Corporación América Airports S.A. Reports March 2025 Passenger Traffic

Corporación América Airports (CAAP) reported strong passenger traffic growth in March 2025, with total passengers increasing 10.5% year-over-year to 7.05 million. The growth was driven by both domestic (+11.0%) and international (+12.7%) traffic improvements.

Argentina, accounting for 81% of total traffic growth, saw a 15.0% increase, with domestic traffic up 12.2% and international traffic rising 21.8%. Italy experienced 11.3% growth, while Brazil showed 4.6% improvement despite aviation challenges. Other markets including Uruguay (+0.5%), Ecuador (+1.1%), and Armenia (+0.6%) also posted positive results.

Cargo volume increased 9.6% YoY to 34,314 tons, with strong performances in Argentina (+20.3%) and Uruguay (+24.3%). Aircraft movements rose 6.0% YoY to 71,469, with positive contributions from all operating countries.

Corporación América Airports (CAAP) ha registrato una forte crescita del traffico passeggeri a marzo 2025, con un aumento totale del 10,5% su base annua a 7,05 milioni di passeggeri. La crescita è stata trainata sia dal traffico domestico (+11,0%) che da quello internazionale (+12,7%).

L'Argentina, che rappresenta l'81% della crescita totale del traffico, ha registrato un incremento del 15,0%, con il traffico domestico in aumento del 12,2% e quello internazionale del 21,8%. L'Italia ha mostrato una crescita dell'11,3%, mentre il Brasile ha segnato un miglioramento del 4,6% nonostante le difficoltà nel settore dell'aviazione. Anche altri mercati come Uruguay (+0,5%), Ecuador (+1,1%) e Armenia (+0,6%) hanno riportato risultati positivi.

Il volume del cargo è cresciuto del 9,6% su base annua raggiungendo 34.314 tonnellate, con ottime performance in Argentina (+20,3%) e Uruguay (+24,3%). I movimenti degli aeromobili sono aumentati del 6,0% su base annua a 71.469, con contributi positivi da tutti i paesi operativi.

Corporación América Airports (CAAP) reportó un fuerte crecimiento en el tráfico de pasajeros en marzo de 2025, con un aumento total del 10,5% interanual hasta 7,05 millones. El crecimiento fue impulsado tanto por el tráfico doméstico (+11,0%) como por el internacional (+12,7%).

Argentina, que representa el 81% del crecimiento total del tráfico, experimentó un aumento del 15,0%, con el tráfico doméstico creciendo un 12,2% y el internacional un 21,8%. Italia registró un crecimiento del 11,3%, mientras que Brasil mostró una mejora del 4,6% a pesar de los desafíos en la aviación. Otros mercados como Uruguay (+0,5%), Ecuador (+1,1%) y Armenia (+0,6%) también presentaron resultados positivos.

El volumen de carga aumentó un 9,6% interanual hasta 34.314 toneladas, con un desempeño destacado en Argentina (+20,3%) y Uruguay (+24,3%). Los movimientos de aeronaves crecieron un 6,0% interanual hasta 71.469, con contribuciones positivas de todos los países operativos.

Corporación América Airports (CAAP)는 2025년 3월 여객 수송량이 전년 대비 10.5% 증가한 705만 명을 기록하며 강한 성장세를 보였습니다. 이 성장은 국내선(+11.0%)과 국제선(+12.7%) 모두의 개선에 힘입은 결과입니다.

아르헨티나는 전체 교통량 증가의 81%를 차지하며 15.0% 증가했으며, 국내선은 12.2%, 국제선은 21.8% 상승했습니다. 이탈리아는 11.3% 성장했으며, 브라질은 항공업계의 어려움에도 불구하고 4.6%의 개선을 보였습니다. 우루과이(+0.5%), 에콰도르(+1.1%), 아르메니아(+0.6%) 등 다른 시장도 긍정적인 결과를 나타냈습니다.

화물량은 전년 대비 9.6% 증가한 34,314톤을 기록했으며, 아르헨티나(+20.3%)와 우루과이(+24.3%)에서 강한 실적을 보였습니다. 항공기 운항 횟수는 전년 대비 6.0% 증가한 71,469회로, 모든 운영 국가에서 긍정적인 기여를 했습니다.

Corporación América Airports (CAAP) a enregistré une forte croissance du trafic passagers en mars 2025, avec une augmentation totale de 10,5 % en glissement annuel pour atteindre 7,05 millions de passagers. Cette croissance a été portée par l'amélioration du trafic domestique (+11,0 %) et international (+12,7 %).

L'Argentine, représentant 81 % de la croissance totale du trafic, a connu une hausse de 15,0 %, avec un trafic domestique en hausse de 12,2 % et un trafic international en progression de 21,8 %. L'Italie a enregistré une croissance de 11,3 %, tandis que le Brésil a affiché une amélioration de 4,6 % malgré les défis du secteur aérien. D'autres marchés, notamment l'Uruguay (+0,5 %), l'Équateur (+1,1 %) et l'Arménie (+0,6 %), ont également présenté des résultats positifs.

Le volume de fret a augmenté de 9,6 % en glissement annuel pour atteindre 34 314 tonnes, avec de solides performances en Argentine (+20,3 %) et en Uruguay (+24,3 %). Les mouvements d'aéronefs ont progressé de 6,0 % en glissement annuel pour atteindre 71 469, avec des contributions positives de tous les pays opérateurs.

Corporación América Airports (CAAP) verzeichnete im März 2025 ein starkes Wachstum im Passagieraufkommen, mit einem Gesamtanstieg von 10,5 % im Jahresvergleich auf 7,05 Millionen Passagiere. Das Wachstum wurde sowohl durch den Inlandsverkehr (+11,0 %) als auch durch den internationalen Verkehr (+12,7 %) getragen.

Argentinien, das 81 % des Gesamtverkehrswachstums ausmacht, verzeichnete einen Anstieg von 15,0 %, wobei der Inlandsverkehr um 12,2 % und der internationale Verkehr um 21,8 % zulegte. Italien wuchs um 11,3 %, während Brasilien trotz Herausforderungen in der Luftfahrt eine Verbesserung von 4,6 % zeigte. Weitere Märkte wie Uruguay (+0,5 %), Ecuador (+1,1 %) und Armenien (+0,6 %) erzielten ebenfalls positive Ergebnisse.

Das Frachtvolumen stieg um 9,6 % im Jahresvergleich auf 34.314 Tonnen, mit starken Leistungen in Argentinien (+20,3 %) und Uruguay (+24,3 %). Die Flugbewegungen nahmen um 6,0 % im Jahresvergleich auf 71.469 zu, mit positiven Beiträgen aus allen operativen Ländern.

- Total passenger traffic increased 10.5% YoY, showing strong recovery

- International passenger traffic grew 12.7% YoY

- Argentina operations showed robust growth with 15.0% total traffic increase

- Cargo volume up 9.6% YoY with strong performance in key markets

- Aircraft movements increased 6.0% YoY across all countries

- Transit passengers declined 1.3% YoY

- Brazil's domestic aviation environment remains challenging with aircraft constraints

- Ecuador's domestic traffic growth by high airfare prices

- Cargo volume declined in Ecuador (-5.2%), Armenia (-6.3%), and Brazil (-3.9%)

Insights

Corporación América Airports' March 2025 traffic report demonstrates robust operational momentum with

Most compelling is Argentina's

The competitive landscape in Argentina is evolving favorably for CAAP, with low-cost carrier JetSMART's

Italy represents another growth engine with

The

CAAP's March traffic data reveals accelerating growth that should positively impact Q1 2025 financial performance. The

Revenue implications are substantial given the company's business model. Higher passenger volumes directly drive aeronautical fees, while the extended dwell time of international passengers (up

Argentina's dominant contribution to growth (

The cargo operation's

CAAP's geographic diversification provides resilience, with five of six operating countries showing positive passenger growth despite varying economic conditions. While Brazil continues facing industry headwinds, its

The consistent growth in multiple metrics—passengers, cargo, and aircraft movements—across diverse geographies signals sustainable operational improvement rather than temporary recovery, strengthening CAAP's long-term outlook.

Total passenger traffic up

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

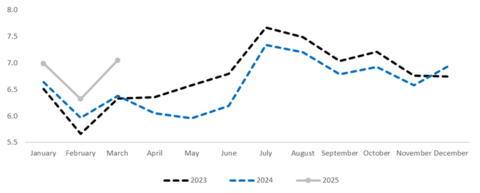

Monthly Passenger Traffic Performance (In million PAX)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2025 vs. 2024) |

|

||||||||

Statistics |

Mar'25 |

Mar'24 |

% Var. |

|

YTD’25 |

YTD'24 |

% Var. |

|

|

Domestic Passengers (thousands) |

3,775 |

3,401 |

|

|

10,639 |

10,230 |

|

|

|

International Passengers (thousands) |

2,675 |

2,373 |

|

|

7,835 |

6,956 |

|

|

|

Transit Passengers (thousands) |

601 |

609 |

- |

|

1,894 |

1,798 |

|

|

|

Total Passengers (thousands)1 |

7,051 |

6,383 |

|

|

20,368 |

18,984 |

|

|

|

Cargo Volume (thousand tons) |

34.3 |

31.3 |

|

|

95.9 |

87.9 |

|

|

|

Total Aircraft Movements (thousands) |

71.5 |

67.4 |

|

|

206.3 |

200.1 |

|

|

|

1 Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. Excluding Natal for comparison purposes, total passenger traffic YTD was up |

|||||||||

Passenger Traffic Overview

Total passenger traffic increased by

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements increased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2025 vs. 2024)

|

Mar'25 |

Mar'24 |

% Var. |

|

YTD'25 |

YTD'24 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

4,152 |

3,612 |

|

|

12,168 |

10,812 |

|

|

640 |

575 |

|

|

1,630 |

1,477 |

|

|

1,272 |

1,215 |

|

|

3,726 |

3,905 |

- |

|

203 |

202 |

|

|

654 |

639 |

|

|

417 |

412 |

|

|

1,134 |

1,110 |

|

|

368 |

366 |

|

|

1,055 |

1,043 |

|

TOTAL |

7,051 |

6,383 |

|

|

20,368 |

18,984 |

|

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|

|||||||

Cargo Volume (tons) |

|

|

|

||||

|

17,558 |

14,591 |

|

50,047 |

44,234 |

|

|

|

1,136 |

1,078 |

|

3,224 |

3,115 |

|

|

|

5,530 |

5,755 |

- |

15,277 |

15,407 |

- |

|

|

3,226 |

2,596 |

|

8,889 |

6,893 |

|

|

|

3,439 |

3,629 |

- |

8,957 |

9,294 |

- |

|

|

3,425 |

3,654 |

- |

9,554 |

8,999 |

|

|

TOTAL |

34,314 |

31,303 |

|

95,947 |

87,943 |

|

|

Aircraft Movements |

|

|

|

|

|

|

|

|

41,370 |

38,489 |

|

119,427 |

114,015 |

|

|

|

5,662 |

5,290 |

|

14,767 |

13,695 |

|

|

|

12,117 |

11,548 |

|

34,583 |

35,607 |

- |

|

|

3,060 |

2,907 |

|

9,911 |

9,720 |

|

|

|

6,434 |

6,407 |

|

19,243 |

18,987 |

|

|

|

2,826 |

2,763 |

|

8,335 |

8,089 |

|

|

TOTAL |

71,469 |

67,404 |

|

206,266 |

200,113 |

|

|

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20250414339105/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports S.A.