Despite Digital Acceleration, Banks Still Lack Ability to Achieve Peak Productivity from Technology Investments, Accenture Report Finds

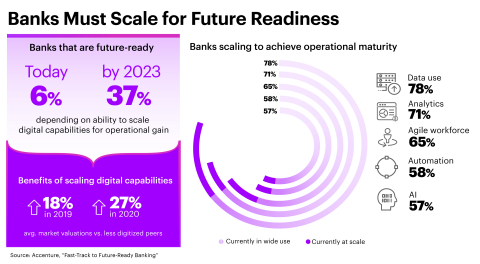

Accenture's new report highlights the necessity for banks to enhance and scale digital technologies to meet evolving consumer expectations and regulatory standards. Despite a surge in digital adoption due to COVID-19, only 6% of banks are deemed 'future-ready,' though this could rise to 37% by 2023 with improved core capabilities like AI and cloud. The report indicates that banks using advanced data analytics enjoy market valuations 18-27% higher than less digitized counterparts. Additionally, by 2023, 43% of banks plan to increase business-technology collaboration significantly.

- Only 6% of banks are currently categorized as 'future-ready,' but this could increase to 37% by 2023 if core digital capabilities are scaled.

- Banks that utilize AI and data analytics have market valuations that are 18% higher in 2019 and 27% higher in 2020 compared to less digitized peers.

- 58% of banks have automated transactional tasks, a four-fold increase from three years ago, indicating significant progress in operational efficiency.

- Despite the push for digital transformation, most banks still have not scaled core technology capabilities, such as AI and cloud.

- Only 7% of banks have scaled analytics and 5% have scaled AI, indicating a critical gap in leveraging data effectively.

Insights

Analyzing...

A new report by Accenture (NYSE:ACN) found banks must extend and scale digital technologies across operations to achieve future-readiness while facing rising consumer expectations and regulatory requirements.

Banks Must Scale for Future Readiness (Graphic: Business Wire)

Despite rapid digital acceleration during COVID-19, most banks have not scaled core technology capabilities, such as cloud, data analytics and artificial intelligence (AI), placing them behind other industries in terms of operational agility and resilience. While

Based on a survey of 100 senior-level banking executives and externally validated financial data, the report assessed the impact of achieving progressive levels of digital and operational maturity with the highest level being “future-ready.” Only

The report found these “future-ready” leaders — which use rich data for decision-making, augment people with technology and employ agile workforce models — benefit from higher market valuations, reduced operating cost and the agility to thrive amid uncertainty. These digitally-focused banks have benefited from market valuations that, on average, were

“The banking industry has a long history of adapting technology in ways that transform how they operate, interact with customers or increase market share,” said Manish Sharma, group chief executive of Accenture Operations. “These future-ready leaders think big — pivoting from improving incrementally to transforming how the work gets done across technology, processes and people.”

To enable better use of expert talent and technology,

Many banks are also adopting an agile workforce strategy to keep up with digital-only competitors and deliver a seamless experience, enabling them to tap into an expanded talent pool and mobilize special talent as needed. More than half (

“To achieve future readiness in an era when people are critical to success, banks will need to use technology to maximize the performance of their workforce,” said Roberto Pagella, who leads banking operations services at Accenture. “Leading banks can harness change by capitalizing on the combination of human ingenuity and machine intelligence to transform the way people work and the business performs.”

The report, “Fast-Track to Future-Ready Banking,” explores ways of operating across technology, processes and people as banks aim to achieve future-ready performance.

Methodology

Accenture’s ongoing research series explores the drivers and trends shaping how enterprises and business functions operate globally. Based on a survey of 1,100 senior-level executives worldwide, including 100 banking executives, the report assessed four levels of business operations maturity — stable, efficient, predictive and future-ready — with each level underpinned by progressing levels of digital capabilities, such as AI, cloud, and data. The business impact was assessed by combining survey responses with externally validated financial data.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 537,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Accenture’s Banking industry group helps retail and commercial banks and payments providers boost innovation; address business, technology and regulatory challenges; and improve operational performance to build trust and engagement with customers and grow more profitably and securely. To learn more, visit https://www.accenture.com/us-en/industries/banking-index

View source version on businesswire.com: https://www.businesswire.com/news/home/20210427005315/en/