New Forecast Sees Sales Peak This Fall, Stay Above Pre-Pandemic Levels Through the Coming Year

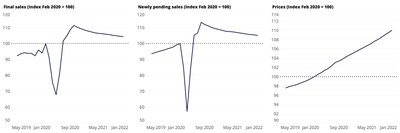

Zillow's latest Market Report forecasts that home sales will peak this fall before tapering off in 2021, yet remain above pre-pandemic levels. Seasonally adjusted home prices are expected to rise by 4.8% between August 2020 and August 2021, up from a previous estimate of 3.8%. Newly pending sales are up 21.8% compared to last year, despite a slight month-to-month decline. However, total inventory has dropped 34.6% year-over-year, leading to a median sale price increase to $284,000, a substantial 8.7% rise from last year.

- Newly pending sales increased by 21.8% year-over-year.

- Median sale price rose to $284,000, up 8.7% year-over-year.

- Seasonally adjusted home prices forecasted to increase 4.8% by August 2021.

- Total inventory decreased by 34.6% year-over-year.

- New listings fell by 13.6% compared to the previous year.

- Sales are expected to taper off in 2021.

Insights

Analyzing...

SEATTLE, Sept. 25, 2020 /PRNewswire/ -- After a remarkably hot summer, home sales are expected to peak this fall then taper off in 2021 while staying above pre-pandemic levels, according to a forecast by Zillow's team of economists in this week's Market Report1. Key market stats from the week ending Sept. 19 show depleted inventory levels plumbing new depths and prices skyrocketing over 2019 figures.

FORECAST: Housing market outlook improves, with major unknowns tempering expectations

- Sales expected to stay high but taper down through 2021

Zillow's team of economists expect seasonally adjusted home sales to peak this fall then gradually decline through 2021. Sales volumes overall are forecasted to remain higher than pre-pandemic levels throughout this year and next. - Home price outlook adjusted higher for coming year

Seasonally adjusted home prices are expected to increase1.2% from August to November and rise4.8% between August 2020 and August 2021. Zillow Research's previous forecast predicted a3.8% increase in home prices over this time frame. - Here's why:

Zillow's predictions for seasonally adjusted home prices and pending sales are more optimistic than previous forecasts because sales and prices have stayed strong through the summer months amid increasingly short inventory and high demand. The pandemic also pushed the buying season further back in the year, adding to recent sales. Future sources of uncertainty including lapsed fiscal relief, the long-term fate of policies supporting the rental and mortgage market, and virus-specific factors, were incorporated into this outlook.

KEY STATS: Market update for the week ending Sept. 19

Rate of homes going under contract slows slightly, but time on market still short

- Buyers are still extremely keen to purchase houses, with newly pending sales up

21.8% compared to last year. However, the frenzied activity of the summer is showing signs of the typical fall slowdown, dropping2.8% compared to a month ago and down1% since the week prior. - Typical time-on-market for listings stayed steady at 13 days, which is 14 days quicker than last year. Among the 50 largest U.S. markets, Cincinnati and Columbus, Ohio, shared the shortest typical time on market at four days to pending. Nashville posted the longest typical time on market at 33 days, while New York and Virginia Beach both marked 32.

Inventory shortage falls further

- Total inventory dropped even further in a steady decline that began the first week of June. For-sale listings fell an enormous

34.6% below this week last year; the largest year-over-year deficit seen since Zillow's weekly stats began in 2019. - There were

13.6% fewer new listings last week than at this point last year.

Prices soar amid strong demand and low supply

- The median sale price continued its meteoric rise to

$284,000 as of the week ending Aug. 8,8.7% higher than the previous year and the largest year-over-year increase seen since at least the beginning of 2019. Sale prices were up2% over the month prior. - The median list price rose to

$345,000 , a full10% over last year but just0.1% higher than a month prior.

New home sales astound in August

- New home sales have been particularly robust, even within this astounding buying season. The annualized pace of new home sales in August exceeded 1 million homes -- a benchmark unseen since 2006.

Metropolitan Area* | Newly | Newly | Median | Total | New | New | Median | Median |

United States | - | 13 | - | - | 284000 | |||

New York/Newark, NY/NJ | 32 | - | - | - | 445000 | |||

Los Angeles, CA | 12 | - | 713375 | |||||

Chicago, IL | - | 13 | - | - | 264500 | |||

Dallas-Fort Worth, TX | - | 23 | - | - | 303812 | |||

Philadelphia, PA | 9 | - | - | 279000 | ||||

Houston, TX | - | 17 | - | - | 271529 | |||

Washington, DC | 7 | - | - | 459431 | ||||

Miami-Fort Lauderdale, FL | 27 | - | - | 329750 | ||||

Atlanta, GA | - | 14 | - | - | 283850 | |||

Boston, MA | 8 | - | - | 522500 | ||||

San Francisco, CA | - | 12 | - | 896500 | ||||

Detroit, MI | - | 8 | - | - | 222975 | |||

Riverside, CA | - | 9 | - | 411250 | ||||

Phoenix, AZ | 11 | - | 322500 | |||||

Seattle, WA | - | 6 | - | - | - | 535525 | ||

Minneapolis-St. Paul, MN | 17 | - | - | 311625 | ||||

San Diego, CA | 8 | - | - | 635188 | ||||

St. Louis, MO | - | 6 | - | - | 217912 | |||

Tampa, FL | 8 | - | - | - | 258409 | |||

Baltimore, MD | 12 | - | - | 317500 | ||||

Denver, CO | - | 6 | - | 462881 | ||||

Pittsburgh, PA | 9 | - | - | 199499 | ||||

Portland, OR | - | 6 | - | - | - | 440225 | ||

Charlotte, NC | - | - | 6 | - | - | 286500 | ||

Sacramento, CA | - | 7 | - | 452875 | ||||

San Antonio, TX | 27 | - | - | 252812 | ||||

Orlando, FL | 12 | - | - | 282562 | ||||

Cincinnati, OH | 4 | - | - | 212125 | ||||

Cleveland, OH | 18 | - | - | - | 175350 | |||

Kansas City, MO | - | 5 | - | - | 259250 | |||

Las Vegas, NV | - | 15 | - | 304750 | - | |||

Columbus, OH | 4 | - | - | 240500 | ||||

Indianapolis, IN | 5 | - | 222625 | |||||

San Jose, CA | - | - | 15 | - | 1139375 | |||

Austin, TX | 8 | - | - | 357978 | ||||

Virginia Beach, VA | 32 | - | - | 276912 | ||||

Nashville, TN | 33 | - | - | 317850 | ||||

Providence, RI | - | 13 | - | - | 318600 | |||

Milwaukee, WI | 28 | - | - | 207475 | ||||

Jacksonville, FL | 14 | - | - | 268362 | ||||

Memphis, TN | 7 | - | - | 209212 | ||||

Oklahoma City, OK | - | 10 | - | - | 205750 | |||

Louisville, KY | - | 5 | - | - | 217812 | |||

Hartford, CT | - | 10 | - | 258800 | ||||

Richmond, VA | 6 | - | - | 284688 | ||||

New Orleans, LA | - | 17 | - | - | - | 232875 | ||

Buffalo, NY | - | 10 | - | - | - | 189850 | ||

Raleigh, NC | 5 | - | - | 312812 | ||||

Birmingham, AL | 8 | - | 224942 | |||||

Salt Lake City, UT | 6 | - | - | 381916 |

*Table ordered by market size |

**Sale price data as of the week ending Aug. 8 |

1 The Zillow Weekly Market Reports are a weekly overview of the national and local real estate markets. The reports are compiled by Zillow Economic Research and data is aggregated from public sources and listing data on Zillow.com. New for-sale listings data reflect daily counts using a smoothed, seven-day trailing average. Total for-sale listings, newly pending sales, days to pending and median list price data reflect weekly counts using a smoothed, four-week trailing average. National newly pending sales trends are based upon aggregation of the 38 largest metro areas where historic pending listing data coverage is most statistically reliable, and excludes some metros due to upstream data coverage issues. For more information, visit www.zillow.com/research/. |

About Zillow

Zillow, the most visited real estate website in the U.S., is building an on-demand real estate experience. Whether selling, buying, renting or financing, customers can turn to Zillow's businesses to find and get into their next home with speed, certainty and ease.

In addition to for-sale and rental listings, Zillow Offers buys and sells homes directly in dozens of markets across the country, allowing sellers control over their timeline. Zillow Home Loans, our affiliate lender, provides our customers with an easy option to get pre-approved and secure financing for their next home purchase.

Millions of people visit Zillow Group sites every month to start their home search, and now they can rely on Zillow to help them finish it — with the same confidence, ease and empowerment they've come to expect from real estate's most trusted brand.

Zillow is owned and operated by Zillow Group, Inc. (NASDAQ:Z and ZG).

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/new-forecast-sees-sales-peak-this-fall-stay-above-pre-pandemic-levels-through-the-coming-year-301137993.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/new-forecast-sees-sales-peak-this-fall-stay-above-pre-pandemic-levels-through-the-coming-year-301137993.html

SOURCE Zillow