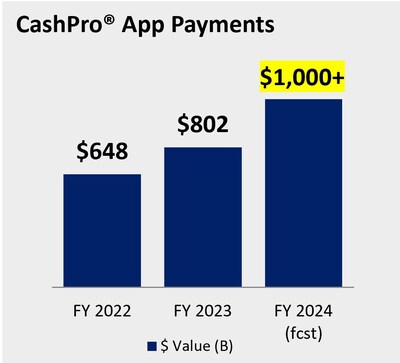

BofA's CashPro® App Will Surpass a Record $1 Trillion in Payment Approvals for the Year

Bank of America's CashPro App is set to exceed $1 trillion in payment approvals by the end of 2024, marking a 25% year-over-year increase. The app, part of BofA's digital banking platform, serves approximately 550,000 users at 40,000 companies globally, managing payments, deposits, loans, and trade finance transactions.

CashPro is ranked as the No. 1 mobile app for corporate and commercial banking, offering payment initiation across four channels: online, app, APIs, and Connect. The platform provides enhanced security features and convenience for corporate clients, with December typically seeing the highest volume of payment approvals due to year-end activity and holiday season travel.

L'app CashPro di Bank of America è destinata a superare 1 trilione di dollari in approvazioni di pagamenti entro la fine del 2024, segnando un aumento del 25% rispetto all'anno precedente. L'app, parte della piattaforma di banking digitale di BofA, serve circa 550.000 utenti in 40.000 aziende a livello globale, gestendo pagamenti, depositi, prestiti e transazioni di finanziamento commerciale.

CashPro è classificata come la migliore app mobile per la banca aziendale e commerciale, offrendo avvio dei pagamenti attraverso quattro canali: online, app, API e Connect. La piattaforma fornisce funzionalità di sicurezza avanzate e comodità per i clienti aziendali, con dicembre che tipicamente vede il volume più elevato di approvazioni di pagamento a causa dell'attività di fine anno e dei viaggi durante le festività.

La aplicación CashPro de Bank of America está destinada a superar 1 billón de dólares en aprobaciones de pagos para finales de 2024, marcando un aumento del 25% año tras año. La aplicación, parte de la plataforma de banca digital de BofA, atiende a aproximadamente 550,000 usuarios en 40,000 empresas a nivel mundial, gestionando pagos, depósitos, préstamos y transacciones de financiamiento comercial.

CashPro se posiciona como la aplicación móvil número 1 para banca corporativa y comercial, ofreciendo la iniciación de pagos a través de cuatro canales: en línea, aplicación, API y Connect. La plataforma proporciona características de seguridad mejoradas y conveniencia para los clientes corporativos, siendo diciembre típicamente el mes con mayor volumen de aprobaciones de pagos debido a la actividad de fin de año y los viajes de la temporada navideña.

뱅크 오브 아메리카의 CashPro 앱은 2024년 말까지 1조 달러 이상의 결제 승인을 초과할 것으로 예상되며, 이는 전년 대비 25% 증가한 수치입니다. 이 앱은 BofA의 디지털 뱅킹 플랫폼의 일부로, 전 세계 40,000개 기업에서 약 550,000명의 사용자를 지원하며, 결제, 예치금, 대출 및 무역 금융 거래를 관리합니다.

CashPro는 기업 및 상업 은행을 위한 최고의 모바일 앱으로 자리잡고 있으며, 온라인, 앱, API 및 Connect의 네 가지 채널을 통해 결제를 시작할 수 있습니다. 이 플랫폼은 기업 고객에게 향상된 보안 기능과 편리함을 제공하며, 12월은 연말 활동 및 휴가 시즌 여행으로 인해 결제 승인량이 가장 높아지는 경향이 있습니다.

L'application CashPro de Bank of America devrait dépasser 1 000 milliards de dollars en approbations de paiements d'ici la fin de 2024, marquant une augmentation de 25 % par rapport à l'année précédente. L'application, qui fait partie de la plateforme de banque numérique de BofA, sert environ 550 000 utilisateurs dans 40 000 entreprises à travers le monde, en gérant les paiements, dépôts, prêts et transactions de financement commercial.

CashPro est classée comme la meilleure application mobile pour la banque d'entreprise et commerciale, offrant l'initiation des paiements sur quatre canaux : en ligne, application, API et Connect. La plateforme propose des fonctionnalités de sécurité améliorées et une commodité pour les clients professionnels, avec décembre qui voit généralement le volume le plus élevé d'approbations de paiements en raison des activités de fin d'année et des voyages de la saison des fêtes.

Die CashPro-App von Bank of America wird voraussichtlich bis Ende 2024 1 Billion Dollar an Zahlungsfreigaben überschreiten, was einem Anstieg von 25 % im Jahresvergleich entspricht. Die App, die Teil der digitalen Bankplattform von BofA ist, bedient weltweit etwa 550.000 Nutzer in 40.000 Unternehmen und verwaltet Zahlungen, Einlagen, Kredite und Handelsfinanzierungstransaktionen.

CashPro wird als die Nr. 1 unter den mobilen Apps für Unternehmens- und Gewerbebanking eingestuft und bietet Zahlungsinitiierung über vier Kanäle: online, App, APIs und Connect. Die Plattform bietet verbesserte Sicherheitsmerkmale und Bequemlichkeit für Unternehmenskunden, wobei der Dezember typischerweise das höchste Volumen an Zahlungsfreigaben verzeichnet, da in dieser Zeit verstärkt Jahresendaktivitäten und Reisen zur Feiertagszeit stattfinden.

- Record $1 trillion in payment approvals through CashPro App in 2024

- 25% year-over-year increase in payment approvals

- Large user base of 550,000 users across 40,000 companies globally

- #1 ranked mobile app for corporate and commercial banking

- None.

Insights

The milestone of

The platform's success in corporate payments positions BAC favorably against fintech competitors and traditional banks in the digital treasury management space. The integration across multiple channels (online, app, APIs and file-based) creates a sticky ecosystem that helps defend BAC's corporate banking relationships. This digital infrastructure reduces operational costs while enabling BAC to capture valuable transaction data and cross-selling opportunities.

The CashPro platform's growing adoption demonstrates BAC's strong positioning in treasury management services, a important high-margin business for commercial banks. The

The platform's expanding functionality and user base strengthen BAC's corporate banking relationships, potentially leading to increased fee income and cross-selling opportunities across other banking services. The focus on mobile accessibility addresses the evolving needs of corporate treasurers, particularly during peak periods and travel seasons, which enhances client satisfaction and loyalty.

Clients Turn to Mobile for Added Visibility and Control Over Their Payments

"The CashPro App plays an instrumental role in helping our clients manage their business, particularly when it comes to payments," said Tom Durkin, Global Head of CashPro in Global Payments Solutions (GPS) at Bank of America. "Surpassing the trillion-dollar milestone illustrates the value clients gain from the convenience, control and transparency of payment approvals."

CashPro is Bank of America's digital banking platform and is accessed by approximately 550,000 users at 40,000 companies around the world, to manage and monitor their payments, deposits, loans, and trade finance transactions. The CashPro App is integral to this platform, and is the No. 1 ranked mobile app for corporate and commercial banking.1

Lauren Hobbs, Cash Management Manager at the energy infrastructure company Sempra, is a CashPro super user. "The CashPro App is great," she said. "Whether I'm in between meetings or at my desk, it's extremely powerful. I can quickly look at account balances and approve high dollar payments with confidence."

Bank of America clients can initiate corporate payments across any of the four channels of the CashPro platform: online, app, Application Program Interfaces (APIs) and Connect (file-based). For added security, these payments may require additional levels of approval prior to being released, and clients can leverage the CashPro App to complete those approvals. Historically, December sees the highest volume and value of payments approved through the app, driven by year-end activity and users traveling during the holiday season.

"From studying the adoption of CashPro App features, we've watched client activity grow and change over time," said Jennifer Sanctis, head of CashPro App and Personalized Technologies in GPS at Bank of America. "Through ongoing investment and listening to client feedback, we'll continue to provide innovative financial experiences to support their transforming needs in 2025 and beyond."

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Reporters may contact:

Louise Hennessy, Bank of America

Phone: 1.646.858.6471

louise.hennessy@bofa.com

1 In 2023 and 2024, the CashPro App received the top mobile ranking in Coalition Greenwich's annual Digital Transformation Benchmarking Study.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bofas-cashpro-app-will-surpass-a-record-1-trillion-in-payment-approvals-for-the-year-302327225.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bofas-cashpro-app-will-surpass-a-record-1-trillion-in-payment-approvals-for-the-year-302327225.html

SOURCE Bank of America Corporation