Ximen Mining Corp. Closes Financing

Ximen Mining Corp (OTCQB:XXMMF) has completed the final tranche of a non-brokered private placement, raising gross proceeds of $70,400 through the issuance of 320,000 flow-through shares at $0.22 each. The net proceeds will support exploration expenses in British Columbia. A related party transaction occurred, involving Christopher Anderson, an officer of the Company. Ximen also granted 1,000,000 stock options and 1,000,000 Restricted Share Units to its personnel, subject to a four-month hold period. The closing is pending TSX-V approval.

- Raised $70,400 through a private placement, enhancing liquidity.

- Funds allocated for exploration in British Columbia, potentially increasing resource valuation.

- Related party transaction is under exemption rules, indicating compliance with regulations.

- Issuance of stock options and RSUs may align interests of employees and shareholders.

- Dependence on TSX-V approval for the financing may pose a risk to timely implementation.

- Potential dilution of shares for existing shareholders due to stock options and RSUs issuance.

VANCOUVER, BC / ACCESSWIRE / December 30, 2021 / Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce that it has closed the final tranche of the non-brokered private placement originally announced on December 1, 2021 consisting of 320,000 flow through shares at a price of

The net proceeds from the Offering will be used by the Company for exploration expenses on the Company's British Columbia mineral properties.

All securities issued in connection with the flow through Offering will be subject to a hold period expiring April 30, 2022. The closing of this private placement financing is subject to final TSX-V approval. This flow-through private placement, originally announced on December 1, 2021, is now closed.

Christopher Anderson a director and/or officer of the Company, participated in the Offering constituting a related party transaction pursuant to TSX Venture Exchange Policy 5.9 and Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company relied on section 5.5(a) of MI 61-101 for an exemption from the formal valuation requirement and section 5.7(1)(a) of MI 61-101 for an exemption from the minority shareholder approval requirement of MI 61-101 as the fair market value of the transaction did not exceed

The Company has granted 1,000,000 stock options at an exercise price of

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

ir@XimenMiningCorp.com

About Ximen Mining Corp

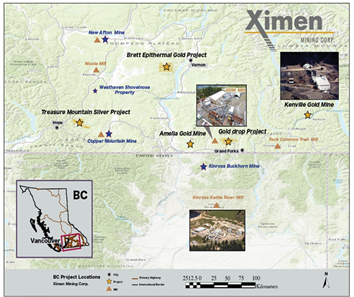

Ximen Mining Corp. owns

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/680301/Ximen-Mining-Corp-Closes-Financing

FAQ

What is the significance of Ximen Mining Corp's private placement announcement on December 30, 2021?

How will the funds from the private placement be used by Ximen Mining Corp?

What are the terms associated with the flow-through shares issued by Ximen Mining Corp?

Who is involved in the related party transaction mentioned in Ximen Mining Corp's press release?