Cerrado Gold Announces Q1 Gold Production Results For Its Minera Don Nicolas Mine In Argentina

Cerrado Gold Inc. (CRDOF) reported a strong performance for Q1 2023, achieving 13,951 Gold Equivalent Ounces (GEO) production, aligned with expectations. The Gold production reached 13,794 ounces, increasing from 13,499 ounces in Q1 2022. GEO sales also grew to 16,255 ounces compared to 15,044 ounces in the prior year. Operating highlights included stable mill throughput exceeding 1,000 tonnes per day and improved gold head grades of 4.59 g/t with recoveries at 91.9%. The Las Calandrias heap leach project is on track for its first gold pour in Q2 2023. Full financial results are expected on June 8, 2023.

- Q1 2023 Gold production increased to 13,794 ounces from 13,499 ounces in Q1 2022.

- Gold Equivalent production rose to 13,951 ounces, with sales reaching 16,255 ounces compared to 15,044 ounces in Q1 2022.

- Gold head grades improved to 4.59 g/t, with recoveries at 91.9%.

- Heap leach construction for Las Calandrias is on track for first gold pour in Q2 2023.

- Operational stability with ore milled above 1,000 tonnes per day.

- None.

Insights

Analyzing...

- Q1 2023 production of 13,951 Gold Equivalent Ounces ("GEO")

- Production for the quarter in line with expectations

- Las Calandrias heap leach construction on-track for first gold pour Q2 2023

TORONTO, ON / ACCESSWIRE / April 24, 2023 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the first quarter of 2023 ("Q1 2023") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full financial results are expected to be released on June 8, 2023.

Q1 Operating Highlights

- Q1 2023 Gold production of 13,794 ounces and Gold Equivalent Ounce production of 13,951 ounces as compared to 13,499 in Q1 2022

- GEO sales in Q1 of 16,255 ounces compared to 15,044 ounces in Q1 2022

- Results demonstrate ongoing stability in mill throughput combined with improving head grades and recoveries

- Gold head grades 4.59 g/t and Gold Recoveries of

91.9% for the quarter.

- Gold head grades 4.59 g/t and Gold Recoveries of

Mark Brennan, CEO and Chairman commented, "We are very pleased with the results from Minera Don Nicolas in Q1/2023, confirming the sustainability of the improvements that have been implemented over the past several quarters, which continues to highlight the skill and dedication of the operational team." He added, "Work continues to focus on unlocking the significant resource growth potential at MDN. Management's continued objective is to build MDN's life of mine and develop a strategic plan that will encompass the same strategies employed at other nearby mines, namely open pit, underground, and heap leach mining operations. We are making significant progress, and during 2023 we will continue to execute on these production and exploration-based growth initiatives."

Operational results presented for the first quarter 2023 highlight the stability of the Company's continued operations. Since Cerrado acquired the Minera Don Nicolas mine, operations, and production rates have continuously improved despite difficult Covid conditions during the first two years. Over the next few quarters, some variability is expected to continue, given the seasonal challenges in the winter months and given the Company is still developing and implementing its Life of Mine ("LOM") strategy.

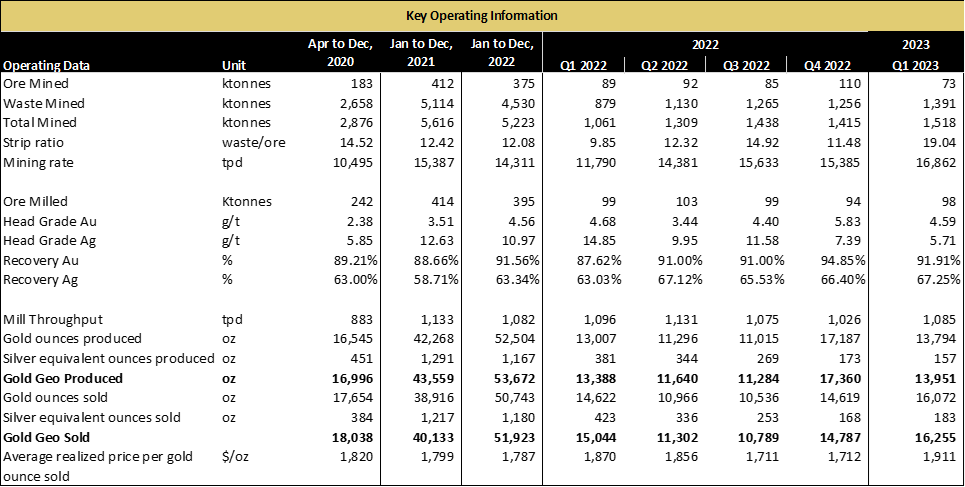

Ore milled remained stable throughout the quarter, above 1,000 tonnes per day each quarter, demonstrating the success of the teams' efforts to normalize operations. Production increases were driven primarily by ongoing efforts to reduce dilution and thus increase head grades. Please see Table 1. for a summary of key highlights for the first quarter of 2023. Sales for the quarter exceeded production due to inventory accumulated in Q4 2022, which was drawn down this quarter.

The consolidation of mine sequencing and exploration work to upgrade and define new sources of resources remains the key focus given the early stage of development at MDN. The operations team is focused on numerous new growth projects aside from expanding current open pit resources, including; the construction of the Las Calandrias Heap Leach operation (first gold pour Q2 2023), underground development and production at Paloma, and a new Heap Leach operation at Martinetas. These development initiatives are expected to be operational later in 2023 and should support a production capacity delivering between 75,000 and 90,000 ounces per year.

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

mbrennan@cerradogold.com

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

About Cerrado

Cerrado is a Toronto-based gold production, development, and exploration company focused on gold projects in the Americas. The Company is the

At Minera Don Nicolas, Cerrado is maximizing asset value through further operations optimization and continued production growth. An extensive exploration campaign is ongoing to further unlock potential resources in our highly prospective 334,000-ha land package.

At Monte Do Carmo, Cerrado is rapidly advancing the Serra Alta deposit through Feasibility and production. The Serra Alta deposit hosts Indicated Resources of 541 kozs of contained gold and Inferred Resources of 780 kozs of contained gold. The Preliminary Economic Assessment demonstrates extremely robust economics as well as the potential to be one of the industry's lowest-cost producers. Cerrado also holds an extensive and highly prospective 82,542-ha land package at Monte Do Carmo.

For more information about Cerrado, please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to continuing progress of Las Calandrias, the resource growth potential at MDN, and production and operating guidance. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/750806/Cerrado-Gold-Announces-Q1-Gold-Production-Results-For-Its-Minera-Don-Nicolas-Mine-In-Argentina