Growth Drilling Begins at Tunkillia Gold Project

Barton Gold Holdings has initiated reverse circulation (RC) growth drilling at its Tunkillia Gold Project in South Australia. The project, which received an updated 1.5Moz Au JORC Mineral Resources Estimate in March 2024, showed promising initial Scoping Study results with production of ~130kozpa gold at AISC of ~A$1,917/oz Au, 40% equity IRR, and 1.9-year payback. The current ~5,000m drilling program targets extensions of the block model and pit design, focusing on areas where gold mineralization was previously intersected but not included in the MRE block model. An optimization review is underway to improve key cost drivers and project economics.

Barton Gold Holdings ha avviato un'attività di perforazione di crescita a circolazione inversa (RC) presso il suo Tunkillia Gold Project in Australia Meridionale. Il progetto, che ha ricevuto una stima aggiornata delle risorse minerali JORC di 1,5 Moz Au a marzo 2024, ha mostrato risultati iniziali promettenti dallo studio di fattibilità con una produzione di circa 130 kozpa di oro a un AISC di circa A$1.917/oz Au, un IRR del 40% e un periodo di rimborso di 1,9 anni. L'attuale programma di perforazione di circa 5.000 m mira a estendere il modello del blocco e il design della miniera, concentrandosi su aree in cui è stata precedentemente intercettata la mineralizzazione aurifera ma non inclusa nel modello del blocco MRE. È in corso una revisione di ottimizzazione per migliorare i principali fattori di costo e l'economia del progetto.

Barton Gold Holdings ha iniciado la perforación de crecimiento de circulación inversa (RC) en su Tunkillia Gold Project en Australia del Sur. El proyecto, que recibió una estimación actualizada de recursos minerales JORC de 1,5 Moz Au en marzo de 2024, mostró resultados iniciales prometedores en el estudio de viabilidad con una producción de aproximadamente 130 kozpa de oro a un AISC de aproximadamente A$1,917/oz Au, un IRR del 40% y un período de recuperación de 1.9 años. El actual programa de perforación de aproximadamente 5,000 m tiene como objetivo extender el modelo de bloque y el diseño del pozo, centrándose en áreas donde se intersectó previamente la mineralización de oro pero no se incluyó en el modelo de bloque MRE. Se está llevando a cabo una revisión de optimización para mejorar los principales impulsores de costos y la economía del proyecto.

바턴 골드 홀딩스(Barton Gold Holdings)가 남호주에 있는 턴킬리아 금 프로젝트에서 역순환(RC) 성장 드릴링을 시작했습니다. 이 프로젝트는 2024년 3월에 업데이트된 1.5Moz Au JORC 광물 자원 추정치를 받았으며, 연간 약 130kg의 금 생산과 AISC 약 A$1,917/온스 Au, 40%의 내부 수익률(IRR), 1.9년의 투자 회수 기간을 보여주는 유망한 초기 스코핑 연구 결과를 나타냈습니다. 현재 약 5,000m의 드릴링 프로그램은 블록 모델과 갱 디자인의 확장을 목표로 하며, 이전에 금 광물이 탐지되었지만 MRE 블록 모델에 포함되지 않은 지역에 집중하고 있습니다. 주요 비용 요인 및 프로젝트 경제성을 개선하기 위한 최적화 검토가 진행 중입니다.

Barton Gold Holdings a lancé des forages de croissance en circulation inversée (RC) sur son projet d'or Tunkillia en Australie-Méridionale. Le projet, qui a reçu une estimation mise à jour des ressources minérales JORC de 1,5 Moz Au en mars 2024, a montré des résultats initiaux prometteurs d'une étude de faisabilité avec une production d'environ 130 kozpa d'or à un AISC d'environ A$1.917/oz Au, un IRR de 40 % et un retour sur investissement de 1,9 an. Le programme de forage actuel de ~5.000 m vise à étendre le modèle de blocs et le design de la mine, en se concentrant sur les zones où la minéralisation aurifère a été précédemment interceptée mais non incluse dans le modèle de blocs MRE. Un examen d'optimisation est en cours pour améliorer les principaux facteurs de coût et l'économie du projet.

Barton Gold Holdings hat mit der Wachstumsbohrung der Rückführung (RC) in ihrem Tunkillia Gold Project in Südaustralien begonnen. Das Projekt erhielt im März 2024 eine aktualisierte JORC-Mineralressourcenschätzung von 1,5 Moz Au und zeigte vielversprechende erste Ergebnisse der Machbarkeitsstudie mit einer Produktion von etwa 130 kozpa Gold zu einem AISC von etwa A$1.917/oz Au, einem IRR von 40 % und einer Amortisationsdauer von 1,9 Jahren. Das aktuelle Bohrprogramm von etwa 5.000 m zielt auf die Erweiterungen des Blockmodells und des Grubendesigns ab und konzentriert sich auf Bereiche, in denen zuvor Goldmineralisierungen durchbohrt wurden, die jedoch nicht im MRE-Blockmodell enthalten sind. Eine Optimierungsprüfung ist im Gange, um die wichtigsten Kostenfaktoren und die Wirtschaftlichkeit des Projekts zu verbessern.

- Initial Scoping Study shows strong production potential of ~130kozpa gold

- High-grade 'Starter pit' expected to produce ~180koz Au in first 18 months

- Attractive 40% equity internal rate of return (IRR)

- Quick payback period of 1.9 years

- Significant resource base of 1.5Moz Au in JORC Mineral Resources

- Relatively high All-in Sustaining Cost (AISC) of ~A$1,917/oz Au

ADELAIDE, AUSTRALIA / ACCESSWIRE / November 18, 2024 /

HIGHLIGHTS

Optimised Scoping Study underway, targeting comminution, power, schedule and pit design

~5,000m reverse circulation (RC) drilling targeting key extensions of block model and pit design

Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to confirm that RC growth drilling has commenced at its South Australian Tunkillia Gold Project (Tunkillia).

In March 2024 Barton published an updated 1.5Moz Au Tunkillia JORC Mineral Resources Estimate (MRE), followed by an initial Scoping Study (July 2024) outlining competitive production of ~130kozpa gold with an all-in sustaining cost (AISC) of ~A

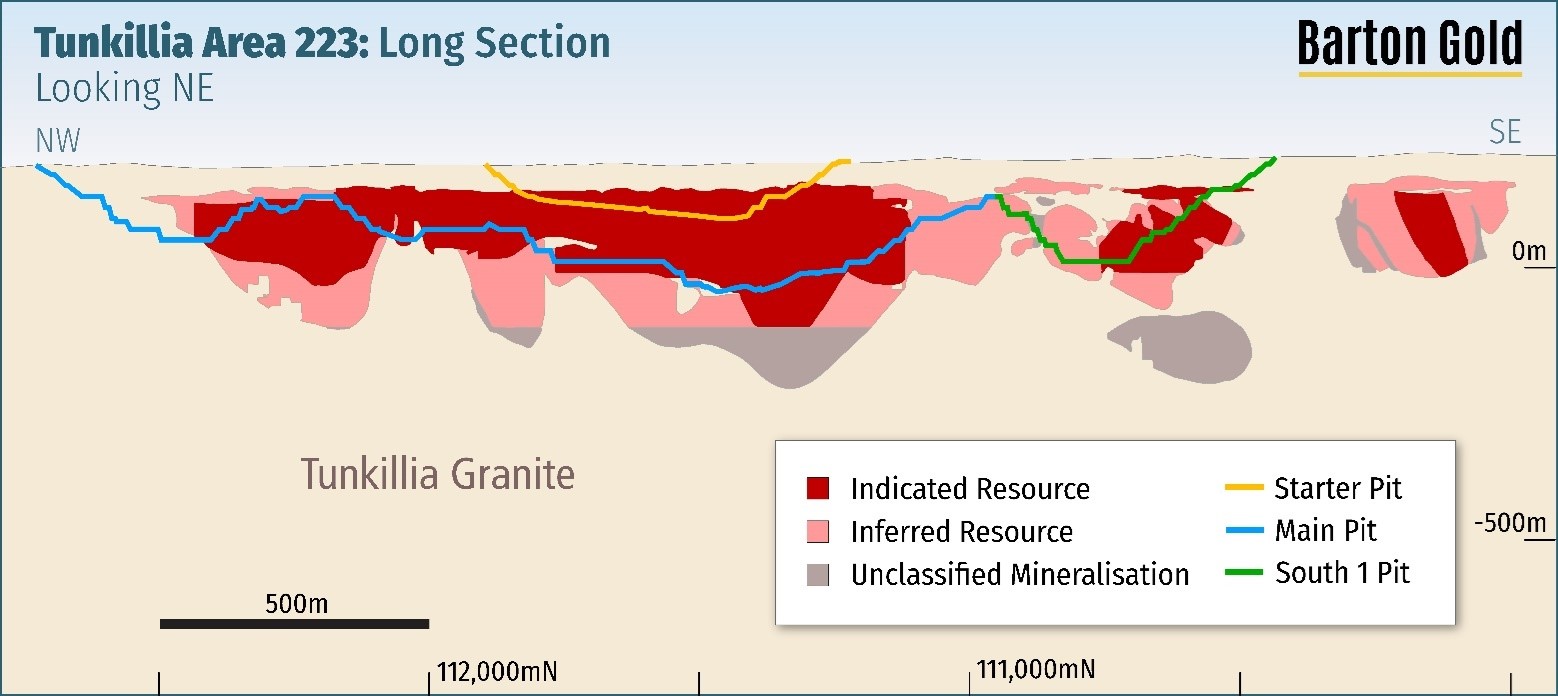

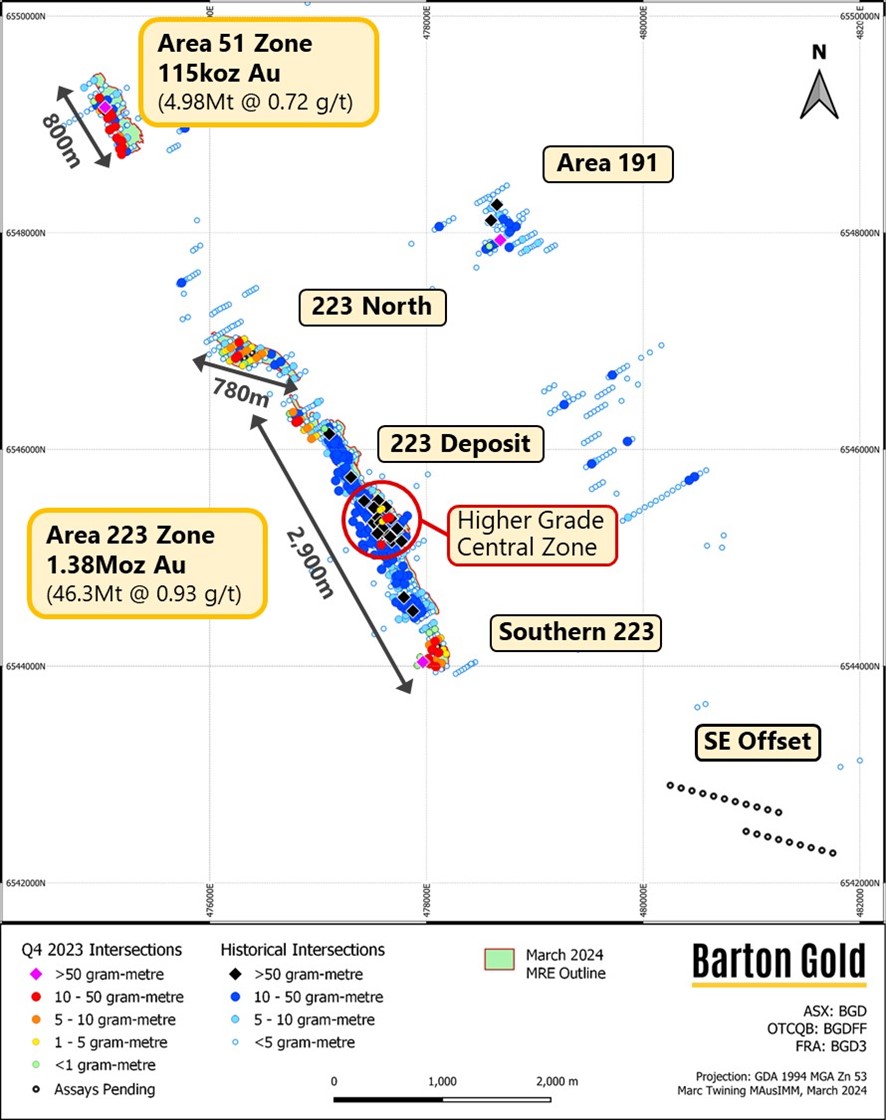

An optimisation review is now underway targeting key cost drivers. The RC drilling is targeting extensions on lodes parallel to, and depth extensions of, the July 2024 optimised pit design in areas where gold mineralisation has been intersected in prior drilling but not yet included in the MRE block model.

Commenting on the current Tunkillia drilling program, Barton MD Alexander Scanlon said:

"Tunkillia has demonstrated its potential as a competitive large-scale gold producer based upon conservative assumptions relating to comminution design, power consumption, the development schedule and procurement.

We are now reviewing optimisation of these assumptions in parallel with selective drilling to reduce processing costs, expand the MRE block model, grow the optimised pit, extend Project life, and improve the project's economics. We look forward to sharing further updates as we advance Tunkillia toward feasibility studies. "

1 Refer to ASX announcements dated 4 March and 16 July 2024

Targets below and adjacent to current MRE block model

Review of the March 2024 MRE block model in conjunction with the July 2024 initial Scoping Study has identified two key ‘near mine' opportunities for expansion of the open pit design and mine life, being:

areas just below the July 2024 optimised open pit, where drilling intersected mineralisation which is excluded from the MRE block model due to an insufficient number of data points; and

areas adjacent to the March 2024 MRE block model and the July 2024 optimised open pit, where areas of known mineralisation may similarly be excluded from the MRE block model.

These represent an opportunity to add further ounces to the MRE block model, optimise the open pit design, and add new bulk efficient mineralisation tonnes into the life of mine (LoM) schedule.

2 Refer to ASX announcement dated 4 March 2024

Alexander Scanlon | Shannon Coates |

|

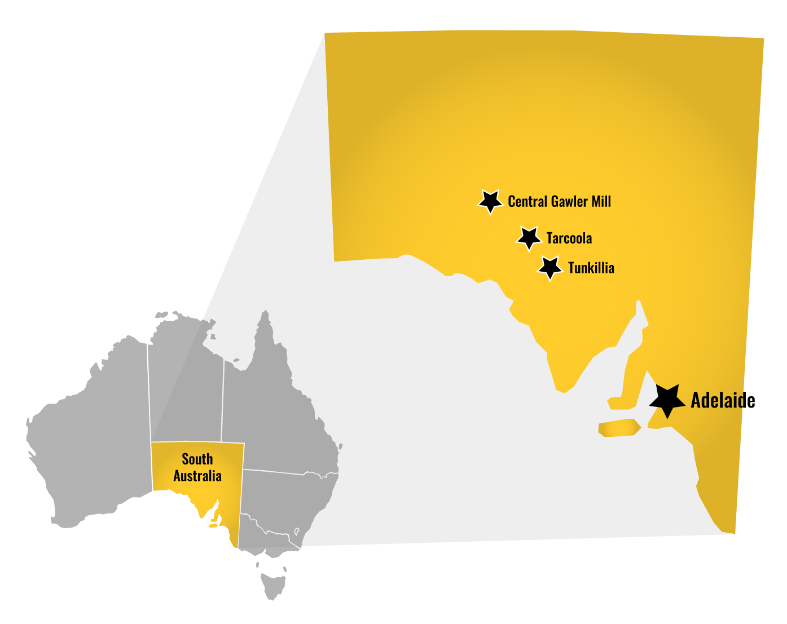

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project *

Infrastructure

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 833koz Au (26.9Mt @ 0.96 g/t Au) in Indicated and 754koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com

FAQ

What are the key production metrics from Tunkillia's 2024 Scoping Study for BGDFF?

What is the current resource size of Barton Gold's Tunkillia Project (BGDFF)?