Ximen Mining Arranges Strategic Investment $2,500,000 Private Placement at a 40% Premium

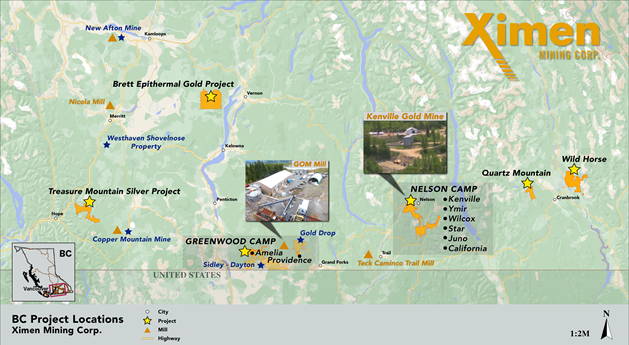

Ximen Mining Corp (OTCQB:XXMMF) has announced a non-brokered private placement of 8,893,635 charity flow-through shares at $0.285 per share, generating gross proceeds of $2,534,686—a 42.5% premium to its current share price. The funds will be used for exploration on its British Columbia properties. The financing is subject to regulatory approvals, with closing expected around February 2, 2022. Ximen is preparing for a robust exploration season with multiple drilling permits in place across various gold and silver properties, including the Kenville Gold Mine.

- Private placement of 8,893,635 charity flow-through shares at $0.285 raises $2,534,686.

- Proceeds are allocated for exploration on British Columbia mineral properties.

- The share offering is at a 42.5% premium to the current share price.

- Multiple drill permits are secured for the 2022 exploration season.

- Active drilling planned at several key sites, including the Amelia Gold Mine and Wild Horse Gold Belt.

- None.

VANCOUER, BC / ACCESSWIRE / January 20, 2022 / Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce it has arranged a non-brokered private placement of 8,893,635 charity flow-through shares are priced at

Each Flow-Through share consists of one common share that qualifies as a "flow-through share" as defined in subsection 66(15) of the Income Tax Act. The closing of the Financing is expected to occur on or about February 2nd, 2022 and is subject to the receipt of regulatory approvals, including the approval of the TSX Venture Exchange.

The Company will use the net proceeds from the Offering for exploration expenses on the Company's British Columbia mineral properties. The Shares are being issued as part of a charity flow-through arrangement. The Company will pay no commission or finders' fee in connection with this Offering.

Ximen is prepared for an active precious metal's exploration season in 2022 with several drill permits in place. Recently added to the Permitted properties for drilling include the Amelia Gold Mine, Wild Horse Gold Belt, and The Bud-Elk Gold Copper Property. Previously and in addition too, in the pipeline for drilling are the Providence Silver and Gold project, The California Gold Mine, The Star Gold Property and Venus & Juno Gold Mine and The Brett Epithermal Gold property. This is of course outside the ongoing work that is being conducted currently at the Kenville Gold Mine. For a complete list of properties and further permitted assets please visit the company's website XimenMiningCorp.com

257 Portal Reconstruction Completed - The Kenville Gold Mine

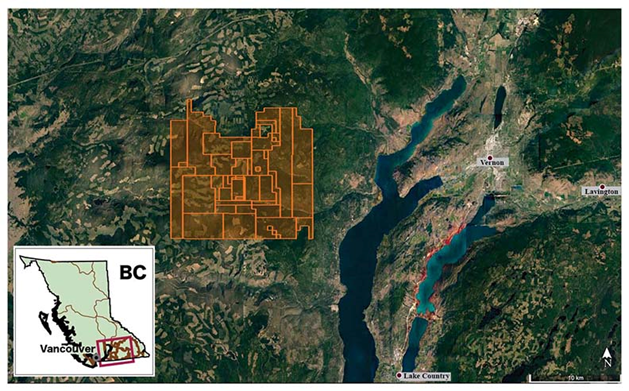

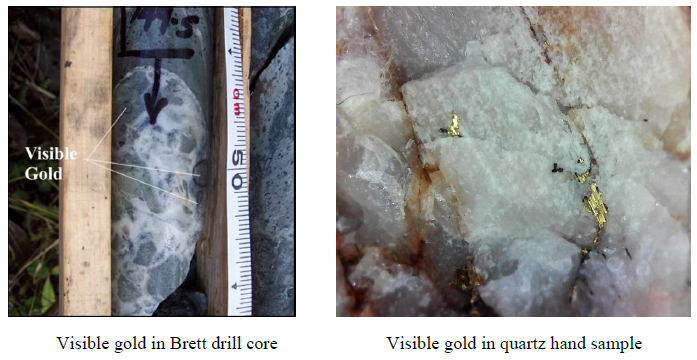

The Brett Epithermal Gold property (near Vernon, BC) is an epithermal gold deposit (low-sulphidation type) with several gold drill intercepts including bonanza high grades over meter-scale widths and low-grade gold over tens of meters (see company website for details). Follow-up drilling of newly identified zones and in-fill drilling of the Main zone is planned.

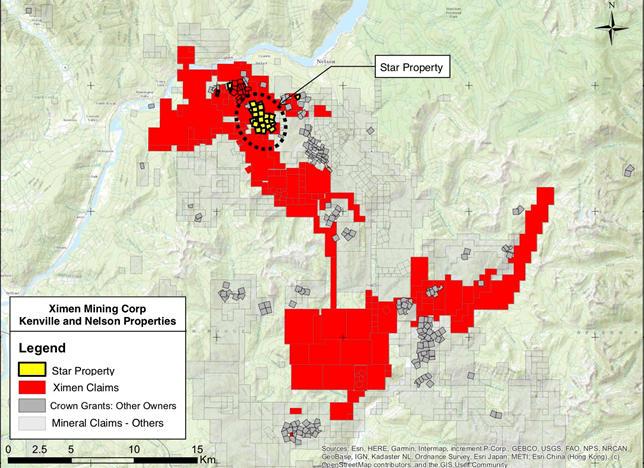

Ximen's Nelson BC properties are being targeted for gold-quartz veins, silver-gold veins and bulk mineable gold-copper mineralization. The gold vein system that extends south from the Kenville gold mine goes through a gradual change in mineralization style from gold in discreet veins to a disseminated style with gold, copper and silver in sheeted veinlets, collectively regarded as a bulk mineable gold target.

Drilling at the Amelia property (Camp McKinney east of Oliver, BC) is planned to test for extensions of the historic Caribou-Amelia gold mine.

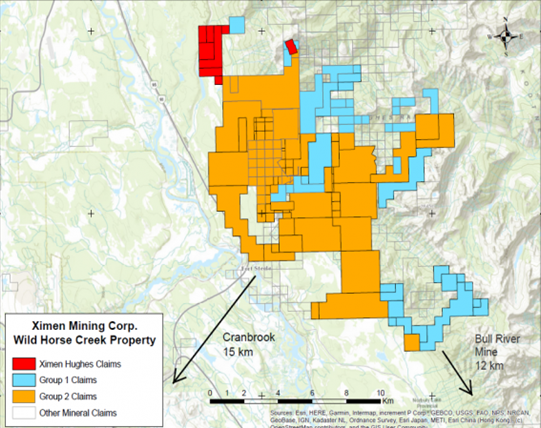

At the Wild Horse (near Cranbrook, BC) drilling will continue and is being planned to test a new area of visible gold in soil samples.

The Brett Epithermal Gold Project

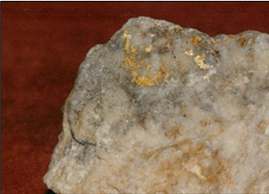

Photos: Left picture shows narrow-high grade style quartz breccia vein characterized by colloform-banded quartz containing gold. Right picture shows gold in quartz vein from Greenwood area high-grade gold-quartz mineralization, typical of gold-quartz veins found at Amelia and Nelson. The famous Wild Horse River placer gold deposits may have been derived from similar gold-quartz veins.

Readers are cautioned that historical information including grades and assay results referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

ir@XimenMiningCorp.com

About Ximen Mining Corp.

Ximen Mining Corp. is focused on acquiring high-grade gold assets in southern BC, with easy access and solid infrastructure. Ximen aims to build a gold mining company with the blue-sky potential of a land package with multi-million ounces of gold targeting over 10,000,000 OZ. Ximen strives to always to take a

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities. This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/684708/Ximen-Mining-Arranges-Strategic-Investment-2500000-Private-Placement-at-a-40-Premium

FAQ

What is the significance of Ximen Mining's private placement of charity flow-through shares on January 20, 2022?

When is the closing date for Ximen Mining's private placement?

How will Ximen Mining utilize the proceeds from the private placement?

What properties is Ximen Mining planning to drill in 2022?