Homes.com Report: Home Price Increases Slowed for the Third Consecutive Month in March

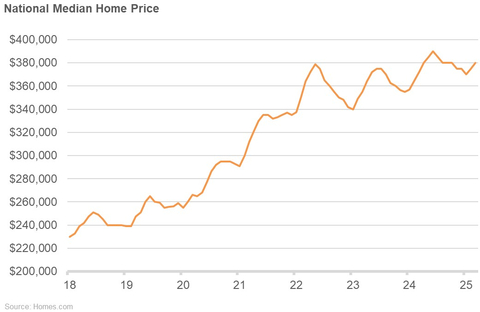

Homes.com's March 2025 housing market report reveals a continued slowdown in home price growth for the third consecutive month. The median home price increased 2.2% year-over-year to $380,000, compared to 2.7% in February and 3.6% in January.

Key findings include:

- Price appreciation has continued for 21 consecutive months, peaking at 5.6% in December

- The Northeast and Midwest markets showed the strongest price growth

- Cleveland led with over 10% price increase, followed by Chicago, New York, and Pittsburgh

- Four markets experienced price declines: Orlando, Jacksonville, San Francisco, and Tampa

The market shows signs of shifting from a seller's to a buyer's market, supported by increased housing inventory and slightly lower mortgage rates in March, which improve affordability and buyer leverage.

Il rapporto sul mercato immobiliare di Homes.com di marzo 2025 rivela un continuo rallentamento nella crescita dei prezzi delle abitazioni per il terzo mese consecutivo. Il prezzo mediano delle abitazioni è aumentato del 2,2% rispetto all'anno precedente, raggiungendo i 380.000 dollari, rispetto al 2,7% di febbraio e al 3,6% di gennaio.

Le principali scoperte includono:

- Apprezzamento dei prezzi che continua per 21 mesi consecutivi, raggiungendo il picco del 5,6% a dicembre

- I mercati del Northeast e del Midwest hanno mostrato la crescita dei prezzi più forte

- Cleveland ha guidato con un aumento dei prezzi di oltre il 10%, seguita da Chicago, New York e Pittsburgh

- Quattro mercati hanno registrato cali dei prezzi: Orlando, Jacksonville, San Francisco e Tampa

Il mercato mostra segni di passaggio da un mercato a favore dei venditori a uno a favore degli acquirenti, supportato da un aumento dell'inventario di abitazioni e da tassi ipotecari leggermente più bassi a marzo, che migliorano l'accessibilità e il potere contrattuale degli acquirenti.

El informe del mercado de viviendas de Homes.com de marzo de 2025 revela una desaceleración continua en el crecimiento de los precios de las viviendas por tercer mes consecutivo. El precio medio de las viviendas aumentó un 2,2% interanual, alcanzando los 380,000 dólares, en comparación con el 2,7% en febrero y el 3,6% en enero.

Los hallazgos clave incluyen:

- La apreciación de precios ha continuado durante 21 meses consecutivos, alcanzando un máximo del 5,6% en diciembre

- Los mercados del Noreste y del Medio Oeste mostraron el crecimiento de precios más fuerte

- Cleveland lideró con un aumento de precios de más del 10%, seguida de Chicago, Nueva York y Pittsburgh

- Cuatro mercados experimentaron caídas de precios: Orlando, Jacksonville, San Francisco y Tampa

El mercado muestra signos de cambio de un mercado de vendedores a uno de compradores, apoyado por un aumento en el inventario de viviendas y tasas hipotecarias ligeramente más bajas en marzo, lo que mejora la asequibilidad y el poder de negociación de los compradores.

Homes.com의 2025년 3월 주택 시장 보고서는 세 번째 연속으로 주택 가격 성장의 지속적인 둔화를 보여줍니다. 중위 주택 가격은 전년 대비 2.2% 증가하여 380,000달러에 달했으며, 이는 2월의 2.7%와 1월의 3.6%와 비교됩니다.

주요 발견 사항은 다음과 같습니다:

- 가격 상승이 21개월 연속으로 지속되었으며, 12월에 5.6%로 정점을 찍었습니다.

- 북동부와 중서부 시장이 가장 강력한 가격 성장을 보였습니다.

- 클리블랜드가 10% 이상의 가격 상승으로 선두를 달리며, 시카고, 뉴욕, 피츠버그가 뒤를 이었습니다.

- 올랜도, 잭슨빌, 샌프란시스코, 탬파의 네 개 시장은 가격 하락을 경험했습니다.

시장은 판매자 시장에서 구매자 시장으로의 전환 조짐을 보이며, 이는 3월에 주택 재고 증가와 약간 낮아진 모기지 금리에 의해 뒷받침되어 접근성과 구매자의 협상력을 향상시킵니다.

Le rapport sur le marché immobilier de Homes.com de mars 2025 révèle un ralentissement continu de la croissance des prix des maisons pour le troisième mois consécutif. Le prix médian des maisons a augmenté de 2,2% par rapport à l'année précédente, atteignant 380 000 dollars, contre 2,7% en février et 3,6% en janvier.

Les principales conclusions incluent :

- L'appréciation des prix se poursuit depuis 21 mois consécutifs, atteignant un pic de 5,6% en décembre

- Les marchés du Nord-Est et du Midwest ont montré la plus forte croissance des prix

- Cleveland a mené avec une augmentation de prix de plus de 10%, suivie de Chicago, New York et Pittsburgh

- Quatre marchés ont connu des baisses de prix : Orlando, Jacksonville, San Francisco et Tampa

Le marché montre des signes de passage d'un marché de vendeurs à un marché d'acheteurs, soutenu par une augmentation de l'inventaire de logements et une légère baisse des taux hypothécaires en mars, ce qui améliore l'accessibilité et le pouvoir de négociation des acheteurs.

Der Immobilienmarktbericht von Homes.com für März 2025 zeigt eine anhaltende Verlangsamung des Anstiegs der Immobilienpreise im dritten Monat in Folge. Der Medianpreis für Immobilien stieg im Jahresvergleich um 2,2% auf 380.000 Dollar, verglichen mit 2,7% im Februar und 3,6% im Januar.

Wichtige Ergebnisse sind:

- Die Preissteigerung setzte sich 21 Monate in Folge fort und erreichte im Dezember einen Höchststand von 5,6%

- Die Märkte im Nordosten und Mittleren Westen zeigten das stärkste Preiswachstum

- Cleveland führte mit einem Preisaufschlag von über 10%, gefolgt von Chicago, New York und Pittsburgh

- Vier Märkte erlebten Preisrückgänge: Orlando, Jacksonville, San Francisco und Tampa

Der Markt zeigt Anzeichen eines Wechsels von einem Verkäufer- zu einem Käufermarkt, unterstützt durch einen Anstieg des Wohnungsangebots und leicht gesunkene Hypothekenzinsen im März, was die Erschwinglichkeit und die Verhandlungsposition der Käufer verbessert.

- None.

- None.

The median home price increased

Homes.com National Median Home Price March 2025

According to the preliminary estimates, home prices continued to go up in March, but the rate of price increases slowed for the third consecutive month. Year-over-year, prices rose

In addition to the slowing price growth in recent months, there was an increase in the number of homes for sale and a small decline in mortgage rates in March. Lower mortgage rates make buying a home more affordable, and more homes for sale equates to higher leverage for homebuyers. Combined, these factors point to a slight shift away from a seller's market and towards a buyer's market.

The Northeast and Midwest continued to see the strongest price appreciation in March. Of the 10 markets with the largest price increases, four were in the Northeast, and four were in the Midwest.

The data shared in this report could change slightly once all home sales are accounted for. Melina Duggal, Senior Director of Market Analytics at CoStar Group and Homes.com, is available for interviews to provide insights on these data and the residential real estate market in general. For more information and insights on the latest home buying and selling market trends, visit Homes.com.

About Homes.com

Homes.com is the fastest-growing residential real estate marketplace and the second largest portal in

Homes.com is the first major

The Homes.com Network reached an audience of 110 million average monthly unique visitors in the fourth quarter ending December 31, 2024.** Consumer brand awareness skyrocketed from

* Based on internal analyses comparing Members to non-Members on Homes.com.

** Homes.com Network (which includes Homes.com, the Apartments Network, and the Land Network) average monthly unique visitors for the quarter ended December 31, 2024, according to Google Analytics.

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; and Homes.com, the fastest-growing residential real estate marketplace. CoStar Group’s industry-leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible, STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the

CoStar Group’s websites attracted over 134 million average monthly unique visitors in the fourth quarter of 2024, serving clients around the world. Headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250410980324/en/

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com

Source: CoStar Group