Astronics Corporation Reports 2022 Fourth Quarter and Full Year Financial Results

Astronics Corporation (Nasdaq: ATRO) reported Q4 2022 sales of $158.2 million, a 36% increase from last year, with full-year sales at $534.9 million, up 20%. The company achieved record backlog of $571.4 million and a book-to-bill ratio of 1.15 in Q4. Despite a net loss of $6.8 million, adjusted EBITDA improved to $4.3 million. The company maintains 2023 revenue guidance of $640 million to $680 million, anticipating a 23% growth. CEO Peter J. Gundermann noted ongoing recovery in the aerospace market while acknowledging supply chain challenges.

- Q4 sales up 36% Year-over-Year to $158.2 million.

- Record backlog of $571.4 million, indicating strong future demand.

- Adjusted EBITDA increased to $4.3 million, showing operational improvement.

- Maintains 2023 revenue guidance of $640 million to $680 million, signaling expected growth.

- Reported net loss of $6.8 million in Q4, compared to a net income in the prior year.

- Margins under pressure due to inflation and supply chain issues.

Insights

Analyzing...

-

Sales for the quarter were

$158.2 million 36% over prior-year period; full year sales were$534.9 million 20% over prior year -

Fourth quarter bookings totaled

$182.4 million $690.6 million 19.6% over prior year resulting in book-to-bill ratio of 1.29 -

Backlog increased

37.4% during 2022 to a record$571.4 million $477.7 million -

Net loss for the quarter was

$6.8 million $4.3 million -

Maintaining revenue guidance of

$640 million $680 million

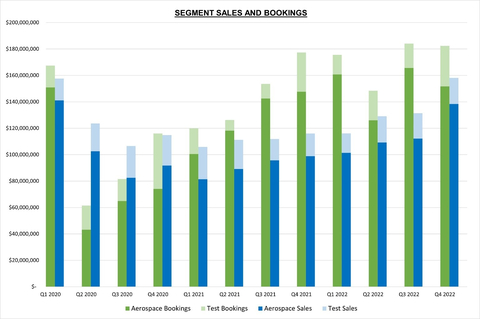

(Graphic: Business Wire)

He added, “Margins remained under pressure in the quarter because of inflation and supply chain workarounds. We are passing on increased costs where we can although it will take time to roll through sales. We are expecting improvement in pricing as well as reduction in certain input costs as we advance through 2023.”

Fourth Quarter Results

|

Three Months Ended |

|

Year Ended |

|||||||||||||||||||

($ in thousands) |

December 31, 2022 |

December 31, 2021 |

% Change |

|

December 31, 2022 |

December 31, 2021 |

% Change |

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

Sales |

$ |

158,153 |

|

$ |

116,052 |

|

36.3 |

% |

|

$ |

534,894 |

|

$ |

444,908 |

|

20.2 |

% |

|||||

Loss from Operations |

$ |

(3,167 |

) |

$ |

(8,744 |

) |

63.8 |

% |

|

$ |

(30,044 |

) |

$ |

(28,674 |

) |

(4.8 |

)% |

|||||

Operating Margin % |

|

(2.0 |

)% |

|

(7.5 |

)% |

|

|

|

(5.6 |

)% |

|

(6.4 |

)% |

|

|||||||

|

$ |

— |

|

$ |

10,677 |

|

|

|

$ |

11,284 |

|

$ |

10,677 |

|

|

|||||||

Net (Loss) Income |

$ |

(6,779 |

) |

$ |

1,604 |

|

(522.6 |

)% |

|

$ |

(35,747 |

) |

$ |

(25,578 |

) |

(39.8 |

)% |

|||||

Net (Loss) Income % |

|

(4.3 |

)% |

|

1.4 |

% |

|

|

|

(6.7 |

)% |

|

(5.7 |

)% |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||||||||

*Adjusted EBITDA |

$ |

4,305 |

|

$ |

(805 |

) |

634.8 |

% |

|

$ |

4,372 |

|

$ |

1,898 |

|

130.3 |

% |

|||||

*Adjusted EBITDA Margin % |

|

2.7 |

% |

|

(0.7 |

)% |

|

|

|

0.8 |

% |

|

0.4 |

% |

|

|||||||

*Adjusted EBITDA is a Non-GAAP Performance Measure. Please see the attached table for a reconciliation of Adjusted EBITDA to GAAP net income.

Fourth Quarter 2022 Results (compared with the prior-year period, unless noted otherwise)

Consolidated sales were up

Consolidated operating loss was

Consolidated net loss was

Consolidated adjusted EBITDA increased to

Bookings were

Aerospace Segment Review (refer to sales by market and segment data in accompanying tables)

Aerospace Fourth Quarter 2022 Results (compared with the prior-year period, unless noted otherwise)

Aerospace segment sales increased

Military Aircraft sales decreased

Aerospace segment operating profit improved to

Aerospace bookings in the fourth quarter of 2022 were

Test Systems Segment Review (refer to sales by market and segment data in accompanying tables)

Test Systems Fourth Quarter Results (compared with the prior-year period, unless noted otherwise)

Test Systems segment sales were

Test Systems segment operating loss was

Bookings for the Test Systems segment in the quarter were

Liquidity and Financing

Cash on hand at the end of the quarter was

On

Amortization of the term loan principal will begin in

The new capitalization provided post-closing available liquidity of approximately

2023 Outlook

He concluded, “Our ability to meet forecast for 2023 will certainly depend on the cooperation of our supply chain, which we perceive is slowly improving. Challenges certainly remain, but our supply base is getting more predictable and the ratio of positive surprises relative to negative surprises is getting higher. We have plenty of backlog for 2023, and believe our supply chain is on track to support our expected revenue range.”

Planned capital expenditures for 2023 are expected to be in the range of

Fourth Quarter 2022 Webcast and Conference Call

The Company will host a teleconference today at

The

About

Safe Harbor Statement

This news release contains forward-looking statements as defined by the Securities Exchange Act of 1934. One can identify these forward-looking statements by the use of the words “expect,” “anticipate,” “plan,” “may,” “will,” “estimate” or other similar expressions and include all statements with regard to the impact of COVID-19 on the Company and its future, reaching any revenue or Adjusted EBITDA margin expectations, the recovery of the commercial aerospace widebody/long haul markets, the recovery of its supply chain, the timing of pricing and impact of inflation on margins, and the expectations of demand by customers and markets. Because such statements apply to future events, they are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the statements. Important factors that could cause actual results to differ materially from what may be stated here include the continued global impact of COVID-19 and related governmental and other actions taken in response, trend in growth with passenger power and connectivity on airplanes, the state of the aerospace and defense industries, the market acceptance of newly developed products, internal production capabilities, the timing of orders received, the status of customer certification processes and delivery schedules, the demand for and market acceptance of new or existing aircraft which contain the Company’s products, the need for new and advanced test and simulation equipment, customer preferences and relationships, and other factors which are described in filings by

FINANCIAL TABLES FOLLOW

|

||||||||||||||||

CONSOLIDATED INCOME STATEMENT DATA |

||||||||||||||||

(Unaudited, $ in thousands except per share data) |

||||||||||||||||

|

|

|

|

|||||||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||||

|

|

|

|

|

|

|||||||||||

Sales |

$ |

158,153 |

|

$ |

116,052 |

|

|

$ |

534,894 |

|

$ |

444,908 |

|

|||

Cost of products sold 1 |

|

136,643 |

|

|

97,588 |

|

|

|

463,354 |

|

|

379,545 |

|

|||

Gross profit |

|

21,510 |

|

|

18,464 |

|

|

|

71,540 |

|

|

65,363 |

|

|||

Gross margin |

|

13.6 |

% |

|

15.9 |

% |

|

|

13.4 |

% |

|

14.7 |

% |

|||

|

|

|

|

|

|

|||||||||||

Selling, general and administrative 2 |

|

24,677 |

|

|

32,222 |

|

|

|

101,584 |

|

|

99,051 |

|

|||

SG&A % of sales |

|

15.6 |

% |

|

27.8 |

% |

|

|

19.0 |

% |

|

22.3 |

% |

|||

Net gain on sale of facility |

|

— |

|

|

5,014 |

|

|

|

— |

|

|

5,014 |

|

|||

Loss from operations |

|

(3,167 |

) |

|

(8,744 |

) |

|

|

(30,044 |

) |

|

(28,674 |

) |

|||

Operating margin |

|

(2.0 |

)% |

|

(7.5 |

)% |

|

|

(5.6 |

)% |

|

(6.4 |

)% |

|||

|

|

|

|

|

|

|||||||||||

Net gain on sale of business 3 |

|

— |

|

|

10,677 |

|

|

|

11,284 |

|

|

10,677 |

|

|||

Other expense, net of other income |

|

431 |

|

|

532 |

|

|

|

1,611 |

|

|

2,159 |

|

|||

Interest expense, net |

|

3,610 |

|

|

1,552 |

|

|

|

9,422 |

|

|

6,804 |

|

|||

Loss before tax |

|

(7,208 |

) |

|

(151 |

) |

|

|

(29,793 |

) |

|

(26,960 |

) |

|||

Income tax (benefit) expense |

|

(429 |

) |

|

(1,755 |

) |

|

|

5,954 |

|

|

(1,382 |

) |

|||

Net (loss) income |

$ |

(6,779 |

) |

$ |

1,604 |

|

|

$ |

(35,747 |

) |

$ |

(25,578 |

) |

|||

Net (loss) income % of sales |

|

(4.3 |

)% |

|

1.4 |

% |

|

|

(6.7 |

)% |

|

(5.7 |

)% |

|||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||

Basic (loss) earnings per share: |

$ |

(0.21 |

) |

$ |

0.05 |

|

|

$ |

(1.11 |

) |

$ |

(0.82 |

) |

|||

Diluted (loss) earnings per share: |

$ |

(0.21 |

) |

$ |

0.05 |

|

|

$ |

(1.11 |

) |

$ |

(0.82 |

) |

|||

|

|

|

|

|

|

|||||||||||

Weighted average diluted shares outstanding (in thousands) |

|

32,401 |

|

|

31,915 |

|

|

|

32,164 |

|

|

31,061 |

|

|||

|

|

|

|

|

|

|||||||||||

Capital expenditures |

$ |

3,392 |

|

$ |

1,395 |

|

|

$ |

7,675 |

|

$ |

6,034 |

|

|||

Depreciation and amortization |

$ |

6,872 |

|

$ |

7,055 |

|

|

$ |

27,777 |

|

$ |

29,005 |

|

|||

1 In |

2 Includes fair value adjustment of contingent consideration liabilities, which was a |

3 Net gain on sale of business for the year ended |

|

||||||||||||||||

SEGMENT DATA |

||||||||||||||||

(Unaudited, $ in thousands) |

||||||||||||||||

|

|

|

|

|

|

|||||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||||

|

|

|

|

|

|

|||||||||||

Sales |

|

|

|

|

|

|||||||||||

Aerospace |

$ |

138,335 |

|

$ |

98,836 |

|

|

$ |

461,206 |

|

$ |

365,261 |

|

|||

Less Inter-segment |

|

— |

|

|

— |

|

|

|

(10 |

) |

|

(23 |

) |

|||

|

|

138,335 |

|

|

98,836 |

|

|

|

461,196 |

|

|

365,238 |

|

|||

|

|

|

|

|

|

|||||||||||

Test Systems |

|

19,818 |

|

|

17,216 |

|

|

|

73,717 |

|

|

80,027 |

|

|||

Less Inter-segment |

|

— |

|

|

— |

|

|

|

(19 |

) |

|

(357 |

) |

|||

Total Test Systems |

|

19,818 |

|

|

17,216 |

|

|

|

73,698 |

|

|

79,670 |

|

|||

|

|

|

|

|

|

|||||||||||

Total consolidated sales |

|

158,153 |

|

|

116,052 |

|

|

|

534,894 |

|

|

444,908 |

|

|||

|

|

|

|

|

|

|||||||||||

Segment operating profit (loss) and margins |

|

|

|

|

|

|||||||||||

Aerospace |

|

5,202 |

|

|

(2,262 |

) |

|

|

(1,883 |

) |

|

(8,614 |

) |

|||

|

|

3.8 |

% |

|

(2.3 |

)% |

|

|

(0.4 |

)% |

|

(2.4 |

)% |

|||

Test Systems |

|

(3,993 |

) |

|

(1,807 |

) |

|

|

(8,118 |

) |

|

(3,765 |

) |

|||

|

|

(20.1 |

)% |

|

(10.5 |

)% |

|

|

(11.0 |

)% |

|

(4.7 |

)% |

|||

Total segment operating profit (loss) |

|

1,209 |

|

|

(4,069 |

) |

|

|

(10,001 |

) |

|

(12,379 |

) |

|||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||

Net gain on sale of business |

|

— |

|

|

10,677 |

|

|

|

11,284 |

|

|

10,677 |

|

|||

Interest expense |

|

3,610 |

|

|

1,552 |

|

|

|

9,422 |

|

|

6,804 |

|

|||

Corporate expenses and other 1 |

|

4,807 |

|

|

5,207 |

|

|

|

21,654 |

|

|

18,454 |

|

|||

Loss before taxes |

$ |

(7,208 |

) |

$ |

(151 |

) |

|

$ |

(29,793 |

) |

$ |

(26,960 |

) |

|||

1 Includes fair value adjustment of contingent consideration liabilities, which was a |

Reconciliation to Non-GAAP Performance Measures

In addition to reporting net income, a

|

||||||||||||||||

RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA |

||||||||||||||||

(Unaudited, $ in thousands) |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Consolidated |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||||

|

|

|

|

|

|

|

|

|||||||||

Net (loss) income |

$ |

(6,779 |

) |

|

$ |

1,604 |

|

|

$ |

(35,747 |

) |

|

$ |

(25,578 |

) |

|

Add back (deduct): |

|

|

|

|

|

|

|

|||||||||

Interest expense |

|

3,610 |

|

|

|

1,552 |

|

|

|

9,422 |

|

|

|

6,804 |

|

|

Income tax (benefit) expense |

|

(429 |

) |

|

|

(1,755 |

) |

|

|

5,954 |

|

|

|

(1,382 |

) |

|

Depreciation and amortization expense |

|

6,872 |

|

|

|

7,055 |

|

|

|

27,777 |

|

|

|

29,005 |

|

|

Equity-based compensation expense |

|

1,319 |

|

|

|

1,313 |

|

|

|

6,497 |

|

|

|

6,460 |

|

|

Contingent consideration liability fair value adjustment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,200 |

) |

|

Restructuring-related charges including severance |

|

— |

|

|

|

85 |

|

|

|

199 |

|

|

|

577 |

|

|

Legal reserve, settlements and recoveries |

|

(1,500 |

) |

|

|

8,374 |

|

|

|

500 |

|

|

|

8,374 |

|

|

Customer accommodation settlement |

|

— |

|

|

|

— |

|

|

|

2,100 |

|

|

|

— |

|

|

Lease termination settlement |

|

— |

|

|

|

— |

|

|

|

450 |

|

|

|

— |

|

|

Non-cash 401K contribution accrual |

|

1,212 |

|

|

|

4,199 |

|

|

|

4,512 |

|

|

|

4,199 |

|

|

AMJP grant benefit |

|

— |

|

|

|

(7,541 |

) |

|

|

(6,008 |

) |

|

|

(8,670 |

) |

|

Net gain on sale of facility |

|

— |

|

|

|

(5,014 |

) |

|

|

— |

|

|

|

(5,014 |

) |

|

Net gain on sale of business |

|

— |

|

|

|

(10,677 |

) |

|

|

(11,284 |

) |

|

|

(10,677 |

) |

|

Adjusted EBITDA |

$ |

4,305 |

|

|

$ |

(805 |

) |

|

$ |

4,372 |

|

|

$ |

1,898 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Sales |

$ |

158,153 |

|

|

$ |

116,052 |

|

|

$ |

534,894 |

|

|

$ |

444,908 |

|

|

Adjusted EBITDA margin |

|

2.7 |

% |

|

|

(0.7 |

)% |

|

|

0.8 |

% |

|

|

0.4 |

% |

|

|

|

|

|

|

|

|

|

|||||||||

|

||||||

CONSOLIDATED BALANCE SHEET DATA |

||||||

($ in thousands) |

||||||

|

(unaudited) |

|

|

|||

|

|

|

|

|||

ASSETS |

|

|

|

|||

Cash and cash equivalents |

$ |

13,778 |

|

$ |

29,757 |

|

Accounts receivable and uncompleted contracts |

|

147,790 |

|

|

107,439 |

|

Inventories |

|

187,983 |

|

|

157,576 |

|

Other current assets |

|

15,743 |

|

|

45,089 |

|

Property, plant and equipment, net |

|

90,658 |

|

|

95,236 |

|

Other long-term assets |

|

21,633 |

|

|

21,439 |

|

Intangible assets, net |

|

79,277 |

|

|

94,320 |

|

|

|

58,169 |

|

|

58,282 |

|

Total assets |

$ |

615,031 |

|

$ |

609,138 |

|

|

|

|

|

|||

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|||

Current maturities of long-term debt |

$ |

4,500 |

|

$ |

— |

|

Accounts payable and accrued expenses |

|

114,545 |

|

|

91,257 |

|

Customer advances and deferred revenue |

|

32,567 |

|

|

27,356 |

|

Long-term debt |

|

159,500 |

|

|

163,000 |

|

Other liabilities |

|

63,999 |

|

|

70,921 |

|

Shareholders' equity |

|

239,920 |

|

|

256,604 |

|

Total liabilities and shareholders' equity |

$ |

615,031 |

|

$ |

609,138 |

|

|

||||||||

CONSOLIDATED CASH FLOWS DATA |

||||||||

(Unaudited, $ in thousands) |

Year Ended |

|||||||

Cash flows from operating activities: |

|

|

|

|||||

Net loss |

$ |

(35,747 |

) |

|

$ |

(25,578 |

) |

|

Adjustments to reconcile net loss to cash flows from operating activities: |

|

|

|

|||||

Non-cash items: |

|

|

|

|||||

Depreciation and amortization |

|

27,777 |

|

|

|

29,005 |

|

|

Provisions for non-cash losses on inventory and receivables |

|

3,415 |

|

|

|

3,942 |

|

|

Equity-based compensation expense |

|

6,497 |

|

|

|

6,460 |

|

|

Deferred tax expense (benefit) |

|

19 |

|

|

|

(441 |

) |

|

Net gain on sale of business |

|

(11,284 |

) |

|

|

(10,677 |

) |

|

Net gain on sales of assets |

|

— |

|

|

|

(5,083 |

) |

|

Contingent consideration liability fair value adjustment |

|

— |

|

|

|

(2,200 |

) |

|

Operating lease non-cash expense |

|

6,028 |

|

|

|

5,198 |

|

|

Non-cash 401K contribution accrual |

|

4,512 |

|

|

|

4,199 |

|

|

Non-cash litigation provision |

|

500 |

|

|

|

8,374 |

|

|

Restructuring activities |

|

— |

|

|

|

267 |

|

|

Other |

|

3,086 |

|

|

|

3,912 |

|

|

Cash flows from changes in operating assets and liabilities: |

|

|

|

|||||

Accounts receivable |

|

(41,646 |

) |

|

|

(14,832 |

) |

|

Inventories |

|

(34,058 |

) |

|

|

(5,150 |

) |

|

Prepaid expenses and other current assets |

|

261 |

|

|

|

20 |

|

|

Accounts payable |

|

27,843 |

|

|

|

8,610 |

|

|

Accrued expenses |

|

787 |

|

|

|

(5,037 |

) |

|

Income taxes payable/receivable |

|

16,134 |

|

|

|

156 |

|

|

Operating lease liabilities |

|

(7,295 |

) |

|

|

(6,036 |

) |

|

Customer advanced payments and deferred revenue |

|

5,264 |

|

|

|

(235 |

) |

|

Supplemental retirement plan and other liabilities |

|

(405 |

) |

|

|

(404 |

) |

|

Cash flows from operating activities |

|

(28,312 |

) |

|

|

(5,530 |

) |

|

Cash flows from investing activities: |

|

|

|

|||||

Proceeds from sales of businesses and assets |

|

22,061 |

|

|

|

9,213 |

|

|

Capital expenditures |

|

(7,675 |

) |

|

|

(6,034 |

) |

|

Cash flows from investing activities |

|

14,386 |

|

|

|

3,179 |

|

|

Cash flows from financing activities: |

|

|

|

|||||

Proceeds from long-term debt |

|

125,825 |

|

|

|

20,000 |

|

|

Principal payments on long-term debt |

|

(124,825 |

) |

|

|

(30,000 |

) |

|

Stock award and employee stock purchase plan activity |

|

97 |

|

|

|

3,396 |

|

|

Finance lease principal payments |

|

(93 |

) |

|

|

(901 |

) |

|

Financing-related costs |

|

(2,416 |

) |

|

|

— |

|

|

Cash flows from financing activities |

|

(1,412 |

) |

|

|

(7,505 |

) |

|

Effect of exchange rates on cash |

|

(641 |

) |

|

|

(799 |

) |

|

Decrease in cash and cash equivalents |

|

(15,979 |

) |

|

|

(10,655 |

) |

|

Cash and cash equivalents at beginning of year |

|

29,757 |

|

|

|

40,412 |

|

|

Cash and cash equivalents at end of year |

$ |

13,778 |

|

|

$ |

29,757 |

|

|

|

|

|

|

|||||

|

|||||||||||||||||||||

SALES BY MARKET |

|||||||||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Three Months Ended |

|

Year Ended |

2022 YTD |

|||||||||||||||||

|

|

|

% change |

|

|

|

% change |

% of Sales |

|||||||||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

|||||||||||||

|

$ |

102,843 |

$ |

58,441 |

76.0 |

% |

|

$ |

314,564 |

$ |

201,990 |

55.7 |

% |

58.8 |

% |

||||||

Military |

|

13,198 |

|

15,464 |

(14.7 |

)% |

|

|

54,534 |

|

70,312 |

(22.4 |

)% |

10.2 |

% |

||||||

|

|

14,647 |

|

15,542 |

(5.8 |

)% |

|

|

63,395 |

|

56,673 |

11.9 |

% |

11.9 |

% |

||||||

Other |

|

7,647 |

|

9,389 |

(18.6 |

)% |

|

|

28,703 |

|

36,263 |

(20.8 |

)% |

5.4 |

% |

||||||

Aerospace Total |

|

138,335 |

|

98,836 |

40.0 |

% |

|

|

461,196 |

|

365,238 |

26.3 |

% |

86.2 |

% |

||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Test Systems Segment |

|

19,818 |

|

17,216 |

15.1 |

% |

|

|

73,698 |

|

79,670 |

(7.5 |

)% |

13.8 |

% |

||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Total Sales |

$ |

158,153 |

$ |

116,052 |

36.3 |

% |

|

$ |

534,894 |

$ |

444,908 |

20.2 |

% |

|

|||||||

SALES BY PRODUCT LINE |

|||||||||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

Three Months Ended |

|

Year Ended |

2022 YTD |

|||||||||||||||||

|

|

|

% change |

|

|

|

% change |

% of Sales |

|||||||||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

|||||||||||||

|

$ |

54,689 |

$ |

39,003 |

40.2 |

% |

|

$ |

187,446 |

$ |

141,746 |

32.2 |

% |

35.0 |

% |

||||||

Lighting & Safety |

|

34,008 |

|

26,820 |

26.8 |

% |

|

|

124,347 |

|

103,749 |

19.9 |

% |

23.2 |

% |

||||||

Avionics |

|

29,781 |

|

17,546 |

69.7 |

% |

|

|

97,234 |

|

64,901 |

49.8 |

% |

18.2 |

% |

||||||

Systems Certification |

|

10,566 |

|

5,113 |

106.6 |

% |

|

|

17,222 |

|

13,050 |

32.0 |

% |

3.2 |

% |

||||||

Structures |

|

1,644 |

|

965 |

70.4 |

% |

|

|

6,244 |

|

5,529 |

12.9 |

% |

1.2 |

% |

||||||

Other |

|

7,647 |

|

9,389 |

(18.6 |

)% |

|

|

28,703 |

|

36,263 |

(20.8 |

)% |

5.4 |

% |

||||||

Aerospace Total |

|

138,335 |

|

98,836 |

40.0 |

% |

|

|

461,196 |

|

365,238 |

26.3 |

% |

86.2 |

% |

||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Test Systems Segment |

|

19,818 |

|

17,216 |

15.1 |

% |

|

|

73,698 |

|

79,670 |

(7.5 |

)% |

13.8 |

% |

||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Total Sales |

$ |

158,153 |

$ |

116,052 |

36.3 |

% |

|

$ |

534,894 |

$ |

444,908 |

20.2 |

% |

|

|||||||

|

|||||||||||||||

ORDER AND BACKLOG TREND |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Trailing Twelve Months |

|||||||||||

|

|

|

|

|

|

||||||||||

Sales |

|

|

|

|

|

||||||||||

Aerospace |

$ |

101,394 |

$ |

109,290 |

$ |

112,177 |

$ |

138,335 |

$ |

461,196 |

|||||

Test Systems |

|

14,782 |

|

19,837 |

|

19,261 |

|

19,818 |

|

73,698 |

|||||

Total Sales |

$ |

116,176 |

$ |

129,127 |

$ |

131,438 |

$ |

158,153 |

$ |

534,894 |

|||||

|

|

|

|

|

|

||||||||||

Bookings |

|

|

|

|

|

||||||||||

Aerospace |

$ |

160,778 |

$ |

126,012 |

$ |

165,719 |

$ |

151,688 |

$ |

604,197 |

|||||

Test Systems |

|

14,844 |

|

22,377 |

|

18,433 |

|

30,707 |

|

86,361 |

|||||

Total Bookings |

$ |

175,622 |

$ |

148,389 |

$ |

184,152 |

$ |

182,395 |

$ |

690,558 |

|||||

|

|

|

|

|

|

||||||||||

Backlog |

|

|

|

|

|

||||||||||

Aerospace |

$ |

394,043 |

$ |

410,765 |

$ |

464,307 |

$ |

477,660 |

|

||||||

Test Systems |

|

81,095 |

|

83,635 |

|

82,807 |

|

93,696 |

|

||||||

Total Backlog |

$ |

475,138 |

$ |

494,400 |

$ |

547,114 |

$ |

571,356 |

|

N/A |

|||||

|

|

|

|

|

|

||||||||||

Book:Bill Ratio |

|

|

|

|

|

||||||||||

Aerospace |

|

1.59 |

|

1.15 |

|

1.48 |

|

1.10 |

|

1.31 |

|||||

Test Systems |

|

1.00 |

|

1.13 |

|

0.96 |

|

1.55 |

|

1.17 |

|||||

Total Book:Bill |

|

1.51 |

|

1.15 |

|

1.40 |

|

1.15 |

|

1.29 |

|||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20230302005842/en/

Company:

Phone: (716) 805-1599, ext. 159

Email: david.burney@astronics.com

Investor Relations:

Phone: (716) 843-3908

Email: dpawlowski@keiadvisors.com

Source: