Coeur Provides Silvertip Exploration Update

-Drilling set to resume at Company’s centerpiece exploration project-

-Campaign to target high-value resource growth opportunities-

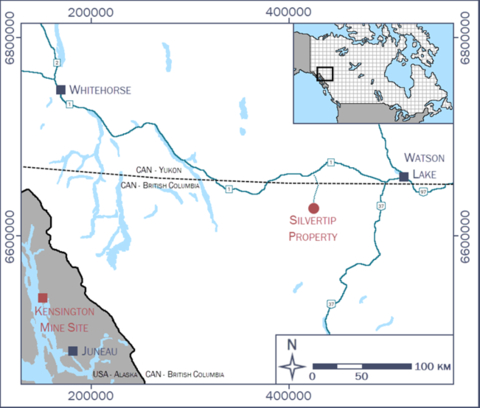

Figure 1: Location of Silvertip Project (Graphic: Business Wire)

Key Highlights

- Grades continue to be among the world’s highest compared to similar carbonate replacement deposits

- Recent deep drilling has indicated proximity to an intrusive heat source, opening up potential for skarn and porphyry styles of mineralization in addition to carbonate replacement style mineralization

- Limestone-rich stratigraphy at district scale over 2,500 vertical meters in thickness presents significant potential for stacked carbonate replacement style deposits (“CRD”)

- Multiple look-alike targets identified within large 37,650 hectares land package

- Exploration priorities during the 24-month program include (i) working to expand the resource base by drilling known extensions to mineralization directly north and south of Silvertip, (ii) testing additional horizons to ascertain the full vertical extent of mineralization through the stratigraphic column, (iii) further exploring the immediately adjacent heat source to test for skarn and/or porphyry styles of mineralization, and (iv) test high-priority regional look-alike targets

“The Silvertip team has made impressive progress on advancing the geologic understanding of this emerging world-class ore body, and the commencement of this focused drilling campaign over the next 18 months positions us to pursue our primary goal of growing overall resource tonnage,” said Mitchell J. Krebs, Coeur President and Chief Executive Officer. “Silvertip is one of the highest-grade undeveloped carbonate replacement deposits in the world, hosting large and growing resources of silver, zinc and lead—three minerals already playing key roles in the accelerating transition to a net-zero emissions global economy. Located in

Since acquisition in late 2017, the Company’s exploration investment has nearly tripled the measured and indicated resource base, including a year-over-year increase of silver, zinc and lead of approximately

In addition to mineralization in the McDame Limestone unit, favorable indications for mineralization have also been identified lower in the stratigraphic sequence, in the underlying dolostone, sandstone and Atan Group limestones (see Figure 3 below). This opens up over 2,500 vertical meters of stratigraphy that is prospective for stacked, carbonate replacement deposits. Testing this large vertical extent of stratigraphy is a key focus of the upcoming drill program.

Another key aim will be to continue building the resource base immediately adjacent to Silvertip located near existing underground development. This will be undertaken mainly over the two kilometer corridor immediately south of the main Silvertip deposit. During 2020 – 2022, 15 of 16 scout holes from Saddle Zone south to Tour Ridge intersected mineralization. This program also outlined mineralization one kilometer north through the Keda zone, thereby doubling the known mineralized strike length to more than four kilometers (see Figure 4).

Alongside the known silver, lead, zinc carbonate replacement style mineralization, the Silvertip District is prospective for porphyry and / or skarn mineralization. A recently completed deep drillhole tested a circular, geophysical anomaly located to the southeast of Silvertip. This anomaly is interpreted to be a potential heat and fluid source for the Silvertip deposit. Geology intersected in this drilling includes higher temperature mineralogical assemblages and increased quantities of alteration and veining that are indicative of an intrusive porphyry or skarn source at depth. The hole therefore provided proof of concept and additional exploration drilling is being designed to further test this target during the next 18-24 months.

Multiple other, similar circular geophysical anomalies are seen on the Silvertip land package. These are associated with similar structural features and/or geochemical signatures and are therefore look-alike targets to Silvertip.

“We believe the resource base currently outlined at Silvertip represents a distal portion of a large mineralizing system and the detailed geological analysis and modelling completed during the first half of 2023 supports that thinking,” said Aoife McGrath Senior, Coeur Vice President of Exploration. “The understanding gained through this process is allowing us to target exploration more concisely and continue to work to build value at this world class project.”

This news release is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

About Coeur

Coeur Mining, Inc. is a

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in

Notes

-

In 2022, the Company reclassified Silvertip‘s reserves to measured and indicated resources. Excluding the reclassification, silver, zinc and lead measured and indicated resources increased

73% ,69% and81% , respectively, year-over-year.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230621310812/en/

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Attention: Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com

Source: Coeur Mining