Brixton Metals Options its Atlin Goldfields Project to Eldorado Gold

Brixton Metals (TSX-V: BBB, OTCQB: BBBXF) has entered into a definitive option agreement with Eldorado Gold for its Atlin Goldfields Project in British Columbia. Key highlights include:

- Eldorado to fund $5,350,000 in exploration over 5 years

- Cash payments to Brixton totaling $1,100,000 during the option period

- Eldorado can acquire 100% ownership for an additional $7,000,000 at the end of the period

- Brixton to retain a 1.0% NSR upon Eldorado's exercise of the option

The 579 square kilometer project is located near Atlin, BC, within the Taku River Tlingit First Nation territory. This agreement allows Brixton to advance the project while maintaining potential future benefits through the NSR.

- Eldorado Gold to fund $5,350,000 in exploration expenditures over 5 years

- Brixton to receive $1,100,000 in cash payments during the option period

- Potential for additional $7,000,000 payment if Eldorado exercises the option to acquire 100% ownership

- Brixton retains a 1.0% NSR upon Eldorado's exercise of the option

- Eldorado has the option to accelerate payments and funding timetables

- Brixton may lose 100% ownership of the Atlin Goldfields Project if Eldorado exercises the option

VANCOUVER, British Columbia, July 16, 2024 (GLOBE NEWSWIRE) -- Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce that it has entered into a definitive option agreement (the “Option Agreement”) with Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has been granted the option to acquire

Highlights of the Option Agreement

- During the 5-year option period (the “Option Period”), Eldorado shall fund

$1,000,000 in exploration expenditures per year beginning September 30th, 2024, for an aggregate spend of$5,350,000 ; including an additional minimum commitment to fund$350,000 of exploration expenditures on or before September 30th, 2024; - Eldorado shall make cash payments to Brixton of

$250,000 per year for aggregate payments of$1,100,000 during the Option Period; including an additional minimum payment of$100,000 within 10 days of signing the Option Agreement; - In addition, at the end of the Option Period, Eldorado shall have the right to exercise the Option to acquire

100% -ownership of the Project by making a cash payment to Brixton in the amount of$7,000,000 ; where Brixton, at its election, may receive up to50% of such payment in the form of common shares of Eldorado, subject to the prior attainment of the customary requisite regulatory approvals; - Eldorado may, in its sole discretion, elect at any time during the option period to accelerate the payments or funding timetables for any of the earn-in requirements of the Option;

- Upon exercise of the Option by Eldorado, Brixton shall be granted a

1.0% (one percent) net smelter return royalty (“NSR”), with Eldorado retaining an option to purchase half (0.5% ) of Brixton’s NSR for$2,000,000 prior to the commencement of commercial production at the Project; and - During the Option Period, Brixton shall be the Operator of the Project with Eldorado approving all work programs and budgets relating to the Project. Eldorado will also work closely and support Brixton with respect to ongoing environmental monitoring and community engagement efforts.

Chairman and CEO, Gary R. Thompson stated, “We are delighted to have attracted Eldorado Gold, a well-established miner, to the Atlin Goldfields Project. We look forward to working with Eldorado in advancing this exciting gold project.”

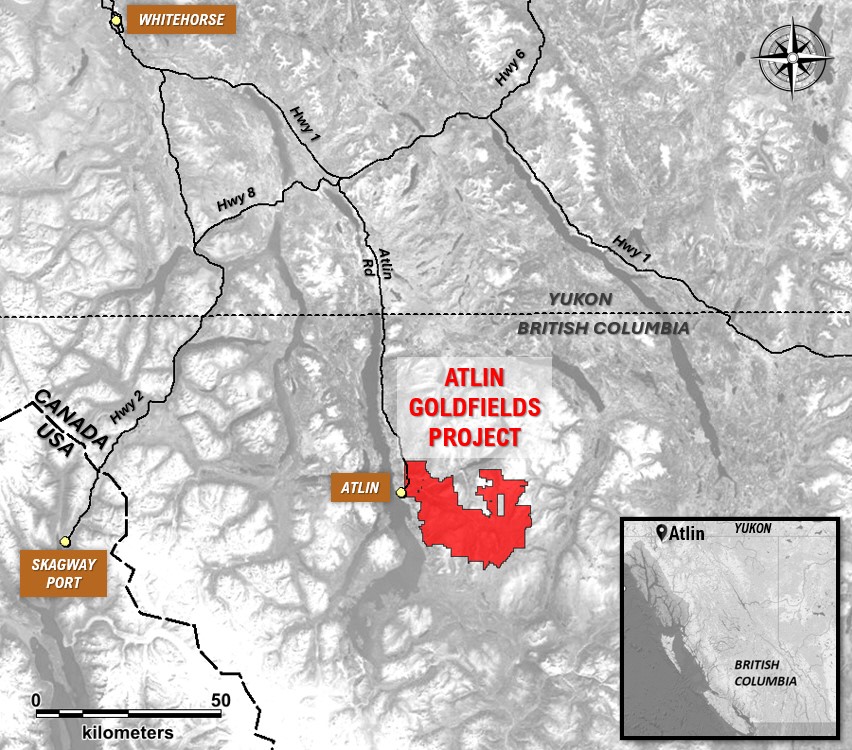

Figure 1. Atlin Goldfields Project Location Map

About the Atlin Goldfields Project

The Atlin Goldfields Project is road accessible near the town of Atlin, BC and about a 2-hour drive from Whitehorse, Yukon. Since 2016, and over a 3-year period, Brixton has consolidated its wholly owned 579 square kilometer claim group with a focus on locating the hard rock source of the placer gold within the mining camp. The Atlin Goldfields Project covers several orogenic and intrusion-related gold targets. The Atlin gold camp has been producing gold for 125 years and is the second largest placer gold producer in British Columbia with a reported 600,000 ounces of gold produced between 1898 and 1945. An estimated additional 400,000 ounces of gold have been produced since the record keeping ceased in 1946 (Ash 2001). The two major placer producing creeks (Pine and Spruce) and many of the other productive creeks are located within the Atlin Goldfields Project. The Atlin gold camp holds the provincial record for the largest gold nugget, which weighed 2.6 kg (85 ounce) and was discovered on Spruce Creek (BCGS Paper 2017-1, p.179-193).

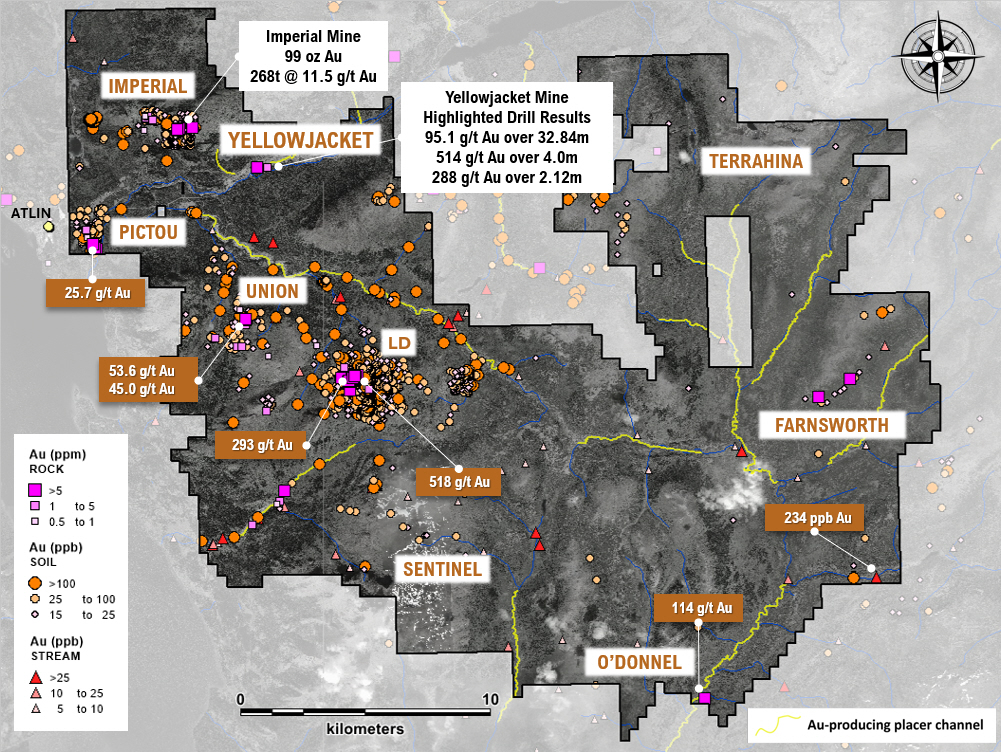

Brixton’s rock samples of coarse-grained quartz veins have returned values of up to 293 g/t gold from the LD Showing in 2017 and 53.60 g/t gold from the Union Mountain Showing in 2020. Historical diamond drilling at the Yellowjacket Target has returned up to 509.96 g/t gold (16.39 oz/ton gold) over 5.57m. Brixton’s drilling in 2023 returned 35.00m of 0.77 g/t gold including 19.00m of 1.34 g/t gold including 0.45m of 38.10 g/t gold at the Yellowjacket Target. In 2019, Brixton drilled 8.53 g/t gold over 2.00m at the LD showing.

The Atlin Goldfields Project is located on the margin of a deep-seated structural and terrane boundary. The Project is underlain primarily by Mississippian to Triassic-aged volcanic and sedimentary rocks of the Cache Creek Complex, including quartz-carbonate-mariposite-altered ultramafic to listwanite and mafic rocks, which are commonly associated with the gold mineralization in the region. The Cache Creek Complex is intruded by the Middle Jurassic Fourth of July batholith and the Late Cretaceous Surprise Lake batholith.

Over 39,500m of drilling has been completed across the property including 1,599m in 2019 at LD and Pictou (22 collars), 292m in 2022 at Yellowjacket (2 collars), and 350m in 2023 at Yellowjacket (1 collar)

Brixton has collected and compiled thousands of surface samples: 2,140 rock samples, 12,650 soil samples, 210 silt samples and 23 associated bulk leach extractable gold samples (BLEG) and 161 biogeochemical samples.

A total of 6,563-line kms of magnetic geophysical surveys have been completed across the project area.

Figure 2. Atlin Goldfields Project, Targets on Gold Geochemistry.

Qualified Person (QP)

Mr. Corey A. James, P.Geo., is a Senior Project Geologist for the Company who is a qualified person as defined by National Instrument 43-101. Mr. James has verified the referenced data disclosed in this press release and has approved the technical information presented herein.

About Eldorado Gold Corporation

Eldorado is a gold and base metals producer with mining, development and exploration operations in Turkiye, Canada, and Greece. Eldorado has a highly skilled and dedicated workforce, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with local communities. Eldorado's common shares trade on the Toronto Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE: EGO).

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton’s flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel Project in Ontario and the Atlin Goldfields Project located in northwest BC which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Senior Manager, Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Links:

https://brixtonmetals.com/wp-content/uploads/2024/07/Figure-1_15July2024.jpg

https://brixtonmetals.com/wp-content/uploads/2024/07/Figure-2_15July2024.jpg

FAQ

What are the key terms of Brixton Metals' option agreement with Eldorado Gold for the Atlin Goldfields Project?

How much exploration funding has Eldorado Gold committed to Brixton Metals' Atlin Goldfields Project?

What royalty will Brixton Metals (BBBXF) retain if Eldorado exercises the option on the Atlin Goldfields Project?