Aspira Women’s Health Announces Preliminary Second Quarter 2024 OvaSuite Product Volume and Highlights

Aspira Women’s Health reported significant growth in its OvaWatch® and OvaSuiteSM product volumes for the second quarter of 2024. OvaWatch volume increased by 24% sequentially and 48% year-over-year, reaching 1,307 units, while OvaSuite volume grew by 11% sequentially and 3% year-over-year to 6,471 units. Aspira has also identified up to 70,000 samples in its biobank for potential secondary research collaborations to generate non-dilutive cash. Additionally, Aspira completed a $1.9 million private placement to support its commercial activities and is focused on reducing cash use for operations.

CEO Nicole Sandford emphasized the commercial success of OvaWatch and its potential for future growth, highlighting the expanded addressable market and robust sales force. President Dr. Sandra Milligan noted the company's progress in molecular test development and the strategic positioning of its biobank.

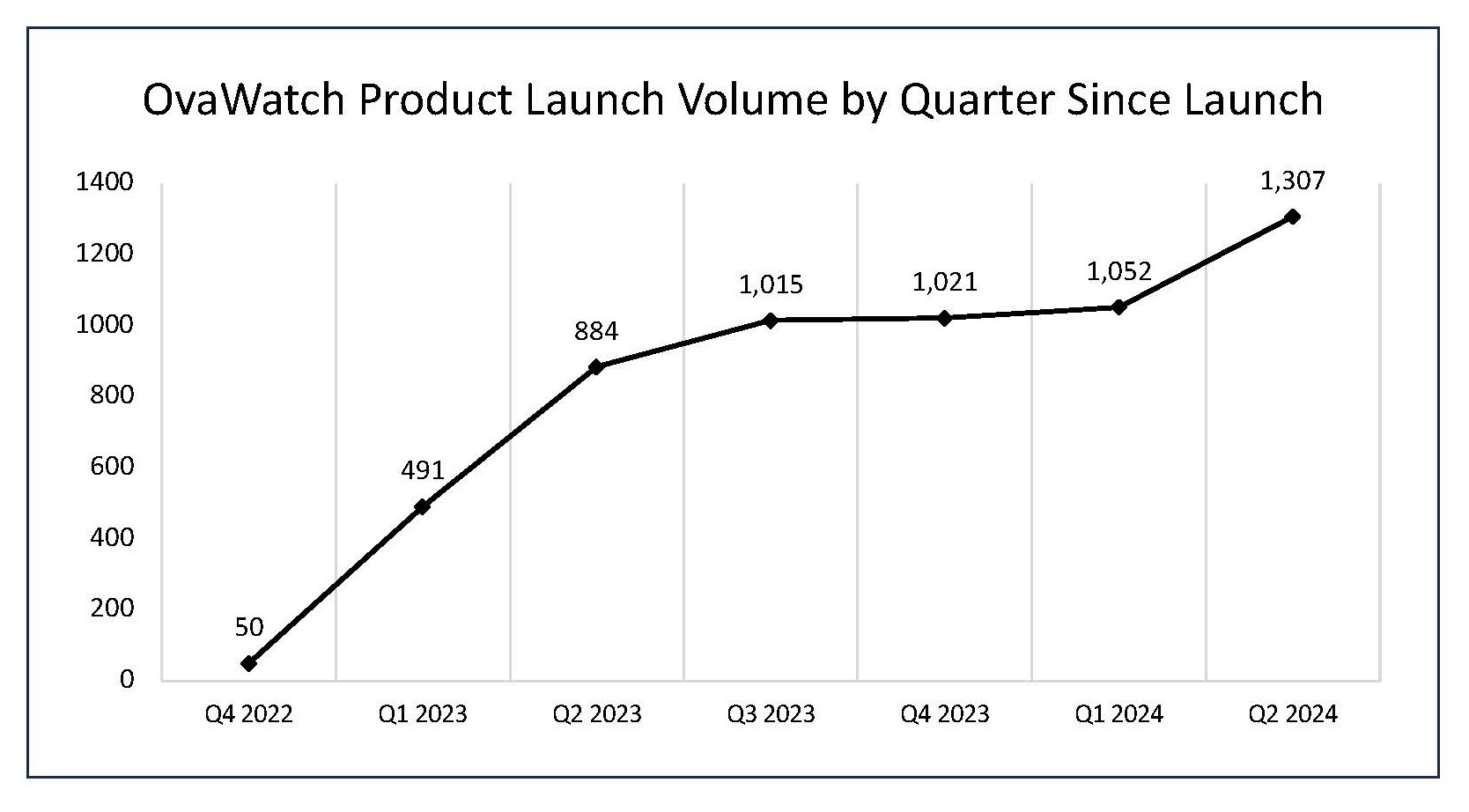

- OvaWatch volume increased by 24% sequentially and 48% year-over-year.

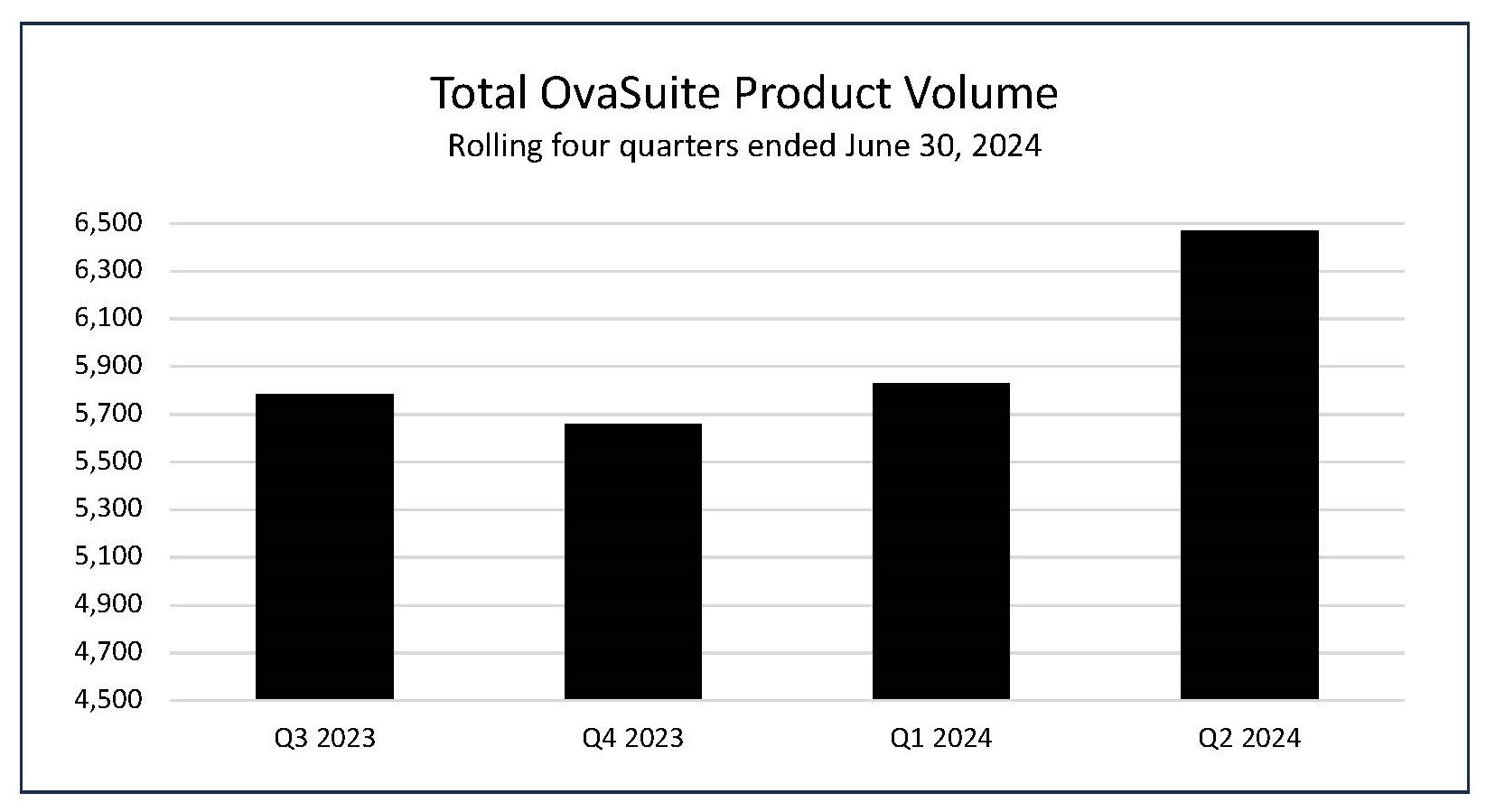

- OvaSuite volume increased by 11% sequentially and 3% year-over-year.

- Aspira was named a finalist for the ARPA-H grant to support the development of an endometriosis test.

- Aspira identified up to 70,000 samples for potential research collaborations, offering non-dilutive cash opportunities.

- Completed a $1.9 million private placement with support from shareholders and insiders.

- None.

Insights

The 24% increase in OvaWatch volumes and 11% rise in OvaSuite volumes show growth momentum in Aspira Women’s Health’s product lines. These results are promising because they indicate the effectiveness of the commercial changes made last year. However, the significance of this growth should be measured against their financial health and market conditions.

It's also essential to note the

Retail investors should consider these figures in the context of the broader market conditions and Aspira's upcoming quarterly earnings report, which will offer clearer guidance on cash management and operational performance.

The increase in OvaWatch and OvaSuite volumes signifies growing acceptance among healthcare providers and payers. The highlight on OvaWatch's clinical effectiveness and its role in the company’s future growth is notable. OvaWatch’s potential market size of 2 to 4 million tests annually is particularly impressive and could drive substantial revenue growth if captured effectively.

The ARPA-H grant finalist selection is a strong endorsement of Aspira’s research capabilities. However, being a finalist doesn't guarantee grant money, so investors should await the final decision. Additionally, the extensive biobank with 70,000 samples could facilitate valuable research collaborations and secondary revenue streams.

Investors should monitor ongoing developments in clinical trials and peer reviews, as these will further validate the products’ efficacy and support broader market adoption.

Aspira’s focus on women’s health diagnostics positions it well in a niche, yet growing market. The increase in test volumes suggests effective market penetration and response to the commercial strategy changes made last year. The mention of product volume growing each month is a good indicator of consistent demand.

However, given the competitive landscape in medical diagnostics, it’s critical to watch how Aspira differentiates itself from competitors. The release of the periodic monitoring feature expanding the addressable market is a strategic move, but execution and sustained competitive advantages will be key determinants of long-term success.

The private placement indicates confidence from existing shareholders but also hints at the need for continuous capital to fuel growth and operations. Retail investors should pay attention to how these funds are utilized and the company’s overall cash management strategy as outlined in the upcoming earnings report.

Preliminary OvaWatch® volume during Q2 2024 grew

Preliminary OvaSuiteSM volume during Q2 2024 grew

AUSTIN, Texas, July 11, 2024 (GLOBE NEWSWIRE) -- Aspira Women’s Health Inc. (“Aspira” or the “Company”) (Nasdaq: AWH), a bio-analytical based women’s health company focused on the development of gynecologic disease diagnostic tools, today announced preliminary second quarter 2024 OvaSuite product volume and highlights.

Preliminary Second Quarter 2024 Product Volume and Highlights

- The number of OvaWatch tests performed during the second quarter ended June 30, 2024, was 1,307, an increase of

48% , compared to the 884 tests in the same period last year, and an increase of24% to the 1,052 tests sequentially.

- The number of OvaSuite tests performed during the second quarter ended June 30, 2024, was 6,471, an increase of

3% compared to the 6,289 tests in the same period last year, and an increase of11% to the 5,829 tests in the first quarter.

- The Company was notified that it has been selected as a finalist for an ARPA-H grant to support further development of its protein + microRNA blood test for endometriosis. Announcement of the final grant award recipients is anticipated in the second half of 2024.

- The Company has completed a comprehensive analysis of its biobank and has identified up to 70,000 serum, plasma, and whole blood samples that are available for secondary research. The Company is exploring opportunities to create non-dilutive sources of cash through related collaborations.

“Our OvaSuite product volume, and in particular our OvaWatch volume, has grown each month since the beginning of the year, demonstrating that the commercial changes we made last year are having a positive impact,” said Nicole Sandford, Chief Executive Officer of Aspira. “The data showing OvaWatch’s clinical effectiveness is resonating with physicians and payers alike. We believe that OvaWatch, which at this early stage already represents

Ms. Sandford added, “We continue to be laser focused on cash management. Earlier this week, we announced the closing of an at-the-market private placement with gross proceeds of nearly

Dr. Sandra Milligan, President of Aspira, said, “We are honored to have been selected from the hundreds of applicants as one of the finalists in the ARPA-H grant process and look forward to sharing our market-leading science and development process. In the meantime, we continue to explore additional grants and other non-dilutive sources of funding including academic collaborations. We believe that our extensive biobank and available samples position us as an ideal strategic partner for others innovating in women’s health.”

“With respect to our in-development pipeline, we continue to progress in the design and development of our molecular tests,” Dr. Milligan added. “We are pleased with the performance of the digital droplet PCR platform, a crucial component of a commercially viable test, and plan to provide a more detailed update on our quarterly earnings call next month.”

In addition to these second-quarter highlights, the Company recently completed a

About Aspira Women’s Health Inc.

Aspira Women’s Health Inc. is dedicated to the discovery, development, and commercialization of noninvasive, AI-powered tests to aid in the diagnosis of gynecologic diseases.

OvaWatch® and Ova1Plus® are offered to clinicians as OvaSuiteSM. Together, they provide the only comprehensive portfolio of blood tests to aid in the detection of ovarian cancer for the 1.2+ million American women diagnosed with an adnexal mass each year. OvaWatch provides a negative predictive value of

Our in-development test pipeline is designed to expand our ovarian cancer portfolio and addresses the tremendous need for noninvasive diagnostics for endometriosis, a debilitating disease that impacts millions of women worldwide. In ovarian cancer, our OvaMDxSM risk assessment is designed to combine microRNA and protein biomarkers with patient data to further enhance the sensitivity and specificity of our current tests. In endometriosis, EndoCheckSM is the first-ever noninvasive test designed to identify endometriomas, one of the most commonly occurring forms of endometriosis. The EndoMDxSM test is designed to combine microRNA and protein biomarkers with patient data to identify all endometriosis.

Forward-Looking Statements

This press release contains forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve a number of risks and uncertainties. Such forward-looking statements include statements regarding, among other things, the timing and completion of any products in the pipeline development and other statements that are predictive in nature. Actual results could differ materially from those discussed due to known and unknown risks, uncertainties, and other factors. These forward-looking statements generally can be identified by the use of words such as “designed to,” “expect,” “plan,” “anticipate,” “could,” “may,” “intend,” “will,” “continue,” “future,” other words of similar meaning and the use of future dates. Forward-looking statements in this press release and other factors that may cause such differences include the satisfaction of customary closing conditions related to the offering and the expected timing of the closing of the offering. These and additional risks and uncertainties are described more fully in the company’s filings with the SEC, including those factors identified as “Risk Factors” in our most recent Annual Report on Form 10-K, for the fiscal year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Aspira presently does not know, or that Aspira currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Aspira’s expectations, plans, or forecasts of future events and views as of the date of this press release. Subsequent events and developments may cause the Company’s assessments to change. However, while Aspira may elect to update these forward-looking statements at some point in the future, Aspira expressly disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Aspira’s assessments of any date after the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Investor Relations Contact:

Nicole Sandford

Chief Executive Officer

Investors@aspirawh.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/839c39d0-429f-436e-aaff-beed552ac624

https://www.globenewswire.com/NewsRoom/AttachmentNg/bcdf6e34-66dc-4d38-b217-3e2bc390ca7d