Collective Audience to Acquire BeOp, Adding Unique AI-Power, Conversational Advertising and Audience Data Offering to AdTech Ecosystem Platform

NEW YORK, March 01, 2024 (GLOBE NEWSWIRE) -- (Nasdaq: CAUD), a leading innovator of audience-based performance advertising and media, has signed a binding letter of intent to acquire BeOp, an award-winning, Europe-based MarTech and AdTech industry-leading innovator.

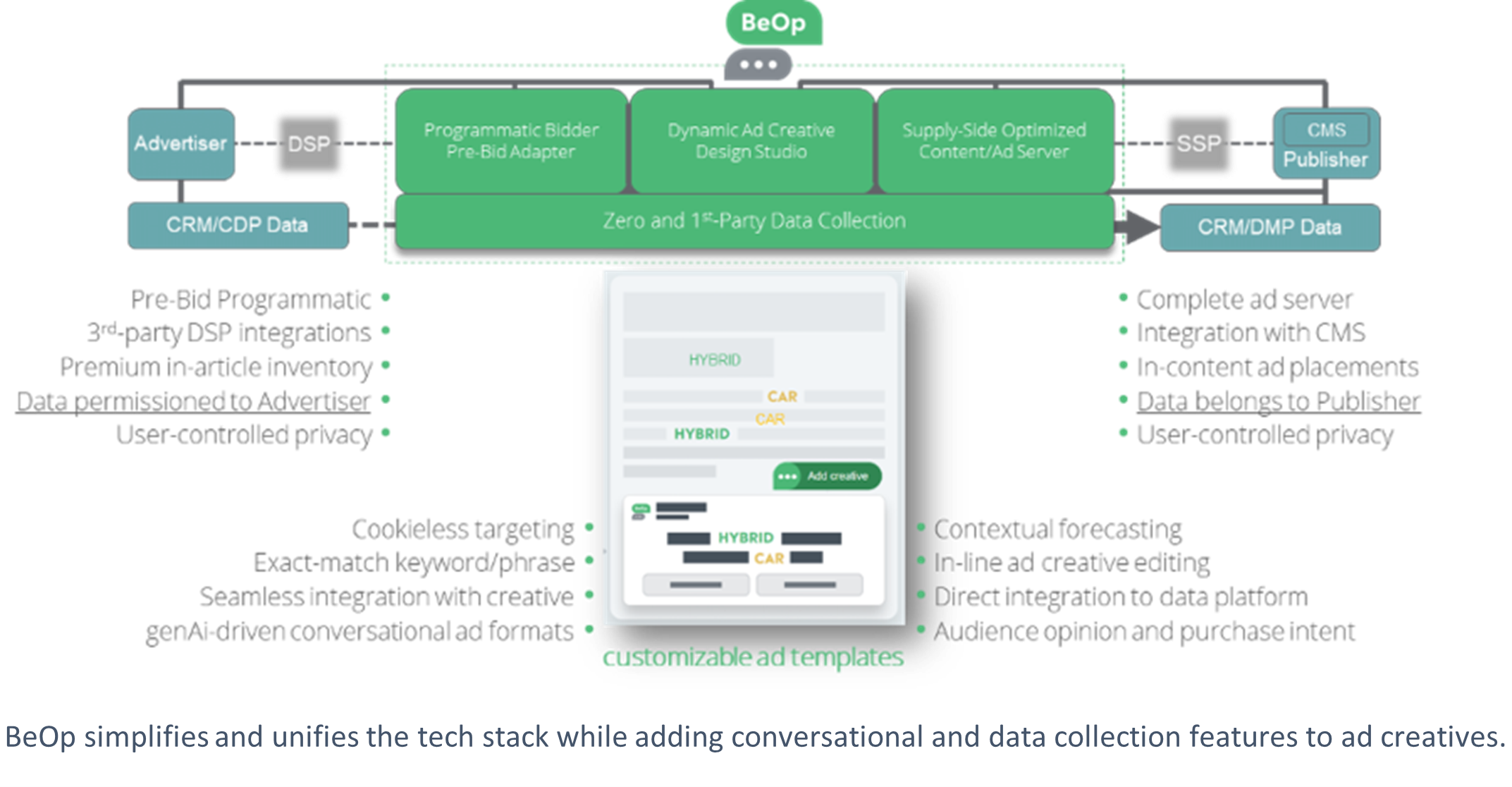

BeOp brings to Collective Audience a cloud based modular platform. The industry’s first SaaS-, services- and marketplace-based, AI-powered, performance advertising and data platform for media and brands.

BeOp is revolutionizing the advertising landscape with its innovative technology tailored for the new digital media and advertising market KPIs such as attention measurement, engagement rate, attribution and time spent. The platform offers a self-serve interface as well as APIs that enable it to be integrated into any environment.

Retail Media

BeOp's conversational ad units, powered by AI and dynamic ad creatives, captivate users attention. This approach ensures unmatched conversion rates in the retail media domain. With BeOp, every interaction becomes a sales opportunity.

Data

BeOp is already integrated with the leading DMPs (data management platforms) in the market. This integration positions Collective Audience at the forefront, offering the unique ability to create exclusive zero and first party segments for media. Empowering publishers for the first time with their data, these functionalities will soon be extended to advertisers, opening up new targeting and customization possibilities.

End of Third-party Cookies

With the disappearance of third-party cookies that have been the industry’s primary targeting mechanism, BeOp is positioned as an independent, cookieless solution. Its comprehensive suite of tools for audiences, data, and monetization offers the open web market a powerful solution to address current and future challenges. The combination of Collective Audience and BeOp represents the future of digital advertising.

BeOp’s conversational approach opens up new communication possibilities for brands and media to engage and convert consumers based on their interests. See examples of such conversational ad experiences BeOp created for leading brands, including Range Rover, Tommy Hilfiger and Samsung, here.

BeOp’s expert teams, based in France (Paris and Montpellier) and New York City, work with more than

Since its founding in 2017, the power and effectiveness of BeOp’s unique approach is reflected in its rapid revenue growth, reportedly climbing

Given the anticipated operational synergies with the existing Collective Audience digital ecosystem, the acquisition is expected to be operationally EBITDA positive upon completion. The additional benefits of scale and cross pollination are also expected to enhance Collective Audience’s overall revenue growth and profitability profile as a part of its rising tide growth model.

BeOp has won numerous awards, including the Innovation Competition by BPI France in 2018, a finalist in the Start & Pulse by Sofinco competition in 2021, and winner of the Cas d’Or du Conversationnel competition in 2022. BeOp was officially certified by the HappyIndex® AtWork in 2022, reflecting employee satisfaction in the company’s work environment.

To advance the relationship and integration process during the closing process, Collective Audience signed an exclusive interim license and joint venture agreement with BeOp for using its conversational advertising technology in North America pending completion of the acquisition.

The companies plan to integrate BeOp's platform into Collective Audience’s product offering to scale the BeOp’s U.S. market share, with this expected to facilitate an immediate ramp up in revenue generation for Collective Audience.

“Building on our success in Europe, BeOp is now set to conquer the North American market as an integral part of the Collective Audience platform,” stated BeOp co-founder and CEO, Louis Prunel. “Our new strategic partnership and the expected eventual merging of our companies opens up endless opportunities for propelling our technology to new dimensions. We see our combination creating an unprecedented growth opportunity.”

According to Collective Audience CEO, Peter Bordes: “BeOp technology is the most advanced, modern AI plus data-driven AdTech stack we have seen. It solves many of the issues the industry faces with its cookieless targeting and next generation high speed ad serving that empowers publishers with an audience data DMP, along with attention-based ad units that are the highest performing in the industry.”

“We see BeOp as two to three acquisitions rolled into one. Their exclusive integration with our platform positions us at the forefront, giving us the unique ability to create zero and first party audience segments for our supply and demand partners,” Bordes continued. “With this strategic partnership between Collective Audience and BeOp, the future of digital advertising knows no bounds.”

“As our first acquisition as Collective Audience, BeOp is reflective of the numerous highly valuable and successful potential acquisitions and JV partnerships we’re currently pursuing on a fast-track basis,” added Bordes. “We expect to make additional related major announcements over the coming weeks.”

The initial strategic partnership and anticipated acquisition is expected to help Collective Audience and BeOp to tap the vast opportunities in the rapidly expanding and evolving global AdTech market that is projected to grow at a

Prunel and BeOp co-founder and COO, Nicolas Sadki, have been appointed to Collective Audience’s Advisor Collective, a recently announced strategic advisory community designed to advance the company’s mission of transforming the AdTech, MarTech and digital media industry.

The acquisition is structured as an all-stock transaction with assumption of certain BeOp liabilities and earn-out provisions. It is expected to close in the second quarter of 2024.

The acquisition would be consummated pursuant to a definitive acquisition agreement between Collective Audience and BeOp. While Collective Audience expects the transaction to be completed as agreed, it is dependent on certain closing terms and no assurances can be provided that the transaction will be completed as described.

Additional details and terms related to the planned transaction will be made available in a Form 8-K filed by Collective Audience and available at www.sec.gov.

About BeOp

The BeOp Creative Studio allows everyone to quickly create new advertising campaigns focused on engagement and interaction, incorporating user data collection and attention tracking natively, while functioning perfectly without cookies. This approach reinvigorates advertising on the Open Web by generating widespread consumer engagement, thereby multiplying advertising effectiveness for advertisers and sustainably defending the value of their spaces for publishers.

Data capture integrated from the creative stage is used by the BeOp Creative Studio to develop content for commerce operations, lead generation, data collection, pre-tests, post-tests, and studies—all with just a few clicks.

BeOp is transforming the advertising era: Instead of trying to impose imperative messages and then snatching a click, it seeks what would interest the consumer most and offers to teach them by giving them control. This approach, endorsed by consumers, allows BeOp creations to achieve memorization rates three times higher.

Publishers can integrate BeOp logic at all levels of their organization:

- Editorial: Increase time spent by using the BeOp Creative Studio to create quizzes and other elements complementary to their articles.

- Marketing / Data: to collect zero and first-party data (newsletter subscriptions, data for advertising retargeting, pre-tests, and post-tests.)

- Business: The ad sales team can create its offers from BeOp's advertising creations and deliver significantly more to its advertisers (performance, interaction data, attention, time spent, brand memorization.)

BeOp's advertising creations are compatible with dissemination in their existing tools.

Publishers wishing to gain independence can integrate the BeOp Ad Server. Unlike other market solutions designed from the outset in the interest of advertisers and for a cookie-based mode, the BeOp Ad Server is designed in the interest of publishers and was created from the start to function in the new cookieless world. Lightning-fast, it is a valuable complement to existing tools and allows regaining control over advertising spaces and advertisers of all sizes.

BeOp Ad Server allows them to create as many buying platforms as desired (including direct advertiser), while also having as many sales platforms as necessary to match their commercial organization. They can also have access to their peers' space in overflow if they wish, enabling them to sign deals of all sizes.

Publishers with one site or 10,000 can market, deliver, and track all their advertising campaigns, while better defending the value of their spaces thanks to the performance of BeOp's advertising creations.

About Collective Audience

Collective Audience provides an innovative audience-based performance advertising and media platform for brands, agencies and publishers. The company has introduced a new open, interconnected, data driven, digital advertising and media ecosystem that will uniquely eliminate many inefficiencies in the digital ad buyer and seller process for brands, agencies and publishers. It will deliver long sought-after visibility, complementary technology, and unique audience data that drives focus on performance, brand reach, traffic and transactions.

For the AdTech providers and media buyers who come onto Collective Audience’s platform, they will be able to leverage audience data as a new asset class, powered by AI as an intelligence layer to guide decision making.

To learn more, visit collectiveaudience.co.

Important Cautions Regarding Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this press release, regarding the company’s future financial performance, as well as the company’s strategy, future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the management of Collective Audience and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Collective Audience. Potential risks and uncertainties that could cause the actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, changes in domestic and foreign business, market, financial, political and legal conditions; unanticipated conditions that could adversely affect the company; the overall level of consumer demand for Collective Audience’s products/services; the ability of Collective Audience to consummate the BeOp acquisition, general economic conditions and other factors affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and credit markets; the financial strength of Collective Audience’s customers; Collective Audience’s ability to implement its business strategy; changes in governmental regulation, Collective Audience’s exposure to litigation claims and other loss contingencies; disruptions and other impacts to Collective Audience’s business, as a result of the COVID-19 pandemic and government actions and restrictive measures implemented in response; Collective Audience’s cash balance and ability to continue as a going concern; Collective Audience’s ability to protect patents, trademarks and other intellectual property rights; any breaches of, or interruptions in, Collective Audience’s information systems; changes in tax laws and liabilities, legal, regulatory, political and economic risks. More information on potential factors that could affect Collective Audience’s financial results is included from time to time in Collective Audience’s public reports filed with the SEC. If any of these risks materialize or Collective Audience’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Collective Audience presently knows, or that Collective Audience currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Collective Audience’s expectations, plans or forecasts of future events and views as of the date of this press release. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. Collective Audience anticipates that subsequent events and developments will cause their assessments to change. However, while Collective Audience may elect to update these forward-looking statements at some point in the future, Collective Audience specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Collective Audience’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Company Contact:

Peter Bordes, CEO

Collective Audience, Inc.

Email contact

Investor Contact:

Ron Both or Grant Stude

CMA Investor Relations

Tel (949) 432-7566

Email contact

Media Contact:

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email contact

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5dfcc3ce-34e5-44af-b01d-d81b74298293