TeraWulf Inc. Announces Closing of $500 Million 2.75% Convertible Senior Notes Offering

TeraWulf has completed a private placement of $500 million in 2.75% Convertible Senior Notes due 2030 to qualified institutional buyers. The company implemented capped call transactions with a cap price of $12.80 and repurchased $115 million of its common stock. The net proceeds of approximately $487.1 million will be allocated as follows: $60 million for capped call transactions, $115 million for stock repurchases, and the remainder for general corporate purposes, including working capital, strategic acquisitions, and data center infrastructure expansion.

TeraWulf ha completato un collocamento privato di 500 milioni di dollari in Note Convertibili Senior a lungo termine con un tasso del 2,75% scadenza 2030 per investitori istituzionali qualificati. L'azienda ha attuato operazioni di capped call con un prezzo limite di 12,80 dollari e ha riacquistato 115 milioni di dollari delle sue azioni ordinarie. I proventi netti di circa 487,1 milioni di dollari saranno destinati come segue: 60 milioni di dollari per le operazioni di capped call, 115 milioni di dollari per il riacquisto di azioni e il resto per scopi aziendali generali, inclusi capitale circolante, acquisizioni strategiche ed espansione dell'infrastruttura dei data center.

TeraWulf ha completado una colocación privada de 500 millones de dólares en Notas Senior Convertibles del 2,75% con vencimiento en 2030, dirigida a compradores institucionales calificados. La compañía implementó transacciones de capped call con un precio máximo de 12,80 dólares y recompró 115 millones de dólares de sus acciones ordinarias. Los ingresos netos de aproximadamente 487,1 millones de dólares se destinarán de la siguiente manera: 60 millones de dólares para transacciones de capped call, 115 millones de dólares para la recompra de acciones, y el resto para propósitos corporativos generales, incluyendo capital de trabajo, adquisiciones estratégicas y expansión de la infraestructura de centros de datos.

TeraWulf는 5억 달러의 2.75% 전환 선순위 노트를 2030년 만기 조건으로 자격을 갖춘 기관 투자자에게 사모 배정했습니다. 회사는 12.80 달러의 한도가 있는 capped call 거래를 시행했고, 1억 1500만 달러의 자사 주식을 재매입했습니다. 순수익 약 4억 8710만 달러는 다음과 같이 배분될 예정입니다: 6000만 달러는 capped call 거래에, 1억 1500만 달러는 주식 재매입에, 나머지는 일반 기업 목적, 즉 운영 자본, 전략적 인수 및 데이터 센터 인프라 확장에 사용됩니다.

TeraWulf a réalisé un placement privé de 500 millions de dollars en Obligations Convertibles Senior à 2,75% arrivant à échéance en 2030 pour des acheteurs institutionnels qualifiés. L'entreprise a mis en œuvre des transactions de capped call avec un prix plafond de 12,80 dollars et a racheté 115 millions de dollars de ses actions ordinaires. Les produits nets d'environ 487,1 millions de dollars seront affectés comme suit : 60 millions de dollars pour les transactions de capped call, 115 millions de dollars pour les rachats d'actions, et le reste pour des fins d'entreprise générales, y compris le fonds de roulement, les acquisitions stratégiques et l'expansion des infrastructures des centres de données.

TeraWulf hat eine Privatplatzierung von 500 Millionen Dollar in 2,75% konvertierbaren Senior Notes mit Fälligkeit im Jahr 2030 für qualifizierte institutionelle Käufer abgeschlossen. Das Unternehmen hat capped call-Transaktionen mit einem Höchstpreis von 12,80 Dollar durchgeführt und 115 Millionen Dollar seiner Stammaktien zurückgekauft. Die Nettoerlöse von etwa 487,1 Millionen Dollar werden wie folgt verwendet: 60 Millionen Dollar für capped call-Transaktionen, 115 Millionen Dollar für den Rückkauf von Aktien und der Rest für allgemeine Unternehmenszwecke, einschließlich Betriebskapital, strategische Akquisitionen und den Ausbau der Rechenzentrumsinfrastruktur.

- Secured $500 million in convertible notes financing

- Implemented capped call transactions to minimize dilution

- Initiated $115 million share repurchase program

- Generated $487.1 million in net proceeds for expansion and operations

- Potential future dilution from convertible notes

- Increased debt obligations with 2.75% interest rate

- Additional financial leverage on balance sheet

Insights

This

The net proceeds of

The strategic allocation of capital towards data center infrastructure expansion is particularly noteworthy in the high-performance computing (HPC) sector. This funding enables TeraWulf to accelerate its zero-carbon energy infrastructure deployment, a critical differentiator in the increasingly ESG-conscious digital infrastructure market. The ability to fund both strategic acquisitions and organic growth provides operational flexibility to capitalize on market opportunities in the rapidly evolving digital asset space.

EASTON, Md., Oct. 25, 2024 (GLOBE NEWSWIRE) -- TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), a leading owner and operator of vertically integrated, next-generation digital infrastructure powered by predominantly zero-carbon energy, today completed its previously announced offering of

In conjunction with the issuance of the Convertible Notes, the Company entered into capped call transactions with a cap price of

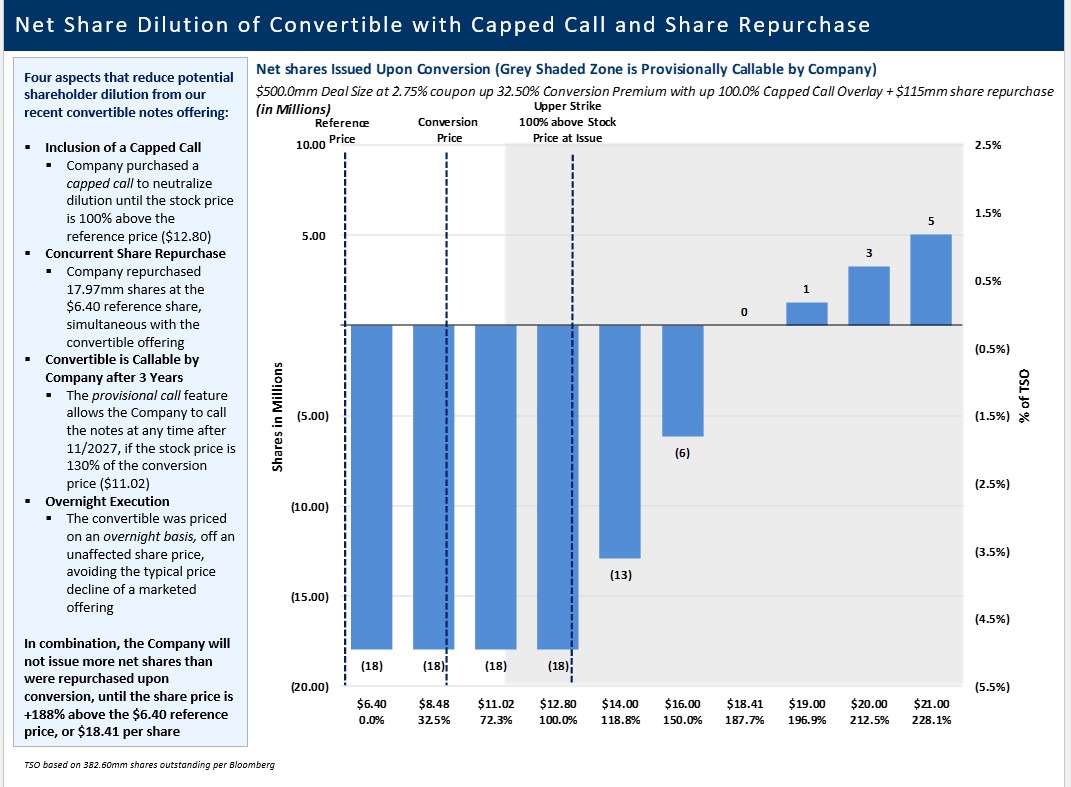

The table below illustrates the potential net dilution expectations from the overall transaction.

The net proceeds from the sale of the Convertible Notes were approximately

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

Investors:

Investors@terawulf.com

Media:

media@terawulf.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6dc9f0ea-cb8a-4910-9e05-daa4d5422db6

FAQ

What is the interest rate on TeraWulf's (WULF) new convertible notes?

How much did TeraWulf (WULF) raise in its convertible notes offering?

What is the cap price for TeraWulf's (WULF) capped call transactions?