Arizona Sonoran Standalone PEA for Cactus Open Pit Project Reports Post-Tax NPV8 of US$2.03 Billion (C$2.77 Billion) and IRR of 24% and LOM EBITDA of US$11.29 Billion (C$15.36 Billion)

Arizona Sonoran Copper Company announced the results of an NI 43-101 Preliminary Economic Assessment (PEA) for its 100%-owned Cactus Project in Arizona. The PEA reports a post-tax Net Present Value (NPV) of $2.03 billion and an Internal Rate of Return (IRR) of 24%. The Life of Mine (LoM) EBITDA is $11.29 billion, with a payback period of 4.9 years.

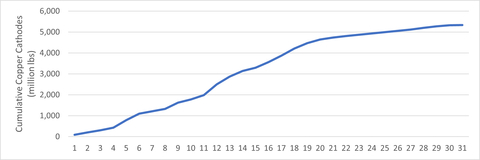

The project is expected to produce 5.34 billion pounds of copper over a 31-year mine life, with an average annual production of 232 million pounds for the first 20 years. Cash costs are projected at $1.82 per pound, with All-in Sustaining Costs (AISC) at $2.00 per pound.

The PEA marks a transition to open pit operations, estimating a total of 889 million tons of processed material with a 94% contribution from open pit mining. The PEA supersedes the earlier Pre-Feasibility Study and integrates new resources, enhancing the project's economic and operational metrics.

Expected initial capital expenditure is $668 million, with sustaining capital at $1.17 billion. The company plans to file a technical report within 45 days of the PEA release.

L'Arizona Sonoran Copper Company ha annunciato i risultati di una Valutazione Economica Preliminare (PEA) NI 43-101 per il suo progetto Cactus, di proprietà al 100% in Arizona. La PEA riporta un Valore Attuale Netto (NPV) post-tasse di 2,03 miliardi di dollari e un Tasso Interno di Rendimento (IRR) del 24%. L'EBITDA della Vita della Miniera (LoM) è di 11,29 miliardi di dollari, con un periodo di recupero di 4,9 anni.

Si prevede che il progetto produca 5,34 miliardi di libbre di rame nell'arco di una vita mineraria di 31 anni, con una produzione media annua di 232 milioni di libbre nei primi 20 anni. I costi di cassa sono proiettati a 1,82 dollari per libbra, mentre i Costi Complessivi Sostenibili (AISC) sono stimati a 2,00 dollari per libbra.

La PEA segna una transizione verso operazioni a cielo aperto, stimando un totale di 889 milioni di tonnellate di materiale trattato con un contributo del 94% dall'estrazione a cielo aperto. La PEA sostituisce il precedente Studio di Perfezionamento e integra nuove risorse, migliorando le metriche economiche e operative del progetto.

Si prevede che la spesa in conto capitale iniziale sia di 668 milioni di dollari, con un capitale di sostegno stimato a 1,17 miliardi di dollari. L'azienda prevede di presentare un rapporto tecnico entro 45 giorni dalla pubblicazione della PEA.

Arizona Sonoran Copper Company anunció los resultados de una Evaluación Económica Preliminar (PEA) NI 43-101 para su proyecto Cactus, de propiedad al 100% en Arizona. La PEA informa un Valor Presente Neto (NPV) post-impuesto de 2.03 mil millones de dólares y una Tasa Interna de Retorno (IRR) del 24%. El EBITDA de la Vida de la Mina (LoM) es de 11.29 mil millones de dólares, con un período de recuperación de 4.9 años.

Se espera que el proyecto produzca 5.34 mil millones de libras de cobre durante una vida minera de 31 años, con una producción anual promedio de 232 millones de libras en los primeros 20 años. Los costos en efectivo se proyectan en 1.82 dólares por libra, con Costos Totales de Sostenimiento (AISC) en 2.00 dólares por libra.

La PEA marca una transición a operaciones a cielo abierto, estimando un total de 889 millones de toneladas de material procesado con una contribución del 94% de la minería a cielo abierto. La PEA reemplaza el anterior Estudio de Prefactibilidad e integra nuevos recursos, mejorando las métricas económicas y operativas del proyecto.

Se espera que el gasto inicial de capital sea de 668 millones de dólares, con un capital de sostenimiento de 1.17 mil millones de dólares. La empresa planea presentar un informe técnico dentro de los 45 días posteriores al lanzamiento de la PEA.

아리조나 소노란 구리 회사는 아리조나에 있는 100% 소유의 Cactus 프로젝트에 대한 NI 43-101의 예비 경제 평가(PEA) 결과를 발표했습니다. PEA는 세후 순현재가치(NPV)가 20억 3천만 달러, 내부수익률(IRR)이 24%에 달한다고 보고합니다. 광산의 생애수익(LoM) EBITDA는 112억 9천만 달러이며, 회수 기간은 4.9년입니다.

이 프로젝트는 31년 동안 53억 4천만 파운드의 구리를 생산할 것으로 예상되며, 처음 20년 동안 평균 연간 생산량은 2억 3천2백만 파운드입니다. 현금 비용은 파운드당 1.82달러로 예상되며, 총 유지 비용(AISC)은 2.00달러입니다.

PEA는 노천 채굴 작업으로의 전환을 나타내며, 처리된 총 자재가 8억 8천9백만 톤으로 94%가 노천 채굴에서 발생한 것으로 추정됩니다. PEA는 이전의 사전 타당성 연구를 대체하고 새로운 자원을 통합하여 프로젝트의 경제적 및 운영 지표를 개선합니다.

초기 자본 지출은 6억 6천8백만 달러로 예상되며, 지속적인 자본은 11억 7천만 달러입니다. 회사는 PEA 발표 후 45일 이내에 기술 보고서를 제출할 계획입니다.

L'Arizona Sonoran Copper Company a annoncé les résultats d'une Évaluation Économique Préliminaire (PEA) selon la norme NI 43-101 pour son projet Cactus, entièrement détenu en Arizona. La PEA indique une Valeur Actualisée Nette (NPV) après impôts de 2,03 milliards de dollars et un Taux de Rendement Interne (IRR) de 24 %. L'EBITDA sur la durée de vie de la mine (LoM) s'élève à 11,29 milliards de dollars, avec une période de retour sur investissement de 4,9 ans.

Le projet devrait produire 5,34 milliards de livres de cuivre sur une durée de vie de mine de 31 ans, avec une production annuelle moyenne de 232 millions de livres lors des 20 premières années. Les coûts d'exploitation en espèces sont estimés à 1,82 dollar par livre, tandis que les Coûts Totaux de Sostenibilité (AISC) s'élèvent à 2,00 dollars par livre.

La PEA marque une transition vers des opérations à ciel ouvert, en estimant un total de 889 millions de tonnes de matériau traité avec une contribution de 94 % provenant du minage en plein air. La PEA remplace l'Étude de Pré-Faisabilité précédente et intègre de nouvelles ressources, améliorant ainsi les paramètres économiques et opérationnels du projet.

Les dépenses en capital initiales sont estimées à 668 millions de dollars, avec des investissements de maintien prévus à 1,17 milliard de dollars. La société prévoit de soumettre un rapport technique dans les 45 jours suivant la publication de la PEA.

Die Arizona Sonoran Copper Company gab die Ergebnisse einer vorläufigen wirtschaftlichen Bewertung (PEA) gemäß NI 43-101 für ihr zu 100 % im Besitz befindliches Cactus-Projekt in Arizona bekannt. Die PEA berichtet von einem Netto-Barwert (NPV) nach Steuern von 2,03 Milliarden Dollar und einer internen Rendite (IRR) von 24 %. Das EBITDA über die Lebensdauer der Mine (LoM) beträgt 11,29 Milliarden Dollar, mit einer Amortisationsdauer von 4,9 Jahren.

Das Projekt wird voraussichtlich über eine Lebensdauer von 31 Jahren 5,34 Milliarden Pfund Kupfer produzieren, wobei die durchschnittliche jährliche Produktion in den ersten 20 Jahren 232 Millionen Pfund beträgt. Die Barausgaben werden auf 1,82 Dollar pro Pfund veranschlagt, während die Gesamtkosten (AISC) bei 2,00 Dollar pro Pfund liegen.

Die PEA markiert den Übergang zu Tagebau, wobei insgesamt 889 Millionen Tonnen verarbeitetes Material geschätzt werden, mit einem 94%igen Anteil aus dem Tagebau. Die PEA ersetzt die frühere Machbarkeitsstudie und integriert neue Ressourcen, wodurch die wirtschaftlichen und betrieblichen Kennzahlen des Projekts verbessert werden.

Die anfänglichen Investitionsausgaben werden auf 668 Millionen Dollar geschätzt, während die nachhaltigen Investitionen bei 1,17 Milliarden Dollar liegen. Das Unternehmen plant, innerhalb von 45 Tagen nach Veröffentlichung der PEA einen technischen Bericht einzureichen.

- Post-tax NPV of $2.03 billion

- IRR of 24%

- LoM EBITDA of $11.29 billion

- Payback period of 4.9 years

- Average annual copper production of 232 million pounds for the first 20 years

- Total copper production of 5.34 billion pounds over 31 years

- Cash costs of $1.82 per pound

- All-in Sustaining Costs (AISC) of $2.00 per pound

- Initial capital expenditure of $668 million

- The PEA is preliminary and includes inferred mineral resources, which are considered too speculative geologically to have the economic considerations applied to them.

-

Key Performance Indicators:

-

US Net Present Value (“NPV”) ($2.03B 8% discount, after-tax) -

24% Internal rate of return (“IRR”) - 4.9 years Payback Period

-

-

Life of Mine (“LoM”) Gross Revenue of

$20.8 billion -

LoM Free Cash Flow (“FCF”) of

$7.3 billion -

Cash costs (C1) of

$1.82 $2.00 -

Financial and operational executability now through transition to Open Pit operation

-

94% material from open pit mining (Cactus West andParks /Salyer),6% from the Stockpile and Cactus East underground

-

- 232 million pounds (“lbs”) (116,052 short tons (“st”)) average annual copper cathode production over the first 20 years of operation and a total of 5,339 million lbs (2,669,342 st) of copper cathode produced over the 31-year operating mine life

-

Cactus Project is well positioned to add value in a variety of copper price environments

-

Copper Price Assumption

-

$3.90 -

$4.50

-

-

NPV8 (after-tax)

-

$2,032 million -

$2,927 million

-

-

IRR (after-tax)

-

24% -

30%

-

-

Payback (after-tax)

- 4.9 Years

- 4.5 Years

-

Development Capital

-

$668 million -

$668 million

-

-

LoM FCF (After Tax)

- 7,295 million

- 9,777 million

-

Copper Price Assumption

FIGURE 1: Cumulative Stacked Recoverable Copper (Graphic: Business Wire)

A webinar will be held on August 8, 2024, at 10:30 am ET. Please join George Ogilvie, Nick Nikolakakis, Bernie Loyer, Steve Dixon and Anthony Bottrill in discussion of the PEA and the Company’s next steps by registering here https://www.bigmarker.com/vid-conferences/ASCU-newdevelopments.

The PEA is preliminary in nature and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the project described in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

TABLE 1: SUMMARY OF KEY METRICS

Valuation Metrics (Unlevered) |

Unit |

2024 PEA

|

Net Present Value @ |

$ millions |

2,769 |

Net Present Value @ |

$ millions |

2,032 |

Internal Rate of Return (after-tax) |

% |

24.0 |

Payback Period (after-tax) |

# years |

4.9 |

Project Metrics (Imperial) |

Unit |

2024 PEA

|

Construction Period – SXEW plant |

# years |

1.5 - 2 |

Life of Mine (“LoM”) |

# years |

31 |

Strip Ratio |

Waste : Feed |

2.23 |

LoM Mineralized Material Mined |

ktons |

889,004 |

LoM Copper Grade |

% CuT |

0.46 |

LoM Avg Annual Contained Copper Production |

000 tons millions lbs |

86 172 |

LoM Annual Crusher Throughput |

millions tons |

29 |

Annual Copper Production (years 1-20) |

000 tons millions lbs |

116 232 |

Recovery (years 1-20) |

%CuTSol |

83 |

LoM Recoveries (LOM) |

% CuTSol |

73 |

LoM Oxide |

% CuTSol |

92 |

LoM Enriched |

% CuTSol |

85 |

LoM Primary (conventional leaching) |

% CuT |

25 |

LoM Recovered Copper Cathodes |

K pounds |

5,338,683 |

Initial Capital (including contingency) |

$ millions |

668 |

Sustaining Capital |

$ millions |

1,169 |

Cash Cost (C1)* |

$/lb Cu |

1.82 |

All in Sustaining Cost (AISC)* |

$/lb Cu |

2.00 |

LoM Revenues |

$ millions |

20,821 |

LoM EBITDA |

$ millions |

11,292 |

LoM FCF (unlevered) after tax |

$ millions |

7,295 |

Notes: |

||

*Project operating costs include mine operating, process plant operating, and general and administrative costs (“G&A”). Total production costs include royalty expense. The AISC additionally includes initial Capex, sustaining Capex, reclamation & closure. |

||

George Ogilvie, ASCU President and CEO commented, “We achieved, and far surpassed each goal to demonstrate leading NPV, IRR and payback and all other operational and economic metrics from the Cactus Project. The PEA represented herein delivers a highly compelling copper mining operation, on a standalone basis. The project size and top-tier location are complemented by a highly skilled operations and development team already based in

He continued, “We now look forward to completing metallurgical programs and the infill drilling to support a PFS expected in 1H2025. Clearly, Cactus shows merit on a standalone basis and we will continue to move forward with this mine plan, while continuing to work with our partner, Nuton Technologies, a Rio Tinto Venture. We envisage Cactus, a brownfield Copper Mine as having the size and scale capable of making a meaningful positive impact to the US copper mining industry.”

Key Impacts on the NPV:

-

Mine plan execution rescopes to

94% open pit-

Parks /Salyer and Cactus West are open pit operations; changes positively impact annual throughput, mining costs, operating costs and processing costs.

-

-

Mineralized material impacts

-

LoM tonnage processed of 889 million st, including:

-

659 million st of oxides and enriched material

-

Parks /Salyer:69% -

Including: new MainSpring inferred mineral resources of 245 Mst @

0.39% CuT (PR dated JUL 16, 2024)

-

Including: new MainSpring inferred mineral resources of 245 Mst @

-

Cactus West:

23% -

Cactus East:

6% -

Stockpile

2%

-

-

230 million st of primary sulphides to the leach pads with current recoveries reported at an average of

25% from year 15-

Parks /Salyer34% -

Cactus West:

66%

-

-

659 million st of oxides and enriched material

-

LoM tonnage processed of 889 million st, including:

-

Processing cost impacts

-

Processing initial capital expenditure (“capex”) of

$511 million -

Processing sustaining capital of

$553 million $18 million -

Processing operating costs (“opex”) of

$2.29

-

Processing initial capital expenditure (“capex”) of

-

Other cost impacts

- Updated salvage cost, land sales, closure and royalties

-

Mining cost impacts

-

Mining opex and capex impacted by

Parks /Salyer rescope to an open pit mining operation -

Initial Capex of

$157 million -

Mining sustaining capital of

$544 million $18 million -

Operating expenditures of

$8.16

-

Mining opex and capex impacted by

Bernie Loyer, ASCU SVP Projects commented, “The evolution of the MainSpring and

Nick Nikolakakis, ASCU CFO commented, “The economics at Cactus in the PEA afford us an opportunity to begin seeking project financing. The Company has been in initial discussions with a group of lenders including commercial banks and an export credit agency. Cactus is projected to generate robust cash flows over a 30+ year mine life. The current economic metrics present a unique opportunity for the Company to actively pursue financing alternatives as the project advances towards a pre-feasibility and definitive feasibility study in 2025.”

The Company intends to file a technical report (the “Technical Report”) in respect of the PEA in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile and the Company’s website within 45 days of the MRE News Release.

Preliminary Economic Assessment Summary

The 2024 PEA supersedes the PFS titled “Cactus Mine Project NI 43-101 Technical Report and Pre-Feasibility Study,

A total of 2,872 million tons will be mined and a total of 889 million tons processed, recovering 5.34 billion pounds of copper cathodes over the LoM or 2,669,000 tons. Copper cathodes will be produced directly onsite via heap leach and SXEW, including a four year ramp up period. Total Copper recoveries are planned at an average of

Onsite facilities at the mine site will consist of two open pits, one underground mining operation, a fine crushing plant incorporating all crushing, classification, agglomeration and conveying systems, heap leach pad, water supply and distribution systems, technical and operational support offices, additional electrical substation, warehousing and an SXEW process plant. Onsite supporting infrastructure will include site power distribution, access roads, mine operations infrastructure, and heap leach facilities, of which the power and roads are already in use.

Current onsite and nearby infrastructure includes:

- Onsite administration buildings, geology, core storage, completed earthworks, substation, parking lot and access roads

-

Clean power via onsite substation for

$0.07 - Paved access roads and easy access to interstate highways I-8 and I-10

- Union Pacific railroad line adjacent to the property

-

Casa Grande ,Maricopa andPhoenix are all located nearby to supply materials/consumables in addition to a skilled labour pool - Permitted water available onsite, and additional water may be available through the city

- Flat land and low altitude

-

Located within the

City of Casa Grande industrial park

TABLE 2: Report Sensitivities to the Copper Price

Revenue, NPV and IRR Sensitivity Based on Copper Price |

|||||

Metal Price |

Copper Price |

Revenue

( |

NPV, before tax @ |

NPV, after tax @ |

IRR after Tax |

Base Case |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

Mining and Processing Operations

Mineralized material will be sourced mainly from the two open pits with an overall LoM strip ratio of 2.3:1. The Cactus West pit (1.0:1 strip ratio) and new

Both

The mine schedule for open pit mining at

The mine schedule for open pit mining at Cactus West consists of 306 million tons of feed material grading

The Stockpile project contributes 9.8 million tons of conventional leach feed material grading

After a comprehensive review of Cactus East¸ sub-level caving (“SLC”) was selected as the preferred underground mining method. A sublevel cave underground mine is planned for Cactus East with development beginning in Year 8 and mining completed in Year 22, peaking at 3.9 million tons per year. Total Cactus East feed material mined is projected to be 42 million tons grading

The Cactus Project heap leaching process design includes crushing of all material types for leaching to a minus ¾” P80 size. All material types, oxides, enriched and primary are to be leached in on a single pad with an initial leaching cycle of 180 days. A maximum 3-year leaching cycle has been assumed (3 lifts) as the practical limit for effective recovery based on experience and hydrodynamic analysis of the materials by HydroGeoScience Inc. (HGS). The copper leaching metallurgical test data has been extrapolated from the testing data at one year based on the rates prevailing after one year using a logarithmic curve fit projection that considers the decaying rate of copper extraction.

Average annual water consumption is planned at approximately 1,200 gallons per minute, the equivalent of 1,935 acre feet per year, well within ASCU’s permitted 3,600 acre feet per year industrial use allocation, using in place onsite wells.

The PEA envisages that overall tonnage will comprise approximately

The total LoM costs, operating costs per ton ($/st) of processed material, and dollars per pound ($/lb) of cathode produced are summarized in the three tables below. Project operating costs include mine operating, process plant operating, and general and administrative costs (“G&A”). Total production costs include royalty expense. The AISC additionally includes initial Capex, sustaining Capex, reclamation & closure.

Mining operating cost estimates, prepared by AGP Mining Consultants Inc., are based on a small owner’s team managing mining activities using an owner-operator model. Process operating cost estimates were prepared by Samuel Engineering and G&A cost estimates were prepared by M3 Engineering with input from ASCU, as summarized in TABLES 3-5 below (note numbers may not add due to rounding). Sequencing of operations and annual cash flows are detailed in Exhibit 1 and 2, at the end of this release.

TABLE 3: LoM OPERATING AND PRODUCTION COSTS |

|||

Cost Elements |

LoM (US$) |

||

Total Cost (US$M) |

US$ / st Processed |

US$ / lb Copper |

|

Mine Operating Cost |

|

|

|

Process Plant Operating Cost |

|

|

|

G & A |

|

|

|

Operating Costs |

|

|

|

Royalties |

|

|

|

Total Production Costs |

|

|

|

Sustaining Capex |

|

|

|

Reclamation & Closure |

|

|

|

Salvage |

- |

- |

- |

All-In Sustaining Costs |

|

|

|

Property & Severance Taxes |

|

|

|

Initial Capex (non-sustaining) |

|

|

|

All-In Costs |

|

|

|

TABLE 4: LoM OPERATING COST AND CASH FLOW |

||

ACTIVITY (LOM) |

US$M |

US$ / st |

LOM REVENUE |

20,821 |

- |

Mining (OP and UG) |

7,252 |

8.16 |

Process Plant |

2,039 |

2.29 |

General & Administration |

50 |

0.06 |

Total Cash Operating Cost |

9,341 |

10.51 |

Royalties |

388 |

0.44 |

Salvage Value |

- |

-0.25 |

Reclamation & Closure |

|

0.03 |

Total Production Cost |

9,529 |

10.72 |

EBITDA |

11,292 |

- |

Total CAPEX |

1,836 |

2.07 |

Net Income Before Taxes |

9,456 |

- |

Taxes and Depreciation |

2,161 |

2.43 |

Free Cash Flow (unlevered) |

7,295 |

- |

The capital cost estimates for the PEA were developed with a -

TABLE 5: CAPITAL COST ESTIMATES |

||||

AREA |

DETAIL |

INITIAL CAPEX

(US |

SUSTAINING CAPEX

(US |

TOTAL CAPEX

(US |

Direct Costs |

Mine Costs |

156,856 |

543,609 |

700,465 |

Processing Plant |

259,320 |

408,240 |

667,560 |

|

Infrastructure |

95,740 |

17,211 |

112,951 |

|

Indirect Costs |

45,470 |

16,944 |

62,414 |

|

Owner's Costs, First Fills, & Light Vehicles |

22,921 |

72,030 |

94,951 |

|

Total CAPEX without Contingency |

580,307 |

1,058,034 |

1,638,341 |

|

Contingency |

87,558 |

110,599 |

198,157 |

|

Total CAPEX with Contingency |

667,865 |

1,168,633 |

1,836,498 |

|

The PEA is based on the updated 2024 MRE, as published in the MRE News Release on JUL 16, 2024, showing a

TABLE 6: Cactus Project Mineral Resource Estimate

Material

|

Tons

|

Grade CuT % |

Grade Cu Tsol % |

Contained

|

Contained

|

Measured |

|||||

Total Leachable |

55,200 |

0.94 |

0.79 |

1,032,200 |

873,800 |

Total Primary |

12,300 |

0.51 |

0.05 |

124,400 |

13,400 |

Total Measured |

67,500 |

0.86 |

0.66 |

1,156,500 |

887,200 |

Indicated |

|||||

Total Leachable |

414,800 |

0.60 |

0.53 |

4,965,000 |

4,365,700 |

Total Primary |

150,400 |

0.39 |

0.04 |

1,173,300 |

126,000 |

Total Indicated |

565,200 |

0.54 |

0.40 |

6,138,200 |

4,491,700 |

M&I |

|||||

Total Leachable |

470,000 |

0.64 |

0.56 |

5.997,200 |

5,239,500 |

Total Primary |

162,700 |

0.40 |

0.04 |

1,297,600 |

139,400 |

Total M&I |

632,600 |

0.58 |

0.43 |

7,294,800 |

5,378,900 |

Inferred |

|||||

Total Leachable |

299,600 |

0.43 |

0.38 |

2,572,400 |

2,262,800 |

Total Primary |

174,500 |

0.36 |

0.04 |

1,267,500 |

124,700 |

Total Inferred |

474,000 |

0.41 |

0.25 |

3,839,900 |

2,387,500 |

NOTES: |

|||||

1. Total soluble copper grades (Cu TSol) are reported using sequential assaying to calculate the soluble copper grade. Tons are reported as short tons. |

|||||

2. Stockpile resource estimates have an effective date of 1st March, 2022, Cactus Project mineral resource estimates have an effective date of 29th April, 2022, |

|||||

3. Technical and economic parameters defining mineral resource pit shells: mining cost |

|||||

4. Technical and economic parameters defining underground mineral resource: mining cost |

|||||

5. Technical and economic parameters defining processing: Oxide heap leach (“HL”) processing cost of |

|||||

6. Royalties of |

|||||

7. Variable cut-off grades were reported depending on material type, potential mining method, potential processing method, and applicable royalties. For ASCU properties - Oxide open pit or underground material = |

|||||

8. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors. |

|||||

9. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification. |

|||||

10. Totals may not add up due to rounding |

|||||

Metallurgical Testwork

Metallurgical testwork used for the PEA shows good metallurgical recoveries from all deposits with no deleterious elements. Testing in the PEA shows an average of

Project Overview

The Cactus Project is a brownfield project located approximately 6 mi (10 km) northwest of the city of Casa Grande and 40 road miles south-southwest of the

The Cactus Project is host to a large porphyry copper system that has been dismembered and displaced by Tertiary extensional faulting. The major host rocks are Precambrian Oracle Granite and Laramide monzonite porphyry and quartz monzonite porphyry. The mine trend features the formation of horst and graben blocks of mineralization where the Cactus deposits are situated, extending from the Cactus East deposit, southwest to the

Ownership, Social License and Permitting

The Cactus Project is

Of the 5,720 acres, 4,732 acres are considered fee simple and private land. The remaining acreage is State land where ASCU owns either the surface or mineral rights and is in the process of acquiring the surface rights from the State.

ASCU has a well-developed community engagement plan that it has implemented through numerous public meetings and outreach. With the presence of legacy mining in the

Royalties

The Cactus Project is subject to three net smelter return (“NSR”) royalties based on potential mining production. The MainSpring property does not contain any royalties. The Tembo/Elemental Altus NSR royalty applied to the originally acquired land package including, Cactus and

Opportunities and Next Steps, including Nuton Technologies

Technical Studies

Following the issuance of the PEA, the anticipated next steps for the Cactus Project include a PFS (which is expected to be completed in 1H2025) (the “2025 PFS”), followed by an early works program, and expects to initiate a Feasibility Study in 2H2025. The Company is planning Project financing for the Cactus Project in conjunction with a potential construction decision.

It is expected that the 2025 PFS will include the major economic and operational rescope; specifically, rescoping

An Early Works program is in the early phases of being defined and planned for mid-2025, dependent upon funding. The program includes executing the permitting and bonding requirements and optimizing a pre-stripping program for the

Nuton Opportunity

The PEA proposes a robust standalone project incorporating conventional leaching technology. In order to capitalize on the primary sulphides, initial test work has validated the application of Nuton proprietary technology. As per the strategy outlined in the option to Joint Venture (“JV”) press release, dated DEC 14, 2023, Phase 2 metallurgical testing and Cactus West pit expansion drilling targeting the primary sulphides will be included to the 2025 PFS.

Nuton LLC, a Rio Tinto Venture, is a copper heap leaching technology. Nuton™ became a shareholder in 2022, and a potential JV partner in late 2023. Its Nuton™ suite of proprietary technologies provide opportunities to leach both primary and secondary copper sulfides, providing significant opportunity to optimize the mine plan and the overall mining and processing operations.

Other Future Opportunities

The project has several other opportunities available to continue the optimization of the operation.

- The addition of an In-Pit-Crush-Convey (IPCC) for waste handling instead of truck haulage will be evaluated for improvement in the economics of the project.

-

There is a potential to access the high-grade

Parks /Salyer material earlier, by moving theParks /Salyer open pit centroid further northward

Exhibit 1: Mine Plan and Key Financial Assumptions

Exhibit 1: Production and Cash Costs |

||||||||||||||

Year |

Production (000’s) tons |

Head Grade |

Recovered Copper |

Costs (/lb) |

||||||||||

Open Pit |

U/G |

OP |

UG |

|||||||||||

|

Cactus West |

Stockpile |

Open Pit Rehandle |

Total Open Pit Moved |

Open Pit Material |

Open Pit Waste |

Cactus East |

% TCu |

% TCu |

ktons |

klbs |

C1 Cost |

AISC |

|

0 |

70,000 |

0 |

0 |

0 |

70,000 |

170 |

69,829 |

0 |

0.12 |

|

48.78 |

87,427 |

|

|

1 |

130,000 |

|

10,000 |

9 |

140,009 |

24,527 |

115,473 |

0 |

0.23 |

|

64.24 |

111,826 |

|

|

2 |

150,000 |

0 |

0 |

0 |

150,000 |

34,303 |

115,697 |

0 |

0.24 |

|

61.62 |

106,669 |

|

|

3 |

140,000 |

0 |

0 |

303 |

140,303 |

30,621 |

109,379 |

0 |

0.25 |

|

72.72 |

126,910 |

|

|

4 |

150,000 |

0 |

0 |

0 |

150,000 |

35,538 |

114,462 |

0 |

0.25 |

|

210.96 |

360,507 |

|

|

5 |

150,000 |

0 |

0 |

0 |

150,000 |

77,997 |

72,003 |

0 |

0.48 |

|

177.01 |

302,233 |

|

|

6 |

152,363 |

0 |

0 |

10,312 |

162,675 |

21,428 |

130,935 |

0 |

0.87 |

|

65.26 |

112,749 |

|

|

7 |

131,119 |

8,881 |

0 |

20,859 |

160,859 |

4,282 |

135,718 |

0 |

0.32 |

|

66.71 |

116,778 |

|

|

8 |

97,685 |

65,000 |

0 |

5,712 |

168,397 |

18,160 |

144,525 |

132 |

0.36 |

0.37 |

176.94 |

303,147 |

|

|

9 |

94,478 |

50,522 |

0 |

0 |

145,000 |

36,401 |

108,599 |

920 |

0.60 |

0.69 |

86.70 |

154,276 |

|

|

10 |

88,593 |

50,558 |

0 |

0 |

139,151 |

33,780 |

105,371 |

2,462 |

0.31 |

0.79 |

116.63 |

207,731 |

|

|

11 |

105,000 |

22,301 |

0 |

0 |

127,301 |

33,486 |

93,815 |

3,456 |

0.33 |

0.82 |

295.39 |

507,032 |

|

|

12 |

125,000 |

0 |

0 |

0 |

125,000 |

49,458 |

75,542 |

3,328 |

0.80 |

0.84 |

220.54 |

378,173 |

|

|

13 |

125,000 |

0 |

0 |

4,601 |

129,601 |

33,652 |

91,348 |

3,825 |

0.76 |

0.92 |

151.19 |

261,603 |

|

|

14 |

115,000 |

0 |

0 |

10,582 |

125,582 |

27,174 |

87,826 |

3,822 |

0.50 |

0.86 |

109.64 |

156,352 |

|

|

15 |

86,891 |

28,109 |

0 |

2,719 |

117,719 |

29,972 |

85,028 |

3,828 |

0.32 |

0.79 |

177.80 |

269,472 |

|

|

16 |

100,000 |

0 |

0 |

4,848 |

104,848 |

24,733 |

75,267 |

3,693 |

0.56 |

0.88 |

203.53 |

306,859 |

|

|

17 |

85,724 |

0 |

0 |

5,478 |

91,202 |

25,134 |

60,590 |

3,502 |

0.72 |

0.88 |

219.74 |

341,302 |

|

|

18 |

53,497 |

0 |

0 |

2,040 |

55,537 |

28,686 |

24,810 |

3,584 |

0.75 |

0.84 |

170.78 |

254,961 |

|

|

19 |

18,367 |

7,763 |

0 |

2,958 |

29,087 |

25,854 |

275,559 |

3,603 |

0.57 |

0.90 |

122.81 |

176,092 |

|

|

20 |

17,015 |

0 |

0 |

12,096 |

29,111 |

16,669 |

346 |

3,535 |

0.47 |

0.75 |

76.39 |

97,761 |

|

|

21 |

9,294 |

0 |

0 |

20,527 |

29,821 |

9,254 |

41 |

2,520 |

0.41 |

0.76 |

61.52 |

70,315 |

|

|

22 |

16,097 |

0 |

0 |

22,520 |

38,617 |

16,079 |

17,895 |

0 |

0.37 |

|

54.06 |

61,131 |

|

|

23 |

0 |

20,813 |

0 |

27,195 |

48,008 |

4,265 |

16,547 |

0 |

0.16 |

|

99.51 |

62,746 |

|

|

24 |

0 |

67,119 |

0 |

22,332 |

89,451 |

15,490 |

51,629 |

0 |

0.22 |

|

88.77 |

58,543 |

|

|

25 |

0 |

67,584 |

0 |

0 |

67,584 |

35,186 |

32,398 |

0 |

0.28 |

|

87.71 |

63,674 |

|

|

26 |

0 |

60,000 |

0 |

5,000 |

65,000 |

30,480 |

29,520 |

0 |

0.28 |

|

72.18 |

61,623 |

|

|

27 |

0 |

60,000 |

0 |

0 |

60,000 |

41,640 |

18,360 |

0 |

0.24 |

|

92.68 |

81,688 |

|

|

28 |

0 |

30,000 |

0 |

4,361 |

34,361 |

26,939 |

3,060 |

0 |

0.32 |

|

94.36 |

68,405 |

|

|

29 |

0 |

34,018 |

0 |

1,997 |

36,015 |

29,305 |

4,712 |

0 |

0.32 |

|

92.06 |

58,879 |

|

|

30 |

0 |

30,000 |

0 |

6,651 |

36,651 |

24,783 |

5,217 |

0 |

0.35 |

|

16.51 |

11,817 |

|

|

31 |

0 |

2,805 |

0 |

7,061 |

9,865 |

1,343 |

1,462 |

0 |

0.33 |

|

|

|

|

|

Exhibit 2: Annual Economics |

||||||

Year |

Revenue |

Operating Cost |

Operating Income |

EBITDA |

Capex |

FCF |

1 |

|

|

|

|

|

- |

2 |

|

|

|

|

|

|

3 |

|

|

|

|

|

- |

4 |

|

|

|

|

|

|

5 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

8 |

|

|

|

|

|

|

9 |

|

|

|

|

|

|

10 |

|

|

|

|

|

|

11 |

|

|

|

|

|

|

12 |

|

|

|

|

|

|

13 |

|

|

|

|

|

|

14 |

|

|

|

|

|

|

15 |

|

|

|

|

|

|

16 |

|

|

|

|

|

|

17 |

|

|

|

|

|

|

18 |

|

|

|

|

|

|

19 |

|

|

|

|

|

|

20 |

|

|

|

|

|

|

21 |

|

|

|

|

|

|

22 |

|

|

|

|

|

|

23 |

|

|

|

|

|

|

24 |

|

|

|

|

|

- |

25 |

|

|

- |

- |

|

- |

26 |

|

|

|

|

|

|

27 |

|

|

|

|

|

- |

28 |

|

|

|

|

|

|

29 |

|

|

|

|

|

|

30 |

|

|

|

|

|

|

31 |

|

|

- |

- |

|

- |

Exhibit 3: PRICE DECK - ASSUMPTIONS |

||

PRICE / RATE |

UNIT |

LONG TERM |

Copper |

$/lb |

3.90 |

Weighted Average Recovery |

% |

73 |

Sulfuric Acid |

$/ton |

160.00 |

Electricity (Nuclear) |

$/kWh |

0.071 |

NSR Royalty |

|

|

|

% |

|

|

% |

|

Effective Taxes |

% |

22.9 |

Quality Assurance and Quality Control Procedures

Skyline Labs is accredited in accordance with the recognized International Standard ISO/IEC 17025:2005. Their quality management system has been certified as conforming to the requirements defined in the International Standard ISO 9001:2015. The standard operating procedure (SOP) used while processing the ASCU samples was to process samples in groups of 20. Each tray consisted of 18 samples with samples No. 1 and No. 10 repeated as duplicates. The results from each tray were analyzed and any variance in the duplicates of more than

The results of these analyses, including the QA/QC checks, were transmitted to a select set of individuals at ASCU and the qualified persons.

Qualified Persons

Each of the persons listed below are authors preparing the 2024 PEA and have reviewed and verified the contents of this news release as it relates to their area of responsibilities. By virtue of their education, experience and professional association membership, each of the below listed persons are considered “qualified person" as defined by NI 43-101.

Scientific and technical aspects of this news release have been reviewed and verified by these Qualified Person’s listed below and Dan Johnson, ASCU Director of Projects, as defined by National Instrument 43-101.

Project Management, M3 Engineering, John Woodson, PE, SME-RM

Metallurgy, M3 Engineering, Laurie Tahija, QP-MMSA

Mineral Resources, Allan L. Schappert, CPG, SME-RM, ALS Geo Resources LLC

Water and Environmental, R. Douglas

Mine Planning, Gordon Zurowski, P.Eng., AGP Mining Consultants Inc.

Links from the Press Release:

Webinar: https://www.bigmarker.com/vid-conferences/ASCU-newdevelopments

Figures and Tables: https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

July 16, 2024: https://arizonasonoran.com/news-releases/arizona-sonoran-updates-cactus-project-mineral-resource-estimate-to-7.3-b-lbs-of-copper-in-m-i-and-3.8-b-lbs-of-copper-in/

December 14, 2023: https://arizonasonoran.com/news-releases/arizona-sonoran-and-nuton-llc-announce-option-to-joint-venture-on-cactus-project-in-arizona/

SEDAR+: https://www.sedarplus.ca

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with low operating costs and to develop the Cactus and

Non-IFRS Financial Performance Measures

This news release contains certain non-IFRS measures, including sustaining capital, sustaining costs, EBITDA, C1 cash costs and AISC. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian disclosure requirements of Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards on Mineral Resources and Mineral Reserves” incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Forward-Looking Statements

This news release contains “forward-looking statements” and/or “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expect”, “is expected”, “in order to”, “is focused on” (a future event), “estimates”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, or the negative connotation thereof. In particular, statements regarding ASCU’s future operations, future exploration and development activities or other development plans constitute forward-looking statements. By their nature, statements referring to mineral reserves or mineral resources constitute forward-looking statements. Forward-looking statements in this news release include, but are not limited to statements with respect to the results (if any) of further exploration work to define and expand or upgrade mineral resources and reserves at ASCU’s properties; the anticipated exploration, drilling, development, construction and other activities of ASCU and the result of such activities; the mineral resources and mineral reserves estimates of the Cactus Project (and the assumptions underlying such estimates); the estimates and assumptions underlying the PEA; projected production; pre-tax and after-tax NPV; [pre-tax] and after-tax IRR; payback period; LOM estimates; free-cash flows estimates; AISC and cost estimates; job creation estimates; expected revenues, EBITDA or recoveries; the ability of exploration work (including drilling) to accurately predict mineralization; the ability of management to understand the geology and potential of the Cactus Project; the focus of the 2024 drilling program at the Cactus Project including the

ASCU considers its assumptions to be reasonable based on information currently available but cautions the reader that their assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect ASCU, its properties and business. Such risks and uncertainties include, but not limited to, the global economic climate, developments in world commodity markets, changes in commodity prices (particularly prices of copper), risks relating to fluctuations in the Canadian dollar and other currencies relative to the US dollar, risks relating to capital market conditions and ASCU’s ability to access capital on terms acceptable to ASCU for the contemplated exploration and development at the Company’s properties, changes in exploration, development or mining plans due to exploration results and changing budget priorities of ASCU or its joint venture partners, the effects of competition in the markets in which ASCU operates, results of further exploration work, the ability to continue exploration and development at ASCU’s properties, the ability to successfully apply the Nuton™ technologies in ASCU’s properties, the impact of the Nuton™ technologies on ASCU operations and cost relating to same, the timing and ability for ASCU to prepare and complete the 2025 PFS and the costs relating to same, errors in geological modelling, changes in any of the assumptions underlying the PEA, the ability to expand operations or complete further exploration activities, the ability to obtain regulatory approvals, the impact of changes in the laws and regulations regulating mining exploration, development, closure, judicial or regulatory judgments and legal proceedings, operational and infrastructure risks and the additional risks described in ASCU’s most recently filed Annual Information Form, annual and interim management’s discussion and analysis, copies of which are available on SEDAR+ (www.sedarplus.ca) under ASCU’s issuer profile. ASCU’s anticipation of and success in managing the foregoing risks could cause actual results to differ materially from what is anticipated in such forward-looking statements.

Although management considers the assumptions contained in forward-looking statements to be reasonable based on information currently available to it based on information available at the date of preparation, those assumptions may prove to be incorrect. There can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and are urged to carefully consider the foregoing factors as well as other uncertainties and risks outlined in ASCU’s public disclosure record.

ASCU disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240807400084/en/

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com

Source: Arizona Sonoran Copper Company Inc.