Corporación América Airports S.A. Reports May 2024 Passenger Traffic

Corporación América Airports S.A. (NYSE: CAAP) reported a 9.5% year-over-year (YoY) decrease in total passenger traffic for May 2024. Excluding Natal Airport, the decline was 7.2% YoY. Domestic passenger traffic fell by 20.8% YoY, while international traffic grew by 8.3% YoY. Argentina and Brazil showed significant declines in domestic traffic, whereas Italy and Uruguay reported increases in international traffic. Cargo volume remained flat, with a 0.1% YoY decrease, while aircraft movements dropped by 10.8% YoY. Argentina, Italy, and Uruguay saw increases in cargo volume, although this was offset by declines in Brazil, Armenia, and Italy. Notably, the company stopped operating Natal Airport as of February 2024.

- International passenger traffic increased by 8.3% YoY.

- Italy's passenger traffic grew by 15.7% YoY, with international traffic up 18.2%.

- Uruguay’s international passenger traffic rose by 12.1% YoY.

- Cargo volume in Uruguay increased by 17.1% YoY.

- Cargo volume in Ecuador rose by 12.6% YoY.

- Aircraft movements in Italy increased by 10.9% YoY.

- Total passenger traffic declined by 9.5% YoY.

- Domestic passenger traffic was down 20.8% YoY.

- Argentina's domestic passenger traffic dropped by 23.3% YoY.

- Brazil's total passenger traffic decreased by 16.2% YoY.

- Cargo volume in Brazil fell by 14.0% YoY.

- Aircraft movements declined by 10.8% YoY.

Insights

The 9.5% YoY decrease in total passenger traffic is significant, especially when paired with a 20.8% drop in domestic passengers. This suggests potential issues in the broader economic environment or specific operational challenges. In contrast, the 8.3% increase in international traffic is a positive note, driven by markets like Argentina, Italy and Uruguay. Investors should note the country's specific variances; for instance, Argentina faces a domestic recession and strikes, which contributed to the decline in local traffic.

Another critical observation is the 4.0% increase in cargo volume YTD, an indication that the company is maintaining resilience in its cargo operations despite the overall drop in passenger numbers. The 10.8% decrease in aircraft movements is concerning as it reflects reduced operational activities across most countries, though Italy is an exception with a notable increase.

In summary, while international traffic growth hints at a recovery in certain markets, the overall decline in passenger and aircraft movements suggests broader systemic challenges that could impact short-term financial performance.

The market dynamics highlighted are multifaceted. Argentina's economic situation, including recession and union strikes, heavily impacted domestic traffic, whereas Italy shows robust growth, particularly in international passengers. This disparity underscores the importance of region-specific strategies. Investors should keep an eye on Italy's strong performance, which may indicate effective local management and potential future gains in international markets.

The overall 17.3% decrease in domestic traffic (excluding Natal) points to potential structural weaknesses or external market pressures affecting local travel. Brazil’s significant drop in traffic due to local airline constraints also emphasizes the need for strategic overhauls or financial support within the aviation sector there.

It's worth noting that despite a mixed performance in passenger traffic, the cargo segment provides a stabilizing factor, particularly with strong growth in Uruguay and Ecuador. This divergence suggests that the company's diversification between passenger and cargo services might mitigate some adverse impacts.

Overall, the data indicates that while CAAP is navigating challenging terrains in some regions, specific growth areas like Italy and the cargo segment offer potential upside.

Total passenger traffic down

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

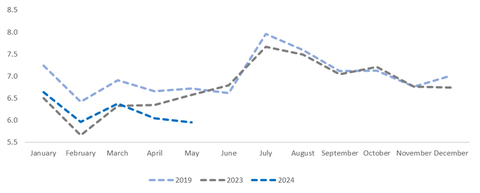

Monthly Passenger Traffic Performance (In million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

||||||||||||

Statistics |

May'24 |

|

May'23 |

|

% Var. |

|

YTD’24 |

|

YTD'23 |

|

% Var. |

|

Domestic Passengers (thousands) |

2,958 |

|

3,735 |

|

- |

|

16,298 |

|

17,867 |

|

- |

|

International Passengers (thousands) |

2,487 |

|

2,296 |

|

|

|

11,847 |

|

10,694 |

|

|

|

Transit Passengers (thousands) |

511 |

|

550 |

|

- |

|

2,845 |

|

2,873 |

|

- |

|

Total Passengers (thousands)1 |

5,955 |

|

6,581 |

|

- |

|

30,989 |

|

31,434 |

|

- |

|

Cargo Volume (thousand tons) |

31.5 |

|

31.6 |

|

- |

|

152.5 |

|

146.7 |

|

|

|

Total Aircraft Movements (thousands) |

64.8 |

|

72.6 |

|

- |

|

329.3 |

|

341.7 |

|

- |

|

1 Excluding Natal for comparison purposes, total passenger traffic was down |

||||||||||||

Monthly Passenger Traffic Performance

(In million PAX)

Passenger Traffic Overview

Total passenger traffic declined

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume remained largely flat compared to the same month in 2023, with positive YoY contributions from

Aircraft movements decreased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||||||

|

May'24 |

|

May'23 |

|

% Var. |

|

YTD'24 |

|

YTD'23 |

|

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

2,916 |

|

3,441 |

|

- |

|

16,870 |

|

17,025 |

|

- |

|

888 |

|

767 |

|

|

|

3,173 |

|

2,785 |

|

|

|

1,165 |

|

1,392 |

|

- |

|

6,209 |

|

6,957 |

|

- |

|

156 |

|

139 |

|

|

|

957 |

|

795 |

|

|

|

393 |

|

409 |

|

- |

|

1,913 |

|

1,987 |

|

- |

|

436 |

|

433 |

|

|

|

1,867 |

|

1,884 |

|

- |

TOTAL |

5,955 |

|

6,581 |

|

- |

|

30,989 |

|

31,434 |

|

- |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||||||

Cargo Volume (tons) |

|

|

|

|

|

|

|

||||||

|

16,856 |

|

16,775 |

|

|

|

78,319 |

|

75,614 |

|

|

||

|

1,137 |

|

1,207 |

|

- |

|

5,313 |

|

5,573 |

|

- |

||

|

4,584 |

|

5,332 |

|

- |

|

25,196 |

|

26,083 |

|

- |

||

|

2,986 |

|

2,549 |

|

|

|

12,599 |

|

13,116 |

|

- |

||

|

3,279 |

|

2,912 |

|

|

|

16,291 |

|

13,705 |

|

|

||

|

2,686 |

|

2,790 |

|

- |

|

14,768 |

|

12,576 |

|

|

||

TOTAL |

31,528 |

|

31,564 |

|

- |

|

152,485 |

|

146,667 |

|

|

||

Aircraft Movements |

|

|

|

|

|

|

|

|

|

|

|

||

|

33,072 |

|

37,948 |

|

- |

|

181,380 |

|

185,213 |

|

- |

||

|

8,329 |

|

7,512 |

|

|

|

29,456 |

|

26,777 |

|

|

||

|

11,540 |

|

14,227 |

|

- |

|

58,496 |

|

65,689 |

|

- |

||

|

2,207 |

|

2,324 |

|

- |

|

14,361 |

|

14,308 |

|

|

||

|

6,297 |

|

6,875 |

|

- |

|

31,279 |

|

33,159 |

|

- |

||

|

3,310 |

|

3,700 |

|

- |

|

14,318 |

|

16,585 |

|

- |

||

TOTAL |

64,755 |

|

72,586 |

|

- |

|

329,290 |

|

341,731 |

|

- |

||

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20240617090931/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports