Corporación América Airports S.A. Reports February 2025 Passenger Traffic

Corporación América Airports (CAAP) reported a 6.0% year-over-year increase in passenger traffic for February 2025, reaching 8.2% YoY when excluding Natal operations. International passenger traffic grew by 11.2%, while domestic traffic rose 2.2% (5.9% ex-Natal).

Key regional performance:

- Argentina: Total traffic up 9.7% YoY, with domestic traffic rising 5.7% and international traffic surging 19.1%

- Italy: 14.1% overall growth, with international traffic up 11.8% and domestic traffic increasing 21.9%

- Brazil: Total traffic declined 1.7% YoY, but showed 9.2% growth when excluding Natal Airport operations

Cargo volume increased by 5.3% YoY, with positive contributions from most countries. Aircraft movements rose 2.0% YoY, primarily driven by Italy (+13.2%) and Argentina (+2.1%).

Corporación América Airports (CAAP) ha riportato un aumento del 6,0% anno su anno nel traffico passeggeri per febbraio 2025, raggiungendo un 8,2% anno su anno escludendo le operazioni di Natal. Il traffico passeggeri internazionale è cresciuto dell'11,2%, mentre il traffico domestico è aumentato del 2,2% (5,9% escludendo Natal).

Performance regionale chiave:

- Argentina: Traffico totale in aumento del 9,7% anno su anno, con il traffico domestico in crescita del 5,7% e il traffico internazionale in forte aumento del 19,1%

- Italia: Crescita complessiva del 14,1%, con il traffico internazionale in aumento dell'11,8% e il traffico domestico che cresce del 21,9%

- Brasile: Traffico totale in calo dell'1,7% anno su anno, ma ha mostrato una crescita del 9,2% escludendo le operazioni dell'Aeroporto di Natal

Il volume delle merci è aumentato del 5,3% anno su anno, con contributi positivi da parte della maggior parte dei paesi. I movimenti aerei sono aumentati del 2,0% anno su anno, principalmente trainati dall'Italia (+13,2%) e dall'Argentina (+2,1%).

Corporación América Airports (CAAP) reportó un aumento del 6,0% interanual en el tráfico de pasajeros para febrero de 2025, alcanzando un 8,2% interanual al excluir las operaciones de Natal. El tráfico de pasajeros internacional creció un 11,2%, mientras que el tráfico nacional aumentó un 2,2% (5,9% excluyendo Natal).

Rendimiento regional clave:

- Argentina: Tráfico total aumentado un 9,7% interanual, con tráfico nacional en aumento del 5,7% y tráfico internacional disparándose un 19,1%

- Italia: Crecimiento general del 14,1%, con tráfico internacional en aumento del 11,8% y tráfico nacional aumentando un 21,9%

- Brasil: Tráfico total disminuyó un 1,7% interanual, pero mostró un crecimiento del 9,2% al excluir las operaciones del Aeropuerto de Natal

El volumen de carga aumentó un 5,3% interanual, con contribuciones positivas de la mayoría de los países. Los movimientos de aeronaves aumentaron un 2,0% interanual, impulsados principalmente por Italia (+13,2%) y Argentina (+2,1%).

코르포라시온 아메리카 공항 (CAAP)는 2025년 2월에 전년 대비 6.0% 증가한 승객 수치를 보고했으며, 나탈 운영을 제외할 경우 8.2% 증가에 달했습니다. 국제 승객 수는 11.2% 증가했으며, 국내 교통은 2.2% 증가했습니다 (나탈 제외 시 5.9%).

주요 지역 성과:

- 아르헨티나: 전체 교통량이 전년 대비 9.7% 증가했으며, 국내 교통은 5.7% 증가하고 국제 교통은 19.1% 급증했습니다.

- 이탈리아: 전체 성장률이 14.1%로, 국제 교통은 11.8% 증가하고 국내 교통은 21.9% 증가했습니다.

- 브라질: 전체 교통량이 전년 대비 1.7% 감소했지만, 나탈 공항 운영을 제외할 경우 9.2% 성장했습니다.

화물량은 전년 대비 5.3% 증가했으며, 대부분의 국가에서 긍정적인 기여가 있었습니다. 항공기 이동은 전년 대비 2.0% 증가했으며, 주로 이탈리아(+13.2%)와 아르헨티나(+2.1%)가 주도했습니다.

Corporación América Airports (CAAP) a rapporté une augmentation de 6,0% par rapport à l'année précédente du trafic passagers pour février 2025, atteignant 8,2% par rapport à l'année précédente en excluant les opérations de Natal. Le trafic passagers international a augmenté de 11,2%, tandis que le trafic domestique a crû de 2,2% (5,9% hors Natal).

Performance régionale clé :

- Argentine : Trafic total en hausse de 9,7% par rapport à l'année précédente, avec un trafic domestique en augmentation de 5,7% et un trafic international en forte hausse de 19,1%

- Italie : Croissance globale de 14,1%, avec un trafic international en hausse de 11,8% et un trafic domestique en augmentation de 21,9%

- Brésil : Trafic total en baisse de 1,7% par rapport à l'année précédente, mais montrant une croissance de 9,2% en excluant les opérations de l'aéroport de Natal

Le volume de fret a augmenté de 5,3% par rapport à l'année précédente, avec des contributions positives de la plupart des pays. Les mouvements d'avions ont augmenté de 2,0% par rapport à l'année précédente, principalement tirés par l'Italie (+13,2%) et l'Argentine (+2,1%).

Corporación América Airports (CAAP) berichtete von einem Jahreswachstum von 6,0% im Passagieraufkommen für Februar 2025, was ohne die Operationen in Natal 8,2% entspricht. Der internationale Passagierverkehr wuchs um 11,2%, während der Inlandsverkehr um 2,2% anstieg (5,9% ohne Natal).

Wichtige regionale Leistungen:

- Argentinien: Gesamtverkehr stieg um 9,7% im Jahresvergleich, der Inlandsverkehr wuchs um 5,7% und der internationale Verkehr sprang um 19,1% an.

- Italien: Insgesamt 14,1% Wachstum, mit einem Anstieg des internationalen Verkehrs um 11,8% und des Inlandsverkehrs um 21,9%.

- Brasilien: Gesamtverkehr ging um 1,7% im Jahresvergleich zurück, zeigte jedoch ein Wachstum von 9,2%, wenn man die Operationen des Flughafens Natal ausschließt.

Das Frachtvolumen stieg im Jahresvergleich um 5,3%, mit positiven Beiträgen aus den meisten Ländern. Die Flugbewegungen stiegen um 2,0% im Jahresvergleich, hauptsächlich angetrieben von Italien (+13,2%) und Argentinien (+2,1%).

- Strong international traffic growth of 11.2% YoY

- Argentina shows robust performance with 19.1% YoY international traffic growth

- Italy posts strong growth with 14.1% total traffic increase

- Cargo volume up 5.3% YoY across most markets

- Aircraft movements increased 2.0% YoY

- Brazil's total traffic declined 1.7% YoY

- Ecuador's traffic decreased 2.3% YoY due to security concerns

- Armenia's passenger traffic dropped 4.5% YoY

- Loss of Natal Airport operations impacts overall traffic numbers

Insights

CAAP's February 2025 traffic report reveals robust operational momentum that signals positive revenue implications across its airport portfolio. The 6.0% YoY growth in total passenger traffic (or 8.2% excluding discontinued Natal operations) demonstrates healthy demand, with the 11.2% surge in international traffic particularly noteworthy given these passengers typically generate higher aeronautical fees and commercial revenues.

The geographic performance shows strategic strength in CAAP's diversified portfolio. Argentina's 9.7% total traffic growth with a remarkable 19.1% international traffic increase highlights recovery in this key market. Meanwhile, Italy delivered 14.1% growth with strong performance in both international (11.8%) and domestic (21.9%) segments. This diversification helps offset challenges in smaller markets like Ecuador (-2.3%) and Armenia (-4.5%).

Operational indicators suggest improving airline dynamics within CAAP's airports. JetSMART's 65% YoY passenger increase in Argentina following fleet expansion with three A321neo aircraft demonstrates how airline capacity growth directly benefits CAAP's traffic volumes. New route launches across multiple markets – including Flybondi's Buenos Aires-Río Gallegos service and new international connections in Uruguay – create additional passenger flow opportunities.

The 5.3% increase in cargo volume provides a valuable supplementary revenue stream, while the 2.0% growth in aircraft movements lagging behind passenger growth indicates improving load factors and operational efficiency across CAAP's network.

Brazil's apparent decline (-1.7%) transforms into 9.2% growth when adjusted for Natal's planned exit, revealing underlying strength despite industry constraints in that market. This operational performance, particularly the high-value international segment growth, points to strengthening revenue fundamentals across CAAP's airport portfolio.

Total passenger traffic up

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

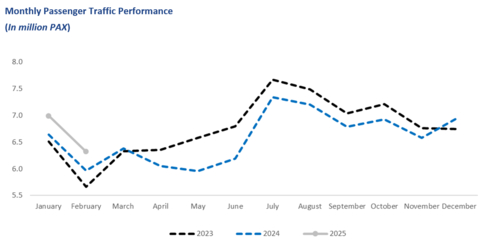

Monthly Passenger Traffic Performance (In million PAX)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2025 vs. 2024) |

||||||||

Statistics |

Feb'25 |

Feb'24 |

% Var. |

|

YTD’25 |

YTD'24 |

% Var. |

|

Domestic Passengers (thousands) |

3,292 |

3,219 |

|

|

6,864 |

6,829 |

|

|

International Passengers (thousands) |

2,442 |

2,197 |

|

|

5,160 |

4,583 |

|

|

Transit Passengers (thousands) |

588 |

546 |

|

|

1,292 |

1,189 |

|

|

Total Passengers (thousands)1 |

6,322 |

5,962 |

|

|

13,316 |

12,602 |

|

|

Cargo Volume (thousand tons) |

29.6 |

28.1 |

|

|

61.6 |

56.6 |

|

|

Total Aircraft Movements (thousands) |

64.2 |

62.9 |

|

|

134.8 |

132.7 |

|

|

1 Excluding Natal for comparison purposes, total passenger traffic was up |

Passenger Traffic Overview

Total passenger traffic increased by

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements increased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2025 vs. 2024)

|

Feb'25 |

Feb'24 |

% Var. |

|

YTD'25 |

YTD'24 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,798 |

3,461 |

|

|

8,016 |

7,200 |

|

|

505 |

442 |

|

|

990 |

902 |

|

|

1,172 |

1,192 |

- |

|

2,455 |

2,690 |

- |

|

209 |

206 |

|

|

452 |

437 |

|

|

344 |

352 |

- |

|

717 |

697 |

|

|

294 |

308 |

- |

|

687 |

676 |

|

TOTAL |

6,322 |

5,962 |

|

|

13,316 |

12,602 |

|

(1) |

Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|

|

|

|

|

|

|

|

Cargo Volume (tons) |

|

|

|

|

|

|

|

|

14,831 |

14,173 |

|

|

32,489 |

29,643 |

|

|

1,014 |

1,009 |

|

|

2,087 |

2,037 |

|

|

5,313 |

4,999 |

|

|

9,747 |

9,652 |

|

|

2,713 |

2,275 |

|

|

5,663 |

4,297 |

|

|

2,707 |

2,712 |

- |

|

5,518 |

5,665 |

- |

|

3,001 |

2,916 |

|

|

6,129 |

5,345 |

|

TOTAL |

29,580 |

28,083 |

|

|

61,633 |

56,640 |

|

Aircraft Movements |

|

|

|

|

|

|

|

|

36,941 |

36,174 |

|

|

78,057 |

75,526 |

|

|

4,581 |

4,046 |

|

|

9,105 |

8,405 |

|

|

11,394 |

11,394 |

|

|

22,466 |

24,059 |

- |

|

2,952 |

2,978 |

- |

|

6,851 |

6,813 |

|

|

5,956 |

5,986 |

- |

|

12,809 |

12,580 |

|

|

2,361 |

2,365 |

- |

|

5,509 |

5,326 |

|

TOTAL |

64,185 |

62,943 |

|

|

134,797 |

132,709 |

|

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20250318243846/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports