BTU Acquires Two Extensive Gold Properties in the Active Wawa Gold District; The Echum Gold Project Adjacent to Alamos Gold and The Hubcap Gold Project Adjacent to Red Pine Exploration

BTU Metals Corp. has acquired two extensive gold properties in the Wawa Gold District, the Echum Gold Project adjacent to Alamos Gold and the Hubcap Gold Project adjacent to Red Pine Exploration. Each project covers historic gold mineralization areas in northern Ontario. The properties have no ongoing payments, net smelter royalties not exceeding 2%, and excellent infrastructure proximity. BTU CEO Paul Wood expressed excitement over the projects' potential and plans for exploration. The acquisition includes 763 mining claims over 16,048 hectares, with a consideration of CAD$25,000 and 5 million BTU treasury common shares.

Acquisition of two extensive gold properties in the active Wawa Gold District.

Properties have no ongoing payments and are subject to net smelter royalties not exceeding 2%.

Excellent proximity to infrastructure, facilitating exploration efforts.

CEO Paul Wood expresses excitement over the projects' potential and plans for exploration.

Consideration for the acquisition includes CAD$25,000 and 5 million BTU treasury common shares.

exploration conducted on the properties in recent years with only two drill holes in the past 6 years.

Transaction subject to customary closing conditions and regulatory approvals, potentially causing delays.

Potential dilution for shareholders with the issuance of 5 million BTU treasury common shares as part of the consideration.

VANCOUVER, BC / ACCESSWIRE / May 7, 2024 / BTU METALS CORP. ("BTU" or the "Company") (TSXC:BTU)(OTCQB:BTUMF) announces it has entered into a purchase and sale agreement pursuant to which the Company will purchase, upon closing, a

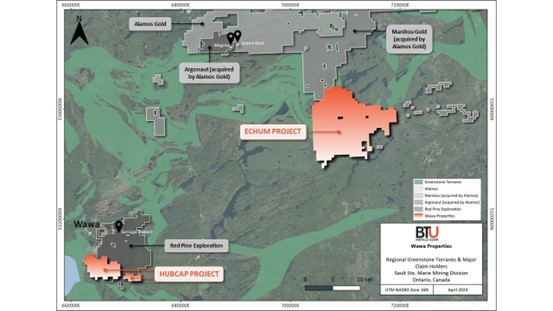

Each of the projects covers areas of historic gold mineralization and neither project has been the subject of significant or comprehensive exploration in recent years. The Echum property is adjacent along trend of the Alamos Gold Inc. ("Alamos") Island Gold Mine property and the Hubcap property is adjacent along the geological trend of the gold mineralization being drill tested extensively by Red Pine Exploration Inc. ("Red Pine").

Figure 1: Map showing the Echum and Hubcap properties and Their Location in Relation to the Properties of Red Pine and Alamos

Asset and Area Highlights

- Each project is adjacent to an active, large scale gold exploration/development project

- Both projects host historic gold mineralization[1]

- Echum, the northern property, covers the extension of geological host rocks that occur on the adjacent Alamos Island Gold Mine property

- Hubcap, the southern property, just southeast of the town of Wawa covers the extension of the geological trends on the Red Pine property, starting approximately 1200m from their historic Darwin Grace gold mine

- The Hubcap project includes the historic Centennial Gold Mine where underground mine work was last undertaken in the 1930's

- The properties, to be purchased

100% , have no ongoing or contingent payments, and are subject only to net smelter royalties of not more than2% (on the majority of the claims the royalty can be reduced to not more than1% ) - Only two drill holes have been drilled on the entire property position in the past 6 years

- Existing data sets and work by neighbouring companies will allow the Company to quickly vector in on the best exploration targets

- Both projects have excellent proximity to infrastructure - roads, highways (including Trans Canada Highway), town of Wawa, airport, water, power, mining aware population and mining labour pool

- No work commitments other than ongoing assessment work requirements with the Ontario government

- The properties cover more than 750 mining claims over a total of 16,048 hectares

- Alamos has acquired other exploration/development projects in the area over the past 2 years and also purchased a

19.9% interest in Red Pine in late 2019

[1] Mineralization on neighboring projects are not indicative of mineralization on the Echum Gold Project or the Hubcap Gold Project

BTU CEO Paul Wood commented; "We are excited to get in the field on both the Echum and Hubcap projects as soon as possible. Based on previous work on the projects which included surface exploration, drilling and, in the case of one area on the Hubcap project, mining, management believes that these are projects of considerable merit. We are funded and intend to start exploration this summer. At the same time Kinross continues to progress early exploration work at Dixie Halo project under the terms of the 2023 Exploration Option Agreement. Dixie Halo is located adjacent to their world class Great Bear project outside Red Lake. We will also continue to pursue additional high-quality projects in strong jurisdictions."

Asset Acquisition

The consideration payable by BTU on closing for a

This transaction is subject to customary closing conditions, including corporate and regulatory approvals.

The Acquisition is an arm's length transaction pursuant to the policies of the TSX-V and is subject to approval of the TSX-V and the shareholders of the vendor which is anticipated to be received in not more than 60 days.

About the Purchased Properties

The Company entered into a property purchase and sale agreement with Kingsview Minerals Ltd., pursuant to which BTU will purchase an undivided

Bruce Durham, P. Geo., a qualified person as defined by National Instrument 43-101 has reviewed and approved the technical information in this press release.

About BTU

BTU Metals Corp. is a junior mining exploration company looking to acquire high quality exploration projects to add to its portfolio for the benefit of its stakeholders. The Company's main asset is the Dixie Halo Project located in Red Lake, Ontario immediately adjacent to the Great Bear Project. The Company has no debt, no property obligations and maintains a cash balance of approximately

ON BEHALF OF THE BOARD

"Paul Wood"

Paul Wood, CEO, Director

pwood@btumetals.com

BTU Metals Corp.

Telephone: 1-604-683-3995

Toll Free: 1-888-945-4770

Cautionary Statement

Trading in the securities of the Company should be considered highly speculative. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. The information in this release about future plans and objectives of the Company are forward-looking information. Other forward-looking information includes but is not limited to information concerning: the intentions, plans and future actions of the Company.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: risks relating to the global economic climate; dilution; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. The Company has also assumed that no significant events occur outside of the normal course of business. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.

SOURCE: BTU Metals Corp.

View the original press release on accesswire.com