CleanSpark, Inc. Announces Closing of Offering of $650 Million Zero-Coupon Convertible Notes

Rhea-AI Summary

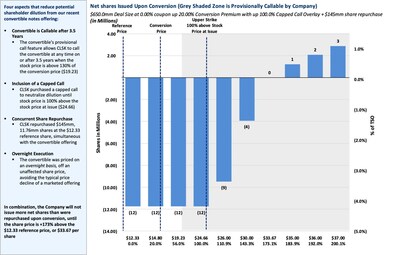

CleanSpark (CLSK) has completed its previously announced $650 million offering of 0.00% Convertible Senior Notes due 2030, including the full exercise of a $100 million option by initial purchasers. The company implemented capped call transactions with a cap price of $24.66 per share and repurchased 11.76 million shares for approximately $145 million.

The net proceeds of approximately $633.6 million will be used for capital expenditures, potential acquisitions, and general corporate purposes. About $90.4 million was allocated to capped call transactions, and $145.0 million for share repurchases. The company plans to use the funds to support growth to 50 EH/s and continue adding mined bitcoin to its balance sheet.

Positive

- Secured $650M in zero-coupon convertible notes, providing significant capital without immediate interest payments

- Implemented capped call transactions to reduce potential dilution with a 100% premium cap price of $24.66

- Repurchased 11.76M shares for $145M, demonstrating confidence in stock value

- Growth to 50 EH/s now fully funded from proceeds

- No immediate plans for additional equity offerings

Negative

- Potential future dilution if stock price exceeds $33.67

- Total debt increased by $650M

News Market Reaction 1 Alert

On the day this news was published, CLSK declined 8.41%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

In connection with the pricing of the Convertible Notes, the Company entered into capped call transactions with various counterparties at a "cap price" of

The Company has also repurchased 11.76 million shares of Common Stock for approximately

"We are proud to have closed this offering with some of the strongest institutional investors in the world and are excited to share that our growth through 50 EH/s and beyond is now expected to be more than fully funded from the proceeds," said Zach Bradford, CEO and President. "In addition to funding the growth to 50 EH/s, share buyback, and capped call, the additional capital will allow us to keep adding the bitcoin we mine to our balance sheet. Beyond our expansion efforts already under way, we remain well positioned to continue executing on opportunistic acquisitions," Bradford continued. "Importantly, this offering provides our stockholders greater clarity on near term share count, given our ATM offering was completed in early November, and we have no immediate plans to commence another equity or equity-linked offering, as the capital received from this offering sufficiently covers our near-term strategic objectives."

The table below illustrates the Company's current expectations regarding potential changes in share count resulting from the Transactions. 1

The net proceeds to the Company from the sale of the Convertible Notes were approximately

The Convertible Notes and any shares of common stock issuable upon conversion of the Convertible Notes, if any, have not been registered under the Securities Act or securities laws of any other jurisdiction, and the Convertible Notes and such shares of common stock may not be offered or sold in

This press release shall not constitute an offer to sell, or a solicitation of an offer to buy the Convertible Notes, nor shall there be any sale of the Convertible Notes or common stock in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About CleanSpark

CleanSpark, Inc. (Nasdaq: CLSK), America's Bitcoin Miner®, is a market-leading, pure play Bitcoin miner with a proven track record of success. We own and operate a portfolio of mining facilities across

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts, such as statements concerning the anticipated use of the net proceeds of the offering and expectations regarding the potential dilutive impact of the Convertible Notes. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as "plan," "believe," "goal," "target," "aim," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would," "will" and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of CleanSpark's management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others, risks described in the Company's prior press releases and in the Company's filings with the Securities and Exchange Commission (the "SEC"), including under the heading "Risk Factors" in those filings, and other risks the Company may identify from time to time. Forward-looking statements contained herein are made only as to the date of this press release, and the Company assumes no obligation to update or revise any forward-looking statements as a result of any new information, changed circumstances or future events or otherwise, except as required by applicable law.

Investors:

Harry Sudock, SVP

702-989-7693

ir@cleanspark.com

Media:

Eleni Stylianou

702-989-7694

pr@cleanspark.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cleanspark-inc-announces-closing-of-offering-of-650-million-zero-coupon-convertible-notes-302334225.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cleanspark-inc-announces-closing-of-offering-of-650-million-zero-coupon-convertible-notes-302334225.html

SOURCE CleanSpark, Inc.