Update on BTU Dixie Halo Project - Kinross (Great Bear) Option

- BTU Metals Corp. provides updates on the Dixie Halo Project exploration work with Kinross Gold Corporation.

- Kinross allocated $85 million for the Great Bear Project in 2024, adjacent to the Dixie Halo Project.

- Deep drill hole results on the Great Bear Project revealed an intersection of 389.57 g/t gold.

- GBR plans re-logging, sampling, and a drilling program on the Dixie Halo Project.

- BTU received a $300,000 payment from GBR and has a cash balance of approximately $1.7 million.

- None.

VANCOUVER, BC / ACCESSWIRE / March 13, 2024 / BTU METALS CORP. ("BTU" or the "Company") (TSX-V:BTU)(OTCQB:BTUMF) announces updates on the exploration work completed on the Dixie Halo Project optioned to Kinross Gold Corporation (K-TSX). Kinross holds their interests in the area in a wholly owned subsidiary Great Bear Resources Ltd. ("GBR"). The Company's Dixie Halo project is a strategic, large land position adjacent to the world class Great Bear gold deposit southeast of the main Red Lake Gold camp area in northwestern Ontario.

The Dixie Halo Project is located adjacent to Kinross' Great Bear project (the "Great Bear Project") where Kinross has budgeted

Exploration Summary and Exploration Plan for 2024

A state-of-the-art airborne magnetic survey was completed in late 2023 using the same contractor (Geotech Ltd.) and the same airborne geophysical system as was used at the Great Bear project to provide a seamless, consistent high-quality airborne magnetic dataset to generate a solid base for updated geophysical interpretation and geological correlation across the Great Bear and Dixie Halo projects. Detailed interpretation of the data is ongoing.

GBR is continuing work under the Option Agreement including an ongoing program of re-logging and sampling of all of the BTU drill core using its ever-expanding experience and geological knowledge they have amassed in relation to the gold mineralization at the Great Bear project. GBR will use the sampling protocols used at Great Bear to provide a more comprehensive and complete understanding of the geology and alteration on the Dixie Halo project and to provide an expanded basis for the correlation of geological units and alteration throughout the area.

GBR plans to complete a geological review and sampling of various outcrop areas of interest on Dixie Halo including some of the areas worked in the past by BTU.

As the various review, relogging and sampling results are received and compiled by GBR, an initial core drilling program will be planned and GBR expects to be in a position to execute an initial drill program once it has secured an exploration permit from the Ontario government.

Under the option agreement GBR is required to spend not less than

BTU CEO Paul Wood commented; "We are very pleased to be working with Kinross and the Great Bear project team as they carry on the exploration of the Dixie Halo project. We are excited to be involved as they apply their expertise to continue the evaluation of the best places to explore on the Dixie Halo project. We look forward to them defining the best available gold targets and then drill testing those targets. The knowledge and expertise they bring to the further evaluation of the Dixie Halo project are invaluable, given they are the experts at defining the structure, alteration and gold mineralization in the area."

BTU has now received the

February 2023 transactions with GBR

The Transactions entered into by BTU and GBR, in late February 2023 included: (i) a purchase agreement pursuant to which GBR acquired from BTU certain unpatented mining claims located in the Kenora District of Ontario, with BTU continuing to participate in those lands through a newly created royalty payable to BTU; (ii) an option agreement, which provides GBR with an option to earn a

Asset Acquisition

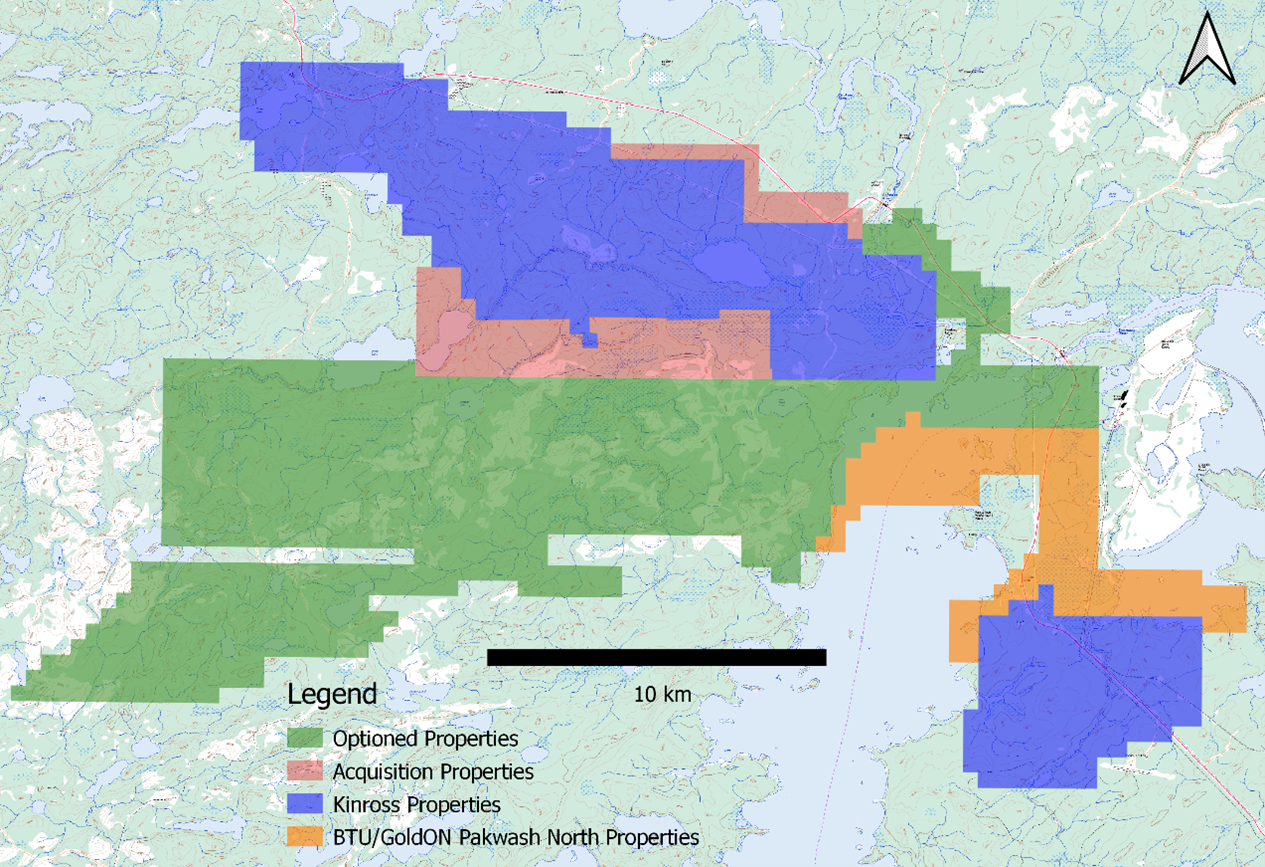

The Company entered into a purchase agreement with GBR, a wholly-owned subsidiary of Kinross, for the purchase (the "Acquisition") of certain unpatented mining claims located in the Kenora District of Ontario (the "Acquisition Properties"). The Acquisition Properties had a total area of 2,637 hectares and consisted of 39 Boundary Cell Mining Claims and 76 Single Cell Mining Claims located to the south of the Great Bear Project, as well as 2 Multi-cell Mining Claims located to the north of the Great Bear Project. BTU holds Net Smelter Royalties from

The consideration payable by GBR pursuant to the Acquisition was: (i) CAD

Figure 1: Map showing the Acquisition Properties, Optioned Properties ase well as Kinross' properties and the BTU/GoldON Pakwash properties. The Great Bear Project mineral resource is located on the northern Kinross property on this map.

The Acquisition was an arm's length transaction pursuant to the policies of the TSX-V.

About the Option Agreement

The Company entered into a property option agreement (the "Option Agreement") with GBR, pursuant to which GBR has been granted the right to acquire an undivided

Pursuant to the terms of the Option Agreement, GBR has the option to acquire the

In connection with a private placement in February 2023, GBR acquired 25,000,000 Common Shares. Pursuant to the private placement GBR held an aggregate of 25,000,000 Common Shares representing approximately

About BTU

BTU Metals Corp. is a junior mining exploration company focused on the Dixie Halo Project located in Red Lake, Ontario immediately adjacent to the Great Bear Project. The Company has no debt, no property obligations and maintains a cash balance of approximately

ON BEHALF OF THE BOARD

"Paul Wood"

Paul Wood, CEO, Director

pwood@btumetals.com

BTU Metals Corp.

Telephone: 1-604-683-3995

Toll Free: 1-888-945-4770

Cautionary Statement

Trading in the securities of the Company should be considered highly speculative. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. The information in this release about future plans and objectives of the Company are forward-looking information. Other forward-looking information includes but is not limited to information concerning: the intentions, plans and future actions of the Company.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: risks relating to the global economic climate; dilution; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. The Company has also assumed that no significant events occur outside of the normal course of business. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.

SOURCE: BTU Metals Corp.

View the original press release on accesswire.com