Zenvia Announces Agreements to Address Funding Gap and Introduces EBITDA Guidance for 2024

- Extension of short-term debt and renegotiation of earnouts to address funding gap

- Introduction of EBITDA guidance for 2024

- Reduced cash outflow to pay financial liabilities in 2024

- Improvement in average debt term from 1.6 to 2.8 years

- Pro-forma leverage at the end of 2024 estimated to be approximately 2.0x

- None.

Insights

Zenvia Inc.'s recent financial restructuring, including the extension of short-term debt, renegotiation of earnouts and direct investment by the CEO, signals a strategic move to stabilize its capital structure. The extension of payment terms to 36 and 60 months, respectively, coupled with a grace period, reduces the immediate cash outflow pressure and aligns debt repayment with anticipated cash flows. This maneuver suggests a focus on liquidity management and could be seen as a positive step towards achieving financial sustainability.

The issuance of 8,860,535 Class A common shares at the Nasdaq closing price without a discount to the CEO implies confidence by the founder in the company's future prospects. However, the potential dilution of up to 11% of the shareholder base upon certain liquidity events warrants attention from current investors, as it may affect share value. The EBITDA guidance for 2024 indicates expected operational profitability, which is crucial for evaluating the company's ability to meet its new debt obligations and finance its growth.

The reduction in cash outflow for 2024 and the improvement in the average debt term from 1.6 to 2.8 years are positive indicators of the company's strategic financial planning. The projected pro-forma leverage of 2.0x, post the potential equity conversion of Movidesk's earnout, reflects a manageable level of debt relative to earnings, which is typically a sign of a healthy balance sheet.

From a market perspective, Zenvia's restructuring may be interpreted as a proactive approach to address its funding gap, potentially reassuring investors and stakeholders of the company's commitment to financial health. The EBITDA guidance release alongside the restructuring announcement provides a transparent outlook for the company's expected performance, which could influence investor sentiment and the stock's performance.

Given Zenvia's positioning as a leading cloud-based CX platform in Latin America, its financial stability is critical for sustaining competitive advantage and funding innovation. The company's ability to renegotiate terms and attract investment suggests a level of confidence among its creditors and leadership in its business model and market potential. This could have a favorable impact on customer and partner relationships, as it demonstrates financial resilience and a long-term strategy.

The legal implications of the transactions undertaken by Zenvia, such as the earnout renegotiations and share issuance, are significant in terms of compliance and disclosure. The terms of the investment agreement, particularly the mechanisms for additional returns linked to share price appreciation, reflect a complex contractual arrangement that requires careful scrutiny to ensure it aligns with shareholder interests and securities regulations.

The potential equity conversion of earnout obligations presents a legal nuance that may affect shareholder equity and voting rights. It is essential for such conversions to be conducted in accordance with the terms agreed upon and within the legal frameworks governing corporate actions. This approach can mitigate the risk of disputes or legal challenges that could arise from such significant corporate transactions.

SÃO PAULO, Feb. 6, 2024 /PRNewswire/ -- Zenvia Inc. (NASDAQ: ZENV), the leading cloud-based CX platform in

These transactions include:

(i) agreements with banks for extension of short-term debt, in the total outstanding amount of approximately

(ii) renegotiation of Movidesk's earnout, in the total outstanding amount of approximately

(iii) renegotiation of D1's earnout, in the total outstanding amount of approximately BRL 20 million (twenty million Brazilian reais). Payment terms were extended to a total of 36 months, with a 6-month grace period and 30 monthly payments, with final maturity in December 2026; and

(iv) issuance of 8,860,535 Class A common shares to be acquired by Cassio Bobsin, Zenvia's founder & CEO via Bobsin Corp, for the price of

Combined with this announcement, the company is also introducing its EBITDA guidance for 2024, with a range between

Considering the announced transactions and the guidance for 2024, the main financial impacts of the operation are the following:

(i) Zenvia's cash outflow to pay financial liabilities in 2024 was reduced by approximately

BRL 120 million (one hundred and twenty million Brazilian reais);

(ii) Zenvia's average debt (including earnouts and bank loans) term improves from current 1.6 to 2.8 years; and

(iii) Zenvia's pro-forma leverage at the end of 2024, considering the new 2024 EBITDA guidance and the conversion of the full permitted amount of Movidesk's earnout into equity for the period, would be approximately 2.0x.

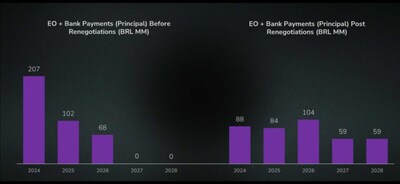

Zenvia's new debt and earnouts amortization schedule will be as follows:

"After several months of constructive discussions, we are pleased to have reached these agreements that are key to mitigate our capital structure gap by allowing our medium- and long-term liabilities to be funded by our future cash generation. These transactions will allow Zenvia to better align its balance sheet with its current business needs," said Shay Chor, Zenvia's Chief Financial Officer. "As we move forward, we remain focused on executing our strategy to create the best integrated SaaS platform for our clients to communicate with their customers. We appreciate the support of our lenders and partners, who share in our long-term strategy."

Contacts

Investor Relations CaioFigueiredo Fernando Schneider | Media Relations – Grayling Lucia Domville – (646) 824-2856 –luciadomville@graylingcom FabianeGoldstein – (954) 625-4793 –fabianegoldstein@graylingcom |

About ZENVIA

ZENVIA is driven by the purpose of empowering companies to create unique experiences for end-consumers through its unified CX SaaS end-to-end platform. ZENVIA empowers companies to transform their existing customer experience from non-scalable, physical and impersonal interactions into highly scalable, digital-first and hyper-contextualized experiences across the customer journey. ZENVIA's unified end-to-end CX SaaS platform provides a combination of (i) SaaS focused on campaigns, sales teams, customer service and engagement, (ii) tools, such as software application programming interfaces, or APIs, chatbots, single customer views, journey designers, documents composer and authentication and (iii) channels, such as SMS, Voice, WhatsApp, Instagram and Webchat. Its comprehensive platform assists customers across multiple use cases, including marketing campaigns, customer acquisition, customer onboarding, warnings, customer services, fraud control, cross-selling and customer retention, among others. ZENVIA's shares are traded on Nasdaq, under the ticker ZENV.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zenvia-announces-agreements-to-address-funding-gap-and-introduces-ebitda-guidance-for-2024-302054752.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zenvia-announces-agreements-to-address-funding-gap-and-introduces-ebitda-guidance-for-2024-302054752.html

SOURCE Zenvia

FAQ

What is the EBITDA guidance for Zenvia in 2024?

What are the main financial impacts of Zenvia's recent transactions?

What are the specific agreements Zenvia has entered to address its funding gap?