Yelp Economic Average Shows Early Signs of Recovery for Local Economies with More than 230,000 Reopened Businesses in 2020

Yelp Inc. (NYSE: YELP) released its Annual 2020 Yelp Economic Average (YEA) report, emphasizing the significant effects of COVID-19 on local economies. Despite the pandemic, the fourth quarter showed signs of recovery, with 230,209 businesses reopening since March 1, 2020. Restaurant openings were notably resilient, nearing pre-pandemic levels with 18,207 new establishments in Q4. Notably, home services showed an average increase of 7% in openings. The report highlights the adaptability of local businesses and the resurgence of consumer interest post-vaccine announcements.

- 230,209 businesses reopened between March 1 and December 31, 2020.

- Restaurant openings approached 2019 levels with 18,207 new establishments in Q4 2020.

- Home services and professional services saw average increases in openings of 7% and 4%, respectively.

- Retail and shopping businesses experienced a 25% decrease in average openings compared to 2019.

- Fitness and beauty sectors faced significant drops in April opening rates, down 64% and 66% respectively.

Yelp Inc. (NYSE: YELP), the company that connects people with great local businesses, today released the Annual 2020 Yelp Economic Average (YEA) report, a benchmark of local economic strength in the U.S. In 2020, the report was adapted to reveal the dramatic impact COVID-19 has had on local economies, uncovering the resilience of local businesses across the country. While the pandemic continues to drive uncertainty, YEA’s fourth quarter data demonstrates early evidence of an economic recovery emerging across the nation.

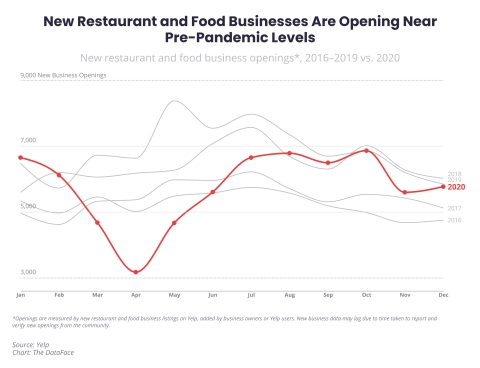

Annual 2020 Yelp Economic Average found that new food and restaurant openings were down in 2020, but had mostly recovered by the fourth quarter. (Graphic: Business Wire)

YEA found that reopenings of local businesses increased in the fourth quarter, with a total of 230,209 businesses reopening between March 1 and Dec. 31. The report also highlighted how many industries have persevered through the pandemic by opening new businesses at comparable or even higher rates than years prior. As millions of Americans spent more time at home, we saw home and professional services businesses increase in new openings. Additionally, YEA uncovered how small tourist towns were heavily impacted by the loss of seasonal travelers, the behavior of affianced couples who chose smaller weddings in 2020 or delayed their nuptials until hearing the promising news of a vaccine, and how the typical weekend spike in user activity on Yelp waned during the spring and summer, but quickly came back as people adapted to the constraints of the pandemic. For the company’s 2020 report, YEA reflects data from millions of local businesses and tens of millions of users on Yelp’s platform, measuring U.S. business openings and reopenings, as well as consumer interest trends via search data, page views, reviews and photos.

“After a challenging year that’s tested millions of local businesses, our data shows early signs that local economies may finally be on the mend,” said Justin Norman, Yelp’s vice president of data science. “As a testament to their resilience many months into the pandemic, we saw numerous industries return to pre-pandemic rates of new openings, as well as restaurants lead in reopenings during the fourth quarter of 2020. As people spent more time at home, businesses in the home, local, professional and auto services, at times, opened more new businesses than prior years, and all ended the year with a higher number of new openings in December than years prior.”

New Openings for Restaurant and Food Businesses, as well as Home, Local, Professional, Local and Auto Services Recover By the End of the Year

In the third quarter of 2020, YEA observed restaurant and food businesses open at pre-pandemic levels, due largely to the innovative ways business owners adapted their operations. Yelp’s data indicates that the number of restaurant and food business openings approached and even surpassed 2019 levels in the fourth quarter. Openings are determined by counting new businesses listed on Yelp. Restaurant and food business owners opened 18,207 restaurants nationwide in the last quarter of 2020, down only

Businesses in the home and professional services space proved to be the most resilient and poised for growth throughout the pandemic. In April, openings dropped by only

Local and auto services experienced less severe declines upon the onset of the pandemic, with their sharpest decline of openings in April for local services (

Retail and shopping businesses averaged approximately 3,118 openings per month in 2020, a

Fitness and beauty categories experienced a significant drop in new openings in April (down

Businesses Reopened Nationwide in the Fourth Quarter, Many Have Reopened More Than Once Throughout the Year

Data from Yelp’s third quarter YEA report found 210,000 reopenings occurred nationwide, as of Sept. 30. In a show of continued resiliency, despite increased COVID-19 cases in the fourth quarter, the total climbed to 230,209 national reopenings between March 1 and Dec. 31. Reopenings slowed in October, but increased again in November and especially December, coinciding with the approval of multiple COVID-19 vaccines by the FDA.

Yelp data tracks all temporary closures of businesses and their subsequent openings, revealing that many local entrepreneurs were forced to temporarily close and reopen multiple times throughout the year. Since March 1, 173,727 businesses reopened once after a temporary closure, 38,702 businesses reopened twice, and 17,780 businesses reopened three times or more. Businesses in restaurants, food, shopping, active, health and beauty categories comprised more than

In the fourth quarter, Yelp’s reopening data reveals food, active, professional services and home-related businesses spiked in reopenings. Despite the ongoing pandemic and surging cases, restaurant and food categories had 3,512 reopenings and 1,142 reopenings in the fourth quarter, respectively. As the new year approached, regions with less restrictions showed increased reopenings in active categories – gyms, health trainers, kids’ activities and parks, had 731 reopenings in the fourth quarter, with 381 of them in December alone. With lower mortgage interest rates, Yelp’s data also shows increased reopenings in the fourth quarter for home and professional services related to home purchases and/or home improvements including: financial services (2,035 of reopenings), real estate (256 of reopenings) and home services (505 of reopenings).

Travel Curbs Hammered Ski and Beach Towns’ Typical Peak Seasons

Yelp’s consumer interest data shows that the areas most impacted by the decline in tourism in 2020 were primarily within four categories: ski towns, beach towns, event locations and Hawaii destinations.

The report’s data indicates that the cities with the largest declines in consumer interest, year-over-year, during the first quarter of 2020 were towns primarily known for their ski mountains, which have peak seasons through April. Towns hardest hit in the second quarter were popular spring break destinations, who experienced decreased volumes of party goers and spring breakers due to initial efforts to contain the virus. As temperatures rose in the third quarter, consumer interest in towns with summertime attractions dipped lower than prior year’s levels, as beachside communities struggled to sustain consumer interest during their peak seasons. And in the fourth quarter, Yelp data indicated that towns hardest hit were primarily in Hawaii, during travel restrictions from the continental U.S.

Betrothed Couples Are Already Planning Those Delayed 2020 Weddings for 2021

Nationally, Yelp data reveals a decrease in consumer interest in the wedding planning category compared to 2019. Between September and November, consumer interest for wedding planning decreased by an average of

Throughout 2020, Yelp data shows that many couples continued to marry, just not the way they initially planned. Consumer interest in officiants, a category dominated by both officiants and notary services, was

Every Day Felt Like a Wednesday in May, but Consumers Are Reclaiming Their Weekends

In previous years, Yelp data has revealed a weekly pattern of how users interact with the local economy on weekends, as Fridays, Saturdays and Sundays are historically the days of the week where users are most active on the platform. Yelp data shows that weekends became less active and eventful with less variation in consumer interest compared to weekdays' during the uncertainty and confusion surrounding the initial outbreak. March through August, the typical increase in consumer interest relative to the weekly average decreased

Read the full report at yelpeconomicaverage.com, as well as find previous YEA reports and other resources. Assets and images from the Annual 2020 YEA report can be found here. For more information and Yelp’s latest company metrics, visit: https://www.yelp-press.com/company/fast-facts/default.aspx

Methodology

Business Openings

Openings are determined by counting new businesses listed on Yelp, which are added by either business owners or Yelp users. Openings are adjusted year-over-year, meaning openings in 2020 are relative to the same period of time in 2019 for the same category and geographic location. This adjustment corrects for both seasonality and the baseline level of Yelp coverage in any given category and geography.

Business Reopenings

On each date, starting with March 1, we count U.S. businesses that were temporarily closed and reopened through Dec. 31. A reopening is of a temporary closure, whether by using Yelp’s temporary closure feature or by editing hours, excluding closures due to holidays. Each reopened business is counted at most once, on the date of its most recent reopening.

To examine the adaptability of local businesses during this year, we compared the number of businesses that reopened only once in 2020 to those that reopened twice, and those that reopened three times or more.

Openings and reopenings are based on when they're indicated on Yelp, as such, the data may lag slightly from the true opening or reopening date due to a delay in reporting from consumers and business owners.

Consumer Interest

We measure consumer interest, in terms of U.S. counts of a few of the many actions people take to connect with businesses on Yelp: viewing business pages, or posting photos or reviews.

Consumer interest for each category is based on the 2020 year-over-year change in the category’s share of all consumer actions in its root category.

Additionally, we measured consumer interest for each category based on the monthly year-over-year change in the category’s share of all consumer actions in its root category.

Search Query Text

Search data is used to understand what consumers are searching for throughout the year. To gather this data, we looked at all search query text entries for the event planning category in 2019 and 2020. To compare the change in volume of a specific search query, we evaluated the number of times per million searches the query was entered. We evaluated this for each week of 2020 and 2019 to determine the year-over-year relative change in search share over time.

Consumer Action Day of Week

Yelp’s consumer action measure counts page views, reviews, and photos.

By totalling the number of consumer actions for each day of the year and comparing the total to the week’s average, you arrive at the day’s share of the weekly total. Specifically, we evaluated each day’s actions relative to the weekly average to compare the changes in consumer interest on weekdays versus weekends (Friday through Sunday) throughout the year. We additionally measured, by category, the weekend’s change in weekly action share during three periods of 2020: Jan. 1 through March 7, March 8 through Aug. 22 and Aug. 23 through Dec. 31.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local businesses. With unmatched local business information, photos and review content, Yelp provides a one-stop local platform for consumers to discover, connect and transact with local businesses of all sizes by making it easy to request a quote, join a waitlist, and make a reservation, appointment or purchase. Yelp was founded in San Francisco in July 2004. Since then, Yelp has taken root in major metros in more than 30 countries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210126005371/en/

FAQ

What does Yelp's Annual 2020 Economic Average report indicate about local businesses?

How many businesses reopened according to Yelp's Q4 2020 report?

What impact did COVID-19 have on restaurant openings in 2020?

What trends did Yelp report regarding small towns during the pandemic?