Arizona Sonoran Announces a Positive Pre-Feasibility Study for the Cactus Mine Project with a US$509M Post-Tax NPV and 55 kstpa Copper Cathode over 21 Years

- Completion of NI 43-101 Prefeasibility Study for Cactus Project by ASCU

- Standalone PFS showcases a lower risk, top 10 potential copper operation in the USA

- Average annual production of 55 ktons of copper with a peak of 74 ktons

- Initial Life of Mine of 21 years, recovering 1,153 ktons of Copper

- Favourable metallurgy with 85%-92% average soluble copper recoveries

- Low carbon footprint mining project with a total initial capital cost of $515 million

- Post-tax NPV of $509 million and IRR of 15.3% at $3.90/lb copper price

- Future opportunities for further improvement in business case through drilling and exploration

- Significant copper project in the USA with proven reserves of 3.0 billion lbs of copper

- ASCU aims to be among the top 10 copper operations in the US, providing domestic supply with copper cathodes

- None.

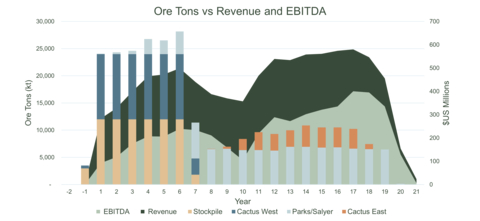

FIGURE 1: Annual Revenues and EBITDA Over Annual Production (Graphic: Business Wire)

The Company intends to file a technical report (the “Technical Report”) in respect of the PFS in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile and the Company’s website within 45 days of the date of this news release.

A webinar will be held on February 22, 2024, at 10:00 am ET. Please join George Ogilvie, Nick Nikolakakis, Bernie Loyer and Anthony Bottrill in discussion of the PFS and the Company’s next steps by registering here https://www.bigmarker.com/vid-conferences/ASCU-VID-THF.

Cactus PFS Highlights

Scalable, Long-Life Operations

- Average annual production of approximately 55 ktons or 110 million pounds (“lbs”) of copper (“Cu”), with a peak of 74 ktons or 149 million pounds of copper

- Initial Life of Mine (“LOM”) 21 years, recovering 1,153 ktons or 2.31 billion pounds of Copper LME Grade A cathode onsite via heap leach facility and SXEW

-

Maiden Proven & Probable (“P&P”) Reserves of 276.3 million tons at

0.48% Soluble Copper (“Cu TSol”) or 3.0 Billion lbs Copper -

Favourable metallurgy with a range of

85% -92% LOM average soluble copper recoveries - Private land ownership with streamlined permitting process

-

Low carbon footprint mining project:

-

Powered by an existing 69 KV Transmission line with access to “Green Energy” through the Palo Verde Nuclear Plant West of

Phoenix for costs of$0.07 - Heap Leach and SXEW Process

- Conveyors and radial stackers used to move ore to leach pads

-

Powered by an existing 69 KV Transmission line with access to “Green Energy” through the Palo Verde Nuclear Plant West of

Robust Economics

-

First quartile capital intensity of

$10,343 -

Total initial capital cost of

$515 million $75 million -

Total revenues of

$9.0 billion -

Post-tax unlevered Free Cash Flow of

$2.4 billion -

C1 Cash Costs of

$1.84 $2.34 -

Post-tax net present value (“NPV”)

$509 million $687 million ) using an8% discount rate and an internal rate of return (“IRR”) of15.3% and using a$3.90 -

Pre-tax NPV

$733 million $990 million )

-

Pre-tax NPV

- Post-tax payback period of 6.8 years from initial production

-

At

$4.25 $780 million $1,054 million ) and$1,064 million $1,436 million ), using an8% discount rate

Significant Copper Project in the

-

Proven & Probable (“P&P”) Reserves of 276.3 million tons at

0.48% Soluble Copper (“Cu TSol”) or 3.0 Billion lbs Copper -

Underground Proven Reserve grade of

0.89% and0.82% Cu TSol from Cactus East andParks /Salyer, respectively - Measured & Indicated Resources of 5.2 billion lbs Copper and Inferred Resources of 2.2 billion lbs Copper (as announced October 16, 2023) (inclusive of reserves)

Future Opportunities to Further Improve Business Case

- Drilling to upgrade known inferred resources and bring them into the mine plan potentially increasing the LOM production, reducing underground development costs, operating expenses, capital expenses and overall strip ratio

-

Drilling to prove a maiden resource at MainSpring as a potential open pit providing operational flexibility and gaining lower cost access to the

Parks /Salyer deposit. Bringing MainSpring into the mine plan potentially improves operational and financial synergies within the Cactus Project - Continued exploration success on the Cactus Project in the “Gap Zone”, below the envelope of the existing Cactus West Open Pit Shell and in the North-East Extension.

- Nuton LLC’s (“Nuton") leaching technology driving primary sulphide optionality, currently excluded from the mine plan

George Ogilvie, ASCU President and CEO commented, “The 55,000-ton Copper Cathode per annum mine plan presented in the PFS illustrates an achievable long-life operation with robust economics and an opportunity for continued scaling of the asset. Our operation has the potential to be among the top 10 copper operations within the US, supplying the domestic supply chain with copper cathodes in the near term. With global copper mine disruptions occurring and a structural deficit currently underway, our timing to develop the asset has a high likelihood to coincide with much higher copper incentive prices. As compared to the original PEA, the PFS demonstrates a significant increase of free cash flow at a conservative long-term copper price assumption of

He continued, “A real organic growth opportunity exists within our 5,370 acres at the MainSpring Property. Based on initial drilling of our MainSpring property there are early indications for Mainspring to be the southern near surface extension of our

“With this cornerstone now placed, we are excited to continue building Cactus, which today is a significant asset, with plenty of future optionality to continue upgrading the asset with scale.”

Bernie Loyer, ASCU SVP Projects notes “Our Cactus Project PFS demonstrates a solid business case, and the potential to deliver a long-life operation utilizing a well-established and industry proven process technology in the treatment of ore from four separate and well understood feed sources. All situated on privately held ground, this brownfield project site located within 45 minutes of the

Pre-Feasibility Summary

The 2024 PFS outlines a lower risk and long-life copper project with low first quartile capital intensity. The heap leach operation will produce on average 55 kstpa of LME Grade A copper cathodes via SXEW. Key metrics are shown in TABLE 1 below.

Conventional open pit mining methods have been selected for the extraction of oxide and secondary sulphide material from the lower grade Cactus West pit, while the higher-grade

Table 1: 2024 PFS Highlights

Financial Metrics |

Unit |

PFS LOM |

Copper Price Assumption |

$/lb |

|

Revenue |

$ millions |

|

Operating Costs* |

$ millions |

|

EBITDA |

$ millions |

|

Unlevered FCF (pre-tax) |

$ millions |

|

Unlevered FCF (post-tax) |

$ millions |

|

Base Case Economics |

||

Pre-tax NPV( |

$ millions |

|

Pre-tax IRR |

$ millions |

|

NPV / Initial Capital (post-tax) |

Ratio |

1:1 |

Post-tax NPV( |

$ millions |

|

Post-tax IRR |

% |

|

Post-tax Payback Period** |

Years |

6.8 |

Initial Capital |

$ millions |

|

Sustaining Capital (primarily UG) |

$ millions |

|

Effective Tax Rate |

% |

|

Production |

||

Construction Period |

Months |

18-24 |

Mine Life |

Years |

21 |

Total Mineralized Material |

Millions tons |

276.3 |

Cu Avg Production (Years 1-5) |

Millions lbs/year |

100 |

Cu Avg Production (Years 6-10) |

Millions lbs/year |

105 |

Cu Avg Production (Years 11-15) |

Millions lbs/year |

136 |

Average Annual LOM Production |

Millions lbs / ktons |

110 / 55 |

Total Payable Copper |

Million lbs |

2,306 |

Average Head Grade |

% Cu TSol |

|

Open Pit Strip Ratio |

Waste:Ore |

1.96 |

Costs |

||

LOM C1 Cash Costs*** |

$/Cu lb |

|

LOM All-in Sustaining Costs**** |

$/Cu lb |

|

Mining |

|

|

Open Pit |

$/ ton mined |

|

Underground |

$/ ton mined |

|

Leaching & Processing |

$/ ton placed |

|

General & Administrative |

$/ ton placed |

|

kt = thousands of short tons; kstpa = thousands of short tons per annum

FOREX Conversion = US

* Operating cash costs consist of mining costs, processing costs, and G&A

** Payback period exclusive of construction

*** Total cash costs consist of operating cash costs plus transportation cost, royalties, treatment and refining charges

**** AISC consist of total cash costs plus sustaining capital, closure cost and salvage value

TABLE 2: Pre- and Post-Tax Sensitivity to the Copper Price

|

|

|

|

|

|

|

Pre-tax |

||||||

NPV( |

|

|

|

|

|

|

Post-tax |

||||||

NPV( |

|

|

|

|

|

|

IRR, % |

|

|

|

|

|

|

Payback years1 |

7.4 |

6.8 |

6.4 |

5.7 |

5.2 |

4.8 |

1 Payback period calculated starting from start of commercial production

Project Overview

The Cactus Mine Project is a brownfield project located approximately 6 mi (10 km) northwest of the city of Casa Grande and 40 road miles south-southwest of the

Since 2019, ASCU has drilled 141 new holes at the Cactus West and East deposits to support verification, metallurgical testing, and resource extension for the Cactus mineral resource estimate. The

The Cactus Mine Project is host to a large porphyry copper system that has been dismembered and displaced by Tertiary extensional faulting. The major host rocks are Precambrian Oracle Granite and Laramide monzonite porphyry and quartz monzonite porphyry. The mine trend features the formation of horst and graben blocks of mineralization where the Cactus deposits are situated, extending from the Cactus East deposit, southwest to the

Reserves and Resources

The PFS is based on the updated 2023 Mineral Resource Estimate (“MRE”), as published on October 16, 2023, showing a

Table 3: Cactus Project Total Measured, Indicated and Inferred Mineral Resource

Material

|

ktons

|

CuT

|

TSol

|

Contained Cu

|

Total Resources |

||||

MEASURED |

||||

Total Leachable |

9,100 |

|

0.230 |

41,900 |

Total Primary |

1,300 |

0.315 |

|

8,000 |

Total Measured |

10,400 |

0.241 |

49,800 |

|

INDICATED |

||||

Total Leachable |

348,500 |

|

0.629 |

4,387,200 |

Total Primary |

86,800 |

0.425 |

|

737,000 |

Total Indicated |

435,300 |

0.589 |

5,124,200 |

|

M&I |

||||

Total Leachable |

357,600 |

|

0.619 |

4,429,000 |

Total Primary |

88,000 |

0.423 |

|

745,000 |

Total M&I |

445,700 |

0.580 |

5,174,000 |

|

INFERRED |

||||

Total Leachable |

107,700 |

|

0.607 |

1,307,900 |

Total Primary |

126,200 |

0.357 |

|

900,000 |

Total Inferred |

233,800 |

0.472 |

2,207,900 |

|

| Notes: | |

1. |

Leachable copper grades are reported using sequential assaying to calculate the soluble copper grade. Primary copper grades are reported as total copper, Total category grades reported as weighted average copper grades of soluble copper grades for leachable material and total copper grades for primary material. Tons are reported as short tons. |

2. |

Stockpile resource estimates have an effective date of 1 March 2022, Cactus resource estimates have an effective date of 29th April 2022, |

3. |

Technical and economic parameters defining resource pit shell: mining cost |

4. |

Technical and economic parameters defining underground resource: mining cost |

5. |

Technical and economic parameters defining processing: Oxide heap leach (HL) processing cost of |

6. |

Royalties of |

7. |

For Cactus: Variable cutoff grades were reported depending on material type, potential mining method, and potential processing method. Oxide material within resource pit shell = |

8. |

For |

9. |

Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors. |

10. |

The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification. |

11. |

Totals may not add up due to rounding. |

As shown in TABLE 4 below, a total of 276 million short tons or 3.0 billion pounds were converted into a P&P Reserve out of the leachable M&I Resource base of 4.43 billion lbs, representing a conversion rate of

Table 4: Cactus Mine Project Reserves Statement by Deposit

Unit |

Cactus West Open Pit |

Stockpile Open Pit |

Cactus East Underground |

|

Totals |

|

Proven |

Tons |

3,600,000 |

|

|

|

3,600,000 |

|

CuT (%) |

0.249 |

|

|

|

0.249 |

|

Cu TSol (%) |

0.225 |

|

|

|

0.225 |

|

Cu (M lbs) |

17.9 |

|

|

|

17.9 |

Probable |

Tons |

71,921,000 |

76,777,000 |

27,739,000 |

96,248,000 |

272,686,000 |

|

CuT (%) |

0.310 |

0.163 |

0.950 |

0.930 |

0.552 |

|

Cu TSol (%) |

0.260 |

0.136 |

0.885 |

0.820 |

0.487 |

|

Cu (M lbs) |

445.4 |

251.0 |

527.0 |

1,789.7 |

3,013.0 |

Proven + Probable |

Tons |

75,521,000 |

76,777,000 |

27,739,000 |

96,248,000 |

276,286,000 |

|

CuT (%) |

0.307 |

0.163 |

0.950 |

0.930 |

0.549 |

|

Cu TSol (%) |

0.259 |

0.136 |

0.885 |

0.820 |

0.484 |

|

Cu (M lbs) |

463.3 |

251.0 |

527.0 |

1,789.7 |

3,031.0 |

Notes to the Mineral Reserves:

1. |

Mineral Reserves have an effective date of November 10, 2023. The Qualified Person for the underground estimates of Cactus East and |

2. |

The Mineral Reserves were estimated in accordance with the CIM Definition Standards for Mineral Resources and Reserves. |

3. |

The Mineral Reserves are supported by a combined open pit and underground mine plan, based on open pit and underground designs and schedules, guided by relevant optimization procedures. |

|

Inputs to that process are: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

The footprint delineations for the Cactus East and |

5. |

Dilution and mining loss adjustments are incorporated into the underground mining inventories by way of cave flow modelling software. Inferred resources included in the mixing process have been assigned zero grade. No allowance for mining dilution or ore loss has been provided in the open pit mining inventories. |

Mining Operations

The Cactus Mine plan includes production from four separate mining areas: Cactus West Open Pit, Historical Stockpile, Cactus East Underground, and

The mine production schedule is initially focused on the surface sources of ore (Stockpile and Cactus West Open Pit) beginning in year -1, along with

The Cactus West mine life consists of 2 phases and includes one year of pre-stripping and seven years of mining. Phase 1 starts with 24 million tons (“Mt”) of pre-production stripping and is completed in Year 4. Phase 2 mining begins in Year 2 and is mined out in Year 6. Target ore production is 12 Mt per annum with a peak mining rate of 47 Mt in Years 2 and 3. A total of 75.5 Mt of leach ore grading

Over the course of the open pit mine schedule, approximately 13.1 Mt of low-grade ore is stockpiled and reclaimed in order to smooth the ore release from the open pits. This amount includes approximately 3.0 Mt of material stockpiled in the first three years of mining, and then processed in Year 3 and 4, and another 10 Mt stockpiled later in the mine schedule before being reclaimed in Years 7 and 8.

Historic Stockpile (FIGURE 5) mining begins near the end of the pre-production year with approximately 3.0 Mt of ore sent to the leach pad. Mining continues concurrently with the Cactus West pit into Year 7 at an annual ore production rate of 12 Mt. A total of 76.8 Mt of leach ore at

The initial

The initial Cactus East SLC (FIGURE 7) level will commence in year 9 at 1,325 ft (404 m) below the surface and will be comprised of 7 sublevels to a final depth 1,845 ft (562 m) below surface. Access will be via a single decline with a portal located within the existing Cactus West pit. Ore haulage to surface will be via a vertical conveyor which can be supplemented with truck haulage to surface via the open pit if necessary. Production is planned from year 9 to 19, with steady state production beginning in year 12, peaking at 3.9 Mtpa in year 15. A total of 28 Mt of leach ore @

SLC production crosscuts have primarily been designed so that each level is horizontally offset from the level above and below. The design parameters for the SLC production drives at Cactus East and

The amount of ore to be extracted will be limited in the upper three production levels to the following proportions:

-

First Level ~

40% (swell only) -

Second Level ~

60% -

Third level ~

100% -

Lower levels >

100% to shutoff grades or dollar values.

The production strategy will help control caveability, minimise the formation of air gaps and create a blasted ore blanket above the production levels to minimise early dilution entry from the overburden rocks. These restricted draw rates also apply to areas where large step-outs distances are required from one sublevel to the next.

The Cactus East Ore/Waste Handling System consists of a crusher station and a 1,600 ft (488 m) vertical conveyor with a capacity of 630 tons/h that will convey ore from the top of the orebody to surface via a vertical raise feeding an overland conveyor. Ore will be hauled by 55-ton diesel trucks to a sizer located adjacent to the bottom of the vertical conveyor. Ore will be crushed to a maximum 6-in dimension. A short conveyor from the sizer will feed the vertical conveyor. Waste will be trucked to the portal for disposal within the Cactus West open pit.

The mine plan for

Ventilation is driven by a fresh air drive developed from the access drive, in which the fresh air will be splitting right and left to connect to the return air drives at the extremities of the footprint. This allows natural flow of ventilation through the entire footprint.

Processing Operations

Material mined from the existing stockpile will be placed in 20-ft lifts and material from all other sources will be stacked in 30-ft lifts. Material will be reclaimed and transferred by haul truck to the crushing circuit where it will be crushed down to P80 minus ¾-in. From the crushing circuit, the material will transfer by overland conveyor to the agglomeration drums, mobile transfer conveyors, and mobile radial stacker to be placed on the geomembrane lined heap leach facility (HLF).

Leaching solutions, containing dilute sulfuric acid will be pumped and applied to the top of each lift and allowed to percolate though the copper leach material. Copper is dissolved into the solution while acid is consumed at approximately 13.6 lb/ton of material leached. Acid consumption is net of regenerated acid in the SXEW process. The height of the leach material on the pad will eventually reach approximately 180 ft (55 m) in overall height.

The pregnant leach solution (PLS) collected from the HLF will be conveyed in pipes to the heap leach ponds where it will be pumped for processing in a copper SX/EW plant capable of producing initially up to 30,000 ton/y of copper cathodes with a design PLS flow of up to 12,000 gpm and grade at approximately 3.0 g/pL Cu based on an overall

The electrowinning circuit capacity will be expanded in Year 3, doubling in size to the overall plant capacity required to a nominal 60,000 ton/y of copper cathodes.

The principal objective of the HLF design is to efficiently extract copper by leaching metals within the geotechnically stable facility. The anticipated ore production will be approximately 65,000 tons/d for the first seven years and reduced to 24,500 tons/d after that for the life-of-mine (LOM) for an average of 55,000 tons of cathode production annually. The pad will be loaded with conveyor belts coming in from the west along the northern side of the pad to discharge to the eastern area of the pad (Phase 1). This area provides a relatively flat area that facilitates the construction of the first phase of the pad and allows for mining of the existing stockpile to liberate additional space for the consecutive phases of construction. A visual representation of the flow sheet is depicted below, in FIGURE 9.

Cost Estimates

The capital cost estimates for the PFS were developed with a -

The project capital cost estimate was compiled by Ausenco Engineering

An 18–24-month construction period is projected with the initial capital costs and sustaining development costs summarized in the table below.

Table 5: Initial and Sustaining Capital Costs (

Capitalized Costs |

Initial Capital |

Sustaining Capital |

Mining and Processing |

|

|

Processing |

|

n/a |

Mining (Pre-Stripping) |

|

n/a |

MINING - Open Pit - Cactus West |

|

|

MINING - Underground - Cactus East |

n/a |

|

MINING - Underground - |

|

|

MINING - Underground - Combined/Shared |

|

n/a |

Other |

|

|

Infrastructure |

|

|

Crushing And Conveying |

|

|

Leaching And Waste Rock Storage |

|

|

Solvent Extraction (SX) |

|

n/a |

Electrowinning (EW) |

|

|

Reagents |

|

n/a |

Process Plant Services and Utilities |

|

n/a |

Project Execution |

|

|

Provisions |

|

|

Total |

|

|

Operating Cost Summary

Mining operating cost estimates, prepared by AGP, are based on a small owner’s team managing mining activities using an owner-operator model. Process operating cost estimates were prepared by Samuel Engineering and G&A cost estimates were prepared by Ausenco with input from ASCU, as summarized in the table above.

Unit Cost table

Operating costs have been based on a delivered diesel price of

Site Infrastructure Summary

The facilities at the mine site will consist of an open pit, underground mining operation, SXEW process plant, conveying, crushing and screening equipment, site sub-station, site power distribution, access roads, heap leach facilities and associated infrastructure.

Local Resources and Infrastructure

The Cactus Mine Project is located approximately 3 miles northwest of the

- Electric power is available from Arizona Public Service’s (APS) 69 kV transmission line which passes on the South side of the site and connects to an existing substation owned by ASCU.

- Paved road and easy access to the interstate networks for transport and two major Interstates Highways (I-10 & I-8) less than 10 miles away from the Cactus Mine Project.

-

Well established road network existing from either ADOT,

Pinal County or theCity of Casa Grande surrounding the property. - Union Pacific rail road line and rail spur adjacent to the property.

-

Five miles distance to

Casa Grande and allowing the ability of the town to supply materials/consumables in addition to just labor. - Kinder Morgan/El Paso Natural Gas two high pressure natural gas pipelines adjacent to the property should natural gas be needed.

- The City of Casa Grande Water Treatment Facility located within 3 miles of the Cactus Mine Project that can supply effluent water for the operation and possibly treat waste.

- An existing Arizona Water Company potable water line is adjacent to the property.

- Water supply is already available via buried pipeline to the property boundary as a result of prior mining and commercial operations.

-

The cities of

Casa Grande andMaricopa are nearby and, combined withPhoenix , can supply sufficient skilled labor for the Cactus Mine Project. In addition, theState of Arizona has a significant presence of copper mining in the state that can specifically provide skilled labor to the Cactus Mine Project.

Metallurgical Testwork

The metallurgical studies and testing for the Cactus Project has been ongoing since late 2019, via 45 column tests covering the resources identified in the study. Additional tests include, bottle roll testing, mineralogical analyses and other metallurgical and materials property testing. Arizona Sonoran geologists are working with metallurgical engineers to quantify the metallurgical performance from the samples obtained in a large drilling campaign. The drill core samples were safely recovered and placed in bags to be studied by geologists and subsequently shipped for testing to a well-established Mineral Processing research and development firm in

Ownership, Social License, Permitting, Taxes and Royalties

The Cactus Mine Project is

Of the 5,381 acres, 4,731.92 acres is fee simple land, three ASLD prospecting permits that the State has surface and minerals (649.12 acres), two ASLD prospecting permits that the State has minerals only with ASCU owning the surface (797.5 acres) and 18 BLM unpatented mining claims, this is for mineral only as ASCU owns the surface rights (320 acres). The BLM unpatented mining claims are outside of the known mineralization and there are currently no plans for mining at this area.

ASCU has a well-developed community engagement plan that it has implemented through numerous public meetings and outreach. With the presence of legacy mining in the

Permitting is limited to

A Mined Land Reclamation Plan was completed and submitted to the Arizona State Mine Inspector’s office in January 2023. The submitted plan does not include the

In 2009, approximately 25 years after the Cactus Mine ceased operation, the mine was conveyed to the ASARCO Multi-State Environmental Custodial Trust as part of ASARCO bankruptcy proceedings, who helped lead a subsequent remediation program. Structures were demolished and reclaimed, and site characterization studies were conducted. Based on the results of the characterization studies and reclamation work, the ADEQ released ASCU from potential legacy liabilities, under the terms of the Prospective Purchaser Agreement (“PPA”) signed in 2019. The PPA does not cover unidentified environmental conditions or contamination.

A corporate tax rate of

The Cactus Mine Project is subject to three royalties based on potential mining production. Tembo/Elemental Altus holds a

Exploration Upside

The Cactus Mine Project mineral resource estimate includes three deposits along a 4 km mine trend. The mineralization is present within horst blocks developed as part of regional extensional faulting. High grade mineralization was emplaced within brecciated host granite at the margin of the intruding monzonite porphyry zone and locally forms a linear NE trend called the mine trend.

Drilling has demonstrated potential for extending mineralization south of

Next Steps

Future opportunities to build value may include a potential MainSpring starter pit, and the successful application of the Nuton technology for leaching of primary sulphides. A Preliminary Economic Assessment (“PEA”) will define the impact of those two opportunities.

- A PEA inclusive of an inferred MainSpring mineral resource and the application of the Nuton technologies to the primary sulphides using the same PFS assumptions is underway with M3 Engineering as lead consultant. The study is expected in the summer of 2024

- Continued metallurgical testing

- Infill drilling at MainSpring and around the Cactus West Pit

- An updated PFS to include the MainSpring opportunity is expected in 2H 2024

- A DFS is expected to begin post MainSpring PFS, for release in 1H 2025

-

Nuton and ASCU have agreed to working towards the Integrated Nuton PFS release by the end of 2024, unless extended mutually by both parties.

- Nuton phase 2 metallurgy

- Infill drilling at MainSpring and Cactus West at depth and southwest and west of the deposit

Links from the Press Release:

Webinar: https://www.bigmarker.com/vid-conferences/ASCU-VID-THF

Figures and Tables: https://arizonasonoran.com/projects/cactus-mine-project/press-release-images/

SEDAR+: https://www.sedarplus.ca

January 30, 2024: https://arizonasonoran.com/news-releases/arizona-sonoran-announces-2024-work-plan/

October 16, 2023: https://arizonasonoran.com/news-releases/arizona-sonoran-announces-updated-mineral-resource-estimate-for-the-cactus-project/

Cactus PEA, effective date of November 10, 2022: https://arizonasonoran.com/site/assets/files/6218/2022-11-10_-_ps_cactus_mre_tech_report.pdf

Quality Assurance and Quality Control Procedures

Skyline Labs is accredited in accordance with the recognized International Standard ISO/IEC 17025:2005. Their quality management system has been certified as conforming to the requirements defined in the International Standard ISO 9001:2015. The standard operating procedure (SOP) used while processing the ASCU samples was to process samples in groups of 20. Each tray consisted of 18 samples with samples No. 1 and No. 10 repeated as duplicates. The results from each tray were analyzed and any variance in the duplicates of more than

The results of these analyses, including the QA/QC checks, were transmitted to a select set of individuals at ASCU and the qualified persons.

Qualified Persons

The authors of the Technical Report, each of whom is an independent qualified person within the meaning of NI 43-101 are listed below. The responsibilities of the engineering consultants are as follows:

- Ausenco was commissioned by ASCU to manage and coordinate the work related to the PFS and the technical report. Ausenco was also retained to complete the infrastructure design, leach pad design, and to compile the overall cost estimate and financial model.

- AGP and Call & Nicholas (CNI) were commissioned to provide the mining methods for the underground and open pit. AGP provided designs for view berms, waste piles, and the stockpile relocation. Capital and operating costs were included in their scope.

- Samuel Engineering was commissioned to provide the mineral processing and metallurgical testing basis and plant design. Samuel’s scope included the metallurgical test work supervision and analysis, SXEW plant, leaching process, conveyor systems, crushing and stacking system designs. Capital and operating costs for these areas were included as part of their scope.

-

Clear Creek managed the drilling programs, hydrogeologic evaluations and environmental field work for the study. - ALS Geo Resources LLC was retained to provide drilling and resource modelling components of the project.

- Minefill was involved in paste backfill evaluations and trade-off studies. However, this process is not being utilized in the current project scope.

The Qualified Person’s listed below for the technical report have reviewed and verified the contents of this press release as it relates to their responsibilities. By virtue of their education, experience and professional association, they are considered Qualified Person as defined by NI 43-101.

Technical aspects of this news release have been reviewed and verified by Dan Johnson, ASCU Director of Projects, who is a qualified person as defined by National Instrument 43-101.

Qualified Person |

Professional Designation |

Position |

Employer |

Erin L. Patterson |

P.E. |

Director of Minerals & Metals |

Ausenco Engineering |

Scott C. Elfen |

P.E. |

Global Lead Geotechnical Services |

Ausenco Engineering Canada ULC. |

R. Douglas |

RG, CHG, |

Principal |

Clear Creek Associates, a subsidiary of Geo-Logic Associates |

Gordon Zurowski |

P.Eng. |

Principal Mine Engineer |

AGP Mining Consultants Inc. |

Nat Burgio |

FAusIMM (CP) |

Principal Geologist |

AGP Mining Consultants Inc. |

Todd Carstensen |

RM-SME |

Principal Mine Engineer |

AGP Mining Consultants Inc. |

Allan L. Schappert |

CPG, SME-RM |

Principal |

ALS Geo Resources LLC |

James L. Sorensen |

FAusIMM |

Director |

Samuel Engineering, Inc. |

Paul F. Cicchini |

P.E. |

President |

North Star Geotech LLC |

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with low operating costs and to develop the Cactus and

Non-IFRS Financial Performance Measures

This news release contains certain non-IFRS measures, including sustaining capital, sustaining costs,

C1 cash costs and AISC. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral

reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian disclosure requirements of Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards on Mineral Resources and Mineral Reserves” incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Forward-Looking Statements

This news release contains “forward-looking statements” and/or “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expect”, “is expected”, “in order to”, “is focused on” (a future event), “estimates”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, or the negative connotation thereof. In particular, statements regarding ASCU’s future operations, future exploration and development activities or other development plans constitute forward-looking statements. By their nature, statements referring to mineral reserves or mineral resources constitute forward-looking statements. Forward-looking statements in this news release include, but are not limited to statements with respect to the results (if any) of further exploration work to define and expand or upgrade mineral resources and reserves at ASCU’s properties; the anticipated exploration, drilling, development, construction and other activities of ASCU and the result of such activities; the mineral resources and mineral reserves estimates of the Cactus Project (and the assumptions underlying such estimates); the ability of exploration work (including drilling) to accurately predict mineralization; the ability of management to understand the geology and potential of the Cactus Project; the focus of the 2024 drilling program at the Cactus Project including the

ASCU considers its assumptions to be reasonable based on information currently available but cautions the reader that their assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect ASCU, its properties and business. Such risks and uncertainties include, but not limited to, the global economic climate, developments in world commodity markets, changes in commodity prices (particularly prices of copper), risks relating to fluctuations in the Canadian dollar and other currencies relative to the US dollar, risks relating to capital market conditions and ASCU’s ability to access capital on terms acceptable to ASCU for the contemplated exploration and development at the Company’s properties, changes in exploration, development or mining plans due to exploration results and changing budget priorities of ASCU or its joint venture partners, the effects of competition in the markets in which ASCU operates, results of further exploration work, the ability to continue exploration and development at ASCU’s properties, the ability to successfully apply the NutonTM technologies in ASCU’s properties, the impact of the NutonTM technologies on ASCU operations and cost relating to same, the timing and ability for ASCU to prepare and complete the Nuton Case PFS and the costs relating to same, errors in geological modelling, changes in any of the assumptions underlying the PFS, the ability to expand operations or complete further exploration activities, the ability to obtain regulatory approvals, the impact of changes in the laws and regulations regulating mining exploration, development, closure, judicial or regulatory judgments and legal proceedings, operational and infrastructure risks and the additional risks described in ASCU’s most recently filed Annual Information Form, annual and interim management’s discussion and analysis, copies of which are available on SEDAR+ (www.sedarplus.ca) under ASCU’s issuer profile. ASCU’s anticipation of and success in managing the foregoing risks could cause actual results to differ materially from what is anticipated in such forward-looking statements.

Although management considers the assumptions contained in forward-looking statements to be reasonable based on information currently available to it based on information available at the date of preparation, those assumptions may prove to be incorrect. There can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and are urged to carefully consider the foregoing factors as well as other uncertainties and risks outlined in ASCU’s public disclosure record.

ASCU disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240221970177/en/

For more information

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com

Source: Arizona Sonoran Copper Company Inc.