5 Jahren zeigt. Die PEA hebt eine durchschnittliche Jahresproduktion von 56.000 GEO und ein durchschnittliches EBITDA über die Lebensdauer von 49 Millionen US-Dollar hervor.

Cerrado Gold ist auf dem richtigen Weg, die Jahresprognose von 50.000-60.000 GEO zu erreichen, und konzentriert sich auf Kostensenkungsinitiativen und die Stärkung der Bilanz.

- Gold equivalent production increased to 16,255 GEO in Q2 2024, up from 12,453 GEO in Q2 2023

- Adjusted EBITDA of $14.7 million for Q2 2024

- Revenue increased to $34.7 million in Q2 2024, up from $21.2 million in Q2 2023

- PEA shows After Tax NPV5% of $111 Million at $2,100/oz Au price

- Average annual production targeted at approximately 56,000 Gold Equivalent Ounces

- Life of Mine Average annual EBITDA of $49 Million and FCF of $25 Million

- No Material Upfront Capital Expenditures required for the PEA plan

- AISC of $1,233 per ounce in Q2 2024, though lower than Q2 2023

- Cost of sales increased to $23.1 million in Q2 2024 from $16.7 million in Q2 2023

- Higher production costs due to increased labor costs

- Other expenses of $7.3 million, including finance expense and foreign exchange loss

Gold equivalent production of 16,255 GEO for Q2; On track for Full year guidance of 50,000-60,0000 GEO

Adjusted EBITDA of

$14.7 million for Q2Operating results for Q2 highlight stable operating performance which is expected for the remainder of the year

Recent 43-101 Mineral Resource Update and Preliminary Economic Assessment Completed for MDN showing an NPV5% of

$111M M at$2,100 oz gold price over a 5 year mine life

TORONTO, ON / ACCESSWIRE / August 29, 2024 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) announces its operational and financial results for the second quarter ("Q2/24") at its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and at its Mont Sorcier Iron Project in Quebec.

Production results for MDN were previously released on July 17, 2024. The Company's financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com).

Q2/24 Operating Highlights

Q2/24 production of 16,255 Gold Equivalent Ounces ("GEO").

Q2/24 Adjusted EBITDA of

$14.7 million AISC of

$1,233 during Q2; Focus on cost reduction initiatives underwayFocus remains on delivering cashflow and strengthening the balance sheet with significant progress made towards debt reduction during the quarter.

Operational results presented for Q2/24 show a marked improvement over the previous quarter as the full exploitation of the Calandrias Norte high-grade open pit was achieved in addition to the continued ramp up of the heap leach operations. Production results for June included a modest decline due to harsh weather conditions where heavy snow impacted the transportation of high-grade ore to the mill and reduced mill throughput. The performance of the Heap leach during the quarter continued to improve despite the harsh weather and bodes well for the ramp-up to full commercial production. Performance of the crushing circuit at the Calandrias Sur Heap Leach continues to improve, allowing the placement of more ore on the heap leach pad during the quarter, which is key to delivering higher sustained production rates. Additional crushing capacity is being added via the addition of a secondary mobile crushing unit that has recently been delivered to the site and is set to double crushing capacity at Calandrias Sur to around 10,000 tpd to support an increase in production in the latter part of the year, doubling capacity to around 4,500 ozs per month.

The Company has also made significant progress in improving its working capital position during the quarter, partly due to cashflow generated by higher gold prices and strong production but also from the remaining proceeds received under the sale of an option on the Monte Do Carmo project in Brazil, to a subsidiary of Hochschild, which was approved by shareholders on 27th June 2024. Further improvement in the balance sheet is expected in the coming quarter due to sustained production rates.

Mark Brennan, CEO and Chairman commented, "With production levels stabilized, the outlook for the remainder of the year appears robust combined with the added expectation of higher gold prices. This should have a strong impact on our balance sheet. The recently completed PEA at MDN, underscores the value of the MDN operations. We are now positioned to ramp up exploration efforts to extend the mine life to further enhance the value of the project. In addition, if the option to purchase our Monte do Carmo project in Brazil is exercised, it would place Cerrado in a very strong financial position to resume an aggressive growth orientated strategy. "

Updated Mineral Resource Estimate and Preliminary Economic Assessment at Minera Don Nicolas

Subsequent to quarter end, on August 6th, 2024 the Company released results of a NI 43-101 Preliminary Economic Assessment ("PEA") and an updated Mineral Resource Estimate ("MRE") for its Minera Don Nicolas mine located in Santa Cruz Province, Argentina. The work was completed by GeoEstima SpA (Chile). The final report is to be completed and available on SEDAR+ by 20th September 2024. The results show a robust cash generating operation producing approximately 56,000 GEO per annum over an initial five year mine life.

Key highlights are presented below:

After Tax NPV5% of US

$111 Million at US$2,100 /oz Au priceAfter Tax NPV5% of US

$153 Million at Spot prices1

Average annual production targeted at approx. 56,000 Gold Equivalent Ounces ("GEO")2

Life of Mine Average annual EBITDA of US

$49 Million and FCF of US$25 Million LOM average EBITDA of US

$64 Million and FCF of US$29 Million at Spot prices1

Mine life of 5 years, from April 2024 based on existing Resources

Average Cash Costs of US

$863 /oz; Avg AISC US$1,144 /ozNo Material Upfront Capital Expenditures required

Updated Mineral Resource Estimate contains 490,000ozs of Measured and Indicated Resources and 121,150 ozs of Inferred Resources with potential upside from continued drilling & resource expansion

Notes

1. Spot prices; Au: US

2. GEO calculated by multiplying recovered silver ounces by (25/2100)

The PEA is primarily designed to exploit the Calandrias Norte high grade deposit and the Calandrias Sur low grade, heap leach, deposit. In addition, a modest underground mine based solely on currently known resources in the Paloma Trend and the smaller Zorro open pit near Martinetas are planned to add additional material for the CIL processing plant. The mine design is based on using standard open pit mining techniques of drill, blast and haul using a fleet of its own and rented mining equipment mining fleet to reduce capital needs. Mineralized material from Calandrias Norte is trucked to the CIL plant near the historical Martinetas mining operations, while material from the Calandrias Sur pit is crushed and placed on the leach pad in close proximity to the mining operations. The gold loaded carbon from the heap leach operations will be transported to the gold recovery circuit at the Martinetas site. Once processing of Calandrias Norte and additional high-grade material is completed, the CIL plant is to be placed on Care and Maintenance until mineralized material from the proposed underground mine becomes available in 2026, after underground development has been completed. Once this material is processed the CIL plant will once again be placed on Care and Maintenance until sufficient new sources of mineralized material have been upgraded to support ongoing mining operations which are expected from future exploration activities. Future mineralized material potential from exploration is currently excluded from the PEA mine plan.

Q2 Financial Performance

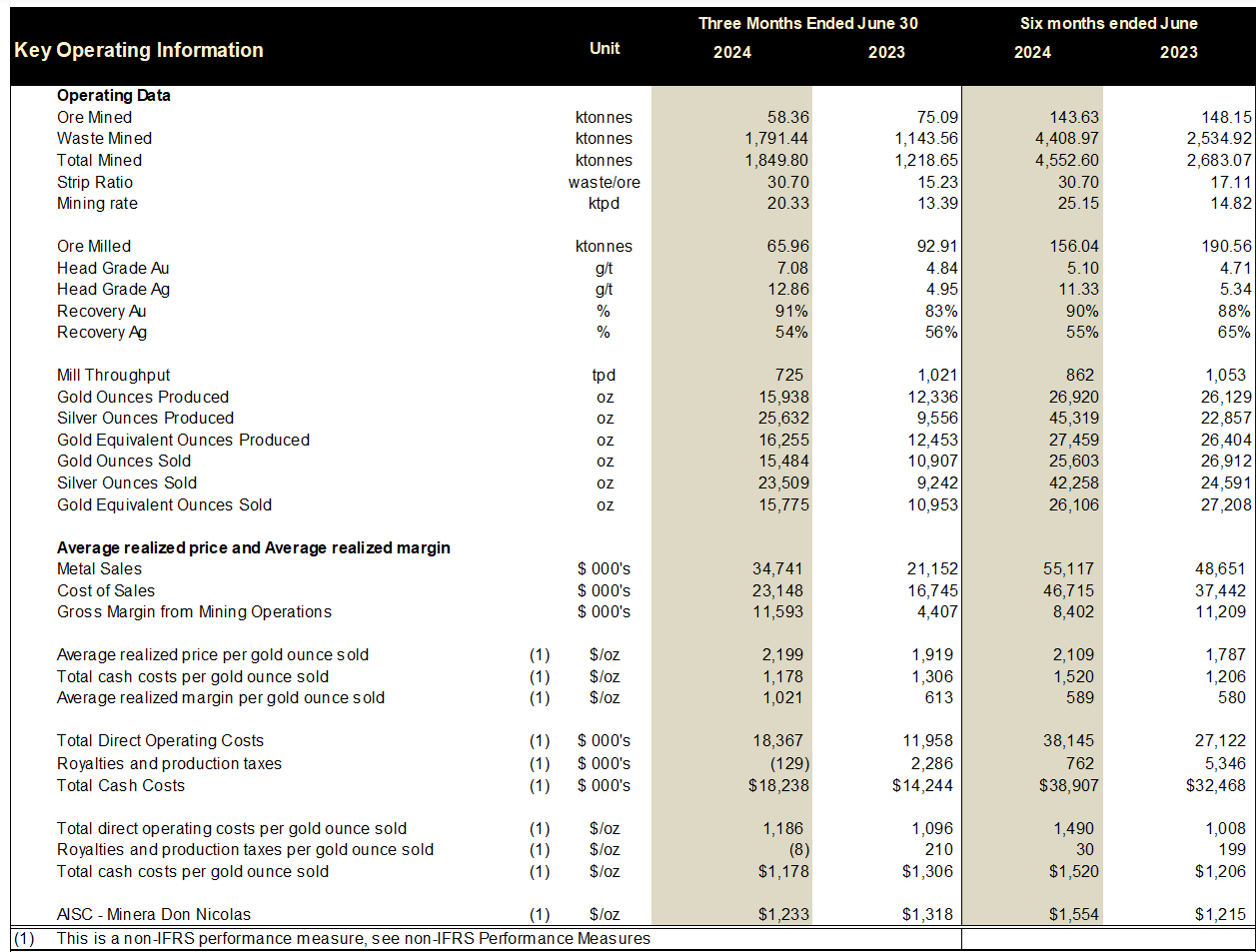

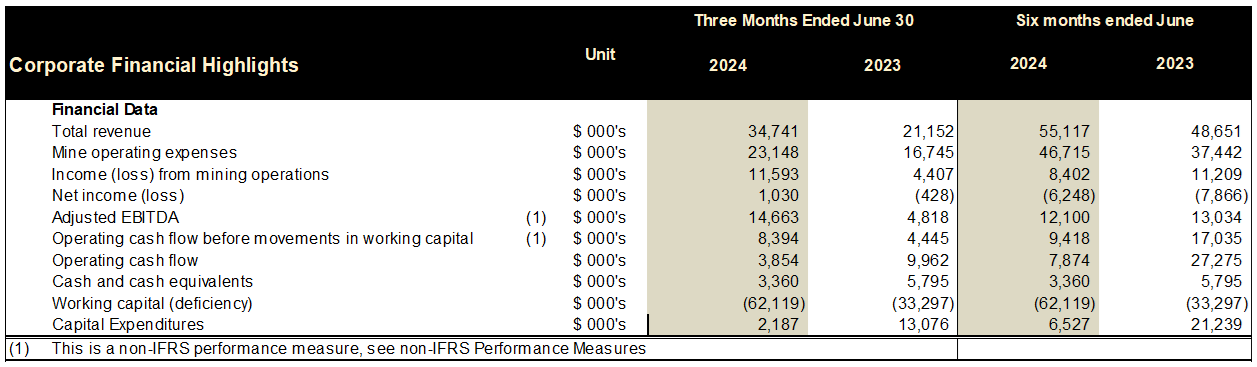

Table 1. Q2 2024 Operational and Financial Performance

The Company produced 16,255 GEO during the second quarter ended June 30, 2024, as compared to 12,453 GEO for the second quarter ended June 30, 2023. Production is higher in the three months ended June 30, 2024, due to

The Company generated revenue of

Cost of sales for the second quarter ended June 30, 2024, were

All in Sustaining Costs (including royalties) per ounce sold were

Net income for the second quarter ended June 30, 2024, was

The Company incurred general and administrative expenses of

Other expense of

Cancellation of Stock Options

The Company and certain directors and employees of the Company have mutually agreed to cancel certain stock options (the "Cancelled Options") exercisable to acquire an aggregate of 7,521,663 common shares of the Company. These Cancelled Options consist of an aggregate of 1,720,000stock options that were granted on August 9, 2021 (expiring August 9, 2026) at an exercise price of CA

No consideration was paid for the surrender of the Cancelled Options. Following this cancellation of stock options, the Company has a total of 1,190,829 stock options outstanding.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, the likelihood of the option to sell the Monte do Carmo project being exercised and assumptions set out in the PEA.. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com