Combining Regional Production and Supply with Digital Maturity Boosts Resiliency, Accenture Report Shows

Companies with the most resilient engineering, supply, production and operations achieved

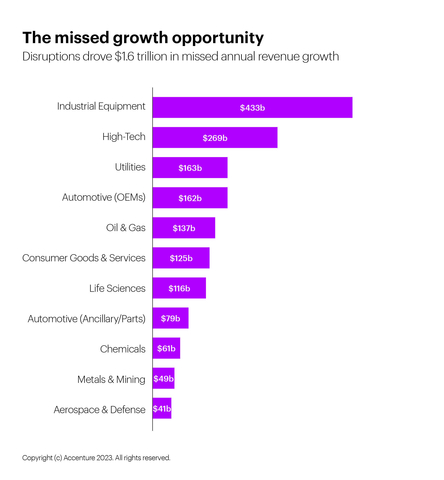

The missed growth opportunity: Disruption drove

According to the report, regional sourcing and production are important to becoming less vulnerable to disruption, but not enough to reach sustained resiliency. Companies must also increase their digital maturity. They need to invest in data, AI and solutions like digital twins. Having more mature capabilities in these areas helps companies build reconfigurable supply chains and autonomous production. These capabilities also enable dynamic, sustainable product development and support decentralized, real-time decision-making at the frontlines of operations.

Disruptive events have surged in recent years, from geopolitical shifts and extreme weather to technology breakthroughs and material and talent shortages. Few businesses sustained their resilience and long-term growth amid the turbulence:

-

In 2021 and 2022, companies missed out on

$1.6 trillion -

At the same time, the

25% most resilient companies achieved3.6% higher annual revenues than the25% most vulnerable companies.

Sef Tuma, global engineering and manufacturing lead, Accenture Industry X, said: “Resiliency has become an opportunity for growth, not just a strategy for survival. Taking advantage of this opportunity requires companies to drive the digitization of engineering, supply, production and operations processes. Solutions like digital twins and technologies like generative AI can help companies adapt faster to sudden changes and take data-driven, real-time actions.”

On average, companies are investing

Sunita Suryanarayan, global supply chain and operations resiliency lead at Accenture, commented: “When disruption struck, many companies quickly applied short-term fixes to their complex global production and supply networks. These networks had been designed for cost efficiency and just-in-time deliveries. Now is the time to strategically redesign them for multi-sourcing, without creating unwieldy silos or new bottlenecks, and make them more transparent and agile with data and AI to drive sustained resiliency.”

Sustained resiliency is still a distant prospect for many companies. As part of the research, Accenture developed a model to measure engineering, supply, production and operations resiliency on a 0-100 scale. On average, companies achieved a score of only 56.

The report recommends three areas companies should focus on to increase their resiliency:

-

Visibility. Companies should make supply chains and production processes more predictable and autonomous. For example, smart end-to-end control towers monitor processes and analyze different scenarios in real time to detect and correct issues early on. Today, only

11% have near real-time alerting;78% need at least a week to fully understand the impact. - Resiliency in design. Moving activities earlier in the development process allows companies to get products, processes and ways of working right the first time. For example, digital twins – digital replicas of physical production facilities down to individual assembly lines and machines – allow product designers and engineers to identify and troubleshoot potential prototype issues or defects and iterate the design before production begins.

-

New ways of working. Businesses must upskill the workforce in data, AI and other digital technologies so they can use predictive and visualization tools to make data-driven decisions at the frontlines of business. Today, only

17% of companies already have such a multi-skilled, digitally literate workforce;68% plan to have one by 2026.

Research Methodology

The “Resiliency in the making” research is based on a survey conducted January – March 2023 among 1,230 senior executives across engineering, production, supply chain and operations. Respondents were from

About Accenture

Accenture (NYSE:ACN) is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services—creating tangible value at speed and scale. We are a talent- and innovation-led company with approximately 733,000 people serving clients in more than 120 countries. Technology is at the core of change today, and we are one of the world’s leaders in helping drive that change, with strong ecosystem relationships. We combine our strength in technology and leadership in cloud, data and AI with unmatched industry experience, functional expertise and global delivery capability. We are uniquely able to deliver tangible outcomes because of our broad range of services, solutions and assets across Strategy & Consulting, Technology, Operations, Industry X and Song. These capabilities, together with our culture of shared success and commitment to creating 360° value, enable us to help our clients reinvent and build trusted, lasting relationships. We measure our success by the 360° value we create for our clients, each other, our shareholders, partners and communities. Visit us at www.accenture.com.

This document is produced by consultants at Accenture as general guidance. It is not intended to provide specific advice on your circumstances. If you require advice or further details on any matters referred to, please contact your Accenture representative.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231026182114/en/

Jens Derksen

Accenture

+49 175 57 61393

jens.derksen@accenture.com

Source: Accenture