Celsius Holdings Reports Second Quarter 2024 Financial Results

Celsius Holdings (CELH) reported record Q2 2024 financial results, with revenue up 23% to $402.0 million and gross profit up 32% to $209.1 million. Diluted EPS increased 65% to $0.28. The company's North American business drove growth, with international sales rising 30% to $19.6 million. Celsius led the energy drink category, contributing 47% of Q2 growth. Gross margin improved to 52.0%, up 320 basis points year-over-year. The company expanded its retail presence, increasing average SKUs per store from 15 to 20. Innovation continued with new flavors and CELSIUS Essentials reaching 64% ACV. International expansion progressed in the UK, Ireland, and Canada, with plans for Australia, France, and New Zealand in H2 2024.

Celsius Holdings (CELH) ha riportato risultati finanziari record per il secondo trimestre del 2024, con ricavi in aumento del 23% a 402,0 milioni di dollari e un profitto lordo in crescita del 32% a 209,1 milioni di dollari. L'EPS diluito è aumentato del 65% a 0,28 dollari. L'attività dell'azienda in Nord America ha guidato la crescita, con vendite internazionali in aumento del 30% a 19,6 milioni di dollari. Celsius ha dominato la categoria delle bevande energetiche, contribuendo al 47% della crescita del secondo trimestre. Il margine lordo è migliorato al 52,0%, con un incremento di 320 punti base rispetto all'anno precedente. L'azienda ha ampliato la sua presenza al dettaglio, aumentando la media degli SKU per negozio da 15 a 20. L'innovazione è proseguita con nuovi gusti e CELSIUS Essentials che ha raggiunto il 64% di ACV. L'espansione internazionale è progredita nel Regno Unito, in Irlanda e in Canada, con piani per Australia, Francia e Nuova Zelanda nella seconda metà del 2024.

Celsius Holdings (CELH) reportó resultados financieros récord para el segundo trimestre de 2024, con ingresos que aumentaron un 23% hasta $402.0 millones y una ganancia bruta que creció un 32% hasta $209.1 millones. El EPS diluido aumentó un 65% hasta $0.28. El negocio de la empresa en América del Norte impulsó el crecimiento, con ventas internacionales que aumentaron un 30% hasta $19.6 millones. Celsius lideró la categoría de bebidas energéticas, contribuyendo con el 47% del crecimiento del segundo trimestre. El margen bruto mejoró al 52.0%, un incremento de 320 puntos base en comparación con el año anterior. La empresa amplió su presencia minorista, aumentando el promedio de SKU por tienda de 15 a 20. La innovación continuó con nuevos sabores y CELSIUS Essentials alcanzando el 64% de ACV. La expansión internacional avanzó en el Reino Unido, Irlanda y Canadá, con planes para Australia, Francia y Nueva Zelanda en la segunda mitad de 2024.

셀시우스 홀딩스(CELH)는 2024년 2분기 기록적인 재무 결과를 보고했으며, 수익은 23% 증가한 4억 20만 달러에, 총 이익은 32% 증가한 2억 9백만 달러에 이르렀습니다. 희석된 주당순이익(EPS)은 65% 증가하여 0.28달러가 되었습니다. 북미 사업 부문이 성장을 이끌었으며, 해외 판매는 30% 증가한 1960만 달러에 달했습니다. 셀시우스는 에너지 음료 카테고리에서 선두를 차지하며, 2분기 성장의 47%를 차지했습니다. 총 마진은 52.0%로 개선되었으며, 지난해 대비 320bp 증가했습니다. 회사는 소매 존재감을 확장하여 매장당 평균 SKU를 15에서 20으로 늘렸습니다. 새로운 맛과 CELSIUS Essentials가 64% ACV에 도달하면서 혁신이 지속되었습니다. 영국, 아일랜드, 캐나다에서 국제적 확장이 진전을 보였으며, 2024년 하반기 호주, 프랑스, 뉴질랜드에 대한 계획이 있습니다.

Celsius Holdings (CELH) a annoncé des résultats financiers record pour le deuxième trimestre 2024, avec un chiffre d'affaires en hausse de 23 % à 402,0 millions de dollars et un bénéfice brut en hausse de 32 % à 209,1 millions de dollars. Le BPA dilué a augmenté de 65 % à 0,28 dollar. L'activité de l'entreprise en Amérique du Nord a été le principal moteur de la croissance, les ventes internationales ayant augmenté de 30 % pour atteindre 19,6 millions de dollars. Celsius a dominé la catégorie des boissons énergétiques, contribuant à 47 % de la croissance du deuxième trimestre. La marge brute s'est améliorée pour atteindre 52,0 %, soit 320 points de base de plus par rapport à l'année précédente. L'entreprise a élargi sa présence au détail, augmentant le nombre moyen de SKU par magasin de 15 à 20. L'innovation s'est poursuivie avec de nouvelles saveurs et les essentiels CELSIUS atteignant 64 % de la valeur de contribution. L'expansion internationale a progressé au Royaume-Uni, en Irlande et au Canada, avec des projets pour l'Australie, la France et la Nouvelle-Zélande dans la deuxième moitié de 2024.

Celsius Holdings (CELH) berichtete von Rekordergebnissen im Finanzviertel Q2 2024, mit einem Umsatzanstieg von 23% auf 402,0 Millionen Dollar und einem Bruttogewinn von 32% auf 209,1 Millionen Dollar. Der verwässerte Gewinn pro Aktie (EPS) stieg um 65% auf 0,28 Dollar. Das nordamerikanische Geschäft des Unternehmens trieb das Wachstum, während die internationalen Verkäufe um 30% auf 19,6 Millionen Dollar zunahmen. Celsius führte die Kategorie der Energydrinks an und trug 47% zum Wachstum im Q2 bei. Die Bruttomarge verbesserte sich auf 52,0%, ein Anstieg um 320 Basispunkte im Jahresvergleich. Das Unternehmen erweiterte seine Präsenz im Einzelhandel und erhöhte die durchschnittliche Anzahl von SKUs pro Geschäft von 15 auf 20. Die Innovation setzte sich mit neuen Geschmacksrichtungen fort und CELSIUS Essentials erreichte 64% ACV. Die internationale Expansion machte Fortschritte im Vereinigten Königreich, in Irland und Kanada, mit Plänen für Australien, Frankreich und Neuseeland in der zweiten Hälfte von 2024.

- Record Q2 revenue of $402.0 million, up 23% year-over-year

- Gross profit increased 32% to $209.1 million

- Diluted EPS grew 65% to $0.28

- Gross margin improved to 52.0%, up 320 basis points

- International sales increased 30% to $19.6 million

- Retail sales in U.S. MULOC grew by 36.5% year-over-year

- Energy drink category dollar share increased to 11%, up 1.4 points

- Average SKUs per store increased from 15 to 20

- Club channel sales increased 30% to $88.0 million

- Amazon sales grew 41% year-over-year to $39.9 million

- Revenue growth was partially offset by inventory reduction from a large distributor

Insights

Celsius Holdings' Q2 2024 results are impressively strong. Revenue jumped

Key growth drivers include:

- North American sales up

23% - International sales growth of

30% - Club channel sales increase of

30% - Amazon sales surge of

41%

The company's ability to gain market share (now

Celsius' market performance is remarkable. The brand contributed

The expansion from an average of 15 to 20 SKUs per store indicates strong retailer confidence and consumer demand. The successful launch of CELSIUS Essentials, reaching

International expansion into the UK, Ireland and Canada, with plans for Australia, France and New Zealand, shows a strategic global growth trajectory. This diversification could help mitigate risks associated with over-reliance on the U.S. market.

The brand's success in both traditional retail and e-commerce channels (notably Amazon) indicates a well-balanced omnichannel strategy, important for capturing modern consumer purchasing habits.

Celsius' performance in the energy drink sector is disrupting the status quo. Their focus on "better-for-you" products is clearly resonating with consumers, filling a important whitespace in the market. The

The introduction of new flavors and formats (like 12-oz cans and On The Go powders) demonstrates agile product development, keeping the brand fresh and appealing. The success of CELSIUS Essentials, already in over 124,000 stores, shows the brand's ability to quickly scale new product lines.

The

However, the reduction in inventory days by a large distributor warrants attention. While it didn't significantly impact overall growth, it's a factor to monitor for potential supply chain or demand forecasting challenges.

Record second quarter revenue of

Record second quarter gross profit of

Second quarter diluted EPS of

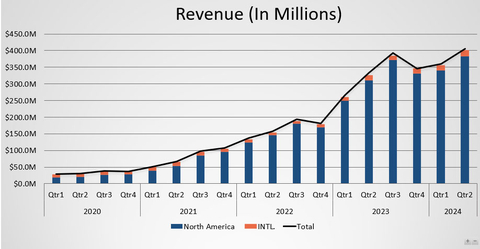

Revenue (in millions) (Graphic: Business Wire)

Summary Financials |

2Q 2024 |

2Q 2023 |

Change |

1H 2024 |

1H 2023 |

Change |

(Millions except for percentages and EPS) |

||||||

Revenue |

|

|

|

|

|

|

N. America |

|

|

|

|

|

|

International |

|

|

|

|

|

|

Gross Margin |

|

|

+320 BPS |

|

|

+500 BPS |

Net Income |

|

|

|

|

|

|

Net Income att. to Common Shareholders |

|

|

|

|

|

|

Diluted EPS |

|

|

|

|

|

|

Adjusted EBITDA* |

|

|

|

|

|

|

John Fieldly, Chairman and CEO of Celsius Holdings, Inc., said: “Celsius today reported its best second quarter financial results ever, delivering records in revenue, gross profit and gross margin. Celsius continued to lead the energy drink category, contributing 47 percent of all second-quarter growth, and we believe that we are well-positioned to capture incremental category dollar share. Celsius innovation is giving consumers great tasting, better-for-you energy drink products that are filling a whitespace and bringing new consumers to an evolving energy drink category.”

FINANCIAL HIGHLIGHTS FOR THE SECOND QUARTER OF 2024

Revenue for the second quarter of 2024 increased

Retail sales of Celsius in total

International sales of

Gross profit for the second quarter of 2024 increased

Diluted earnings per share for the second quarter increased

FINANCIAL HIGHLIGHTS FOR THE FIRST HALF OF 2024

Revenue for the first half of 2024 increased

Gross profit for the first half of 2024 increased

Diluted earnings per share for the first half of the year increased

BUSINESS OPERATIONS AND COMPANY HIGHLIGHTS

Share Growth

Celsius’ energy drink category dollar share in MULOC in the last-four-week period ended July 14, 2024, was

Celsius gained approximately

Alternative Growth Drivers

Club channel sales for the quarter ended June 30, 2024, increased

Celsius sales to Amazon increased

Approximately

Innovation and Marketing

Sales of CELSIUS Essentials continue to exceed the company’s expectations and have reached

Celsius introduced three great tasting and refreshing 12-ounce flavors during the summer: CELSIUS Sparkling Watermelon Lemonade, CELSIUS Sparkling Kiwi Strawberry and CELSIUS Sparkling Cherry Cola. Additionally, three new CELSIUS On The Go powders debuted in the second quarter: CELSIUS On The Go Peach Vibe, CELSIUS On The Go Tropical Vibe and CELSIUS On The Go Arctic Vibe.

International Expansion

Celsius began sales in the

Sales in

Sales in

Second Quarter 2024 Earnings Webcast

Management will host a webcast at 8 a.m. EDT on Tuesday, Aug. 6, 2024, to discuss the company’s second quarter financial results with the investment community. Investors are invited to join the webcast accessible from https://ir.celsiusholdingsinc.com. Downloadable files, an audio replay and transcript will be made available on the Celsius Holdings investor relations website.

*The company reports financial results in accordance with generally accepted accounting principles in

1Circana Total US MULOC L13W ended 6/30/24, RTD Energy |

2Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

3Circana Total US MULOC L13W ended 6/30/24, RTD Energy |

4Circana Total US MULOC L4W ended 12/3/23 v. L4W ended 7/14/24, RTD Energy |

5Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

6Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

About Celsius Holdings, Inc.

Celsius Holdings, Inc. (Nasdaq: CELH) is the maker of energy drink brand CELSIUS®, a lifestyle energy drink born in fitness and a pioneer in the rapidly growing energy category. For more information, please visit www.celsiusholdingsinc.com.

Forward-Looking Statements

This press release contains statements that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of Celsius Holdings’ future results of operations or financial position, or state other forward-looking information. You can identify these statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” “could,” “project,” “plan,” “potential,” “designed,” “seek,” “target,” and variations of these terms, the negatives of such terms and similar expressions. You should not rely on forward-looking statements because Celsius Holdings’ actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include but are not limited to: the strategic investment by and long term partnership with PepsiCo, Inc.; management’s plans and objectives for international expansion and future operations globally; general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expectations regarding our strategy and investments; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; the Company’s ability to satisfy, in a timely manner, all Securities and Exchange Commission (the “SEC”) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the SEC, such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Forward-looking statements speak only as of the date the statements were made. Celsius Holdings does not undertake any obligation to update forward-looking information, except to the extent required by applicable law.

CELSIUS HOLDINGS, INC. - FINANCIAL TABLES CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except par value) (Unaudited) |

|||||||

|

June 30,

|

|

December 31,

|

||||

ASSETS |

|

|

|

||||

Current assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

903,210 |

|

|

$ |

755,981 |

|

Accounts receivable-net |

|

262,920 |

|

|

|

183,703 |

|

Note receivable-current-net |

|

1,166 |

|

|

|

2,318 |

|

Inventories-net |

|

180,669 |

|

|

|

229,275 |

|

Deferred other costs-current |

|

14,124 |

|

|

|

14,124 |

|

Prepaid expenses and other current assets |

|

22,900 |

|

|

|

19,503 |

|

Total current assets |

|

1,384,989 |

|

|

|

1,204,904 |

|

|

|

|

|

||||

Property and equipment-net |

|

36,282 |

|

|

|

24,868 |

|

Deferred tax assets |

|

22,727 |

|

|

|

29,518 |

|

Right of use assets-operating leases |

|

1,507 |

|

|

|

1,957 |

|

Right of use assets-finance leases |

|

233 |

|

|

|

208 |

|

Deferred other costs-non-current |

|

241,276 |

|

|

|

248,338 |

|

Intangibles-net |

|

11,491 |

|

|

|

12,139 |

|

Goodwill |

|

13,730 |

|

|

|

14,173 |

|

Other long-term assets |

|

6,653 |

|

|

|

291 |

|

Total Assets |

$ |

1,718,888 |

|

|

$ |

1,536,396 |

|

|

|

|

|

||||

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY |

|

|

|

||||

|

|

|

|

||||

Current liabilities: |

|

|

|

||||

Accounts payable |

$ |

47,423 |

|

|

$ |

42,840 |

|

Accrued expenses |

|

79,633 |

|

|

|

62,120 |

|

Income taxes payable |

|

5,374 |

|

|

|

50,424 |

|

Accrued promotional allowance |

|

156,479 |

|

|

|

99,787 |

|

Lease liability obligation-operating leases-current |

|

729 |

|

|

|

980 |

|

Lease liability obligation-finance leases |

|

61 |

|

|

|

59 |

|

Deferred revenue-current |

|

9,513 |

|

|

|

9,513 |

|

Other current liabilities |

|

13,772 |

|

|

|

10,890 |

|

Total current liabilities |

|

312,984 |

|

|

|

276,613 |

|

|

|

|

|

||||

Lease liability obligation-operating leases-non-current |

|

762 |

|

|

|

955 |

|

Lease liability obligation-finance leases-non-current |

|

228 |

|

|

|

193 |

|

Deferred tax liabilities |

|

2,201 |

|

|

|

2,880 |

|

Deferred revenue-non-current |

|

162,471 |

|

|

|

167,227 |

|

Total Liabilities |

|

478,646 |

|

|

|

447,868 |

|

|

|

|

|

||||

Commitment and contingencies (Note 15) |

|

|

|

||||

|

|

|

|

||||

Mezzanine Equity: |

|

|

|

||||

Series A convertible preferred shares, |

|

824,488 |

|

|

|

824,488 |

|

|

|

|

|

||||

Stockholders’ Equity: |

|

|

|

||||

Common stock, |

|

78 |

|

|

|

77 |

|

Additional paid-in capital |

|

286,173 |

|

|

|

276,717 |

|

Accumulated other comprehensive loss |

|

(2,363 |

) |

|

|

(701 |

) |

Retained earnings (accumulated deficit) |

|

131,866 |

|

|

|

(12,053 |

) |

Total Stockholders’ Equity |

|

415,754 |

|

|

|

264,040 |

|

Total Liabilities, Mezzanine Equity and Stockholders’ Equity |

$ |

1,718,888 |

|

|

$ |

1,536,396 |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

|

For the Three Months Ended

|

|

For the Six Months Ended

|

||||||||||||

|

2024 |

|

2023 |

|

2024 |

|

2023 |

||||||||

Revenue |

$ |

401,977 |

|

|

$ |

325,883 |

|

|

$ |

757,685 |

|

|

$ |

585,822 |

|

Cost of revenue |

|

192,879 |

|

|

|

166,889 |

|

|

|

366,380 |

|

|

|

313,010 |

|

Gross profit |

|

209,098 |

|

|

|

158,994 |

|

|

|

391,305 |

|

|

|

272,812 |

|

Selling, general and administrative expenses |

|

114,850 |

|

|

|

94,181 |

|

|

|

213,867 |

|

|

|

163,086 |

|

Income from operations |

|

94,248 |

|

|

|

64,813 |

|

|

|

177,438 |

|

|

|

109,726 |

|

|

|

|

|

|

|

|

|

||||||||

Other income (expense): |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

Interest income on note receivable |

|

— |

|

|

|

28 |

|

|

|

28 |

|

|

|

73 |

|

Interest income, net |

|

10,647 |

|

|

|

5,545 |

|

|

|

20,259 |

|

|

|

10,469 |

|

Foreign exchange loss |

|

(264 |

) |

|

|

(931 |

) |

|

|

(633 |

) |

|

|

(1,049 |

) |

Total other income |

|

10,383 |

|

|

|

4,642 |

|

|

|

19,654 |

|

|

|

9,493 |

|

|

|

|

|

|

|

|

|

||||||||

Net income before provision for income taxes |

|

104,631 |

|

|

|

69,455 |

|

|

|

197,092 |

|

|

|

119,219 |

|

|

|

|

|

|

|

|

|

||||||||

Provision for income taxes |

|

(24,848 |

) |

|

|

(17,946 |

) |

|

|

(39,498 |

) |

|

|

(26,483 |

) |

Net income |

$ |

79,783 |

|

|

$ |

51,509 |

|

|

$ |

157,594 |

|

|

$ |

92,736 |

|

|

|

|

|

|

|

|

|

||||||||

Dividends on Series A convertible preferred stock |

|

(6,838 |

) |

|

|

(6,856 |

) |

|

|

(13,675 |

) |

|

|

(13,637 |

) |

Income allocated to participating preferred stock |

|

(6,289 |

) |

|

|

(3,890 |

) |

|

|

(12,417 |

) |

|

|

(6,898 |

) |

Net income attributable to common stockholders |

$ |

66,656 |

|

|

$ |

40,763 |

|

|

$ |

131,502 |

|

|

$ |

72,201 |

|

|

|

|

|

|

|

|

|

||||||||

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

||||||||

Foreign currency translation adjustments, net of income tax |

|

(308 |

) |

|

|

(590 |

) |

|

|

(1,662 |

) |

|

|

4 |

|

Comprehensive income |

$ |

66,348 |

|

|

$ |

40,173 |

|

|

$ |

129,840 |

|

|

$ |

72,205 |

|

|

|

|

|

|

|

|

|

||||||||

*Earnings per share: |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

0.29 |

|

|

$ |

0.18 |

|

|

$ |

0.56 |

|

|

$ |

0.31 |

|

Dilutive |

$ |

0.28 |

|

|

$ |

0.17 |

|

|

$ |

0.55 |

|

|

$ |

0.31 |

|

*Please refer to Note 3 in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024, for Earnings per Share reconciliations. |

|||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Reconciliation of GAAP net income to non-GAAP adjusted EBITDA |

|||||||||||||||

|

Three months ended

|

|

Six months ended

|

||||||||||||

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Net income (GAAP measure) |

$ |

79,783 |

|

|

$ |

51,509 |

|

|

$ |

157,594 |

|

|

$ |

92,736 |

|

Add back/(Deduct): |

|

|

|

|

|

|

|

||||||||

Net interest income |

|

(10,647 |

) |

|

|

(5,573 |

) |

|

|

(20,287 |

) |

|

|

(10,542 |

) |

Provision for income taxes |

|

24,848 |

|

|

|

17,946 |

|

|

|

39,498 |

|

|

|

26,483 |

|

Depreciation and amortization expense |

|

1,418 |

|

|

|

698 |

|

|

|

2,648 |

|

|

|

1,246 |

|

Non-GAAP EBITDA |

|

95,402 |

|

|

|

64,580 |

|

|

|

179,453 |

|

|

|

109,923 |

|

Stock-based compensation1 |

|

4,746 |

|

|

|

5,735 |

|

|

|

8,309 |

|

|

|

11,242 |

|

Foreign exchange |

|

264 |

|

|

|

931 |

|

|

|

633 |

|

|

|

1,049 |

|

Distributor Termination2 |

|

— |

|

|

|

(1,007 |

) |

|

|

— |

|

|

|

(3,241 |

) |

Legal Settlement Costs3 |

|

— |

|

|

|

7,900 |

|

|

|

— |

|

|

|

7,900 |

|

Non-GAAP Adjusted EBITDA |

$ |

100,412 |

|

|

$ |

78,139 |

|

|

$ |

188,395 |

|

|

$ |

126,873 |

|

___________________________

| 1Selling, general and administrative expenses related to employee non-cash stock-based compensation expense. Stock-based compensation expense consists of non-cash charges for the estimated fair value of unvested restricted share unit and stock option awards granted to employees and directors. The Company believes that the exclusion provides a more accurate comparison of operating results and is useful to investors to understand the impact that stock-based compensation expense has on its operating results. |

22023 distributor termination represents reversals of accrued termination payments. The unused funds designated for termination expense payments to legacy distributors were reimbursed to Pepsi for the quarter ended June 30, 2023. |

32023 Legal class action settlement pertained to the McCallion vs Celsius Holdings class action lawsuit, which we settled during the quarter ended June 30, 2023. |

USE OF NON-GAAP MEASURES

Celsius defines Adjusted EBITDA as net income before net interest income, income tax expense (benefit), and depreciation and amortization expense, further adjusted by excluding stock-based compensation expense, foreign exchange gains or losses, distributor termination fees, legal settlement costs and certain impairment charges. Adjusted EBITDA is a non-GAAP financial measure.

Celsius uses Adjusted EBITDA for operational and financial decision-making and believes these measures are useful in evaluating its performance because they eliminate certain items that management does not consider indicators of Celsius’ operating performance. Adjusted EBITDA may also be used by many of Celsius’ investors, securities analysts, and other interested parties in evaluating its operational and financial performance across reporting periods. Celsius believes that the presentation of Adjusted EBITDA provides useful information to investors by allowing an understanding of measures that it uses internally for operational decision-making, budgeting and assessing operating performance.

Adjusted EBITDA is not a recognized term under GAAP and should not be considered as a substitute for net income or any other financial measure presented in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of Celsius’ results as reported under GAAP. Celsius strongly encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

Because non-GAAP financial measures are not standardized, Adjusted EBITDA, as defined by Celsius, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare Celsius’ use of these non-GAAP financial measures with those used by other companies.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240806461910/en/

Paul Wiseman

Investors: investorrelations@celsius.com

Press: press@celsius.com

Source: Celsius Holdings, Inc.