Corporación América Airports S.A. Reports June 2024 Passenger Traffic

Corporación América Airports S.A. (NYSE: CAAP) reported a 8.9% year-on-year decrease in passenger traffic for June 2024. Excluding Natal airport, the decline was 6.7%. Key highlights include:

- Domestic traffic down 20.3% YoY

- International traffic up 9.4% YoY

- Cargo volume increased by 4.3% YoY

- Aircraft movements decreased by 10.5% YoY

Notable country performances:

- Argentina: Total traffic down 14.1%, with domestic traffic declining 22.3%

- Italy: Traffic grew 15.2%, driven by international passengers

- Brazil: Traffic decreased 14.9% (4.4% excluding Natal)

- Uruguay: Strong 21.1% YoY increase in traffic

- International passenger traffic up 9.4% YoY

- Cargo volume increased by 4.3% YoY

- Italy's passenger traffic grew by 15.2% YoY

- Uruguay's passenger traffic increased by 21.1% YoY

- New routes launched in Argentina and Uruguay

- Total passenger traffic down 8.9% YoY (6.7% excluding Natal)

- Domestic passenger traffic decreased 20.3% YoY

- Aircraft movements decreased by 10.5% YoY

- Argentina's total passenger traffic declined 14.1% YoY

- Brazil's passenger traffic decreased by 14.9% YoY (4.4% excluding Natal)

- Ecuador's passenger traffic decreased by 6.6% YoY

Insights

Passenger Traffic: A Mixed Picture

The decline in total passenger traffic by

On the other hand, the international passenger traffic increase of

Financial Implications

The reduction in total passenger numbers might negatively impact revenue, although the rise in international passengers could partially offset this if international travel generally results in higher ticket prices and ancillary spending. However, the overall decline could strain profit margins.

A short-term concern involves operational costs remaining constant or increasing despite lower passenger volumes. Long-term, if domestic traffic continues to falter, the company might need to reassess its operational strategies and market focus.

Industry Dynamics and Regional Variations

The varied regional performance is telling of the broader industry dynamics. Argentina's domestic decline, exacerbated by the end of the 'Previaje' program and flight cancellations, signals underlying economic instability. Meanwhile, increased international routes in Italy and Uruguay reflect robust market demand in these regions.

The improvement in international traffic for most regions could hint at stronger demand for international travel, despite regional economic challenges. The rise in cargo volume by

Strategic Insights

For investors, understanding these regional disparities is key. While the overall passenger decline is a concern, the growth in international traffic places CAAP in a potentially advantageous position to capitalize on international demand recovery post-COVID. Long-term strategies might involve expanding international routes and optimizing domestic operations.

Insights into the performance in Italy and Uruguay also highlight where to look for growth and stability amid otherwise turbulent results. This regional focus could be beneficial in portfolio diversification.

Total passenger traffic down

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

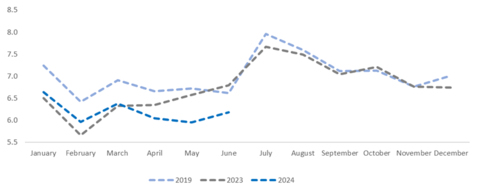

Monthly Passenger Traffic Performance (In million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|||||||||

Statistics |

Jun'24 |

Jun'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

||

Domestic Passengers (thousands) |

3,039 |

3,812 |

- |

|

19,337 |

21,679 |

- |

||

International Passengers (thousands) |

2,595 |

2,371 |

|

|

14,441 |

13,065 |

|

||

Transit Passengers (thousands) |

554 |

609 |

- |

|

3,399 |

3,482 |

- |

||

Total Passengers (thousands)1 |

6,188 |

6,792 |

- |

|

37,177 |

38,226 |

- |

||

Cargo Volume (thousand tons) |

30.5 |

29.3 |

|

|

183.0 |

175.9 |

|

||

Total Aircraft Movements (thousands) |

65.3 |

73.0 |

- |

|

394.6 |

414.7 |

- |

||

1 Excluding Natal for comparison purposes, total passenger traffic was down |

|||||||||

Passenger Traffic Overview

Total passenger traffic declined

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements decreased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||

|

Jun'24 |

Jun'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,011 |

3,506 |

- |

|

19,881 |

20,531 |

- |

|

949 |

824 |

|

|

4,122 |

3,610 |

|

|

1,203 |

1,415 |

- |

|

7,413 |

8,372 |

- |

|

163 |

135 |

|

|

1,120 |

930 |

|

|

371 |

398 |

- |

|

2,284 |

2,385 |

- |

|

490 |

514 |

- |

|

2,356 |

2,399 |

- |

TOTAL |

6,188 |

6,792 |

- |

|

37,177 |

38,226 |

- |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||

|

|||||||||||

Cargo Volume (tons) |

|

||||||||||

|

15,777 |

15,072 |

|

94,096 |

90,687 |

|

|||||

|

1,047 |

1,163 |

- |

6,359 |

6,735 |

- |

|||||

|

5,702 |

5,450 |

|

30,898 |

31,534 |

- |

|||||

|

2,615 |

2,834 |

- |

15,214 |

15,950 |

- |

|||||

|

2,804 |

2,229 |

|

19,094 |

15,934 |

|

|||||

|

2,575 |

2,525 |

|

17,343 |

15,101 |

|

|||||

TOTAL |

30,519 |

29,273 |

|

183,005 |

175,941 |

|

|||||

Aircraft Movements |

|

|

|

|

|

|

|||||

|

33,243 |

37,928 |

- |

214,623 |

223,141 |

- |

|||||

|

8,766 |

8,265 |

|

38,222 |

35,042 |

|

|||||

|

11,361 |

13,965 |

- |

69,857 |

79,654 |

- |

|||||

|

2,206 |

2,249 |

- |

16,567 |

16,557 |

|

|||||

|

6,125 |

6,518 |

- |

37,404 |

39,677 |

- |

|||||

|

3,642 |

4,062 |

- |

17,960 |

20,647 |

- |

|||||

TOTAL |

65,343 |

72,987 |

- |

394,633 |

414,718 |

- |

|||||

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20240716472338/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports