Bristow Enters into Government-Backed Equipment Financing for up to €100 Million

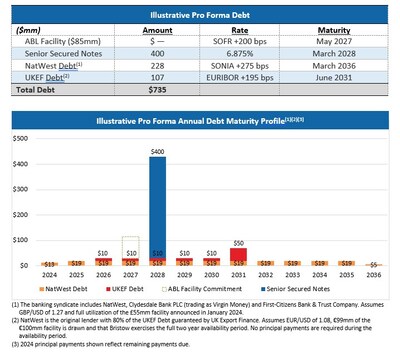

Bristow Group announced that its UK subsidiary, Bristow Leasing , has entered into a €100 million Export Development Guarantee term-loan facility with NatWest, backed by UK Export Finance (UKEF). This funding will support Bristow's next-generation search and rescue (SAR) operations in Ireland. The loan, guaranteed 80% by UKEF, is secured by five new Leonardo AW189 SAR-configured helicopters. The loan has a two-year availability period, followed by a five-year term, with interest at EURIBOR plus 1.95% per annum. Bristow's President, Chris Bradshaw, highlighted the loan's role in enhancing financial flexibility for their growing government services business.

- Secured €100 million loan facility enhances Bristow's financial flexibility.

- Loan is guaranteed 80% by UK Export Finance, reducing financial risk.

- Funds will support capital commitments for SAR operations in Ireland, aligning with growth strategy.

- Loan secured by five new Leonardo AW189 SAR-configured helicopters, providing asset backing.

- Interest rate set at EURIBOR plus 1.95% is relatively competitive.

- Obligations backed by the loan introduce financial liabilities.

- Interest rate tied to EURIBOR may fluctuate, affecting cost predictability.

- Funding contingent on the delivery of new helicopters, introducing potential delays.

Insights

Bristow's new financing deal is a significant move for the company. By securing up to

From an investor's perspective, this financing shows Bristow's commitment to expanding its government services, potentially leading to increased revenue streams. The secured interest rate and government backing also reduce financial risk. Short-term, this might impact Bristow’s leverage, but long-term, the investment in next-generation SAR operations could enhance profitability and market position.

The UK Export Finance's backing through an 80% guarantee is a strong endorsement of Bristow's operations and financial stability. This kind of support is usually reserved for companies with solid business models and significant growth potential. For Bristow, this guarantee lowers the lending risk significantly, which might make investors more confident in the company's future. Additionally, the focus on new SAR helicopters for Ireland indicates a strategic investment in high-demand services, potentially enhancing Bristow’s competitiveness in the European market.

While immediate financial returns might not be evident, the long-term strategic position looks promising. The availability period of two years followed by a five-year term also suggests a well-planned approach to financial management and operational scaling.

The acquisition of five new Leonardo AW189 SAR-configured helicopters is a significant upgrade for Bristow. These helicopters are designed for advanced search and rescue missions, offering higher efficiency and better performance. For investors, this means Bristow is investing in reliable and state-of-the-art equipment that can enhance service quality and operational effectiveness. The helicopter model is known for its long range, advanced avionics and robust safety features, all essential for critical SAR operations. This investment not only aligns with Bristow's growth strategy but also positions the company to meet increasing demands in the SAR sector, potentially leading to new contracts and business opportunities.

"The proceeds from the UKEF Debt will enhance our financial flexibility as Bristow grows its leading government services business with the new Irish Coast Guard contract investments," said Chris Bradshaw, Bristow's President and Chief Executive Officer. "We would like to thank NatWest and

Bristow's obligations will be secured by five new-delivery Leonardo AW189 SAR-configured helicopters. The UKEF Debt has a two-year availability period followed by a five-year term and is expected to fund during 2024, subject to delivery of the new SAR-configured helicopters. The UKEF Debt will bear interest at a rate equal to the Euro Interbank Offered Rate ("EURIBOR") plus

About Bristow Group

Bristow Group Inc. (the "Company") is the leading global provider of innovative and sustainable vertical flight solutions. Bristow primarily provides aviation services to a broad base of offshore energy companies and government entities. The Company's aviation services include personnel transportation, search and rescue "SAR", medevac, fixed-wing transportation, unmanned systems, and ad hoc helicopter services.

Bristow currently has customers in

Forward-Looking Statements Disclosure

This press release contains "forward-looking statements." Forward-looking statements represent the Company's current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "believe," "project," or "continue," or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management's current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company's actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof, except as may be required by applicable law.

Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; our reliance on a limited number of helicopter manufacturers and suppliers and the impact of a shortfall in availability of aircraft components and parts required for maintenance and repairs of our helicopters, including significant delays in the delivery of parts for our S92 fleet; our reliance on a limited number of customers and the reduction of our customer base as a result of consolidation and/or the energy transition; public health crises, such as pandemics (including COVID-19) and epidemics, and any related government policies and actions; our inability to execute our business strategy for diversification efforts related to government services and advanced air mobility; the potential for cyberattacks or security breaches that could disrupt operations, compromise confidential or sensitive information, damage reputation, expose to legal liability, or cause financial losses; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of alternative modes of transportation and solutions; the possibility that portions of our fleet may be grounded for extended periods of time or indefinitely (including due to severe weather events); the possibility of political instability, civil unrest, war or acts of terrorism in any of the countries where we operate or elsewhere; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of changes in tax, environmental and other laws and regulations and policies, including, without limitation, actions of the governments that impact oil and gas operations, favor renewable energy projects or address climate change; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; general economic conditions, including interest rates or uncertainty in the capital and credit markets; the possibility that reductions in spending on aviation services by governmental agencies where we are seeking contracts could adversely affect or lead to modifications of the procurement process or that such reductions in spending could adversely affect SAR contract terms or otherwise delay service or the receipt of payments under such contracts; and the effectiveness of our environmental, social and governance initiatives.

If one or more of the foregoing risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the "SEC"), all of which are accessible on the SEC's website at www.sec.gov.

Investors

Bristow Group Inc.

Jennifer Whalen

InvestorRelations@bristowgroup.com

Media

Bristow Group Inc.

Adam Morgan

Adam.morgan@bristowgroup.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bristow-enters-into-government-backed-equipment-financing-for-up-to-100-million-302171206.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bristow-enters-into-government-backed-equipment-financing-for-up-to-100-million-302171206.html

SOURCE Bristow Group