Whitestone REIT Responds to MCB Indication of Interest

Rhea-AI Summary

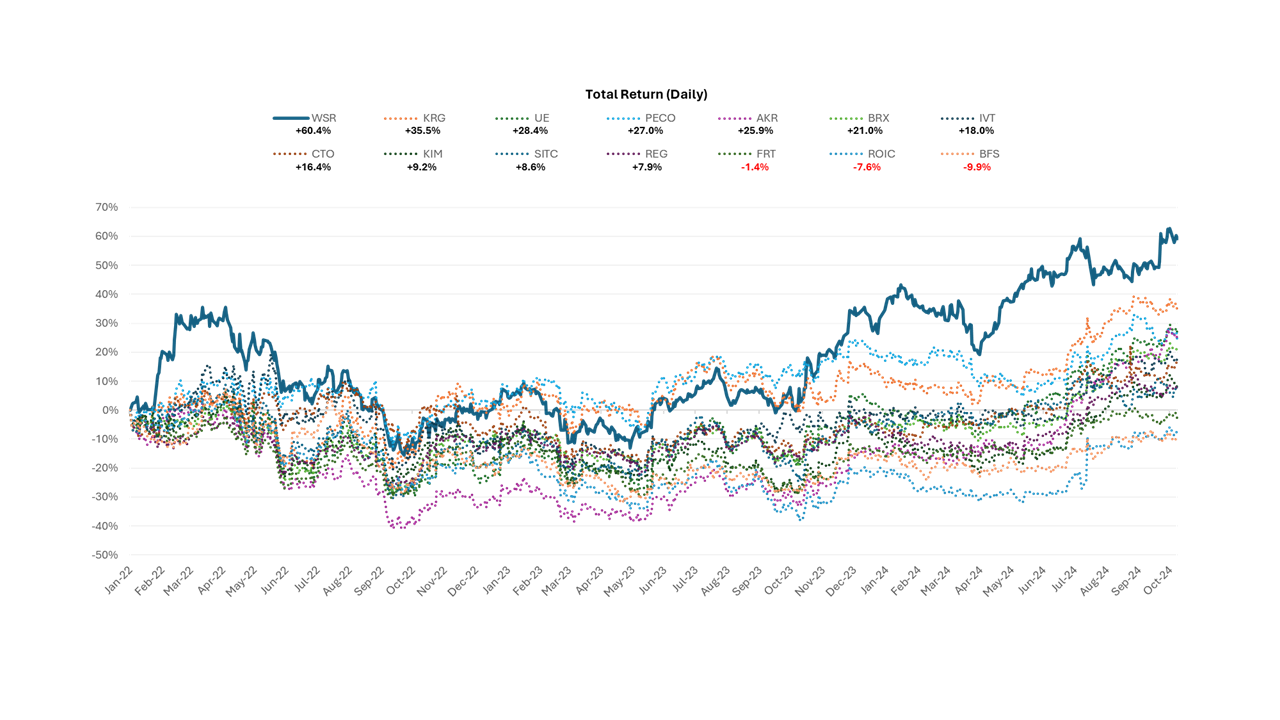

Whitestone REIT (NYSE: WSR) has unanimously rejected MCB Real Estate's $15 per share indication of interest, stating it undervalues the company based on Net Asset Value and Discounted Cash Flow analysis. The Board emphasized the company's strong performance, highlighting key metrics including: targeted 11% growth in 2024 Core FFO per share ($0.98-$1.04), increased Same Store NOI growth target of 3.75%-4.75%, improved Debt/EBITDAre ratio of 7.2x, and over 60% total shareholder returns since January 2022. The Board views the offer as opportunistically timed while the company gains momentum under new management.

Positive

- Targeting 11% growth in Core FFO per share for 2024

- Same Store NOI growth of 4.9% year-to-date

- Debt/EBITDAre ratio improved by 0.6x to 7.2x year-over-year

- Total shareholder returns exceeded 60% since January 2022

- Accretive asset recycling with favorable cap rate spreads

Negative

- Potential acquisition offer rejected, limiting immediate shareholder exit opportunity

News Market Reaction

On the day this news was published, WSR declined 1.92%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

HOUSTON, Oct. 30, 2024 (GLOBE NEWSWIRE) -- Whitestone REIT (NYSE: WSR) (“Whitestone” or the “Company”) provided the following response to MCB’s recent indication of interest:

P. David Bramble

MCB Real Estate

Baltimore, MD 21211

Dear Mr. Bramble,

The Whitestone Board of Trustees has reviewed your October 9, 2024, indication of interest. The Board’s review considered the

The Whitestone Board also considered the following in rejecting your indication of interest:

- The Whitestone REIT Board of Trustees believes the indication of interest is opportunistically timed to take advantage of Whitestone’s performance while the company is still gaining momentum under the new management team. Given the all cash indication of interest, Whitestone believes that a transaction at this valuation would deprive all other Whitestone shareholders of the opportunity to maximize the value of their investment while transferring additional value directly to MCB.

- Whitestone REIT is well-positioned for growth. As our financial results disclosed today demonstrate, Whitestone is making great progress against its strategic objectives and gaining momentum while driving shareholder value. Key highlights include:

- Reiteration of 2024’s Core FFO per share estimate of

$0.98 t o$1.04 , targeting11% growth in 2024 versus 2023 (at the midpoint) - An increased Same Store NOI growth target of

3.75% –4.75% , after delivering year-to-date Same Store NOI growth of4.9% - Q3 2024 Debt / EBITDAre ratio of 7.2x, a 0.6x improvement versus one year ago

- Accretive asset recycling with disposition cap rates over 100 basis points below acquisition cap rates while simultaneously positioning Whitestone for future growth

- Reiteration of 2024’s Core FFO per share estimate of

- Whitestone’s strong performance has driven total shareholder returns of over

60% since the current management team took over on January 18, 2022.

Source: S&P Capital IQ (Oct 25, 2024 Closing Price)

The Whitestone Board of Trustees continues to consider MCB an important shareholder and remains committed to acting in the best interests of all shareholders to maximize shareholder value.

Sincerely,

Whitestone Board of Trustees:

David T. Taylor

Nandita V. Berry

Julia B. Buthman

Amy S. Feng

David K. Holeman

Jeffrey A. Jones

Investor and Media Contacts:

David Mordy

Director of Investor Relations

Whitestone REIT

(713) 435-2219

ir@whitestonereit.com

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit www.whitestonereit.com.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition and results of operations, statements related to our expectations regarding the performance of our business, and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy and the real estate industry, both in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston, Dallas, and Phoenix in particular, including the potential impact of public health emergencies, on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; increases in interest rates, including as a result of inflation, which may increase our operating costs or general and administrative expenses; our current geographic concentration in the Houston, Dallas, and Phoenix metropolitan area markets makes us susceptible to potential local economic downturns; natural disasters, such as floods and hurricanes, which may increase as a result of climate change may adversely affect our returns and adversely impact our existing and prospective tenants; increasing focus by stakeholders on environmental, social, and governance matters; financial institution disruptions; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; harm to our reputation, ability to do business and results of operations as a result of improper conduct by our employees, agents or business partners; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; risks related to generative artificial intelligence tools and language models, along with the potential interpretations and conclusions they might make regarding our business and prospects, particularly concerning the spread of misinformation; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine, the conflict in the Gaza Strip and unrest in the Middle East; the need to fund tenant improvements or other capital expenditures out of our operating cash flow; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all: the ultimate amount we will collect in connection with the redemption of our equity investment in Pillarstone Capital REIT Operating Partnership LP (“Pillarstone” or “Pillarstone OP.”); and other factors detailed in the Company's most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Non-GAAP Financial Measures

This release contains supplemental financial measures that are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”) including EBITDAre, FFO, NOI and net debt. Following are explanations and reconciliations of these metrics to their most comparable GAAP metric.

EBITDAre: The National Association of Real Estate Investment Trusts (“NAREIT”) defines EBITDAre as net income computed in accordance with GAAP, plus interest expense, income tax expense, depreciation and amortization and impairment write-downs of depreciable property and of investments in unconsolidated affiliates caused by a decrease in value of depreciable property in the affiliate, plus or minus losses and gains on the disposition of depreciable property, including losses/gains on change in control and adjustments to reflect the entity’s share of EBITDAre of the unconsolidated affiliates and consolidated affiliates with non-controlling interests. The Company calculates EBITDAre in a manner consistent with the NAREIT definition. Management believes that EBITDAre represents a supplemental non-GAAP performance measure that provides investors with a relevant basis for comparing REITs. There can be no assurance the EBITDAre as presented by the Company is comparable to similarly titled measures of other REITs. EBITDAre should not be considered as an alternative to net income or other measurements under GAAP as indicators of operating performance or to cash flows from operating, investing or financing activities as measures of liquidity. EBITDAre does not reflect working capital changes, cash expenditures for capital improvements or principal payments on indebtedness.

FFO: Funds From Operations: The National Association of Real Estate Investment Trusts (“NAREIT”) defines FFO as net income (loss) (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains or losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. We calculate FFO in a manner consistent with the NAREIT definition and also include adjustments for our unconsolidated real estate partnership.

Core Funds from Operations (“Core FFO”) is a non-GAAP measure. From time to time, we report or provide guidance with respect to “Core FFO” which removes the impact of certain non-recurring and non-operating transactions or other items we do not consider to be representative of our core operating results including, without limitation, default interest on debt of real estate partnership, extinguishment of debt cost, gains or losses associated with litigation involving the Company that is not in the normal course of business, and proxy contest professional fees.

Management uses FFO and Core FFO as a supplemental measure to conduct and evaluate our business because there are certain limitations associated with using GAAP net income (loss) alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Because real estate values instead have historically risen or fallen with market conditions, management believes that the presentation of operating results for real estate companies that use historical cost accounting is insufficient by itself. In addition, securities analysts, investors and other interested parties use FFO and Core FFO as the primary metric for comparing the relative performance of equity REITs. FFO and Core FFO should not be considered as an alternative to net income or other measurements under GAAP, as an indicator of our operating performance or to cash flows from operating, investing or financing activities as a measure of liquidity. FFO and Core FFO do not reflect working capital changes, cash expenditures for capital improvements or principal payments on indebtedness. Although our calculation of FFO is consistent with that of NAREIT, there can be no assurance that FFO and Core FFO presented by us is comparable to similarly titled measures of other REITs.

NOI: Net Operating Income: Management believes that NOI is a useful measure of our property operating performance. We define NOI as operating revenues (rental and other revenues) less property and related expenses (property operation and maintenance and real estate taxes). Other REITs may use different methodologies for calculating NOI and, accordingly, our NOI may not be comparable to other REITs. Because NOI excludes general and administrative expenses, depreciation and amortization, equity or deficit in earnings of real estate partnership, interest expense, interest, dividend and other investment income, provision for income taxes, gain on sale of property from discontinued operations, management fee (net of related expenses) and gain or loss on sale or disposition of assets, and includes NOI of real estate partnership (pro rata) and net income attributable to noncontrolling interest, it provides a performance measure that, when compared year-over-year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from net income. We use NOI to evaluate our operating performance since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, lease rates and tenant base have on our results, margins and returns. In addition, management believes that NOI provides useful information to the investment community about our property and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of property performance in the real estate industry. However, NOI should not be viewed as a measure of our overall financial performance since it does not reflect the level of capital expenditure and leasing costs necessary to maintain the operating performance of our properties, including general and administrative expenses, depreciation and amortization, equity or deficit in earnings of real estate partnership, interest expense, interest, dividend and other investment income, provision for income taxes, gain on sale of property from discontinued operations, management fee (net of related expenses) and gain or loss on sale or disposition of assets.

Same Store NOI: Management believes that Same Store NOI is a useful measure of the Company’s property operating performance because it includes only the properties that have been owned for the entire period being compared, and it is frequently used by the investment community. Same Store NOI assists in eliminating differences in NOI due to the acquisition or disposition of properties during the period being presented, providing a more consistent measure of the Company’s performance. The Company defines Same Store NOI as operating revenues (rental and other revenues, excluding straight-line rent adjustments, amortization of above/below market rents, and lease termination fees) less property and related expenses (property operation and maintenance and real estate taxes), Non-Same Store NOI, and NOI of our investment in Pillarstone OP (pro rata). We define “Non-Same Stores” as properties that have been acquired since the beginning of the period being compared and properties that have been sold, but not classified as discontinued operations. Other REITs may use different methodologies for calculating Same Store NOI, and accordingly, the Company's Same Store NOI may not be comparable to that of other REITs.

| Whitestone REIT and Subsidiaries | |||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||

| Initial & Revised Full Year Guidance for 2024 | |||||||||||||

| (in thousands, except per share and per unit data) | |||||||||||||

| Q3 Revised Range Full Year 2024 (1) | Projected Range Full Year 2024 | ||||||||||||

| Low | High | Low | High | ||||||||||

| FFO and Core FFO per diluted share and OP unit | |||||||||||||

| Net income attributable to Whitestone REIT | $ | 24,602 | $ | 27,602 | $ | 16,600 | $ | 19,600 | |||||

| Adjustments to reconcile to FFO | |||||||||||||

| Depreciation and amortization of real estate assets | 34,705 | 34,705 | 34,252 | 34,252 | |||||||||

| Depreciation and amortization of real estate assets of real estate partnership (pro rata) | 133 | 133 | 133 | 133 | |||||||||

| Gain on sale of properties | (10,212 | ) | (10,212 | ) | — | — | |||||||

| FFO | $ | 49,228 | $ | 52,228 | $ | 50,985 | 53,985 | ||||||

| Adjustments to reconcile to Core FFO | |||||||||||||

| Proxy contest costs | 1,757 | 1,757 | — | — | |||||||||

| Core FFO | $ | 50,985 | 53,985 | $ | 50,985 | $ | 53,985 | ||||||

| Denominator: | |||||||||||||

| Diluted shares | 51,262 | 51,262 | 51,262 | 51,262 | |||||||||

| OP Units | 695 | 695 | 695 | 695 | |||||||||

| Diluted share and OP Units | 51,957 | 51,957 | 51,957 | 51,957 | |||||||||

| Net income attributable to Whitestone REIT per diluted share | $ | 0.47 | $ | 0.53 | $ | 0.32 | $ | 0.38 | |||||

| FFO per diluted share and OP Unit | $ | 0.95 | $ | 1.01 | $ | 0.98 | $ | 1.04 | |||||

| Core FFO per diluted share and OP Unit | $ | 0.98 | $ | 1.04 | $ | 0.98 | $ | 1.04 | |||||

| (1) Includes a | |||||||||||||

| Whitestone REIT and Subsidiaries | ||||||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | ||||||||||||||||||||

| (continued) | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| PROPERTY NET OPERATING INCOME | ||||||||||||||||||||

| Net income attributable to Whitestone REIT | $ | 7,624 | $ | 2,486 | $ | 19,556 | $ | 17,639 | ||||||||||||

| General and administrative expenses | 4,878 | 5,392 | 17,610 | 15,651 | ||||||||||||||||

| Depreciation and amortization | 8,921 | 8,332 | 26,242 | 24,538 | ||||||||||||||||

| Deficit in earnings of real estate partnership (1) | — | 375 | 28 | 1,627 | ||||||||||||||||

| Interest expense | 8,506 | 8,400 | 25,813 | 24,563 | ||||||||||||||||

| Interest, dividend and other investment income | (3 | ) | (11 | ) | (15 | ) | (49 | ) | ||||||||||||

| Provision for income taxes | 118 | 95 | 327 | 339 | ||||||||||||||||

| Gain on sale of properties | (3,762 | ) | (5 | ) | (10,212 | ) | (9,626 | ) | ||||||||||||

| Management fee, net of related expenses | — | — | — | 16 | ||||||||||||||||

| Loss on disposal of assets, net | 111 | 480 | 183 | 500 | ||||||||||||||||

| NOI of real estate partnership (pro rata)(1) | — | 667 | 183 | 1,883 | ||||||||||||||||

| Net income attributable to noncontrolling interests | 99 | 35 | 257 | 248 | ||||||||||||||||

| NOI | $ | 26,492 | $ | 26,246 | $ | 79,972 | $ | 77,329 | ||||||||||||

| Non-Same Store NOI (2) | (1,330 | ) | (1,074 | ) | (5,389 | ) | (4,228 | ) | ||||||||||||

| NOI of real estate partnership (pro rata) (1) | — | (667 | ) | (183 | ) | (1,883 | ) | |||||||||||||

| NOI less Non-Same Store NOI and NOI of real estate partnership (pro rata) | 25,162 | 24,505 | 74,400 | 71,218 | ||||||||||||||||

| Same Store straight-line rent adjustments | (695 | ) | (833 | ) | (2,581 | ) | (2,390 | ) | ||||||||||||

| Same Store amortization of above/below market rents | (221 | ) | (214 | ) | (600 | ) | (607 | ) | ||||||||||||

| Same Store lease termination fees | (30 | ) | (300 | ) | (298 | ) | (600 | ) | ||||||||||||

| Same Store NOI (3) | $ | 24,216 | $ | 23,158 | $ | 70,921 | $ | 67,621 | ||||||||||||

| (1) We rely on reporting provided to us by our third-party partners for financial information regarding the Company's investment in Pillarstone OP. Because Pillarstone OP financial statements for the three and nine months ended September 30, 2024 and 2023 have not been made available to us, we have estimated deficit in earnings and pro rata share of NOI of real estate partnership based on the information available to us at the time of this Report. As of September 30, 2024, our ownership in Pillarstone OP no longer represents a majority interest. On January 25, 2024, we exercised our notice of redemption for substantially all of our investment in Pillarstone OP. | ||||||||||||||||||||

| (2) We define “Non-Same Store” as properties that have been acquired since the beginning of the period being compared and properties that have been sold, but not classified as discontinued operations. For purpose of comparing the three months ended September 30, 2024 to the three months ended September 30, 2023, Non- Same Store includes properties owned before July 1, 2023, and not sold before September 30, 2024, but not included in discontinued operations. For purposes of comparing the nine months ended September 30, 2024 to the nine months ended September 30, 2023, Non-Same Store includes properties acquired between January 1, 2023 and September 30, 2024 and properties sold between January 1, 2023 and September 30, 2024, but not included in discontinued operations. | ||||||||||||||||||||

| (3) We define “Same Store” as properties that have been owned during the entire period being compared. For purpose of comparing the three months ended September 30, 2024 to the three months ended September 30, 2023, Same Store includes properties owned before July 1, 2023 and not sold before September 30, 2024. For purposes of comparing the nine months ended September 30, 2024 to the nine months ended September 30, 2023, Same Store includes properties owned before January 1, 2023 and not sold before September 30, 2024. Straight line rent adjustments, above/below market rents, and lease termination fees are excluded. | ||||||||||||||||||||

| Whitestone REIT and Subsidiaries | ||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | ||||||||||||||||

| (continued) | ||||||||||||||||

| (in thousands) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) | ||||||||||||||||

| Net income attributable to Whitestone REIT | $ | 7,624 | $ | 2,486 | $ | 19,556 | 17,639 | |||||||||

| Depreciation and amortization | 8,921 | 8,332 | 26,242 | 24,538 | ||||||||||||

| Interest expense | 8,506 | 8,400 | 25,813 | 24,563 | ||||||||||||

| Provision for income taxes | 118 | 95 | 327 | 339 | ||||||||||||

| Net income attributable to noncontrolling interests | 99 | 35 | 257 | 248 | ||||||||||||

| Deficit in earnings of real estate partnership (1) | — | 375 | 28 | 1,627 | ||||||||||||

| EBITDAre adjustments for real estate partnership (1) | — | 223 | 136 | 169 | ||||||||||||

| Gain on sale of properties | (3,762 | ) | (5 | ) | (10,212 | ) | (9,626 | ) | ||||||||

| Loss on disposal of assets | 111 | 480 | 183 | 500 | ||||||||||||

| EBITDAre | $ | 21,617 | $ | 20,421 | $ | 62,330 | 59,997 | |||||||||

| (1) We rely on reporting provided to us by our third-party partners for financial information regarding the Company's investment in Pillarstone OP. Because Pillarstone OP financial statements for the three and nine months ended September 30, 2024 and 2023 have not been made available to us, we have estimated deficit in earnings in Pillarstone OP no longer represents a majority interest. On January 25, 2024, we exercised our notice of redemption for substantially all of our investment in Pillarstone OP. | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Debt/EBITDAre Ratio | ||||||||||||||||||||

| Outstanding debt, net of insurance financing | $ | 633,437 | $ | 632,353 | $ | 633,437 | $ | 632,353 | ||||||||||||

| Less: Cash | (2,534 | ) | (2,976 | ) | (2,534 | ) | (2,976 | ) | ||||||||||||

| Less: Deposit due to real estate partnership debt default | (13,633 | ) | — | (13,633 | ) | — | ||||||||||||||

| Add: Proportional share of net debt of unconsolidated real estate partnership (1) | — | 8,685 | — | 8,685 | ||||||||||||||||

| Total Net Debt | $ | 617,270 | $ | 638,062 | $ | 617,270 | $ | 638,062 | ||||||||||||

| EBITDAre | $ | 21,617 | $ | 20,421 | $ | 62,330 | $ | 59,997 | ||||||||||||

| Effect of partial period acquisitions and dispositions | $ | (172 | ) | $ | — | $ | (1,004 | ) | $ | — | ||||||||||

| Pro forma EBITDAre | $ | 21,445 | $ | 20,421 | $ | 61,326 | $ | 59,997 | ||||||||||||

| Annualized pro forma EBITDAre | $ | 85,780 | $ | 81,684 | $ | 81,768 | $ | 79,996 | ||||||||||||

| Ratio of debt to pro forma EBITDAre | 7.2 | 7.8 | 7.5 | 8.0 | ||||||||||||||||

| (1) We rely on reporting provided to us by our third-party partners for financial information regarding the Company's investment in Pillarstone OP. Because Pillarstone OP financial statements as of September 30, 2023 have not been made available to us, we have estimated proportional share of net debt based on the information available to us at the time of this Report | ||||||||||||||||||||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/60363def-9013-4ae3-8f6d-5da763e12eea