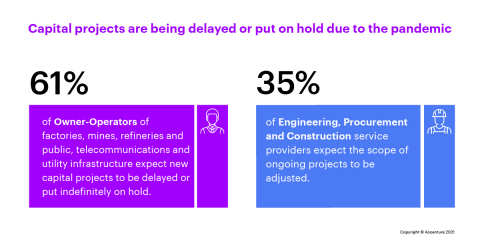

Many Companies Are Delaying or Putting Capital Projects on Hold Due to the Pandemic, Accenture Report Finds

New research from Accenture (NYSE: ACN) reveals that 61% of industrial owner-operators foresee delays or indefinite holds on new projects due to COVID-19 impacts. The report titled "Building Value with Capital Projects" highlights that while 79% of executives utilize data analytics, only 34% reported cost reductions on completed projects. Additionally, 24% of owner-operators and 14% of EPCs outperformed industry peers in productivity. Key strategies such as strong data leadership and incentive-based contracts could yield a 6.6% increase in return on capital investment for owner-operators.

- 24% of owner-operators and 14% of EPCs exceed industry benchmarks in productivity and efficiency.

- Implementing differentiated strategies can drive a potential increase of 6.6% in return on capital for owner-operators.

- The report emphasizes the importance of a data-driven culture for capital projects.

- 61% of owner-operators expect project delays or indefinite holds due to COVID-19.

- Despite high usage of data analytics, only 34% achieved reduced costs in completed projects.

- A majority of companies have not realized the intended benefits from their digitization efforts.

Insights

Analyzing...

New global research from Accenture (NYSE: ACN) shows that

Capital project are being delayed or put on hold due to the pandemic (Graphic: Business Wire)

“Compared to other industrial sectors, many owner-operators and EPCs were already trailing behind in digital transformation when sudden shutdowns and delays challenged their efficiency and competitiveness even further,” said Tracey Countryman, global lead for Digital Manufacturing & Operations, Accenture Industry X. “To build greater resiliency, mitigate current and future disruption, and drive more value from capital projects execution, companies need to adopt greater data-driven digitization within and across their value chains.”

The report shows that many companies haven’t achieved the desired benefits from their digitization efforts:

-

For example,

79% of the owner-operators use data analytics for predictive project performance forecasting and real-time project decision support. However, only34% have reduced maintenance and operations cost on recently completed projects;38% have increased construction productivity. -

Similarly,

79% of the EPCs deploy logistics control tower for logistics tracking, materials management, warehousing and people logistics; yet just34% have been able to reduce equipment and material cost.

Other findings paint a similar picture, with 75

“Data-driven insights play an integral role in creating digital solutions like digital twins,” said Andy Webster, global lead for Capital Projects, Accenture Industry X. “Generating, applying and collaborating on these insights are crucial to enabling greater value in productivity, efficiency, workforce safety and material wastage.”

The research found that

-

A data-committed C-suite. Most outperforming owner-operators (

57% ) and EPCs (60% ) make a top senior executive such as the CEO or COO responsible for data-driven digitization of capital projects. They are also more likely to have infused a culture of data-sharing for informed and insightful collaboration within their organizations and across partners and value chains. - Data-sharing infrastructure and capabilities. Cloud platforms, data lakes, drones and reality capture are top technologies in which outperforming owner-operators invested in the past five years. EPC outperformers spent heavily on, for example, industrial IoT technologies to make supply chains more intelligent and predictive.

- Data-centric talent. Owner-operators identified data stewards to use data for addressing schedule management, productivity and regulatory issues. Outperforming EPCs readied an army of digital coaches who work closely with their workforce in the field to help them execute projects and deliver outcomes with more efficiency, safety and certainty.

-

Incentive-based contracts: Over a fifth of all outperformers engage in contracts that incentivize project stakeholders to achieve financial, environmental and social responsibility goals (owner-operators:

22% , EPCs:27% ). These contracts foster collaboration on, and a more rigorous adoption of, data-driven solutions and advanced analytics to drive joint success.

“These actions are based on insights built from analyzing a million data points, making this a unique analysis of the Capital Projects industry,” said Raghav Narsalay, managing director and global research lead for Accenture Industry X.

Collaboration, as well as a strong data foundation and data culture have emerged as important value drivers in other recent studies. These include Accenture’s “Together Makes Better: How To Drive Cross-Function Collaboration” report published in June and its 2019 study titled “AI: Built to Scale.”

About the study

Between June and August 2020, Accenture surveyed 710 senior executives across owner-operators and EPCs in 13 industries and 20 countries with annual sales exceeding

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services—all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 514,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Accenture Industry X embeds intelligence in how clients run factories and plants, as well as design and engineer connected products and services—making manufacturing and operations more efficient, effective and safe; enabling companies to transform how they make things, and the things they make, for sustainable growth. To learn more, visit www.accenture.com/industryx.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210112005014/en/