Crown Castle Reports Third Quarter 2024 Results

Crown Castle Inc. (NYSE: CCI) reported its Q3 2024 results and maintained its full year 2024 Outlook, except for a reduction in net income. Key highlights include:

- Site rental revenues grew 1% to $1,593 million

- Net income increased 14% to $303 million

- Adjusted EBITDA rose 3% to $1,075 million

- AFFO per share grew 4% to $1.84

The company completed discussions with customers, resulting in the cancellation of approximately 7,000 greenfield small cell nodes from the contracted backlog. This is expected to improve capital efficiency and increase returns on the remaining ~40,000 node backlog. Crown Castle remains optimistic about long-term growth opportunities driven by increasing U.S. data consumption and demand for communications infrastructure.

Crown Castle Inc. (NYSE: CCI) ha riportato i risultati del terzo trimestre 2024 e ha mantenuto le previsioni per l'intero anno 2024, a eccezione di una riduzione dell'utile netto. I punti salienti includono:

- I ricavi da affitto dei siti sono aumentati dell'1% a 1.593 milioni di dollari

- L'utile netto è cresciuto del 14% a 303 milioni di dollari

- L'EBITDA rettificato è salito del 3% a 1.075 milioni di dollari

- L'AFFO per azione è aumentato del 4% a 1,84 dollari

L'azienda ha completato le discussioni con i clienti, portando alla cancellazione di circa 7.000 nodi di piccole celle greenfield dal backlog contratto. Questo dovrebbe migliorare l'efficienza del capitale e aumentare i rendimenti sul restante backlog di circa 40.000 nodi. Crown Castle rimane ottimista riguardo alle opportunità di crescita a lungo termine, sostenute dall'aumento del consumo di dati negli Stati Uniti e dalla domanda di infrastrutture di comunicazione.

Crown Castle Inc. (NYSE: CCI) informó sobre sus resultados del tercer trimestre de 2024 y mantuvo su previsión para todo el año 2024, salvo por una reducción en el ingreso neto. Los aspectos más destacados incluyen:

- Los ingresos por alquiler de sitios crecieron un 1% a 1.593 millones de dólares

- El ingreso neto aumentó un 14% a 303 millones de dólares

- El EBITDA ajustado subió un 3% a 1.075 millones de dólares

- El AFFO por acción creció un 4% a 1,84 dólares

La compañía completó las discusiones con los clientes, lo que resultó en la cancelación de aproximadamente 7,000 nodos de pequeñas celdas greenfield del backlog contratado. Se espera que esto mejore la eficiencia de capital y aumente los rendimientos del backlog restante de aproximadamente 40,000 nodos. Crown Castle sigue siendo optimista sobre las oportunidades de crecimiento a largo plazo impulsadas por el aumento del consumo de datos en EE. UU. y la demanda de infraestructura de comunicaciones.

Crown Castle Inc. (NYSE: CCI)는 2024년 3분기 실적을 발표하고 2024년도 전체 전망을 유지했으며, 순이익 감소를 제외했습니다. 주요 하이라이트는 다음과 같습니다:

- 사이트 임대 수익이 1% 증가하여 15억 9,300만 달러에 달했습니다

- 순이익이 14% 증가하여 3억 3백만 달러에 달했습니다

- 조정 EBITDA가 3% 증가하여 10억 7,500만 달러에 달했습니다

- 주당 AFFO가 4% 증가하여 1.84달러에 달했습니다

회사는 고객과의 논의를 완료하여 약 7,000개의 그린필드 소형 셀 노드가 계약된 적체에서 취소되었습니다. 이는 자본 효율성을 개선하고 남은 약 40,000개의 노드 적체에 대한 수익을 증가시킬 것으로 예상됩니다. Crown Castle은 미국 데이터 소비 증가와 통신 인프라에 대한 수요에 의해 주도되는 장기 성장 기회에 대해 낙관적입니다.

Crown Castle Inc. (NYSE: CCI) a publié ses résultats pour le troisième trimestre 2024 et a maintenu ses prévisions pour l'ensemble de l'année 2024, à l'exception d'une réduction du revenu net. Les principaux points forts incluent :

- Les revenus locatifs des sites ont augmenté de 1 % pour atteindre 1 593 millions de dollars

- Le revenu net a augmenté de 14 % pour atteindre 303 millions de dollars

- Le EBITDA ajusté a augmenté de 3 % pour atteindre 1 075 millions de dollars

- L'AFFO par action a progressé de 4 % pour atteindre 1,84 dollar

L'entreprise a achevé les discussions avec les clients, entraînant l'annulation d'environ 7 000 nœuds de petites cellules greenfield dans le carnet de commandes contracté. Cela devrait améliorer l'efficacité du capital et augmenter les rendements sur le reste du carnet d'environ 40 000 nœuds. Crown Castle reste optimiste quant aux opportunités de croissance à long terme, soutenues par l'augmentation de la consommation de données aux États-Unis et la demande d'infrastructure de communication.

Crown Castle Inc. (NYSE: CCI) hat seine Ergebnisse für das 3. Quartal 2024 veröffentlicht und die Prognose für das gesamte Jahr 2024 beibehalten, abgesehen von einer Reduzierung des Nettogewinns. Zu den wichtigsten Punkten gehören:

- Die Mieteinnahmen aus Standorten stiegen um 1% auf 1.593 Millionen Dollar

- Der Nettogewinn stieg um 14% auf 303 Millionen Dollar

- Das angepasste EBITDA erhöhte sich um 3% auf 1.075 Millionen Dollar

- Das AFFO pro Aktie wuchs um 4% auf 1,84 Dollar

Das Unternehmen hat die Gespräche mit den Kunden abgeschlossen, was zur Stornierung von etwa 7.000 Greenfield-Kleinzellenknoten aus dem beauftragten Auftragsbestand führte. Dies wird voraussichtlich die Kapitaleffizienz verbessern und die Renditen des verbleibenden Auftragsbestands von ca. 40.000 Knoten erhöhen. Crown Castle bleibt optimistisch in Bezug auf langfristige Wachstumsmöglichkeiten, die durch den Anstieg des Datenverbrauchs in den USA und die Nachfrage nach Kommunikationsinfrastruktur vorangetrieben werden.

- Site rental revenues increased 1% year-over-year to $1,593 million

- Net income grew 14% to $303 million compared to Q3 2023

- Adjusted EBITDA rose 3% to $1,075 million

- AFFO per share increased 4% to $1.84

- Organic Contribution to Site Rental Billings was $65 million, including $15 million of non-recurring small cell revenues

- Issued $1.25 billion in senior unsecured notes with a weighted average maturity of 8 years and 5.1% coupon

- Reduction in full year 2024 net income outlook by 12% compared to previous guidance

- Cancellation of approximately 7,000 greenfield small cell nodes from the contracted backlog

- Incurred $48 million in charges related to the restructuring plan announced in June 2024

- $6 million in advisory fees primarily related to the recent proxy contest

- $4 million unfavorable impact on fiber solutions due to adjustments related to prior period revenues

- $6 million unfavorable impact on fiber solutions from the absence of Sprint Cancellation payments

Insights

Site rental revenues grew

Net income increased

The company maintained its full-year 2024 outlook for most metrics but reduced its net income projection by

The cancellation of 7,000 small cell nodes from the backlog aims to improve capital efficiency but may impact future growth. With

Crown Castle's Q3 results reflect the evolving dynamics in the telecom infrastructure sector. The modest

The company's strategic shift, including the cancellation of 7,000 greenfield small cell nodes, signals a more disciplined approach to capital allocation in the fiber and small cell segments. This move, while potentially limiting near-term growth, aims to enhance overall returns and capital efficiency.

The

Looking ahead, Crown Castle's focus on customer service, revenue generation and operational excellence aligns with industry trends towards more efficient infrastructure deployment. The company's optimism about long-term opportunities in digital connectivity is warranted, but execution will be key in translating these trends into sustainable financial performance.

HOUSTON, Oct. 16, 2024 (GLOBE NEWSWIRE) -- Crown Castle Inc. (NYSE: CCI) ("Crown Castle") today reported results for the third quarter ended September 30, 2024 and maintained its full year 2024 Outlook with the exception of a reduction to net income.

| (dollars in millions, except per share amounts) | Current Full Year 2024 Outlook(a) | Full Year 2023 Actual | % Change | Previous Full Year 2024 Outlook(b) | Current Compared to Previous Outlook | ||||||

| Site rental revenues | (3)% | —% | |||||||||

| Net income (loss) | (32)% | (12)% | |||||||||

| Net income (loss) per share—diluted | (32)% | (12)% | |||||||||

| Adjusted EBITDA(c) | (6)% | —% | |||||||||

| AFFO(c) | (8)% | —% | |||||||||

| AFFO per share(c) | (8)% | —% | |||||||||

(a) Reflects midpoint of full year 2024 Outlook as issued on October 16, 2024.

(b) Reflects midpoint of full year 2024 Outlook as issued on July 17, 2024.

(c) See "Non-GAAP Measures and Other Information" for further information and reconciliation of non-GAAP financial measures to net income (loss), including on a per share basis.

“In the third quarter, we achieved solid operating and financial performance across our businesses and reaffirmed our full year 2024 Outlook for Adjusted EBITDA and AFFO,” stated Steven Moskowitz, Chief Executive Officer of Crown Castle. “Looking ahead, we continue to be optimistic about the long-term value creation opportunities in our tower, small cell, and fiber solutions offerings. Across all forms of digital connectivity, the U.S. is generating record annual increases in data consumption, which we expect to drive continued demand for communications infrastructure. We believe we are well positioned to benefit from these positive trends and are also actively developing initiatives that prioritize customer service, revenue generation, capital discipline, and operational excellence. As part of our previously announced plans to enhance returns by improving profitability and capital efficiency in our Fiber segment, we completed discussions with our customers in the fourth quarter and jointly identified approximately 7,000 greenfield small cell nodes in our contracted backlog that we mutually agreed to cancel. These agreed upon cancellations increase the overall return of our remaining contracted backlog of approximately 40,000 nodes and improve our capital efficiency going forward. These changes to our operating plan and capital expenditure profile are consistent with our previously provided expectations and position us to increase the value of our fiber and small cell assets, while we remain focused on the ongoing Fiber segment strategic review.”

RESULTS FOR THE QUARTER

The table below sets forth select financial results for the quarters ended September 30, 2024 and September 30, 2023.

| (dollars in millions, except per share amounts) | Q3 2024 | Q3 2023 | Change | % Change | |||||

| Site rental revenues | |||||||||

| Net income (loss) | |||||||||

| Net income (loss) per share—diluted | |||||||||

| Adjusted EBITDA(a) | |||||||||

| AFFO(a) | |||||||||

| AFFO per share(a) | |||||||||

(a) See "Non-GAAP Measures and Other Information" for further information and reconciliation of non-GAAP financial measures to net income (loss), including on a per share basis.

HIGHLIGHTS FROM THE QUARTER

- Site rental revenues. Site rental revenues grew

1% , or$16 million , from third quarter 2023 to third quarter 2024, inclusive of$65 million in Organic Contribution to Site Rental Billings, a$19 million decrease in amortization of prepaid rent, and a$30 million decrease in straight-lined revenues. The$65 million in Organic Contribution to Site Rental Billings benefited from$15 million of previously disclosed small cell non-recurring revenues primarily related to early termination payments, partially offset by a$4 million unfavorable impact on fiber solutions due to adjustments related to prior period revenues and a$6 million unfavorable impact on fiber solutions from the absence of Sprint Cancellation payments that occurred in the third quarter of 2023. - Net income. Net income for the third quarter 2024 was

$303 million compared to$265 million for the third quarter 2023, and included$48 million of charges incurred in the quarter related to the restructuring plan announced in June 2024. - Adjusted EBITDA. Third quarter 2024 Adjusted EBITDA was

$1.1 billion compared to$1.0 billion for the third quarter 2023. The increase in the quarter was primarily a result of the higher contribution from site rental revenues and lower costs related to the reduction in staffing levels and office closures announced in June 2024, partially offset by$6 million of advisory fees primarily related to the recent proxy contest. - AFFO and AFFO per share. Third quarter 2024 AFFO was

$801 million , or$1.84 per share, representing an increase from the third quarter 2023 of4% . - Capital expenditures. Capital expenditures during the quarter were

$297 million , comprised of$274 million of discretionary capital expenditures and$23 million of sustaining capital expenditures. Discretionary capital expenditures included approximately$239 million attributable to Fiber and$30 million attributable to Towers. - Common stock dividend. During the quarter, Crown Castle paid common stock dividends of approximately

$681 million in the aggregate, or$1.56 5 per common share, unchanged on a per share basis compared to the same period a year ago. - Financing activity. In August 2024, Crown Castle issued

$1.25 billion in aggregate principal amount of senior unsecured notes in a combination of 5-year and 10-year maturities with a weighted average maturity and coupon of approximately 8 years and5.1% , respectively. Net proceeds from the senior notes offering were used to repay outstanding indebtedness under Crown Castle's commercial paper program and pay related fees and expenses.

“Since announcing a change in our operational strategy in June, we have continued to deliver results in line with expectations,” said Dan Schlanger, Crown Castle’s Chief Financial Officer. “The third quarter was highlighted by

OUTLOOK

This Outlook section contains forward-looking statements, and actual results may differ materially. Information regarding potential risks which could cause actual results to differ from the forward-looking statements herein is set forth below and in Crown Castle's filings with the SEC.

The following table sets forth Crown Castle's current full year 2024 Outlook, which has been updated to reflect the impact of the mutual cancellation of approximately 7,000 small cell nodes as discussed above. These cancellations are expected to result in a

| (in millions, except per share amounts) | Full Year 2024(a) | Changes to Midpoint from Previous Outlook(b) | |||||||

| Site rental billings(c) | to | ||||||||

| Amortization of prepaid rent | to | ||||||||

| Straight-lined revenues | to | ||||||||

| Site rental revenues | to | ||||||||

| Site rental costs of operations(d) | to | ||||||||

| Services and other gross margin | to | ||||||||

| Net income (loss) | to | ( | |||||||

| Net income (loss) per share—diluted | to | ( | |||||||

| Adjusted EBITDA(e) | to | ||||||||

| Depreciation, amortization and accretion | to | ||||||||

| Interest expense and amortization of deferred financing costs, net(f) | to | ||||||||

| FFO(e) | to | ||||||||

| AFFO(e) | to | ||||||||

| AFFO per share(e) | to | ||||||||

| Towers Segment discretionary capital expenditures(e) | to | ||||||||

| Fiber Segment discretionary capital expenditures(e) | to | ||||||||

(a) As issued on October 16, 2024.

(b) As issued on July 17, 2024.

(c) See "Non-GAAP Measures and Other Information" for our definition of site rental billings.

(d) Exclusive of depreciation, amortization and accretion.

(e) See "Non-GAAP Measures and Other Information" for further information and reconciliation of non-GAAP financial measures to net income (loss), including on a per share basis, and for definition of discretionary capital expenditures.

(f) See "Non-GAAP Measures and Other Information" for the reconciliation of "Outlook for Components of Interest Expense."

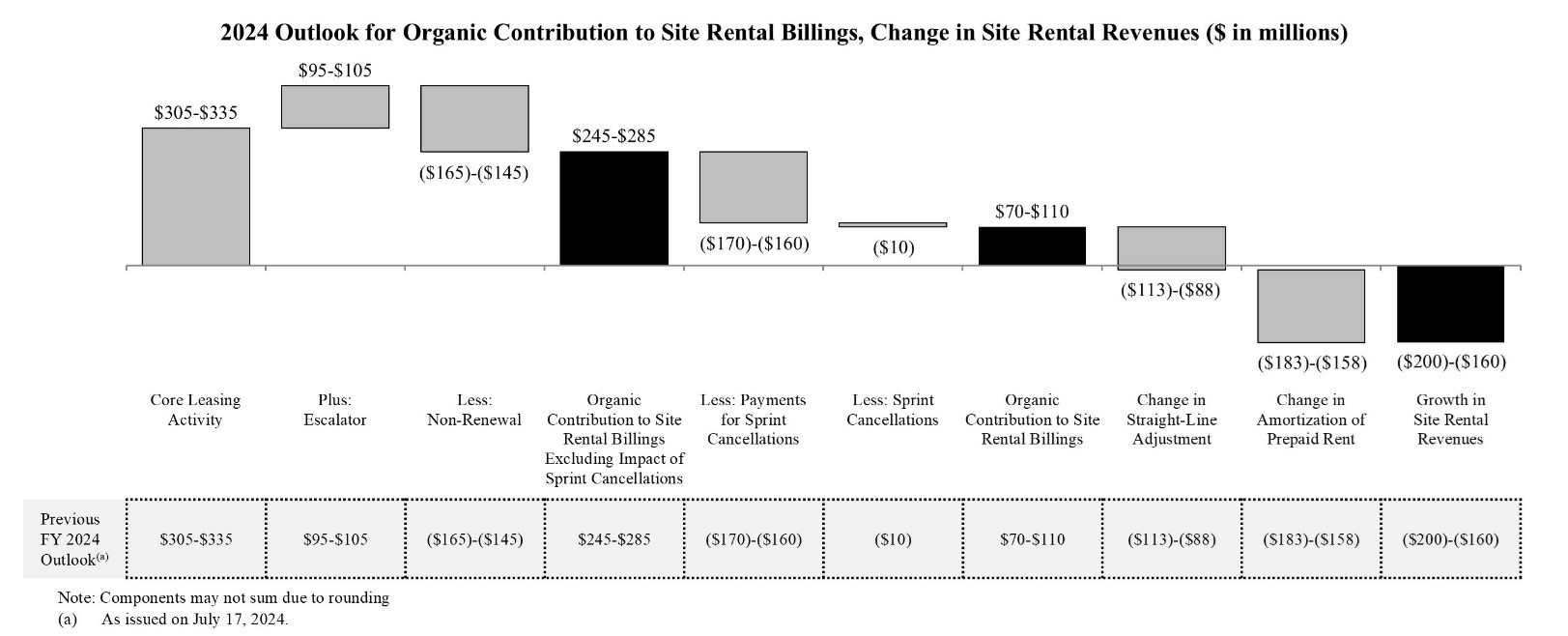

- The chart below reconciles the components contributing to expected 2024 growth in site rental revenues. Full year consolidated site rental billings growth, excluding the impact of Sprint Cancellations, is expected to be

5% , inclusive of4.5% from towers,15% from small cells, and2% from fiber solutions.

- Core leasing activity for full year 2024 is expected to contribute

$305 million to$335 million , consisting of$105 million to$115 million from towers (compared to$126 million in full year 2023),$65 million to$75 million from small cells (compared to$28 million in full year 2023), and$135 million to$145 million from fiber solutions (compared to$120 million in full year 2023). - The expected 2024 small cell core leasing activity of

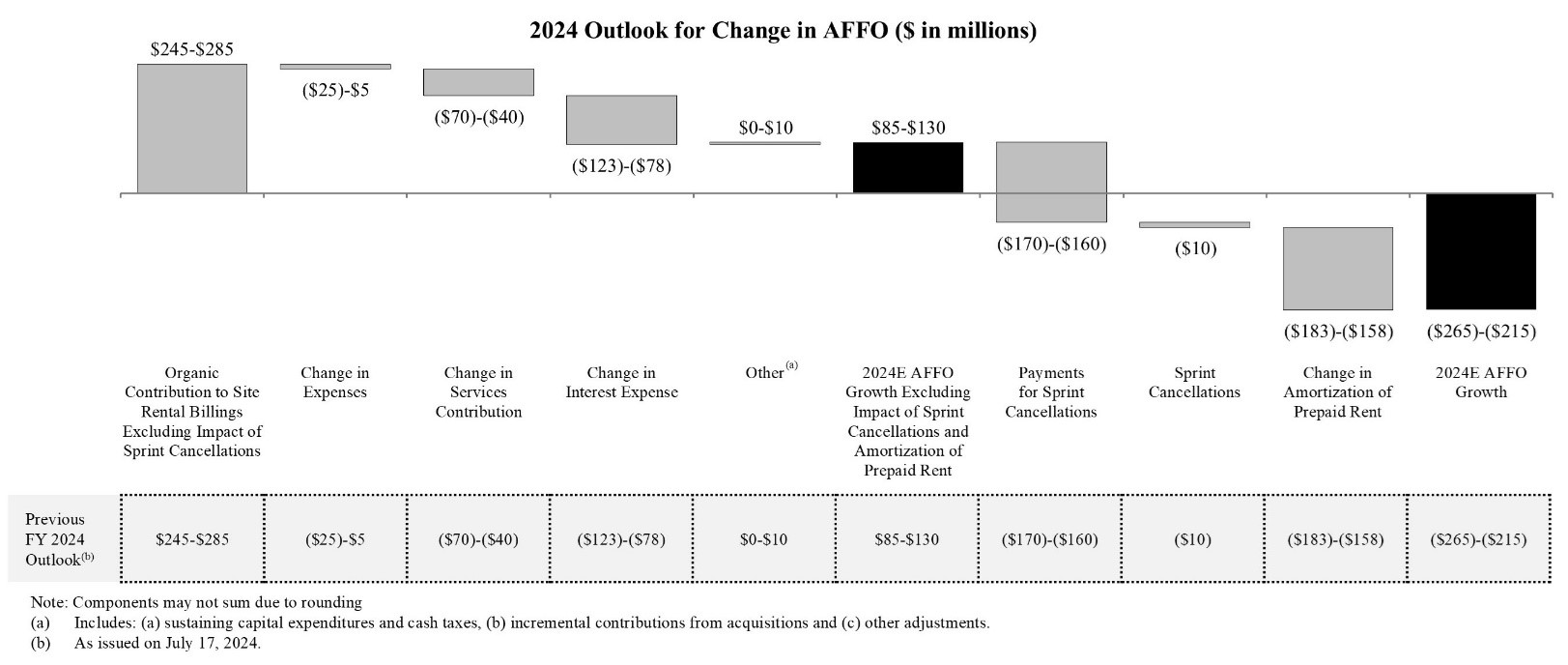

$70 million at the midpoint includes$22 million of higher-than-expected non-recurring revenues primarily related to early termination payments which occurred in the third quarter. Excluding the impact of Sprint Cancellations and the increase in non-recurring revenues, small cell organic growth is expected to be10% in 2024. - The chart below reconciles the components contributing to the year over year change to 2024 AFFO.

- The expected increase in full year 2024 expenses includes approximately

$30 million of advisory fees primarily related to the recent proxy contest, which is expected to be more than offset by an approximately$65 million decrease in costs related to the reduction in staffing levels and office closures announced in June 2024. - The full year 2024 Outlook for discretionary capital expenditures is

$1.2 billion to$1.3 billion , including approximately$1.1 billion in the Fiber segment and$180 million in the Towers segment, and prepaid rent additions are expected to be approximately$355 million in 2024, including$275 million from Fiber and$80 million from Towers.

Additional information is available in Crown Castle's quarterly Supplemental Information Package posted in the Investors section of our website.

CONFERENCE CALL DETAILS

Crown Castle has scheduled a conference call for Wednesday, October 16, 2024, at 5:00 p.m. Eastern time to discuss its third quarter 2024 results. A listen only live audio webcast of the conference call, along with supplemental materials for the call, can be accessed on the Crown Castle website at https://investor.crowncastle.com. Participants may join the conference call by dialing 833-816-1115 (Toll Free) or 412-317-0694 (International) at least 30 minutes prior to the start time. All dial-in participants should ask to join the Crown Castle call.

A replay of the webcast will be available on the Investor page of Crown Castle's website until end of day, Thursday, October 16, 2025.

ABOUT CROWN CASTLE

Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service - bringing information, ideas and innovations to the people and businesses that need them. For more information on Crown Castle, please visit www.crowncastle.com.

Non-GAAP Measures and Other Information

This press release includes presentations of Adjusted EBITDA, Adjusted Funds from Operations ("AFFO"), including per share amounts, Funds from Operations ("FFO"), including per share amounts, Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, and Net Debt, which are non-GAAP financial measures. These non-GAAP financial measures are not intended as alternative measures of operating results or cash flow from operations (as determined in accordance with Generally Accepted Accounting Principles ("GAAP")).

Our non-GAAP financial measures may not be comparable to similarly titled measures of other companies, including other companies in the communications infrastructure sector or other real estate investment trusts ("REITs").

In addition to the non-GAAP financial measures used herein, we also provide segment site rental gross margin, segment services and other gross margin and segment operating profit, which are key measures used by management to evaluate our operating segments. These segment measures are provided pursuant to GAAP requirements related to segment reporting. In addition, we provide the components of certain GAAP measures, such as site rental revenues and capital expenditures.

Our non-GAAP financial measures are presented as additional information because management believes these measures are useful indicators of the financial performance of our business. Among other things, management believes that:

- Adjusted EBITDA is useful to investors or other interested parties in evaluating our financial performance. Adjusted EBITDA is the primary measure used by management (1) to evaluate the economic productivity of our operations and (2) for purposes of making decisions about allocating resources to, and assessing the performance of, our operations. Management believes that Adjusted EBITDA helps investors or other interested parties meaningfully evaluate and compare the results of our operations (1) from period to period and (2) to our competitors, by removing the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation, amortization and accretion) from our financial results. Management also believes Adjusted EBITDA is frequently used by investors or other interested parties in the evaluation of the communications infrastructure sector and other REITs to measure financial performance without regard to items such as depreciation, amortization and accretion, which can vary depending upon accounting methods and the book value of assets. In addition, Adjusted EBITDA is similar to the measure of current financial performance generally used in our debt covenant calculations. Adjusted EBITDA should be considered only as a supplement to net income (loss) computed in accordance with GAAP as a measure of our performance.

- AFFO, including per share amounts, is useful to investors or other interested parties in evaluating our financial performance. Management believes that AFFO helps investors or other interested parties meaningfully evaluate our financial performance as it includes (1) the impact of our capital structure (primarily interest expense on our outstanding debt and dividends on our preferred stock (in periods where applicable)) and (2) sustaining capital expenditures, and excludes the impact of our (1) asset base (primarily depreciation, amortization and accretion) and (2) certain non-cash items, including straight-lined revenues and expenses related to fixed escalations and rent free periods. GAAP requires rental revenues and expenses related to leases that contain specified rental increases over the life of the lease to be recognized evenly over the life of the lease. In accordance with GAAP, if payment terms call for fixed escalations or rent free periods, the revenues or expenses are recognized on a straight-lined basis over the fixed, non-cancelable term of the contract. Management notes that Crown Castle uses AFFO only as a performance measure. AFFO should be considered only as a supplement to net income (loss) computed in accordance with GAAP as a measure of our performance and should not be considered as an alternative to cash flow from operations or as residual cash flow available for discretionary investment.

- FFO, including per share amounts, is useful to investors or other interested parties in evaluating our financial performance. Management believes that FFO may be used by investors or other interested parties as a basis to compare our financial performance with that of other REITs. FFO helps investors or other interested parties meaningfully evaluate financial performance by excluding the impact of our asset base (primarily real estate depreciation, amortization and accretion). FFO is not a key performance indicator used by Crown Castle. FFO should be considered only as a supplement to net income (loss) computed in accordance with GAAP as a measure of our performance and should not be considered as an alternative to cash flow from operations.

- Organic Contribution to Site Rental Billings (also referred to as organic growth) is useful to investors or other interested parties in understanding the components of the year-over-year changes in our site rental revenues computed in accordance with GAAP. Management uses Organic Contribution to Site Rental Billings to assess year-over-year growth rates for our rental activities, to evaluate current performance, to capture trends in rental rates, core leasing activities and tenant non-renewals in our core business, as well as to forecast future results. Separately, we are also disclosing Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations (including by line of business), which is outside of ordinary course, to provide further insight into our results of operations and underlying trends. Management believes that identifying the impact for Sprint Cancellations provides increased transparency and comparability across periods. Organic Contribution to Site Rental Billings (including as Adjusted for Impact of Sprint Cancellations) is not meant as an alternative measure of revenue and should be considered only as a supplement in understanding and assessing the performance of our site rental revenues computed in accordance with GAAP.

- Net Debt is useful to investors or other interested parties in evaluating our overall debt position and future debt capacity. Management uses Net Debt in assessing our leverage. Net Debt is not meant as an alternative measure of debt and should be considered only as a supplement in understanding and assessing our leverage.

Non-GAAP Financial Measures

Adjusted EBITDA. We define Adjusted EBITDA as net income (loss) plus restructuring charges (credits), asset write-down charges, acquisition and integration costs, depreciation, amortization and accretion, amortization of prepaid lease purchase price adjustments, interest expense and amortization of deferred financing costs, net, (gains) losses on retirement of long-term obligations, net (gain) loss on interest rate swaps, (gains) losses on foreign currency swaps, impairment of available-for-sale securities, interest income, other (income) expense, (benefit) provision for income taxes, net (income) loss from discontinued operations, (gain) loss on sale of discontinued operations, cumulative effect of a change in accounting principle and stock-based compensation expense, net.

AFFO. We define AFFO as FFO before straight-lined revenues, straight-lined expenses, stock-based compensation expense, net, non-cash portion of tax provision, non-real estate related depreciation, amortization and accretion, amortization of non-cash interest expense, other (income) expense, (gains) losses on retirement of long-term obligations, net (gain) loss on interest rate swaps, (gains) losses on foreign currency swaps, impairment of available-for-sale securities, acquisition and integration costs, restructuring charges (credits), net (income) loss from discontinued operations, (gain) loss on sale of discontinued operations, cumulative effect of a change in accounting principle and adjustments for noncontrolling interests, less sustaining capital expenditures.

AFFO per share. We define AFFO per share as AFFO divided by diluted weighted-average common shares outstanding.

FFO. We define FFO as net income (loss) plus real estate related depreciation, amortization and accretion and asset write-down charges, less noncontrolling interest and cash paid for preferred stock dividends (in periods where applicable), and is a measure of funds from operations attributable to common stockholders.

FFO per share. We define FFO per share as FFO divided by diluted weighted-average common shares outstanding.

Organic Contribution to Site Rental Billings. We define Organic Contribution to Site Rental Billings (also referred to as organic growth) as the sum of the change in site rental revenues related to core leasing activity, escalators and payments for Sprint Cancellations, less non-renewals of tenant contracts and non-renewals associated with Sprint Cancellations. Additionally, Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations reflects Organic Contribution to Site Rental Billings less payments for Sprint Cancellations, plus non-renewals associated with Sprint Cancellations (including by line of business).

Net Debt. We define Net Debt as (1) debt and other long-term obligations and (2) current maturities of debt and other obligations, excluding unamortized adjustments, net; less cash and cash equivalents and restricted cash and cash equivalents.

Segment Measures

Segment site rental gross margin. We define segment site rental gross margin as segment site rental revenues less segment site rental costs of operations, excluding stock-based compensation expense, net and amortization of prepaid lease purchase price adjustments recorded in consolidated site rental costs of operations.

Segment services and other gross margin. We define segment services and other gross margin as segment services and other revenues less segment services and other costs of operations, excluding stock-based compensation expense, net recorded in consolidated services and other costs of operations.

Segment operating profit. We define segment operating profit as segment site rental gross margin plus segment services and other gross margin, less segment selling, general and administrative expenses.

All of these measurements of profit or loss are exclusive of depreciation, amortization and accretion, which are shown separately. Additionally, certain costs are shared across segments and are reflected in our segment measures through allocations that management believes to be reasonable.

Other Definitions

Site rental billings. We define site rental billings as site rental revenues exclusive of the impacts from (1) straight-lined revenues, (2) amortization of prepaid rent in accordance with GAAP and (3) contribution from recent acquisitions until the one-year anniversary of such acquisitions.

Core leasing activity. We define core leasing activity as site rental revenues growth from tenant additions across our entire portfolio and renewals or extensions of tenant contracts, exclusive of (1) the impacts from both straight-lined revenues and amortization of prepaid rent in accordance with GAAP and (2) payments for Sprint Cancellations, where applicable.

Non-renewals. We define non-renewals of tenant contracts as the reduction in site rental revenues as a result of tenant churn, terminations and, in limited circumstances, reductions of existing lease rates, exclusive of non-renewals associated with Sprint Cancellations, where applicable.

Discretionary capital expenditures. We define discretionary capital expenditures as those capital expenditures made with respect to activities which we believe exhibit sufficient potential to enhance long-term stockholder value. They primarily consist of expansion or development of communications infrastructure (including capital expenditures related to (1) enhancing communications infrastructure in order to add new tenants for the first time or support subsequent tenant equipment augmentations or (2) modifying the structure of a communications infrastructure asset to accommodate additional tenants) and construction of new communications infrastructure. Discretionary capital expenditures also include purchases of land interests (which primarily relates to land assets under towers as we seek to manage our interests in the land beneath our towers), certain technology-related investments necessary to support and scale future customer demand for our communications infrastructure, and other capital projects.

Sustaining capital expenditures. We define sustaining capital expenditures as those capital expenditures not otherwise categorized as discretionary capital expenditures, such as (1) maintenance capital expenditures on our communications infrastructure assets that enable our tenants' ongoing quiet enjoyment of the communications infrastructure and (2) ordinary corporate capital expenditures.

Sprint Cancellations. We define Sprint Cancellations as lease cancellations related to the previously disclosed T-Mobile US, Inc. and Sprint network consolidation as described in our press release dated April 19, 2023.

Reconciliation of Historical Adjusted EBITDA:

| For the Three Months Ended | For the Nine Months Ended | For the Twelve Months Ended | |||||||||||||||||

| (in millions; totals may not sum due to rounding) | September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | December 31, 2023 | ||||||||||||||

| Net income (loss) | $ | 303 | $ | 265 | $ | 865 | $ | 1,139 | $ | 1,502 | |||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||||||||||

| Asset write-down charges | 15 | 8 | 24 | 30 | 33 | ||||||||||||||

| Acquisition and integration costs | — | — | — | 1 | 1 | ||||||||||||||

| Depreciation, amortization and accretion | 432 | 439 | 1,301 | 1,315 | 1,754 | ||||||||||||||

| Restructuring charges(a) | 48 | 72 | 104 | 72 | 85 | ||||||||||||||

| Amortization of prepaid lease purchase price adjustments | 4 | 4 | 12 | 12 | 16 | ||||||||||||||

| Interest expense and amortization of deferred financing costs, net(b) | 236 | 217 | 692 | 627 | 850 | ||||||||||||||

| Interest income | (6 | ) | (3 | ) | (14 | ) | (10 | ) | (15 | ) | |||||||||

| Other (income) expense | 6 | — | 5 | 4 | 6 | ||||||||||||||

| (Benefit) provision for income taxes | 5 | 7 | 19 | 21 | 26 | ||||||||||||||

| Stock-based compensation expense, net | 30 | 36 | 108 | 126 | 157 | ||||||||||||||

| Adjusted EBITDA(c)(d) | $ | 1,075 | $ | 1,047 | $ | 3,117 | $ | 3,339 | $ | 4,415 | |||||||||

Reconciliation of Current Outlook for Adjusted EBITDA:

| Full Year 2024 | |||||||

| (in millions; totals may not sum due to rounding) | Outlook(f) | ||||||

| Net income (loss) | to | ||||||

| Adjustments to increase (decrease) net income (loss): | |||||||

| Asset write-down charges(g) | to | ||||||

| Acquisition and integration costs | to | ||||||

| Depreciation, amortization and accretion | to | ||||||

| Restructuring charges(a) | to | ||||||

| Amortization of prepaid lease purchase price adjustments | to | ||||||

| Interest expense and amortization of deferred financing costs, net(e) | to | ||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | ||||

| Interest income | to | ||||||

| Other (income) expense | to | ||||||

| (Benefit) provision for income taxes | to | ||||||

| Stock-based compensation expense, net | to | ||||||

| Adjusted EBITDA(c)(d) | $4,143 | to | $4,193 | ||||

(a) Represents restructuring charges recorded for the periods presented related to (1) the Company's restructuring plan announced in July 2023, as further discussed in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 ("2023 Restructuring Plan"), and (2) the Company's restructuring plan announced in June 2024, as further discussed in the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 ("2024 Restructuring Plan"), as applicable for the respective period. For the three-month period ended September 30, 2024, there were (

(b) See the reconciliation of "Components of Interest Expense" for a discussion of non-cash interest expense.

(c) See discussion and our definition of Adjusted EBITDA in this "Non-GAAP Measures and Other Information."

(d) The above reconciliation excludes line items included in our definition which are not applicable for the periods shown.

(e) See the reconciliation of "Outlook for Components of Interest Expense" for a discussion of non-cash interest expense.

(f) As issued on October 16, 2024.

(g) Change in current full year 2024 Outlook for asset write-down charges are related to the impact of cancellations of small cell nodes, as further discussed above.

Reconciliation of Historical FFO and AFFO:

| For the Three Months Ended | For the Nine Months Ended | For the Twelve Months Ended | |||||||||||||||||

| (in millions; totals may not sum due to rounding) | September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | December 31, 2023 | ||||||||||||||

| Net income (loss) | $ | 303 | $ | 265 | $ | 865 | $ | 1,139 | $ | 1,502 | |||||||||

| Real estate related depreciation, amortization and accretion | 419 | 425 | 1,259 | 1,266 | 1,692 | ||||||||||||||

| Asset write-down charges | 15 | 8 | 24 | 30 | 33 | ||||||||||||||

| FFO(a)(b) | $ | 737 | $ | 698 | $ | 2,148 | $ | 2,435 | $ | 3,227 | |||||||||

| Weighted-average common shares outstanding—diluted | 436 | 434 | 435 | 434 | 434 | ||||||||||||||

| FFO (from above) | $ | 737 | $ | 698 | $ | 2,148 | $ | 2,435 | $ | 3,227 | |||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||

| Straight-lined revenues | (29 | ) | (59 | ) | (145 | ) | (222 | ) | (274 | ) | |||||||||

| Straight-lined expenses | 16 | 18 | 49 | 56 | 73 | ||||||||||||||

| Stock-based compensation expense, net | 30 | 36 | 108 | 126 | 157 | ||||||||||||||

| Non-cash portion of tax provision | 1 | 4 | 6 | 8 | 8 | ||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 13 | 14 | 42 | 49 | 62 | ||||||||||||||

| Amortization of non-cash interest expense | 2 | 3 | 9 | 11 | 14 | ||||||||||||||

| Other (income) expense | 6 | — | 5 | 4 | 6 | ||||||||||||||

| Acquisition and integration costs | — | — | — | 1 | 1 | ||||||||||||||

| Restructuring charges(c) | 48 | 72 | 104 | 72 | 85 | ||||||||||||||

| Sustaining capital expenditures | (23 | ) | (21 | ) | (72 | ) | (54 | ) | (83 | ) | |||||||||

| AFFO(a)(b) | $ | 801 | $ | 767 | $ | 2,255 | $ | 2,487 | $ | 3,277 | |||||||||

| Weighted-average common shares outstanding—diluted | 436 | 434 | 435 | 434 | 434 | ||||||||||||||

(a) See discussion and our definitions of FFO and AFFO in this "Non-GAAP Measures and Other Information."

(b) The above reconciliation excludes line items included in our definition which are not applicable for the periods shown.

(c) Represents restructuring charges recorded for the periods presented related to the 2023 Restructuring Plan and the 2024 Restructuring Plan, as applicable, for the respective period. For the three-month period ended September 30, 2024, there were (

Reconciliation of Historical FFO and AFFO per share:

| For the Three Months Ended | For the Nine Months Ended | For the Twelve Months Ended | |||||||||||||||||

| (in millions, except per share amounts; totals may not sum due to rounding) | September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | December 31, 2023 | ||||||||||||||

| Net income (loss) | $ | 0.70 | $ | 0.61 | $ | 1.99 | $ | 2.62 | $ | 3.46 | |||||||||

| Real estate related depreciation, amortization and accretion | 0.96 | 0.98 | 2.89 | 2.92 | 3.90 | ||||||||||||||

| Asset write-down charges | 0.03 | 0.02 | 0.06 | 0.07 | 0.08 | ||||||||||||||

| FFO(a)(b) | $ | 1.69 | $ | 1.61 | $ | 4.94 | $ | 5.61 | $ | 7.43 | |||||||||

| Weighted-average common shares outstanding—diluted | 436 | 434 | 435 | 434 | 434 | ||||||||||||||

| FFO (from above) | $ | 1.69 | $ | 1.61 | $ | 4.94 | $ | 5.61 | $ | 7.43 | |||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||

| Straight-lined revenues | (0.07 | ) | (0.14 | ) | (0.33 | ) | (0.51 | ) | (0.63 | ) | |||||||||

| Straight-lined expenses | 0.04 | 0.04 | 0.11 | 0.13 | 0.17 | ||||||||||||||

| Stock-based compensation expense, net | 0.07 | 0.08 | 0.25 | 0.29 | 0.36 | ||||||||||||||

| Non-cash portion of tax provision | — | 0.01 | 0.01 | 0.02 | 0.02 | ||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 0.03 | 0.03 | 0.10 | 0.11 | 0.14 | ||||||||||||||

| Amortization of non-cash interest expense | — | 0.01 | 0.02 | 0.03 | 0.03 | ||||||||||||||

| Other (income) expense | 0.01 | — | 0.01 | 0.01 | 0.01 | ||||||||||||||

| Acquisition and integration costs | — | — | — | — | — | ||||||||||||||

| Restructuring charges(c) | 0.11 | 0.17 | 0.24 | 0.17 | 0.20 | ||||||||||||||

| Sustaining capital expenditures | (0.05 | ) | (0.05 | ) | (0.17 | ) | (0.12 | ) | (0.19 | ) | |||||||||

| AFFO(a)(b) | $ | 1.84 | $ | 1.77 | $ | 5.18 | $ | 5.73 | $ | 7.55 | |||||||||

| Weighted-average common shares outstanding—diluted | 436 | 434 | 435 | 434 | 434 | ||||||||||||||

(a) See discussion and our definitions of FFO and AFFO, including per share amounts, in this "Non-GAAP Measures and Other Information."

(b) The above reconciliation excludes line items included in our definition which are not applicable for the periods shown.

(c) Represents restructuring charges recorded for the periods presented related to the 2023 Restructuring Plan and the 2024 Restructuring Plan, as applicable, for the respective period. For the three-month period ended September 30, 2024, there were (

Reconciliation of Current Outlook for FFO and AFFO:

| Full Year 2024 | Full Year 2024 | ||||||||||||||||

| (in millions, except per share amounts; totals may not sum due to rounding) | Outlook(a) | Outlook per share(a) | |||||||||||||||

| Net income (loss) | to | to | |||||||||||||||

| Real estate related depreciation, amortization and accretion | to | to | |||||||||||||||

| Asset write-down charges(e) | to | to | |||||||||||||||

| FFO(b)(c) | $2,863 | to | $2,893 | $6.58 | to | $6.65 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | 435 | |||||||||||||||

| FFO (from above) | to | to | |||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||

| Straight-lined revenues | to | to | |||||||||||||||

| Straight-lined expenses | to | to | |||||||||||||||

| Stock-based compensation expense, net | to | to | |||||||||||||||

| Non-cash portion of tax provision | to | to | |||||||||||||||

| Non-real estate related depreciation, amortization and accretion | to | to | |||||||||||||||

| Amortization of non-cash interest expense | to | to | |||||||||||||||

| Other (income) expense | to | to | |||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||

| Acquisition and integration costs | to | to | |||||||||||||||

| Restructuring charges(d) | to | to | |||||||||||||||

| Sustaining capital expenditures | to | to | |||||||||||||||

| AFFO(b)(c) | $3,005 | to | $3,055 | $6.91 | to | $7.02 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | 435 | |||||||||||||||

(a) As issued on October 16, 2024.

(b) See discussion and our definitions of FFO and AFFO, including per share amounts, in this "Non-GAAP Measures and Other Information."

(c) The above reconciliation excludes line items included in our definition which are not applicable for the period shown.

(d) Represents restructuring charges related to the 2023 Restructuring Plan and the 2024 Restructuring Plan.

(e) Change in current full year 2024 Outlook for asset write-down charges are related to the impact of cancellations of small cell nodes, as further discussed above.

For Comparative Purposes - Reconciliation of Previous Outlook for Adjusted EBITDA:

| Previously Issued | ||||||||

| (in millions; totals may not sum due to rounding) | Full Year 2024 Outlook(a) | |||||||

| Net income (loss) | to | |||||||

| Adjustments to increase (decrease) income (loss) from continuing operations: | ||||||||

| Asset write-down charges | to | |||||||

| Acquisition and integration costs | to | |||||||

| Depreciation, amortization and accretion | to | |||||||

| Restructuring charges(b) | to | |||||||

| Amortization of prepaid lease purchase price adjustments | to | |||||||

| Interest expense and amortization of deferred financing costs, net(c) | to | |||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | |||||

| Interest income | to | |||||||

| Other (income) expense | to | |||||||

| (Benefit) provision for income taxes | to | |||||||

| Stock-based compensation expense, net | to | |||||||

| Adjusted EBITDA(d)(e) | $4,143 | to | $4,193 | |||||

For Comparative Purposes - Reconciliation of Previous Outlook for FFO and AFFO:

| Previously Issued | Previously Issued | ||||||||||||||||

| (in millions, except per share amounts; totals may not sum due to rounding) | Full Year 2024 Outlook(a) | Full Year 2024 Outlook per share(a) | |||||||||||||||

| Net income (loss) | to | to | |||||||||||||||

| Real estate related depreciation, amortization and accretion | to | to | |||||||||||||||

| Asset write-down charges | to | to | |||||||||||||||

| FFO(d)(e) | $2,863 | to | $2,893 | $6.58 | to | $6.65 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | 435 | |||||||||||||||

| FFO (from above) | to | to | |||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||

| Straight-lined revenues | to | to | |||||||||||||||

| Straight-lined expenses | to | to | |||||||||||||||

| Stock-based compensation expense, net | to | to | |||||||||||||||

| Non-cash portion of tax provision | to | to | |||||||||||||||

| Non-real estate related depreciation, amortization and accretion | to | to | |||||||||||||||

| Amortization of non-cash interest expense | to | to | |||||||||||||||

| Other (income) expense | to | to | |||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||

| Acquisition and integration costs | to | to | |||||||||||||||

| Restructuring charges(b) | to | to | |||||||||||||||

| Sustaining capital expenditures | to | to | |||||||||||||||

| AFFO(d)(e) | $3,005 | to | $3,055 | $6.91 | to | $7.02 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | 435 | |||||||||||||||

(a) As issued on July 17, 2024.

(b) Represents restructuring charges recorded related to the 2023 Restructuring Plan and the 2024 Restructuring Plan.

(c) See the reconciliation of "Outlook for Components of Interest Expense" for a discussion of non-cash interest expense.

(d) See discussion of and our definition of Adjusted EBITDA, FFO and AFFO, including per share amounts in this "Non-GAAP Measures and Other Information."

(e) The above reconciliation excludes line items included in our definition which are not applicable for the period shown.

Components of Changes in Site Rental Revenues for the Quarters Ended September 30, 2024 and 2023:

| Three Months Ended September 30, | |||||||

| (dollars in millions; totals may not sum due to rounding) | 2024 | 2023 | |||||

| Components of changes in site rental revenues: | |||||||

| Prior year site rental billings excluding payments for Sprint Cancellations(a) | $ | 1,386 | $ | 1,339 | |||

| Prior year payments for Sprint Cancellations(a)(b) | 6 | — | |||||

| Prior year site rental billings(a) | 1,392 | 1,339 | |||||

| Core leasing activity(a) | 85 | 66 | |||||

| Escalators | 25 | 24 | |||||

| Non-renewals(a) | (38 | ) | (37 | ) | |||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(a) | 72 | 53 | |||||

| Payments for Sprint Cancellations(a)(b) | (5 | ) | 6 | ||||

| Non-renewals associated with Sprint Cancellations(a)(b) | (1 | ) | (6 | ) | |||

| Organic Contribution to Site Rental Billings(a) | 65 | 53 | |||||

| Straight-lined revenues | 29 | 58 | |||||

| Amortization of prepaid rent | 107 | 126 | |||||

| Acquisitions(c) | — | 1 | |||||

| Total site rental revenues | $ | 1,593 | $ | 1,577 | |||

| Year-over-year changes in revenues: | |||||||

| Site rental revenues as a percentage of prior year site rental revenues | 1.0 | % | 0.6 | % | |||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings excluding payments for Sprint Cancellations(a) | 5.2 | % | 4.0 | % | |||

| Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(a) | 4.7 | % | 3.9 | % | |||

(a) See our definitions of site rental billings, core leasing activity, non-renewals, Sprint Cancellations, Organic Contribution to Site Rental Billings and Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations in this "Non-GAAP Measures and Other Information."

(b) In the third quarter 2023, we received

(c) Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, until the one-year anniversary of such acquisitions.

Towers Segment Components of Changes in Site Rental Revenues for the Quarters Ended September 30, 2024 and 2023:

| Three Months Ended September 30, | |||||||

| (dollars in millions; totals may not sum due to rounding) | 2024 | 2023 | |||||

| Components of changes in site rental revenues: | |||||||

| Prior year site rental billings(a) | $ | 956 | $ | 915 | |||

| Core leasing activity(a) | 26 | 25 | |||||

| Escalators | 23 | 22 | |||||

| Non-renewals(a) | (8 | ) | (7 | ) | |||

| Organic Contribution to Site Rental Billings(a) | 41 | 40 | |||||

| Straight-lined revenues | 28 | 57 | |||||

| Amortization of prepaid rent | 39 | 61 | |||||

| Acquisitions(b) | — | 1 | |||||

| Other | — | — | |||||

| Total site rental revenues | $ | 1,063 | $ | 1,074 | |||

| Year-over-year changes in revenues: | |||||||

| Site rental revenues as a percentage of prior year site rental revenues | (1.0)% | (0.9)% | |||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||

| Organic Contribution to Site Rental Billings(a) | 4.3 | % | 4.4 | % | |||

(a) See our definitions of site rental billings, core leasing activity, non-renewals, Sprint Cancellations, Organic Contribution to Site Rental Billings and Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations in this "Non-GAAP Measures and Other Information."

(b) Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, until the one-year anniversary of such acquisitions.

Fiber Segment Components of Changes in Site Rental Revenues by Line of Business for the Quarters Ended September 30, 2024 and 2023:

| Small Cells | Three Months Ended September 30, | ||||||

| (dollars in millions; totals may not sum due to rounding) | 2024 | 2023 | |||||

| Components of changes in site rental revenues: | |||||||

| Prior year site rental billings excluding payments for Sprint Cancellations(a) | $ | 113 | $ | 109 | |||

| Prior year payments for Sprint Cancellations(a) | — | — | |||||

| Prior year site rental billings(a) | 113 | 109 | |||||

| Core leasing activity(a) | 28 | 8 | |||||

| Escalators | 2 | 2 | |||||

| Non-renewals(a) | (2 | ) | (1 | ) | |||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(a) | 28 | 8 | |||||

| Payments for Sprint Cancellations(a) | — | — | |||||

| Non-renewals associated with Sprint Cancellations(a)(b) | (1 | ) | (5 | ) | |||

| Organic Contribution to Site Rental Billings(a) | 28 | 3 | |||||

| Straight-lined revenues | (2 | ) | (1 | ) | |||

| Amortization of prepaid rent | 51 | 45 | |||||

| Acquisitions(c) | — | — | |||||

| Total site rental revenues | $ | 190 | $ | 157 | |||

| Year-over-year changes in revenues: | |||||||

| Site rental revenues as a percentage of prior year site rental revenues | 21.0 | % | 1.9 | % | |||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings excluding payments for Sprint Cancellations(a) | 25.0 | % | 7.3 | % | |||

| Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(a) | 24.5 | % | 3.1 | % | |||

(a) See our definitions of site rental billings, core leasing activity, non-renewals, Sprint Cancellations, Organic Contribution to Site Rental Billings and Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations in this "Non-GAAP Measures and Other Information."

(b) In third quarter 2023, there were

(c) Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, until the one-year anniversary of such acquisitions.

Fiber Segment Components of Changes in Site Rental Revenues by Line of Business for the Quarters Ended September 30, 2024 and 2023:

| Fiber Solutions | Three Months Ended September 30, | ||||||

| (dollars in millions; totals may not sum due to rounding) | 2024 | 2023 | |||||

| Components of changes in site rental revenues: | |||||||

| Prior year site rental billings excluding payments for Sprint Cancellations(a) | $ | 318 | $ | 315 | |||

| Prior year payments for Sprint Cancellations(a)(b) | 6 | — | |||||

| Prior year site rental billings(a) | 324 | 315 | |||||

| Core leasing activity(a) | 31 | 34 | |||||

| Escalators | — | — | |||||

| Non-renewals(a) | (29 | ) | (29 | ) | |||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(a) | 2 | 5 | |||||

| Payments for Sprint Cancellations(a)(b) | (5 | ) | 6 | ||||

| Non-renewals associated with Sprint Cancellations(a)(b) | (1 | ) | (2 | ) | |||

| Organic Contribution to Site Rental Billings(a) | (4 | ) | 9 | ||||

| Straight-lined revenues | 3 | 2 | |||||

| Amortization of prepaid rent | 17 | 20 | |||||

| Acquisitions(c) | — | — | |||||

| Total site rental revenues | $ | 340 | $ | 346 | |||

| Year-over-year changes in revenues: | |||||||

| Site rental revenues as a percentage of prior year site rental revenues | (1.7)% | 4.8 | % | ||||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings excluding payments for Sprint Cancellations(a) | 0.7 | % | 1.5 | % | |||

| Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(a) | (1.1)% | 2.8 | % | ||||

Outlook for Components Changes in Site Rental Revenues by Line of Business

| Full Year 2024 Outlook(d) | ||||||||||||||||||||

| Towers | Fiber Segment | |||||||||||||||||||

| (in millions) | Small Cells | Fiber Solutions | ||||||||||||||||||

| Core leasing activity (a) | to | to | to | |||||||||||||||||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings excluding payments for Sprint Cancellations(a)(e)(f) | | | | |||||||||||||||||

| Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(a)(e) | | (8)% | (4)% | |||||||||||||||||

(a) See our definitions of site rental billings, core leasing activity, non-renewals, Sprint Cancellations, Organic Contribution to Site Rental Billings and Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations in this "Non-GAAP Measures and Other Information."

(b) In the third quarter 2023, we received

(c) Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, until the one-year anniversary of such acquisitions.

(d) As issued on October 16, 2024 and unchanged from previous outlook issued on July 17, 2024.

(e) Calculated based on midpoint of full year 2024 Outlook.

(f) In full year 2023, we received

Components of Changes in Site Rental Revenues for Full Year 2024 Outlook:

| (dollars in millions; totals may not sum due to rounding) | Full Year 2024 Outlook(a) | |||||||

| Components of changes in site rental revenues: | ||||||||

| Prior year site rental billings excluding payments for Sprint Cancellations(b) | ||||||||

| Prior year payments for Sprint Cancellations(b)(c) | ||||||||

| Prior year site rental billings(b) | ||||||||

| Core leasing activity(b) | to | |||||||

| Escalators | to | |||||||

| Non-renewals(b) | to | |||||||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) | to | |||||||

| Payments for Sprint Cancellations(b)(c) | to | |||||||

| Non-renewals associated with Sprint Cancellations(b)(c) | to | |||||||

| Organic Contribution to Site Rental Billings(b) | to | |||||||

| Straight-lined revenues | to | |||||||

| Amortization of prepaid rent | to | |||||||

| Acquisitions(d) | — | |||||||

| Total site rental revenues | $6,317 | to | $6,362 | |||||

| Year-over-year changes in revenues:(e) | ||||||||

| Site rental revenues as a percentage of prior year site rental revenues | (3.0)% | |||||||

| Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings excluding payments for Sprint Cancellations(b) | ||||||||

| Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) | ||||||||

(a) As issued on October 16, 2024 and unchanged from previous outlook issued on July 17, 2024.

(b) See our definitions of site rental billings, core leasing activity, non-renewals, Sprint Cancellations, Organic Contribution to Site Rental Billings, and Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations in this "Non-GAAP Measures and Other Information."

(c) In 2023, we received

(d) Represents the contribution from recent acquisitions. The financial impact of recent acquisitions is excluded from Organic Contribution to Site Rental Billings, including as Adjusted for Impact of Sprint Cancellations, until the one-year anniversary of such acquisitions.

(e) Calculated based on midpoint of full year 2024 Outlook, where applicable.

Components of Capital Expenditures:(a)

| For the Three Months Ended | |||||||||||||||||

| September 30, 2024 | September 30, 2023 | ||||||||||||||||

| (in millions) | Towers | Fiber | Other | Total | Towers | Fiber | Other | Total | |||||||||

| Discretionary capital expenditures: | |||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 16 | $ | 239 | $ | 5 | $ | 260 | $ | 34 | $ | 273 | $ | 5 | $ | 312 | |

| Purchases of land interests | 14 | — | — | 14 | 13 | — | — | 13 | |||||||||

| Sustaining capital expenditures | 2 | 18 | 3 | 23 | 2 | 14 | 6 | 22 | |||||||||

| Total capital expenditures | $ | 32 | $ | 257 | $ | 8 | $ | 297 | $ | 49 | $ | 287 | $ | 11 | $ | 347 | |

| For the Nine Months Ended | |||||||||||||||||

| September 30, 2024 | September 30, 2023 | ||||||||||||||||

| (in millions) | Towers | Fiber | Other | Total | Towers | Fiber | Other | Total | |||||||||

| Discretionary capital expenditures: | |||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 51 | $ | 769 | $ | 16 | $ | 836 | $ | 101 | $ | 843 | $ | 17 | $ | 961 | |

| Purchases of land interests | 38 | — | — | 38 | 51 | — | — | 51 | |||||||||

| Sustaining capital expenditures | 7 | 50 | 15 | 72 | 8 | 29 | 18 | 55 | |||||||||

| Total capital expenditures | $ | 96 | $ | 819 | $ | 31 | $ | 946 | $ | 160 | $ | 872 | $ | 35 | $ | 1,067 | |

Outlook for Discretionary Capital Expenditures Less Prepaid Rent Additions:(d)

| (in millions) | Full Year 2023 | Full Year 2024 Outlook(b) | |||||||

| Discretionary capital expenditures | to | ||||||||

| Less: Prepaid rent additions(c) | ~ | ||||||||

| Discretionary capital expenditures less prepaid rent additions | $993 | $875 | to | $975 | |||||

Components of Interest Expense:

| For the Three Months Ended | |||||||

| (in millions) | September 30, 2024 | September 30, 2023 | |||||

| Interest expense on debt obligations | $ | 234 | $ | 213 | |||

| Amortization of deferred financing costs and adjustments on long-term debt | 8 | 8 | |||||

| Capitalized interest | (6 | ) | (4 | ) | |||

| Interest expense and amortization of deferred financing costs, net | $ | 236 | $ | 217 | |||

Outlook for Components of Interest Expense:

| (in millions) | Full Year 2024 Outlook(b) | |||||||

| Interest expense on debt obligations | to | |||||||

| Amortization of deferred financing costs and adjustments on long-term debt | to | |||||||

| Capitalized interest | to | |||||||

| Interest expense and amortization of deferred financing costs, net | $926 | to | $971 | |||||

(a) See our definitions of discretionary capital expenditures and sustaining capital expenditures in this "Non-GAAP Measures and Other Information."

(b) As issued on October 16, 2024 and unchanged from previous outlook issued on July 17, 2024.

(c) Reflects up-front consideration from long-term tenant contracts (commonly referred to as prepaid rent) that are amortized and recognized as revenue over the associated estimated lease term in accordance with GAAP.

(d) Excludes sustaining capital expenditures. See "Non-GAAP Measures and Other Information" for our definitions of discretionary capital expenditures and sustaining capital expenditures.

Debt Balances and Maturity Dates as of September 30, 2024:

| (in millions) | Face Value(a) | Final Maturity | ||

| Cash and cash equivalents and restricted cash and cash equivalents | $ | 371 | ||

| Senior Secured Notes, Series 2009-1, Class A-2(b) | 34 | Aug. 2029 | ||

| Senior Secured Tower Revenue Notes, Series 2015-2(c) | 700 | May 2045 | ||

| Senior Secured Tower Revenue Notes, Series 2018-2(c) | 750 | July 2048 | ||

| Installment purchase liabilities and finance leases(d) | 301 | Various | ||

| Total secured debt | $ | 1,785 | ||

| 2016 Revolver(e) | — | July 2027 | ||

| 2016 Term Loan A(f) | 1,132 | July 2027 | ||

| Commercial Paper Notes(g) | 1,312 | Various | ||

| 500 | July 2025 | |||

| 900 | Feb. 2026 | |||

| 750 | June 2026 | |||

| 1,000 | July 2026 | |||

| 750 | Mar. 2027 | |||

| 500 | Mar. 2027 | |||

| 1,000 | Sept. 2027 | |||

| 1,000 | Jan. 2028 | |||

| 1,000 | Feb. 2028 | |||

| 600 | Sept. 2028 | |||

| 600 | Feb. 2029 | |||

| 750 | June 2029 | |||

| 550 | Sept. 2029 | |||

| 550 | Nov. 2029 | |||

| 750 | July 2030 | |||

| 1,100 | Jan. 2031 | |||

| 1,000 | Apr. 2031 | |||

| 750 | July 2031 | |||

| 750 | May 2033 | |||

| 750 | Mar. 2034 | |||

| 700 | Sept. 2034 | |||

| 1,250 | Apr. 2041 | |||

| 350 | May 2047 | |||

| 400 | Feb. 2049 | |||

| 350 | Nov. 2049 | |||

| 500 | July 2050 | |||

| 900 | Jan. 2051 | |||

| Total unsecured debt | $ | 22,444 | ||

| Net Debt(h) | $ | 23,858 | ||

(a) Net of required principal amortizations.

(b) The Senior Secured Notes, 2009-1, Class A-2 principal amortizes over a period ending in August 2029.

(c) If the respective series of Tower Revenue Notes are not paid in full on or prior to an applicable anticipated repayment date, then the Excess Cash Flow (as defined in the indenture) of the issuers of such notes will be used to repay principal of the applicable series, and additional interest (of an additional approximately

(d) As of September 30, 2024, reflects

(e) As of September 30, 2024, the undrawn availability under the

(f) The 2016 Term Loan A principal amortizes over a period ending in July 2027.

(g) As of September 30, 2024, the Company had

(h) See further information on, and our definition and calculation of, Net Debt in this "Non-GAAP Measures and Other Information."

Cautionary Language Regarding Forward-Looking Statements

This news release contains forward-looking statements and information that are based on our management's current expectations as of the date of this news release. Statements that are not historical facts are hereby identified as forward-looking statements. In addition, words such as "estimate," "see," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned," "continue," "target," "focus," and any variations of these words and similar expressions are intended to identify forward-looking statements. Such statements include our full year 2024 Outlook and plans, projections, expectations and estimates regarding (1) the value of our business model and strategy, the performance of our business and the demand for our communications infrastructure, (2) revenue growth and its driving factors, (3) net income (loss) (including on a per share basis), (4) AFFO (including on a per share basis) and its components and growth, (5) Adjusted EBITDA and its components and growth, (6) Organic Contribution to Site Rental Billings (including as Adjusted for Impact of Sprint Cancellations) and its components and growth, (7) site rental revenues and its components and growth, (8) interest expense, (9) the impact of Sprint Cancellations on our operating and financial results, (10) services contribution,(11) discretionary capital expenditures, (12) prepaid rent additions and amortization, (13) core leasing activity, (14) increase in our expenses, including its driving factors, (15) Fiber segment strategic review and the potential impacts and benefits therefrom, (16) changes to our operating plans and capital expenditure profile for the Fiber segment and the impacts and potential benefits therefrom (including with respect to the value of our assets), (17) operating cost reductions, including cost savings and other resulting benefits, (18) payment of advisory fees, including timing, and the impact on our results, (19) the trends impacting our business and the potential benefits derived therefrom, (20) small cell node cancellations and the impacts thereof and (21) our ability to capitalize on potential opportunities created by increasing data demand. All future dividends are subject to declaration by our board of directors.

Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and the following:

- Our business depends on the demand for our communications infrastructure (including towers, small cells and fiber), driven primarily by demand for data, and we may be adversely affected by any slowdown in such demand. Additionally, a reduction in the amount or change in the mix of network investment by our tenants may materially and adversely affect our business (including reducing demand for our communications infrastructure or services).

- A substantial portion of our revenues is derived from a small number of tenants, and the loss, consolidation or financial instability of any of such tenants may materially decrease revenues, reduce demand for our communications infrastructure and services and impact our dividend per share growth.

- The expansion or development of our business, including through acquisitions, increased product offerings or other strategic opportunities, may cause disruptions in our business, which may have an adverse effect on our business, operations or financial results.

- Our Fiber segment has expanded, and the Fiber business model contains certain differences from our Towers business model, resulting in different operational risks. If we do not successfully operate our Fiber business model or identify or manage the related operational risks, such operations may produce results that are lower than anticipated.

- Our review of potential strategic alternatives may not result in an executed or consummated transaction or other strategic alternative, and the process of reviewing strategic alternatives or the outcome could adversely affect our business. There is no guarantee that any transaction resulting from the strategic review will ultimately benefit our shareholders.

- Failure to timely, efficiently and safely execute on our construction projects could adversely affect our business.

- New technologies may reduce demand for our communications infrastructure or negatively impact our revenues.

- If we fail to retain rights to our communications infrastructure, including the rights to land under our towers and the right-of-way and other agreements related to our small cells and fiber, our business may be adversely affected.

- Our services business has historically experienced significant volatility in demand, which reduces the predictability of our results.

- If radio frequency emissions from wireless handsets or equipment on our communications infrastructure are demonstrated to cause negative health effects, potential future claims could adversely affect our operations, costs or revenues.

- Cybersecurity breaches or other information technology disruptions could adversely affect our operations, business, and reputation.

- Our business may be adversely impacted by climate-related events, natural disasters, including wildfires, and other unforeseen events.

- As a result of competition in our industry, we may find it more difficult to negotiate favorable rates on our new or renewing tenant contracts.

- New wireless technologies may not deploy or be adopted by tenants as rapidly or in the manner projected.

- Our focus on and disclosure of our Environmental, Social and Governance position, metrics, strategy, goals and initiatives expose us to potential litigation and other adverse effects to our business.

- Failure to attract, recruit and retain qualified and experienced employees could adversely affect our business, operations and costs.

- Changes to management, including turnover of our top executives, could have an adverse effect on our business.

- Actions that we are taking to restructure our business in alignment with our strategic priorities may not be as effective as anticipated.

- Actions of activist stockholders could impact the pursuit of our business strategies and adversely affect our results of operations, financial condition, or stock price.

- Our substantial level of indebtedness could adversely affect our ability to react to changes in our business, and the terms of our debt instruments limit our ability to take a number of actions that our management might otherwise believe to be in our best interests. In addition, if we fail to comply with our covenants, our debt could be accelerated.

- We have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we could face substantial liquidity issues and might be required to issue equity securities or securities convertible into equity securities, or sell some of our assets, possibly on unfavorable terms, to meet our debt payment obligations.

- Sales or issuances of a substantial number of shares of our common stock or securities convertible into shares of our common stock may adversely affect the market price of our common stock.

- Certain provisions of our restated certificate of incorporation amended and restated by-laws and operative agreements, and domestic and international competition laws may make it more difficult for a third party to acquire control of us or for us to acquire control of a third party, even if such a change in control would be beneficial to our stockholders.

- If we fail to comply with laws or regulations which regulate our business and which may change at any time, we may be fined or even lose our right to conduct some of our business.

- Future dividend payments to our stockholders will reduce the availability of our cash on hand available to fund future discretionary investments, and may result in a need to incur indebtedness or issue equity securities to fund growth opportunities. In such event, the then current economic, credit market or equity market conditions will impact the availability or cost of such financing, which may hinder our ability to grow our per share results of operations.

- Remaining qualified to be taxed as a Real Estate Investment Trust ("REIT") involves highly technical and complex provisions of the Code. Failure to remain qualified as a REIT would result in our inability to deduct dividends to stockholders when computing our taxable income, thereby increasing our tax obligations and reducing our available cash.

- Complying with REIT requirements, including the

90% distribution requirement, may limit our flexibility or cause us to forgo otherwise attractive opportunities, including certain discretionary investments and potential financing alternatives. - REIT related ownership limitations and transfer restrictions may prevent or restrict certain transfers of our capital stock.

Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risk factors which could affect our results is included in our filings with the SEC. Our filings with the SEC are available through the SEC website at www.sec.gov or through our investor relations website at investor.crowncastle.com. We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors, the media and others interested in us to visit our investor relations website from time to time to review up-to-date information or to sign up for e-mail alerts to be notified when new or updated information is posted on the site.

As used in this release, the term "including," and any variation thereof, means "including without limitation."

| CROWN CASTLE INC. CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED) (Amounts in millions, except par values) |

| September 30, 2024 | December 31, 2023 | ||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 194 | $ | 105 | |||

| Restricted cash and cash equivalents | 172 | 171 | |||||

| Receivables, net | 413 | 481 | |||||

| Prepaid expenses | 144 | 103 | |||||

| Deferred site rental receivables | 158 | 116 | |||||

| Other current assets | 43 | 56 | |||||

| Total current assets | 1,124 | 1,032 | |||||

| Deferred site rental receivables | 2,340 | 2,239 | |||||

| Property and equipment, net | 15,643 | 15,666 | |||||

| Operating lease right-of-use assets | 5,843 | 6,187 | |||||

| Goodwill | 10,085 | 10,085 | |||||

| Other intangible assets, net | 2,878 | 3,179 | |||||

| Other assets, net | 130 | 139 | |||||

| Total assets | $ | 38,043 | $ | 38,527 | |||

| LIABILITIES AND EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 200 | $ | 252 | |||

| Accrued interest | 164 | 219 | |||||

| Deferred revenues | 483 | 605 | |||||

| Other accrued liabilities | 338 | 342 | |||||

| Current maturities of debt and other obligations | 611 | 835 | |||||

| Current portion of operating lease liabilities | 301 | 332 | |||||

| Total current liabilities | 2,097 | 2,585 | |||||

| Debt and other long-term obligations | 23,452 | 22,086 | |||||

| Operating lease liabilities | 5,272 | 5,561 | |||||

| Other long-term liabilities | 1,926 | 1,914 | |||||

| Total liabilities | 32,747 | 32,146 | |||||

| Commitments and contingencies | |||||||

| Stockholders' equity: | |||||||

| Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: September 30, 2024—435 and December 31, 2023—434 | 4 | 4 | |||||

| Additional paid-in capital | 18,371 | 18,270 | |||||

| Accumulated other comprehensive income (loss) | (5 | ) | (4 | ) | |||

| Dividends/distributions in excess of earnings | (13,074 | ) | (11,889 | ) | |||

| Total equity | 5,296 | 6,381 | |||||

| Total liabilities and equity | $ | 38,043 | $ | 38,527 | |||

| CROWN CASTLE INC. CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) (Amounts in millions, except per share amounts) |

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net revenues: | |||||||||||||||

| Site rental | $ | 1,593 | $ | 1,577 | $ | 4,761 | $ | 4,929 | |||||||

| Services and other | 59 | 90 | 158 | 378 | |||||||||||

| Net revenues | 1,652 | 1,667 | 4,919 | 5,307 | |||||||||||

| Operating expenses: | |||||||||||||||

| Costs of operations:(a) | |||||||||||||||

| Site rental | 430 | 420 | 1,292 | 1,259 | |||||||||||

| Services and other | 30 | 66 | 91 | 268 | |||||||||||

| Selling, general and administrative | 153 | 176 | 540 | 581 | |||||||||||

| Asset write-down charges | 15 | 8 | 24 | 30 | |||||||||||

| Acquisition and integration costs | — | — | — | 1 | |||||||||||

| Depreciation, amortization and accretion | 432 | 439 | 1,301 | 1,315 | |||||||||||

| Restructuring charges | 48 | 72 | 104 | 72 | |||||||||||

| Total operating expenses | 1,108 | 1,181 | 3,352 | 3,526 | |||||||||||

| Operating income (loss) | 544 | 486 | 1,567 | 1,781 | |||||||||||