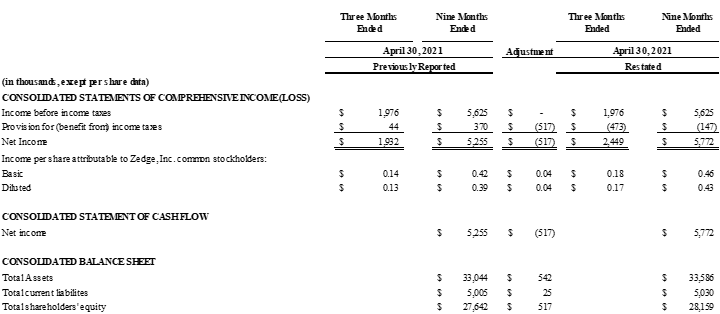

Zedge Announces Revised Results for Third Quarter Fiscal Year 2021 Reported Diluted EPS Should Have Been $0.04 Higher at $0.17 versus $0.13 as Originally Reported

Zedge, Inc. (NYSE AMERICAN:ZDGE) has filed a 10Q/A for the third quarter of fiscal 2021, reporting a net income increase of $0.5 million or $0.04 EPS, attributed to a tax-related benefit. This adjustment will not affect the full-year fiscal net income or EPS. Key highlights include a 93% revenue increase to $5.2 million for Q4 2021 and a 106.6% increase to $19.6 million for the full year. Active subscriptions rose by 49.2%, and operating income reached $7.8 million, a significant turnaround from a loss in the previous year. The company has acknowledged a material weakness in its disclosure controls.

- Revenue increased 93% to $5.2 million for Q4 2021.

- Full-year revenue grew 106.6% to $19.6 million.

- Operating income for the full year reached $7.8 million, a significant improvement.

- Active subscriptions rose 49.2%, with subscription revenue up 100.8%.

- Monthly Active Users (MAU) increased by 7.8% to 34.4 million.

- Identified a material weakness in disclosure controls over deferred tax assets.

- The tax-related benefit of $0.5 million was due to a timing issue.

Insights

Analyzing...

- Files 10Q/A for the Third Quarter Fiscal Year 2021

- Increase in net income and EPS due to tax-related benefit of

$0.5 million ; - Full-year fiscal net income and EPS will not be affected by this change

NEW YORK, NY / ACCESSWIRE / November 5, 2021 / Zedge, Inc. (NYSE AMERICAN:ZDGE), a global app publisher with a portfolio of leading digital consumer brands serving 43 million monthly active users in October 2021, today announced that it has filed a 10Q/A with the SEC for the third quarter of fiscal 2021 ended April 30, 2021.

The amended filing reflects a net impact of adding

The partial results below are for the fiscal fourth quarter and full-year 2021 and were provided on October 27, 2021.

Select Fiscal FourthQuarter Highlights (Fiscal 2021 versus Fiscal 2020)

- Revenue increased

93.0% to$5.2 million versus$2.7 million ; - Active subscriptions1 and subscription revenue increased

49.2% and55.0% , respectively; - Operating income and operating margin of

$2.2 million and42.2% versus$0.4 million and14.4% , respectively; - MAU increased by

7.8% to 34.4 million; ARPMAU1 increased76.3% to$0.05 ; - Zedge Premium Gross Transaction Value1 (GTV) of

$0.3 million an increase of45.0% .

Select Full-Year Fiscal 2021 Highlights (versus Fiscal 2020)

- Revenue increased

106.6% to$19.6 million versus$9.5 million ; - Active subscriptions and subscription revenue increased

49.2% and100.8% , respectively; - Operating income and operating margin of

$7.8 million and39.9% versus an operating loss of ($0.4) million and (4.2)%, respectively; - Zedge Premium GTV of

$0.95 million an increase of29.8% versus last year.

1We use the following business metrics in this release because we believe they are useful in evaluating Zedge as an investment.

- Monthly active users, or MAU, captures the number of unique users that used our Zedge app during the previous 30-days of the relevant period, is useful for evaluating consumer engagement with our app which correlates to advertising revenue as more users drive more ad impressions for sale. It also allows readers and potential advertisers to evaluate the size of our user base;

- Average Revenue Per Monthly Active User, or ARPMAU, is a useful statistic in evaluating how well we are monetizing our user base;

- Zedge Premium Gross Transaction Value, or GTV, is the total dollar amount of transactions conducted through the Zedge Premium Marketplace. As Zedge Premium is an internal focus for growth, we believe that this metric will help investors evaluate the progress we are making in growing this part of our business;

- The term Active Subscriptions is replacing "paid subscriptions" due to changes made by Google Play with respect to how they calculate subscriptions. An active subscription is a subscription that has commenced and not been canceled, including paused subscriptions, and subscriptions in free trials, grace periods, or account hold.

About Zedge

Zedge owns a portfolio of leading digital consumer brands that serve 43 million monthly active users in October 2021 across the globe. Our portfolio consists of Zedge Ringtones and Wallpapers, the leading mobile app used for mobile phone personalization, social content, and fandom art; Zedge Premium, a marketplace for artists, celebrities, and emerging creators to market their digital content, to Zedge's users; Emojipedia, the leading source of all things emoji; and Shortz, a mobile entertainment app in beta, focused on short-form storytelling. Zedge monetizes its content through ad-supported offerings, tokens, and subscriptions. For more information, visit https://www.zedge.net.

Forward-Looking Statements

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words "believe," "anticipate," "expect," "plan," "intend," "estimate," "target" and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks and should be consulted along with this release. To the extent permitted under applicable law, we assume no obligation to update any forward-looking statements.

Contact:

Brian Siegel IRC, MBA Managing Director

Hayden IR

(346) 396-8696

ir@zedge.net

SOURCE: Zedge, Inc.

View source version on accesswire.com:

https://www.accesswire.com/671432/Zedge-Announces-Revised-Results-for-Third-Quarter-Fiscal-Year-2021-Reported-Diluted-EPS-Should-Have-Been-004-Higher-at-017-versus-013-as-Originally-Reported