Silver X Provides 2021 Progress Overview and Outlines Key Objectives for 2022

Silver X Mining Corp. (OTCQB: WRPSF) reported significant progress at its Nueva Recuperada project in Peru for 2021. Notable achievements include 4,114 metres of mine development, 8,423 metres of drilling, and 732 surface channel samples. The company aims to expand its processing plant capacity from 600 to 720 tonnes per day by March 2022. For 2022, objectives include a new resource estimate and a Preliminary Economic Assessment (PEA), along with plans for extensive underground drilling and exploration at the Esperanza and Cauca projects.

- Completed 4,114 metres of mine development and 8,423 metres of drilling in 2021.

- Expanding processing plant capacity from 600 tpd to 720 tpd, expected by March 2022.

- Plans for a new resource estimate report and PEA scheduled for Q2 and Q3 2022, respectively.

- Acquisition of Tangana West concessions consolidates mining operations.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / January 10, 2022 / SILVER X MINING CORP. (TSX-V:AGX)(OTCQB:WRPSF) ("Silver X" or the "Company") is pleased to provide a summary of 2021 achievements and key targets for 2022 at the Company's flagship Nueva Recuperada project (the "Project") located in Huancavelica, Peru.

2021 Year End Highlights

- 4,114 metres of mine development completed at the Tangana and San Antonio Mining Units

- 8,423 metres of resource expansion, resource upgrading, and exploration drilling completed at the Nueva Recuperada project over 41 drill holes

- 732 surface channel samples taken across outcropping silver-(gold)-polymetallic mineralized structures at the Tangana Mining Unit

- 834 underground channel samples from pre-existing and new mine infrastructure at Tangana

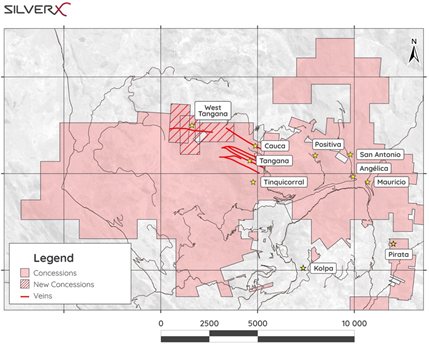

- Consolidated the Tangana Mining Unit with the acquisition of the Tangana West concessions

- Commenced plant capacity expansion from 600 tpd to 720 tonnes per day (expected completion March 15, 2022)

- Began updating the Company's Environmental and Social Impact Assessment (ESIA) to expand mining and processing capacity to 2,500 tpd

2022 Objectives

- Complete new resource estimate report in Q2 2022 to be followed by a Preliminary Economic Assessment in Q3 2022

- Advance 9,000 metres underground to exploit multiple veins at the Tangana Mining Unit to access sufficient stoping blocks to profitably sustain commercial production

- Complete 15,500 metres of resource expansion, resource upgrading, and exploration diamond drilling from surface and underground

- Esperanza Project - Begin operations in this silver-polymetallic project containing several intermediate epithermal high-grade vein targets. Social permit expected for Q2, first drilling in Q3-Q4

- Satellite Projects - Map and sample Tangana West and Pucapunta silver-(gold)-polymetallic mineralized structures

- Ccasahuasi Project - Commence drilling of a breccia-hosted disseminated gold target located adjacent to Tangana

Updated Resource Statement and PEA Targeted for Q2 2022

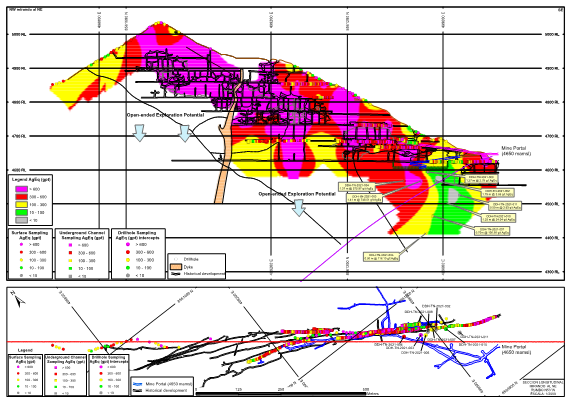

The ongoing comprehensive exploration program at Tangana has thus far expanded the extent of silver-(gold)-polymetallic mineralization at surface and underground by over 1.7 km horizontally and 400 m vertically along the main Tangana structure. The three faceted programme that includes diamond core drilling, surface and underground channel sampling has identified two potential high-grade mineralized zones that will be the focus of immediate follow-up work (See Figure 1).

The results from 2022 resource upgrade activities in combination with results from 834 underground channel samples, 732 surface channel samples, and 8,422.5 metres of diamond drilling completed during 2021, will contribute to a new mineral resource estimate in Q2 2022 and a Preliminary Economic Assessment (PEA) targeted for completion in Q3 2022. Surface channel sample results along the outcropping portions of the Tangana and neighbouring along-strike Morlupo veins confirm the presence of high-grade mineralization along a consistently mineralized strike length of 1.7 km (see November 30, 2021 news release). These results, along with those taken from underground channel samples in historical workings (see September 3, 2021 news release) and diamond drill core samples (see August 23, 2021 news release), support the Company's interpretation that Tangana is a potentially economically mineralized silver-(gold)-polymetallic structure with considerable resource potential.

To provide additional support for the proposed PEA study (scheduled for reporting during Q3 2022), Silver X has budgeted 15,500 m of complementary resource extension drilling from some 16 underground drill locations, 2,000 m of underground channel sampling from accessible historical and new underground development infrastructure, as well as 2,000 metres of additional surface channel sampling.

2022 Exploration Strategy

Tangana Mining Unit

As part of its exploration strategy during 2022 and following on from the positive 2021 sampling

results, Silver X will be prioritizing underground mine development and resource expansion drilling in this extensive system of silver-(gold)-polymetallic veins to provide feed for the plant whose capacity is being increased to 720 tons per day with expected completion by March 15, 2022.

Figure 1: Compilation long-section and plan view of the Tangana 1 & 2 silver-(gold)-polymetallic vein projects showing current underground development, past-producing mined-out stopes, locations of recently reported results from drill hole intercepts and channel samples, and AgEq (g/t) grade contours spotlighting high priority silver-(gold)-polymetallic resource extension exploration targets (blue arrows). To see the figure in full size, click here.

Tangana 1 & 2

Exploration and development budgeting for 2022 includes 7,500 metres of underground resource evaluation drilling on the Tangana structures (See Figure 2). The drilling is expected to facilitate the evaluation and upgrading of more than 500,000 tonnes of potentially economic silver-(gold)-polymetallic mineralization. The mentioned 7,500 metres of drilling will target underground extensions of the Tangana 1 & 2 mineralized structures by drilling from its 4590 and 4650 levels. Exploration will focus on:

- Resource extension diamond drilling on upper levels from surface

- Systematic channel sampling of approximately 2,000 metres along surface as well as planned future underground mining infrastructure within mineralized structures

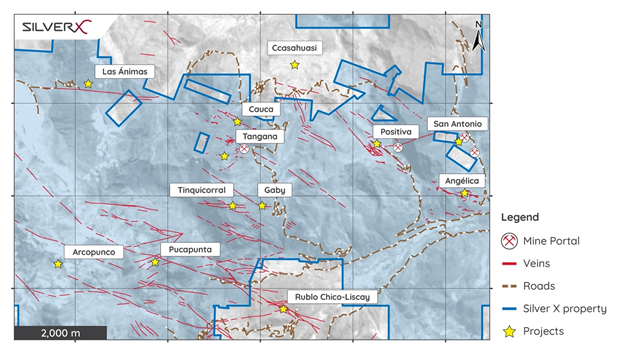

Figure 2: Map of the Tangana Mining Unit, showing the location of key veins (Tangana veins located centrally towards the North; Cauca immediately towards the North of Tangana), infrastructure, concession limits.

Cauca

Cauca (See Figure 2) represents a possible low-cost, rapid expansion of the Tangana Mining Unit. The Cauca silver-(gold)-polymetallic structure (aligned sub-parallel to the Tangana 1 & 2 structures and located 400 metres to the NE), is historically interpreted to be 2.2 kilometres long, average some 1.1 metres in width, and have an estimated average grade of 306.67g/t AgEq[1].

Existing mine infrastructure includes an interconnecting 450 metre long crosscut from Tangana 1 & 2 which intersects with the Cauca structure. This crosscut will be used to facilitate i) rapid low-cost access; ii) early mining infrastructure development; iii) other preparatory mining activities; and iv) resource extension and evaluation programs. Recent analytical results from first systematic surface channel sampling of the Tangana Mining Unit's Cauca vein, which on surface extends over 1.77 kilometres of strike at an average width of 1.8 metres, include values up to 1,296 g/t AgEq with an average grade of 236 g/t AgEq (see November 2, 2021 news release).

With the objective of advancing resource knowledge concerning the tenor of silver-(gold)-polymetallic mineralization and its potential economic viability, Silver X´s 2022 exploration strategy at Cauca incorporates:

- Underground systematic channel sampling of approximately 2,000 metres of accessible as well as planned future mining infrastructure

- 2,500 metres of underground resource extension evaluation drilling

District Consolidation

The recently acquired Tangana West property (see September 22, 2021 news release), lies westwards and along strike from Tangana and may be an extension of the same underlying structure. Silver X acquired the 250-hectare Tangana West silver project hosting silver-polymetallic veins with surface channel samples returning grades up to 9,379 g/t Ag,

Figure 3: Map of Silver X claims of the Tangana Mining Unit, identifying the newly acquired Tangana West claims and showing relationship to roads and surrounding veins.

Processing Plant Expansion to 720 TPD

In late October, the Company secured the environmental permit required to increase production capacity at its Recuperada polymetallic concentrate plant to 720 tonnes per day (see October 20, 2021, press release). Installation of a new crushing circuit and flotation cells has commenced, and Silver X expects full commissioning by March 15, 2022. New mineralized zones encountered at the Tangana Mining Unit has necessitated an increase in plant capacity to keep pace with the processing of development mineralization.

Environmental and Social Impact Assessment - ESIA

The ESIA is a key component of a comprehensive environmental and social permitting process to further expand processing plant operations. The 4,900-ha study area covers the Tangana silver-polymetallic Mining Unit and associated mining infrastructure. The updated assessment will allow Silver X to expand the mineral processing capacity to 2,500 tpd from the current 600 tpd, and to build a new 8,000,000 m3 capacity tailings storage facility (see October 6, 2021 news release).

The updated ESIA of the Nueva Recuperada Project will include the following components:

- Baseline Assessment: Initial survey to assess the environmental and social situation within the project area; commenced September 2021.

- Project Description: Detailed summary of all project components, facilities, and associated organizations; commenced September 2021.

- Impact Identification and Prediction: Comprehensive review of impacts and benefits from proposed expansion.

- Environmental and Social Management Plan (ESMP): Incorporates measures and procedures for the short and long-term environmental and social management of the project.

- Stakeholder Engagement: An ongoing process that continues throughout the ESIA. This focuses on a broad range of activities, including information sharing, consultation, negotiation, and partnership building. The initial community workshop was held in September 2021.

Corporate Update

Analyst Coverage

Red Cloud Securities Inc., Echelon Capital Markets, and Fundamental Research Corp. initiated analyst coverage of the Company in December.

OTC QB Listing

The Company's common shares commenced trading on the OTCQB marketplace under the symbol "WRPSF" in November. Common shares will continue to trade on the TSX Venture Exchange under the symbol "AGX" and on the Frankfurt Stock Exchange under the symbol "WPZ".

Sampling, Analytical Analysis, Quality Assurance and Quality Control (QAQC)

Drill core from all drill holes is extracted in lengths of 1.52 meters (5 feet) and stored on-site in appropriate core trays in a secure Company core-shed. Drill hole orientation, downhole survey data, and collar coordinates are registered. When the extracted core has been measured and marked up, it is then geologically and geotechnically logged. Splitting and sampling of all silver-(gold)-polymetallic mineralized structures encountered in the drill core is done from start to finish of the mineralized structure. Minimum sample length is 30 centimeters. No sample collected through potentially economic mineralized intersections is longer than 50 centimeters. Sterile country rock hosting the mineralized structure is sampled for a minimum of 1.0 meter either side of the structure. The interval to be sampled is split by rock-saw and taking care not to allow contamination of the sample, carefully stored in a suitably prepared plastic bag. Samples have unique number identifiers for "chain of custody" tracking of samples and for subsequent incorporation into the database once QAQC sign-off on analytical results has been received. Depending on the diameter, length, and bulk density of the core sample, approximately 4-8 kg of sample are collected for analysis per one metre length of sample.

Surface and underground channel sampling is undertaken as near as perpendicularly as possible across silver-(gold)-polymetallic structures and stored on-site in clearly labelled plastic sample-bags in a secure storage facility attached to the Company core-shed. Channel sample length and locality coordinates are registered. The geological description of the sample is recorded. Where mineralized veins and structures are fully exposed, sampling is done from one side of the mineralized structure to the other. Minimum sample length is 30 centimeters. No sample collected through the potentially economic mineralized vein exposures is longer than 0.5 meter. Each channel sample has a minimum channel thickness of 60 mm and minimum channel depth of 30 mm. Taking care not to allow contamination of the sample, the channel sample is collected with the use of either a rock-cutting saw or a hammer and chisel and rock-chips are carefully stored in a suitably prepared plastic bag. Samples have unique number identifiers for "chain of custody" tracking of samples and for subsequent incorporation into the database once QAQC sign-off on analytical results has been received. Depending on the width, length, depth, and bulk density of the channel sample, approximately 3-4 kg of sample are collected for analysis per 0.5 metre length of sample.

All samples are shipped by Company 4x4 vehicle from the field to the certified and independent Certimin analytical laboratory facility in Lima. Certimin complies with ISO 9001, OHSAS 18001 and is a fully recognized and certified facility. After the underground channel samples have been prepared for analysis (code G0640), the sample pulps are then analyzed for gold, silver, and multi-elements using relevant Certimin analytical methodologies. All samples are analyzed using 30 g nominal weight fire assay with an ICP finish (code G0108) and multi-element four acid digest ICP-AES/ICP-MS methodology (code G0176). Where Au analytical results from G0108 are >10 g/t, the analysis is repeated with 30 g nominal weight fire assay and a gravimetric finish (code G0014). Where multi-element results from G0176 are greater than 100 ppm for Ag, the analysis is repeated with ore-grade four acid digest method (Code G0002). Where multi-element results from G0176 are greater than 10,000 ppm for Cu, Pb or Zn, the analysis is repeated with ore-grade four acid digest methods, respectively codes G0039, G0077 and G0388. Periodically, duplicate sample pulps are sent to independent umpire laboratories for review and checking of Certimin analytical analyses results.

Silver X Mining applies a fully NI 43-101 compliant quality assurance/quality control (QAQC) protocol on all its advanced and exploration projects. Our trained QAQC staff insert both fine and coarse blank samples, field duplicates and twin samples into each batch of field samples prior to delivery to the independent certified analytical laboratory. The QAQC control samples, including the random insertion of certified reference material, are designed to test the integrity of the samples by providing an independent check on precision, accuracy, and possibilities of contamination during sample preparation and analytical procedure within the elected commercial laboratory. With the objective of assuring best practice compliance, resource and exploration related assay results are not reported until the results of internal QAQC procedures have been reviewed and approved.

Qualified Person

Mr. Donald McIver, B.Sc., M.Sc., who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. McIver is a Fellow of the Australian Institute of Mining and Metallurgy (FAusIMM), as well as of the Society of Economic Geologists (FSEG). Donald is a Qualified Person as defined by National Instrument 43-101 and is a past member of the SEG Board of Trustees. Mr. McIver has accumulated a solid geological and resource development background over 30 years within project generation, advanced exploration, and mining programs for precious and base metals. Donald has over 20 years of experience in the Americas and since 2005 has fulfilled the positions of Vice President of Exploration (Minera IRL S.A. & Palamina Corp.), Director of Mining Consulting (Ausenco) and Mineral Resource Manager (Barrick Gold). Mr. McIver is a Senior Geological Advisor for Silver X.

About Silver X Mining

Silver X Mining is a Canadian silver mining company with assets in Peru and Ecuador. The Company's flagship asset is the Nueva Recuperada silver lead zinc project located in Huancavelica, Peru. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverxmining.com.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements

ON BEHALF OF THE BOARD

José M García

CEO and Director

For further information, please contact:

Silver X Mining Corp.

+ 1 604 358 1382 | j.garcia@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, expected commencement of commercial production at the Project, expected completion of a resource report and the Preliminary Economic Assessment, and the expected financial performance of the Company.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

[1] Latitude Silver, "Plan Comparativo del Proyecto Tangana para Segundo Pulmón de Mineral, Setiembre de 2020" (Issue Date: September 2020).

SOURCE: Silver X Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/681571/Silver-X-Provides-2021-Progress-Overview-and-Outlines-Key-Objectives-for-2022