Corporación América Airports S.A. Reports January 2024 Passenger Traffic

- None.

- None.

Insights

The reported increase in passenger traffic for Corporación América Airports S.A. (CAAP) is a positive indicator for the aviation sector, suggesting a continued recovery trajectory towards pre-pandemic levels. The data shows a nuanced recovery, with international passenger traffic slightly exceeding pre-pandemic levels, which could signal a shift in consumer behavior favoring international travel or a rebound in global business activities. However, the mixed performance across various countries, such as the notable recovery in Armenia and the decline in Brazil, points to uneven economic recovery and possibly differing levels of consumer confidence or restrictions related to travel.

For investors, the regional variances in traffic recovery could influence strategic decisions on asset allocation within the aviation industry. The increased cargo volume, particularly in Argentina, Ecuador and Uruguay, also reflects broader economic activity and could be a leading indicator for trade and commerce health in these regions. The long-term implication for stakeholders includes potential infrastructure investments to accommodate the changing patterns of passenger and cargo traffic.

An 8.4% year-over-year increase in cargo volume is a strong performance metric, especially considering the overall cargo volume has not yet reached pre-pandemic levels. This growth may reflect an increase in trade activity or an optimization of cargo operations by CAAP. The financial health of the company could benefit from this uptick in cargo volume, as cargo operations often provide a stable revenue stream, less susceptible to the volatility seen in passenger traffic.

However, the overall passenger traffic still being below pre-pandemic levels by 8.3% indicates that while there is growth, the company has not fully recovered from the pandemic's impact. This could affect the company's short-term revenue and profitability. The detailed breakdown of passenger traffic growth in key markets like Argentina and Italy, versus the decline in markets like Brazil, provides a more granular understanding of regional performance, which is critical for investors assessing the company's growth prospects and risk factors.

The reported figures could be indicative of broader economic trends, such as the resurgence of international trade and tourism. The differential recovery rates among domestic and international passengers could reflect varying degrees of economic resilience and public health strategies in response to the pandemic. For instance, the significant YoY increase in international traffic in Italy might be associated with the country's appeal as a tourist destination and its economic ties within the European Union.

Conversely, the financial and aircraft constraints impacting Brazil's passenger traffic suggest underlying economic challenges that extend beyond the aviation sector. These challenges could have broader implications for regional economic stability and growth prospects. The data provided by CAAP could therefore serve as an economic barometer for the regions in which it operates, offering insights into the post-pandemic economic recovery and the resilience of the aviation industry as a whole.

Total passenger traffic up

International passenger traffic

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

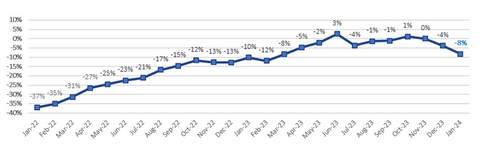

2-Year Passenger Traffic Monthly Performance (vs. 2019) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|||

Statistics |

Jan'24 |

Jan'23 |

% Var. |

Domestic Passengers (thousands) |

3,610 |

3,639 |

- |

International Passengers (thousands) |

2,387 |

2,136 |

|

Transit Passengers (thousands) |

643 |

732 |

- |

Total Passengers (thousands) |

6,640 |

6,507 |

|

Cargo Volume (thousand tons) |

28.6 |

26.3 |

|

Total Aircraft Movements (thousands) |

69.8 |

69.1 |

|

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2019) |

|||

Statistics |

Jan'24 |

Jan'19 |

% Var. |

Domestic Passengers (thousands) |

3,610 |

4,010 |

- |

International Passengers (thousands) |

2,387 |

2,380 |

|

Transit Passengers (thousands) |

643 |

850 |

- |

Total Passengers (thousands) |

6,640 |

7,240 |

- |

Cargo Volume (thousand tons) |

28.6 |

33.0 |

- |

Total Aircraft Movements (thousands) |

69.8 |

74.7 |

- |

(1) |

Note that preliminary passenger traffic figures for 2019, as well as January 2020 for Ezeiza Airport, in |

(2) |

Cargo volumes in |

Passenger Traffic Overview

Total passenger traffic grew

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased

Aircraft movements increased

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023)

|

Jan'24 |

Jan'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

3,738 |

3,585 |

|

|

459 |

423 |

|

|

1,497 |

1,592 |

- |

|

232 |

183 |

|

|

345 |

361 |

- |

|

368 |

363 |

|

TOTAL |

6,640 |

6,507 |

|

(1) |

See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

Cargo Volume (tons) |

|

|

|

|

15,471 |

13,359 |

|

|

1,029 |

1,052 |

- |

|

4,653 |

4,958 |

- |

|

2,022 |

1,985 |

|

|

2,953 |

2,747 |

|

|

2,429 |

2,248 |

|

TOTAL |

28,557 |

26,348 |

|

Aircraft Movements |

|

|

|

|

39,352 |

37,642 |

|

|

4,359 |

4,113 |

|

|

12,665 |

13,602 |

- |

|

3,835 |

3,767 |

|

|

6,594 |

6,631 |

- |

|

2,961 |

3,380 |

- |

TOTAL |

69,766 |

69,135 |

|

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2019)

|

Jan'24 |

Jan'19 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

3,738 |

3,853 |

- |

|

459 |

460 |

- |

|

1,497 |

1,866 |

- |

|

232 |

247 |

- |

|

345 |

353 |

- |

|

368 |

212 |

|

|

|

249 |

- |

TOTAL |

6,640 |

7,240 |

- |

(1) |

See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

Cargo Volume (tons) |

|

|

|

|

15,471 |

18,845 |

- |

|

1,029 |

1,027 |

|

|

4,653 |

6,042 |

- |

|

2,022 |

2,121 |

- |

|

2,953 |

3,733 |

- |

|

2,429 |

859 |

|

|

- |

370 |

- |

TOTAL |

28,557 |

32,996 |

- |

Aircraft Movements |

|

|

|

|

39,352 |

40,140 |

- |

|

4,359 |

4,644 |

- |

|

12,665 |

14,670 |

- |

|

3,835 |

3,941 |

- |

|

6,594 |

7,154 |

- |

|

2,961 |

1,948 |

|

|

- |

2,164 |

- |

TOTAL |

69,766 |

74,661 |

- |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 53 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20240216193710/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports