Benton Purchases Strategic Ground Directly Along Strike of the South Pond Gold Deposit from Noble Minerals

Benton Resources (TSXV:BNTRF) agreed to acquire 100% of Noble Mineral Exploration's Island Pond Property for $30,000 CAD cash plus 1,000,000 common shares, subject to TSXV approval. The property lies directly north of Benton's South Pond Gold Zone and could add >1000 m to the current 2.7 km mineralized trend.

Benton will assume an underlying 2% NSR (buyback option $1.5M) and Noble retains a 1% NSR with a ROFR. Benton plans immediate prospecting and geophysics. To date Benton drilled 23,300 m at Great Burnt and South Pond with multiple gold intercepts up to 74.20 m of 1.43 g/t Au.

Benton Resources (TSXV:BNTRF) ha concordato di acquisire il 100% della Island Pond Property di Noble Mineral Exploration per 30.000 CAD in contanti più 1.000.000 azioni ordinarie, soggetto all'approvazione della TSXV. La proprietà si trova direttamente a nord della South Pond Gold Zone di Benton e potrebbe aggiungere >1000 m al corrente trend mineralizzato di 2,7 km. Benton assumerà una NSR del 2% (opzione di riacquisto a 1,5 M) e Noble manterrà una NSR dell'1% con ROFR. Benton prevede prospezioni e geofisica immediate. Ad oggi Benton ha effettuato trivellazioni per 23.300 m a Great Burnt e South Pond con numerosi intercetti d'oro fino a 74,20 m di 1,43 g/t Au.

Benton Resources (TSXV:BNTRF) acordó adquirir el 100% de la propiedad Island Pond de Noble Mineral Exploration por CAD 30,000 en efectivo más 1,000,000 de acciones ordinarias, sujeto a la aprobación de TSXV. La propiedad se encuentra directamente al norte de la South Pond Gold Zone de Benton y podría sumar >1000 m al actual tramo mineralizado de 2,7 km. Benton asumirá un NSR del 2% subyacente (opción de recompra 1,5 M) y Noble retendrá un NSR del 1% con ROFR. Benton planea prospección y geofísica inmediatas. Hasta la fecha Benton ha taladrado 23.300 m en Great Burnt y South Pond con múltiples interceptos de oro de hasta 74,20 m de 1,43 g/t Au.

Benton Resources (TSXV:BNTRF)가 Noble Mineral Exploration의 Island Pond Property를 현금 CAD 30,000 및 1,000,000 주식으로 100% 인수하는 데 합의했으며, TSXV의 승인을 조건으로 합니다. 이 자산은 Benton의 South Pond Gold Zone 바로 북쪽에 위치하며 현재의 2.7 km 광물화 트렌드에 >1000 m를 더할 수 있습니다. Benton은 기본 2% NSR을 인수하고(바이백 옵션 1.5M), Noble은 ROFR이 있는 1% NSR을 보유합니다. Benton은 즉시 시추 및 지구물리 조사를 계획하고 있습니다. 지금까지 Benton은 Great Burnt와 South Pond에서 23,300 m를 시추했으며 여러 골드 인터셉트가 74.20 m of 1.43 g/t Au까지 기록되었습니다.

Benton Resources (TSXV:BNTRF) a accepté d'acquérir 100 % de la propriété Island Pond de Noble Mineral Exploration pour 30 000 CAD en espèces plus 1 000 000 d'actions ordinaires, sous réserve de l'approbation du TSXV. La propriété se situe juste au nord de la zone aurifère South Pond de Benton et pourrait ajouter >1000 m à la tendance minéralisée actuelle de 2,7 km. Benton assumera une NSR sous-jacente de 2% (option de rachat 1,5 M) et Noble conservera une NSR de 1% avec ROFR. Benton prévoit des travaux de prospection et de géophysique immédiats. À ce jour, Benton a foré 23 300 m à Great Burnt et South Pond avec de multiples intercepts d'or jusqu'à 74,20 m de 1,43 g/t Au.

Benton Resources (TSXV:BNTRF) hat zugestimmt, 100% der Island Pond Property von Noble Mineral Exploration für CAD 30.000 Barzahlungen plus 1.000.000 Stammaktien zu erwerben, vorbehaltlich der Genehmigung durch die TSXV. Die Property liegt direkt nördlich der Bentons South Pond Gold Zone und könnte die derzeitige 2,7 km lange mineralisierte Trendlinie um >1000 m erweitern. Benton wird eine zugrundeliegende 2% NSR übernehmen (Wiedererwerbsoption 1,5 M) und Noble behält eine 1% NSR mit ROFR. Benton plant sofort Prospektion und Geophysik. Bis heute hat Benton 23.300 m in Great Burnt und South Pond gebohrt mit mehreren Gold-Intercepts bis zu 74,20 m bei 1,43 g/t Au.

Benton Resources (TSXV:BNTRF) وافقت على الاستحواذ على 100% من عقار Island Pond الخاص بشركة Noble Mineral Exploration مقابل 30,000 CAD نقداً بالإضافة إلى 1,000,000 سهماً عادياً، رهناً بموافقة TSXV. يقع العقار مباشرة شمال منطقة South Pond Gold Zone التابعة لبنتون ويمكنه إضافة >1000 m إلى الاتجاه المعدني الحالي بطول 2,7 كم. ستتحمل Benton NSR أساسي بنسبة 2% (خيار إعادة الشراء 1,5 M) وتحتفظ Noble بـ NSR بنسبة 1% مع ROFR. تخطط Benton لإجراء تنقيب وجيوفيزياء فورية. حتى الآن قامت Benton بحفر 23.300 م في Great Burnt وSouth Pond مع العديد من اعتراضات الذهب حتى 74.20 م من 1.43 g/t Au.

Benton Resources (TSXV:BNTRF) 已同意以 CAD 30,000 现金加上 1,000,000 股普通股的方式,收购 Noble Mineral Exploration 的 Island Pond Property 的 100% 权益,须经 TSXV 批准。该资产直接位于 Benton 的 South Pond Gold Zone 北侧,可能在当前 2.7 km 的矿化趋势上再增加 >1000 m。 Benton 将承担基础 2% 的 NSR(回购选项 1.5M),Noble 保留 1% 的 NSR 及 ROFR。 Benton 计划立即进行勘探和地球物理工作。迄今为止,Benton 在 Great Burnt 和 South Pond 已钻探 23,300 m,并取得多处金矿化截距,最高达 74.20 m of 1.43 g/t Au。

- Acquisition grants 100% ownership of Island Pond

- May add >1000 m to 2.7 km mineralized trend

- Planned immediate prospecting and geophysics

- 23,300 m drilled to date at Great Burnt and South Pond

- 1,000,000 shares issued will dilute existing shareholders

- 2% NSR assumed plus 1% NSR to Noble

- NSR buyback requires $1.5M cash to remove 2% royalty

Thunder Bay, Ontario--(Newsfile Corp. - October 14, 2025) - Benton Resources Inc. (TSXV: BEX) ("Benton" or the "Company") is pleased to announce that it has entered into a purchase agreement to acquire a

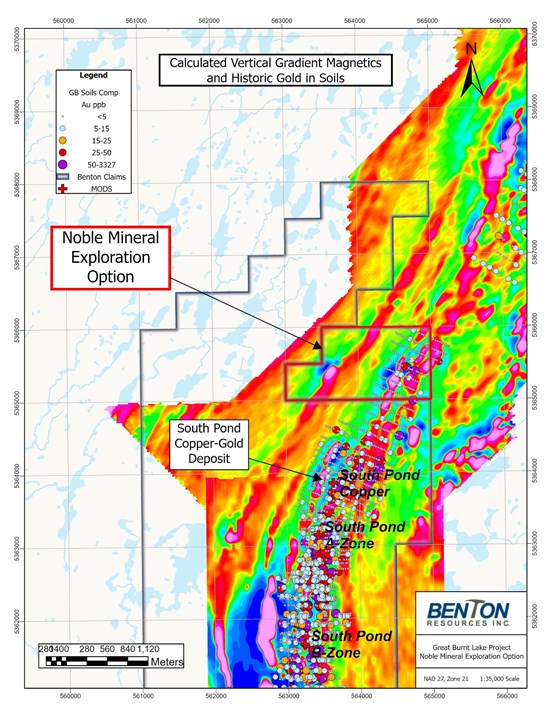

The Island Pond Property is strategically located north of Benton's South Pond Gold Zone within the Great Burnt Copper-Gold Project area. Geological and geophysical similarities between the Island Pond and South Pond areas suggest a potential continuation of significant gold-copper mineralization along the same structural trend.

By securing

Figure 1.

The shares will have a standard four-month hold period from the TSXV approval date and the project is subject to an underlying

Figure 1: Noble Mineral Exploration Option

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/270340_4ddfe972f468a831_002full.jpg

To date, Benton has drilled 23,300 m from late 2023 to present at Great Burnt and South Pond with some highlights listed below:

South Pond Highlights

- SP-24-01: 18.80 m of 1.13g/t, and 5.96 m of 2.06g/t Au

- SP-24-03: 43.75 m of 1.62g/t Au, incl 4.00 m of 3.99g/t Au

- SP-24-07: 74.20 m of 1.43g/t Au, incl 8.00 m of 2.94g/t Au

- SP-24-08: 14.00 m of 1.23g/t Au incl, 4.00 m of 2.33g/t Au

- SP-24-09: 24.00 m of 1.48g/t Au, incl 7.00 m of 2.03g/t Au

- SP-24-10: 20.00 m of 1.04g/t Au, and 25.00 m of 1.54g/t Au

- SP-24-12: 27.07 m of 1.08g/t Au, incl 5.00 m of 2.11g/t Au

- SP-24-13: 19.75 m of 1.42g/t Au, incl 4.00 m of 3.08g/t Au

- SP-24-15: 22.50 m of 1.24g/t Au, incl 4.00 m of 2.08g/t Au

- SP-24-23: 6.75 m of 2.90g/t Au

- SP-24-28: 27.40 m of 1.00g/t Au, incl 3.00 m of 2.92g/t Au

- SP-24-30: 8.00 m of 2.07g/t Au, incl 2.00 m of 4.83g/t Au

Note: Widths quoted are true core length, true widths are estimated at approximately

QP

Stephen House (P.Geo.), Vice President of Exploration for Benton Resources Inc., the 'Qualified Person' under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

QA/QC Protocols

Core and rock samples, including standards, blanks and duplicates, are submitted to Eastern Analytical Ltd., Springdale, Newfoundland for preparation and analysis. All samples were acquired by saw-cut (channels/drill core) with one-half submitted for assay and one-half retained for reference, or hand (rocks) and delivered, by Benton personnel, in sealed bags, to the Springdale lab of Eastern Analytical, which is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using Eastern's Au (Fire assay) @ 30g + ICP-34 method that delivers a 34-element package utilizing a 200 mg subsample totally dissolved in four acids and analyzed by ICP-OES analytical technique. Overlimits are analysed with Eastern's atomic absorption method, using a 0.200 g to 2.00 g of sample, digested with three acids. All reported assays are uncut. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website). Grab samples are selective in nature and may not represent the average mineralization of a bedrock exposure.

About Benton Resources Inc.

Benton Resources is a well-financed mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Benton has a diversified, highly prospective property portfolio and holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton is focused on advancing its high-grade Copper-Gold Great Burnt Project in central Newfoundland, which has a Mineral Resource estimate of 667,000 tonnes @

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-474-9020

Email: sstares@bentonresources.ca

Nick Konkin, Investor Relations

Phone: 647-249-9298 ext. 322

Email: nick@grovecorp.ca

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270340