Wolters Kluwer Expert Examines the Threats to Biden's Student Loan Forgiveness Program and Analyzes the Potential State Income Taxation for Borrowers

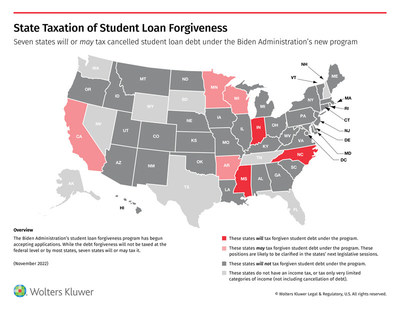

Wolters Kluwer released insights on the impact of Biden's Student Loan Forgiveness Program, focusing on potential state income taxes for borrowers. The program, announced in August 2022 and currently on hold due to legal challenges, may see seven states imposing taxes on forgiven amounts despite federal protections against income tax. Senior Legal Analyst Anne H. Gibson provided a comprehensive analysis including eligibility and legal opposition, along with a detailed chart of state tax implications. The analysis is crucial for understanding the evolving debt cancellation landscape.

- Detailed insights on the Biden Student Loan Forgiveness Program.

- Comprehensive mapping of state taxation implications for borrowers.

- Federal protections ensure no federal income tax on debt forgiveness.

- Ongoing legal challenges could delay the implementation of the forgiveness program.

- Potential tax burdens for borrowers in states that choose to tax forgiven debt.

Senior legal analyst examines recent developments as Biden's Student Loan Forgiveness Program begins to take shape

NEW YORK, Nov. 4, 2022 /PRNewswire/ --

What: Seven states may tax student loan forgiveness under the Biden Administration program

Why: During his 2020 campaign, President Biden touted promises of student loan forgiveness, and on August 24, his administration announced that the application for debt relief was coming soon. Although the application was officially released on October 17, the program itself is currently "on hold," with no debt allowed to be forgiven until federal appeals courts, and potentially the Supreme Court, resolve ongoing challenges to the program. While the American Rescue Plan Act of 2021 (ARPA) ensures that this debt forgiveness is not subject to federal income taxes, some states are still looking to impose state income taxes.

In her new Strategic Perspective entitled "Fate of Student Loan Forgiveness Program Unclear, but State Income Tax Consequences for Borrowers Taking Shape", Wolters Kluwer Legal & Regulatory U.S. Senior Legal Analyst Anne H. Gibson offers keen insights on the program by analyzing eligibility, legal opposition, how it differs from other cancellation of debt initiatives, and how state income tax will affect it. In addition, Gibson provides a comprehensive map and chart detailing the quickly developing debt cancellation program. The map highlights states that will tax forgiven student debt, states that will not, and states that may do so. The chart breaks down each state's conformity with the IRC definition of income as well as relevant code sections.

Who: Anne H. Gibson, J.D., LL.M.

The student loan forgiveness program is sure to be a boon to many borrowers, but the one-time debt relief could result in an additional tax burden for those living in states that have chosen to tax it. Some opponents of the program have even based their legal challenges on this potential state taxation. - Anne H. Gibson, J.D., LL.M. Senior Legal Analyst

To read the full Strategic Perspective, visit: Fate of Student Loan Forgiveness Program Unclear, but State Income Tax Consequences for Borrowers Taking Shape

Contact: To arrange an interview with Anne H. Gibson, or other legal experts from Wolters Kluwer Legal & Regulatory U.S. on this or any other legal topics, please contact Linda Gharib: lrusmedia@wolterskluwer.com

Wolters Kluwer (WKL) is a global leader in professional information, software solutions, and services for the healthcare; tax and accounting; governance, risk, and compliance; and legal and regulatory sectors. We help our customers make critical decisions every day by providing expert solutions that combine deep domain knowledge with specialized technology and services.

Wolters Kluwer reported 2021 annual revenues of

Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and are included in the AEX and Euronext 100 indices. Wolters Kluwer has a sponsored Level 1 American Depositary Receipt (ADR) program. The ADRs are traded on the over-the-counter market in the U.S. (WTKWY).

For more information, visit www.wolterskluwer.com, follow us on LinkedIn, Twitter, Facebook, and YouTube.

MEDIA CONTACT:

Linda Gharib

Director, Brand & Communications

Wolters Kluwer Legal & Regulatory U.S.

Tel: +1 (646) 887-7962

Email: lrusmedia@wolterskluwer.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/wolters-kluwer-expert-examines-the-threats-to-bidens-student-loan-forgiveness-program-and-analyzes-the-potential-state-income-taxation-for-borrowers-301669329.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/wolters-kluwer-expert-examines-the-threats-to-bidens-student-loan-forgiveness-program-and-analyzes-the-potential-state-income-taxation-for-borrowers-301669329.html

SOURCE Wolters Kluwer Legal & Regulatory U.S.

FAQ

What is the status of Biden's Student Loan Forgiveness Program?

How many states may tax the student loan forgiveness?

Who analyzed the implications of the Student Loan Forgiveness Program?

When was the application for the Student Loan Forgiveness Program released?