Mines d'Or Orbec Signs Agreement to Be Acquired by IAMGOLD Corporation

Mines d'Or Orbec (OTC: BLTMF) agreed to be acquired by IAMGOLD (NYSE: IAG) under a court-approved plan of arrangement dated October 19, 2025. Consideration is C$0.125 per Orbec share, delivered as C$0.0625 cash plus 0.003466 IAMGOLD share per Orbec share, implying a total equity value of ~C$18.1 million and a ~25% premium to Orbec's October 17, 2025 TSXV close. IAMGOLD holds ~6.70% of Orbec and expects to issue ~369,341 IAMGOLD shares to other Orbec holders. The Transaction includes a C$500,000 convertible debenture facility, a $660,000 termination fee, and is expected to close by the end of 2025, subject to securityholder, court and regulatory approvals.

Highlights:

- Consolidates a 24,979-hectare land position near IAMGOLD's Nelligan and Monster Lake projects.

- Orbec board and special committee recommend the Transaction; a fairness opinion was provided.

Mines d'Or Orbec (OTC: BLTMF) accetta di essere acquisita da IAMGOLD (NYSE: IAG) secondo un piano di riorganizzazione approvato dal tribunale datato 19 ottobre 2025. La contrpartita è C$0,125 per azione Orbec, erogata come C$0,0625 in contanti più 0,003466 azioni IAMGOLD per ogni azione Orbec, implicando un valore azionario totale di ~C$18,1 milioni e una ~25% di premio rispetto alla chiusura TSXV di Orbec del 17 ottobre 2025. IAMGOLD detiene ~6,70% di Orbec e prevede di emettere ~369.341 azioni IAMGOLD agli altri azionisti di Orbec. La Transazione include una linea di debito convertibile da C$500,000, una fee di risoluzione di $660,000, ed è prevista per chiudere entro la fine del 2025, soggetta all'approvazione di azionisti, tribunali e autorità regolatorie.

Punti salienti:

- Consolida una posizione territoriale di 24.979 ettari vicino ai progetti Nelligan e Monster Lake di IAMGOLD.

- Il consiglio di Orbec e il comitato speciale raccomandano la Transazione; è stata fornita un'opinione di fairness.

Mines d'Or Orbec (OTC: BLTMF) acordó ser adquirida por IAMGOLD (NYSE: IAG) bajo un plan de arreglo aprobado por el tribunal con fecha 19 de octubre de 2025. La contraprestación es C$0,125 por acción Orbec, entregada como C$0,0625 en efectivo más 0,003466 acción IAMGOLD por cada acción Orbec, lo que implica un valor total de capitais d de ~C$18,1 millones y ~un 25% de prima respecto al cierre TSXV de Orbec del 17 de octubre de 2025. IAMGOLD posee ~6,70% de Orbec y espera emitir ~369.341 acciones IAMGOLD a otros accionistas de Orbec. La Transacción incluye una facilidad de debentures convertibles de C$500,000, una tarifa de terminación de $660,000, y se espera cierre para fines de 2025, sujeto a aprobaciones de accionistas, tribunal y reguladoras.

Aspectos destacados:

- Consolida una posición de tierras de 24,979 hectáreas cerca de los proyectos Nelligan y Monster Lake de IAMGOLD.

- La junta de Orbec y el comité especial recomiendan la Transacción; se proporcionó una opinión de equidad.

Mines d'Or Orbec (OTC: BLTMF)은 IAMGOLD (NYSE: IAG)에 의해 2025년 10월 19일 법원이 승인한 합병 계획에 따라 인수되기로 합의되었습니다. 보상은 Orbec 주당 C$0.125이며, 이는 Orbec 주당 C$0.0625 현금과 0.003466 IAMGOLD 주식 per Orbec 주식으로 구성되며, 총 주식 가치는 약 C$18.1백만, Orbec의 2025년 10월 17일 TSXV 종가 대비 약 25% 프리미엄으로 해석됩니다. IAMGOLD는 Orbec의 약 6.70%를 보유하며, 다른 Orbec 주주에게 약 369,341 IAMGOLD 주식을 발행할 예정입니다. 거래에는 C$500,000 전환사채 한도, $660,000 해지 수수료가 포함되며, 2025년 말까지 마무리될 것으로 예상되며 주주, 법원 및 규제 승인에 따라 달라질 수 있습니다.

주요 내용:

- IAMGOLD의 Nelligan 및 Monster Lake 프로젝트 근처의 24,979헥타르 토지 위치를 통합합니다.

- Orbec 이사회 및 특별위원회가 거래를 권고하며, 공정성 의견이 제공되었습니다.

Mines d'Or Orbec (OTC: BLTMF) a accepté d'être acquise par IAMGOLD (NYSE: IAG) selon un plan d'arrangement approuvé par le tribunal en date du 19 octobre 2025. La contrepartie est C$0,125 par action Orbec, versée à raison de C$0,0625 en espèces plus 0,003466 action IAMGOLD par action Orbec, ce qui implique une valeur totale de capitaux propres d'environ C$18,1 millions et une ~prime de 25% par rapport à la clôture TSXV d'Orbec du 17 octobre 2025. IAMGOLD détient environ 6,70% d'Orbec et prévoit d'émettre environ 369 341 actions IAMGOLD aux autres détenteurs d'Orbec. La transaction comprend une facilité de debenture convertible de C$500,000, des honoraires de résiliation de $660,000, et devrait être clôturée d'ici la fin de 2025, sous réserve des approbations des actionnaires, des tribunaux et des autorités réglementaires.

Points forts :

- Consolide une position foncière de 24 979 hectares près des projets Nelligan et Monster Lake d'IAMGOLD.

- Le conseil d'Orbec et le comité spécial recommandent la transaction; une opinion de justice/équité a été fournie.

Mines d'Or Orbec (OTC: BLTMF) wurde von IAMGOLD (NYSE: IAG) gemäß einem gerichtlich genehmigten Fusionsplan vom 19. Oktober 2025 übernommen. Die Gegenleistung beträgt C$0,125 pro Orbec-Aktie, ausgezahlt als C$0,0625 Bargeld plus 0,003466 IAMGOLD-Aktien pro Orbec-Aktie, was einem Gesamtäquivalenzwert von ca. C$18,1 Millionen und einer ~25%-Prämie gegenüber dem Orbec-Schlusskurs der TSXV vom 17. Oktober 2025 entspricht. IAMGOLD hält ca. 6,70% von Orbec und plant, ca. 369.341 IAMGOLD-Aktien an andere Orbec-Inhaber auszugeben. Die Transaktion umfasst eine C$500.000 konvertierbare Anleihe-Einrichtung, eine Beendigungsentschädigung von $660,000, und soll bis Ende 2025 abgeschlossen werden, vorbehaltlich der Zustimmung der Aktionäre, Gerichte und Aufsichtsbehörden.

Highlights:

- Konsolidiert eine Landposition von 24.979 Hektar in der Nähe der Nelligan- und Monster Lake-Projekte von IAMGOLD.

- Orbec-Vorstand und Sonderausschuss empfehlen die Transaktion; eine Fairness-Meinung wurde erbracht.

مينز دوئر أوربيك (OTC: BLTMF) وافقت على أن تكون مُستَخدَة من قبل IAMGOLD (NYSE: IAG) بموجب خطة ترتيب معتمدة من المحكمة في 19 أكتوبر 2025. المقابلة هي C$0.125 لكل سهم من Orbec، تُدفع كـ C$0.0625 نقداً بالإضافة إلى 0.003466 سهم IAMGOLD لكل سهم Orbec، مما يعني قيمة أسهم إجمالية قدرها ~C$18.1 مليون وبـ ~علاوة قدرها 25% مقارنةً بإغلاق Orbec في TSXV بتاريخ 17 أكتوبر 2025. تملك IAMGOLD نحو 6.70% من Orbec وتتوقع إصدار نحو 369,341 سهماً من IAMGOLD لملاك Orbec الآخرين. تتضمن الصفقة تسهِيلات سندات قابلة للتحويل بقيمة C$500,000، ورسوم إنهاء قدرها $660,000، ومن المتوقع أن تُغلق بنهاية 2025، رهناً بموافقة المساهمين، والمحكمة والجهات التنظيمية.

أبرز النقاط:

- يُدمج موقع أرض قدره 24,979 هكتار بالقرب من مشروعي Nelligan و Monster Lake لدى IAMGOLD.

- يوصي مجلس Orbec ولجنة خاصة بالصفقة؛ وتوفير رأي للإنصاف.

Mines d'Or Orbec (OTC: BLTMF) 已同意被 IAMGOLD (NYSE: IAG) 根据法院批准的重组计划收购,日期为 2025 年 10 月 19 日。对价为 每股 Orbec 0.125 加元,以每股 0.0625 加元现金+每股 0.003466 IAMGOLD 股的方式支付,总股本价值约为 加元 1810 万,对 Orbec 2025 年 10 月 17 日 TSXV 收盘价的溢价约为 25%。IAMGOLD 持有 Orbec ≈ 6.70%,并预计向其他 Orbec 股东发行约 369,341 股 IAMGOLD 股。交易包括 50 万加元的可转换票据工具、66 万美元的终止费,预计在 2025 年底前完成,需获得股东、法院及监管批准。

要点:

- 整合了 IAMGOLD 的 Nelligan 与 Monster Lake 项目附近的 24,979 公顷 土地资产。

- Orbec 董事会及特别委员会推荐该交易;提供了公平性意见。

- Transaction values Orbec at approximately C$18.1 million

- Consideration includes a ~25% premium to Oct 17, 2025 close

- Immediate 50% cash component of C$0.0625 per share

- Consolidates 24,979 hectares adjacent to IAMGOLD assets

- Access to IAMGOLD's financial strength and liquidity

- Remaining 50% of consideration paid in IAMGOLD shares (no immediate cash)

- IAMGOLD to provide a C$500,000 convertible debenture to Orbec

- Orbec agreed to pay a $660,000 termination fee in certain cases

Brossard, Québec--(Newsfile Corp. - October 20, 2025) - Mines d'Or Orbec Inc. (TSXV: BLUE) (OTC Pink: BLTMF) ("Orbec" or the "Company") is pleased to announce that it has entered into a definitive arrangement agreement dated October 19, 2025 (the "Arrangement Agreement") with IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) ("IAMGOLD") pursuant to which IAMGOLD has agreed to acquire all of the issued and outstanding common shares of Orbec (each, an "Orbec Share") by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) (the "Transaction").

Under the terms of the Arrangement Agreement, Orbec shareholders will receive total consideration representing a value of C

John Tait, Chief Executive Officer of Orbec, commented: "This Transaction represents an exceptional outcome for Orbec shareholders. Over the past several years, we have advanced the Muus Project into one of Quebec's most promising gold exploration plays, with early drilling confirming a strong geological connection to IAMGOLD's adjacent Nelligan and Monster Lake deposits. Through this Transaction, Orbec shareholders will realize immediate value of

Highlights of the Transaction

- Provides an immediate premium of approximately

25% to Orbec shareholders based on the closing price of Orbec's common shares on October 17, 2025.

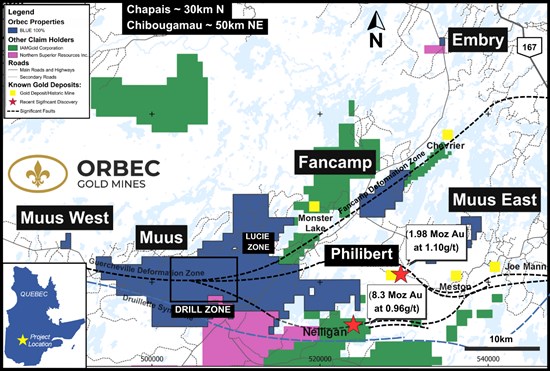

- Positions the Muus Project alongside IAMGOLD's Nelligan and Monster Lake Projects, forming one of the most significant pre-production gold land packages in Quebec's Chibougamau district.

- Consolidates a highly prospective 24,979 hectare land position within the Guercheville and Fancamp Deformation Zones, known for hosting major regional gold discoveries.

- Offers Orbec shareholders access to IAMGOLD's financial strength, high share liquidity, and continued exposure to the region's exploration upside through IAMGOLD's larger regional program.

Transaction Details

Under the terms of the Arrangement Agreement, each of the issued and outstanding Orbec Share (other than the Orbec Shares held by IAMGOLD) will be exchanged for C

The board of directors of Orbec (the "Orbec Board"), after consultation with its financial and legal advisors, and on the recommendation of a special committee of independent directors (the "Special Committee"), unanimously determined that the Transaction is in the best interests of the Company and recommends that shareholders of Orbec vote in favour of the Transaction. Evans & Evans, Inc. provided a fairness opinion to the Orbec Board stating that, subject to the assumptions, limitations and qualifications set out therein, the consideration to be received by shareholders of Orbec in connection with the Transaction is fair, from a financial point of view, to such shareholders.

In connection with the Transcation, certain shareholders as well as directors and executive officers of Orbec entered into voting support agreements with IAMGOLD pursuant to which they have agreed to vote their Orbec Shares in favour of the Transaction, in each case subject to customary exceptions and the terms and conditions of their respective agreements.

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario), will constitute a "business combination" for purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), and will require the approval of at least (i) 66 2/

In addition to securityholder and court approvals, completion of the Transaction is subject to applicable regulatory approvals, including the approval of the TSXV and the Toronto Stock Exchange, and the satisfaction of certain other closing conditions customary in transactions of this nature. The Arrangment Agreement contains customary provisions, including representations and warranties of each party, non-solicitation covenants of Orbec and "fiduciary out" provisions, as well as "right-to-match" provisions in favour of IAMGOLD. The Company has also agreed to pay a termination fee of

Complete details of the Transaction will be included in the Circular and made available under Orbec's issuer profile on SEDAR+ at www.sedarplus.ca and on Orbec's website at www.orbec.ca. The Transaction is expected to be completed by the end of 2025.

Convertible Debenture

In connection with the Transaction, IAMGOLD agreed to make available to Orbec an unsecured convertible debenture in the principal amount of C

Advisors

Evans & Evans, Inc. acted as the Special Committee's financial advisor and Cassels Brock & Blackwell LLP acted as legal counsel to the Company.

About the Muus Project

The Muus Project covers approxmiately 24,979 hectares, is located approximately 50 kilometres southwest of Chibougamau, Quebec, and is prospective for both gold and base metals at the intersection of two major mineralized structural breaks: including the northeast-trending Fancamp Deformation Zone (hosting IAMGOLD's Monster Lake deposit and Orbec's Fancamp Property) and the east-west-trending Guercheville Deformation Zone (hosting IAMGOLD's Nelligan deposit). Limited modern exploration has occurred since the mid-1990s, providing significant discovery potential through systematic drilling and structural targeting.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6951/271085_2345a551c432cbdd_001full.jpg

Qualified Person and Technical Information

The scientific and technical information contained in this news release has been reviewed and approved by Lucie Tremblay, P.Geo., Exploration Manager for Orbec, who is a "qualified person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD

John Tait, CEO and Director

For more information, please visit our website www.orbec.ca or contact Mr. John Tait, info@orbec.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to the completion of the Transaction, the anticipated benefits of the Transaction to securityholders of Orbec, the consideration to be to be paid and the treatment of options and warrants pursuant to the Transaction, the timing for the special meeting to consider the Transaction, and the timing for completion of the Transaction.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271085